THE INJECTIVE PROTOCOL DERIVATIVE: ALL YOU CAN EAT BUFFET

Intro

Business digitization is hiking daily with the uptick of Fintech thus there are significant changes in the structure of financial institutions and financial instruments. Blockchain technologies, especially cryptocurrency play an important role in the transformation of business ecosystems and are getting by mainstream adoption as an economic asset. However, volatility being a double edged sword of cryptocurrencies is slowing the adoption rates. This brings us up to speed with cryptocurrency derivatives which are instruments used to hedge against and benefit from price movements.

DERIVATIVES

A derivative itself is a contract between two or more parties, with its price ascertained from fluctuations in the underlying asset. In other words, a financial security with a value that is reliant upon or derived from, an underlying asset or group of assets—a benchmark. The most common underlying assets for derivatives are stocks, bonds, commodities, currencies, interest rates, and market indexes. These assets are commonly purchased through brokerages. The term "security" is a fungible, negotiable financial tool that has an inherent monetary value, which represents an ownership position in a publicly-traded corporation—via stock—a creditor relationship with a governmental body or a corporation—represented by owning that entity's bond—or rights to ownership as represented by an option.

Trading

Financial derivatives can be traded on a traditional exchange or traded over-the-counter (OTC).

Only standardized and more heavily regulated derivatives are exchange traded

OTC derivatives constitute a greater proportion of the derivatives market. OTC-traded derivatives and have a higher risk of counterparty risk. Counterparty risk is the danger that one of the parties involved in the transaction might default. These parties trade between two private parties and are unregulated.

Fundamentals of Derivatives

The main functions of a financial derivative are used to hedge position, speculate on the directional movement of an asset, and/or ascribe leverage to holdings. Today, derivatives are based upon a wide variety of transactions and have many more uses. Originally, derivatives were used to ensure balanced exchange rates for goods traded internationally.

Types of Derivatives

The common types of derivatives are Forwards, Swaps, Options and Futures.

Forwards

Forwards only trade on over-the-counter platforms. Thus when a forward contract is created, the buyer and seller may have customized the terms, size and settlement process for the derivative. Forwards carry a greater degree of counterparty risk for both buyers and sellers. If one party of the contract becomes insolvent, the other party may have no recourse and could lose the value of its position. Once created, the parties in a forward contract can offset their position with other counterparties, which can increase the potential for counterparty risks as more traders become involved in the same contract.

Swaps

Swaps are usually used to exchange one kind of cash flow with another and can also be constructed to exchange currency exchange rate risk or the risk of default on a loan or cash flows from other business activities. Swaps related to the cash flows and potential defaults of mortgage bonds are the most known type of derivative

Options

This is usually an agreement between two parties to buy or sell an asset at a predetermined future date for a specific price with the buyer not obliged to exercise their agreement to buy or sell.

Futures

The most tradable derivative and tradable on traditional exchanges. These are agreements between two parties for the purchase and delivery of an asset at an agreed upon price at a pre-agreed future date. Traders will use a futures contract to hedge their risk or speculate on the price of an underlying asset. The parties involved must fulfill a commitment to buy or sell the underlying asset, though not all futures contracts are settled at expiration by delivering the underlying asset. Many derivatives are cash-settled, which means that the gain or loss in the trade is simply an accounting cash flow to the trader's brokerage. Examples are interest rate futures, stock index futures.

Advantages and Disadvantages of Derivatives

Many financial instruments have their pros and cons, and Derivatives are not an exception.

Pros

1.Reduce trading risks at cheaper costs.

2.Hedge against unfavorable movements in rates.

3.They provide a way to lock in prices.

4.They can often be purchased on margin and makes them even less expensive.

Cons

1.Most derivatives are prone to changes in the amount of time to expiration, the cost of holding the underlying asset, and interest rates.

2.The risks for OTC derivatives like Forwards include counter-party. These risks are a kind of credit risk in that the buyer or seller may not be able to live up to the obligations outlined in the contract.

3.They are difficult to value because they are based on the price of another asset.

CRYPTOCURRENCY DERIVATIVES

Cryptocurrency derivatives are popular these days with Bitcoin futures being the most popular . Over the course of the years, several cryptocurrency derivative platforms have been launched as a result of the heady days of 2017 cryptocurrency all-time-highs. Exchanges for futures like Phemex were launched trading Bitcoin, Ethereum, Ripple contracts with 1000BTC is traded daily in its BTC/USD perpetual contracts.

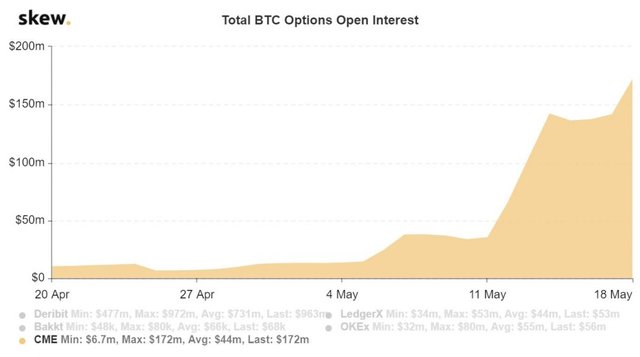

Also the cryptocurrency watchdog site Cryptocompare notes that bitcoin (BTC) derivatives saw large increases in trading volume last month, with institutional player Chicago Mercantile Exchange (CME) rising fastest at 59% to $7.2 billion. CME, a Chicago-based exchange is also looking to launch options (on its bitcoin futures contract), another form of cryptocurrency derivatives in the first quarter of 2020. Also, Bakkt also revealed that it. New York-based TrueEx was the first exchange approved by the Commodity Futures Trading Commission (CFTC) for Designated Contract Marketplace (DCM) swaps. Now it has partnered with Consensys, a blockchain technology company to promote ethereum, to form a regulated derivatives marketplace for digital assets.Cryptocurrency derivatives are financial products that have gained popularity of late.

Are Cryptocurrency Derivatives this needed?

What has Derivatives contributed to the crypto world since its inception.

Derivatives is being touted to be under government and thus legislative control thus bringing in the mainstream dollar.

Also, cryptocurrency derivatives could boost liquidity and trading volumes for coins other than bitcoin. Cryptocurrency derivatives trading volumes climbed 32% in May to a new record high of $602 billion, according to data analytics company Cryptocompare and total spot volumes grew at a slower pace, rising 5% to $1.27 trillion in May, the London-based firm said in a new report published June 4, 2020.The figures show increasing investor interest in trading derivatives, with derivatives market share rose to 32% compared to 27% in April.May’s all-time-high represents a slight increase over the previous record of $600 billion in March.

Why Injective Protocol?

With the blessing of Binance in its pocket, Injective Protocol is the first end-to-end, fully-decentralized exchange protocol that eliminates front-running and allows for trustless liquidity sharing, featuring a decentralized perpetual swaps, futures, margin and spot trading. It is mainly made up of a Holy Trinity. This trinity is the Injective Chain, the Injective Exchange, and the Injective Futures platform. A fusion of this trio gave Injective Protocol its uniqueness and distinctiveness.

Injective Chain

This Chain is comprised of a layer-2 sidechain and Cosmos Zone connected to Ethereum, utilizing a verifiable delay functions (VDFs) to enforce a fair transaction ordering consensus that reflects real-world time via Proof-of-Elapsed-Time (PoET) , solving critical race conditions and miner extractable value issues present in Ethereum. Injective Chain powers Injective Protocol's layer-2 derivatives platform, serves as a decentralized Trade Execution Coordinator (TEC), and hosts a decentralized open orderbook. The chain itself is built on top of Tendermint and allows for transferring and trading Erc-20 assets on the Injective Chain. Tendermint Core can tolerate up to one third of machine failures arbitrarily and with it you can write an app in any language and deploy it on any machine or system anywhere in the world. Thus the Injective Chain can tolerate malicious behaviour In the future. Injective will be integrated with Cosmos IBC, bringing advanced inter-chain decentralized finance capabilities.

Injective Exchange

This is a truly 100% decentralized exchange with the front-end exchange interface, back-end infrastructure, smart contracts, orderbook liquidity all steeped in decentralization.

Injective Futures

With a very robust support for decentralized perpetual swaps, contracts for difference (CFDs), and many other derivatives, the Injective Futures protocol is a decentralized peer-to-peer futures protocol which expressly permits individuals to trade on arbitrary derivative markets with just a price feed.

Injective also utilizes Atomic Swap or Cross-chain trading, which permits a seamless exchange between one cryptocurrency for another, even between two different blockchains, without the help from a third party. It’s basically a variation of smart contract technology and hash time locked contracts (HTLC).

Injective Protocol also handles Decentralized Derivatives, which are slightly different, since no third party broker is required, and it is trustless, with the contract terms can be programmed into smart contracts, eliminating the need for a third party. Settlement automatically takes place on-chain when the terms of the contract are fulfilled. The flexibility of decentralized derivatives is vast, enabling users to create instruments on virtually any underlying asset.

Decentralized derivatives account for around 18% of the total value locked in DeFi, according to DeFi Pulse. It’s the second most popular category of DeFi dApp after lending. The Injective Protocol platform will even support the use of various types of currencies to make it easier for its users to exchange derivatives such as Ethereum, Injective, Dai, MKR and Trueus, with support for more types of cryptocurrency in the immediate future.

Injective Protocol has stepped in to change the negative trends of illiquidity in the Cryptocurrency exchanges to enable easy trading transactions .Liquidity is usually the bane of decentralized exchanges. Thus with more liquidity, the traders will once more flock to this type of exchange . The Injective team has partnered with Binance Dex to ensure this vision becomes accomplished. The problem of liquidity can be solved by ‘’Batch Trading’’. This can be simply explained like an order-pool created with the sum of more than 2 plat.

The Injective Protocol is structured in a well-differentiated manner. It was founded by the CEO, Eric Chen who is currently and colleague Albert Chon who later became the CTO.. They collectively have several years of experience in blockchain and cryptography and this is exactly what brought them together to pursue the Injective Protocol Project. Both students of New York University, NYU and Stanford respectively. Currently the Injective Protocol has as many as 8 core expert teams consisting of the founders named Eric Chen and Albert Chin. These are seasoned personnel in the world of blockchain.

Although many trading platforms provide decentralized exchange services, they are not a fully decentralized system. This can be seen from control measures like Know-Your-Customer (KYC) from the number of centralized companies or financial authorities taking part in operating the platform. This is a completely different image Injective Protocol actually applies a decentralized system so that they do not have a component or a centralized authority that oversees every transaction made in the Injective Protocol platform. Users can even control the funds that have been invested and trade through peer to peer clients. Not only that, users can see orders that have been uploaded and can also be paired via sidechain. Moreover, there are currently many cryptocurrency exchange platforms that do not provide services that meet the needs of users. Therefore the Injective Protocol can be used as the most reliable alternative cryptocurrency trading today. Where anyone can exchange derivatives and other services by utilizing the type of cryptocurrency they have

THE INJECTIVE PROTOCOL TOKEN

Injective Protocol's native token is used for the following purposes:

Proof-of-stake reward

Validators can stake with the token and receive block reward proportional to stake.

Fee Distribution

Exchange fees collected via negative spread model are periodically auctioned off through smart contract to buy back Injective's native token for reward distribution. The tokens are first distributed to relayers proportional by orders discovered/originated, and then to validators proportional by stake. Part of the tokens may also be burned instead of distributing to validators depending on final implementation.

We will implement these features in future iterations.

Market Maker Incentives

Order makers would receive a net positive fee rebate to incentivize liquidity.

Fee Discount Token incentives Fee Discount Token holders may get discounted on exchange trading fees.

Exchange fees collected from all trading pairs are aggregated monthly into a "basket of tokens" and sold as a batch to the public which can bid on the basket with INJ tokens. To achieve this, we utilize a simple public auction mechanism that repeats every 1 month equivalent of blocks. During the auction, one can bid on the auction by calling the auction contract bid function which transfers the bidder's INJ token amount to the auction contract (which of course can only occur if the bidder has set the necessary ERC-20 approval). At any given point in time, only the current highest bidder will have their INJ tokens locked in the auction contract, thus allowing any bidders who have been outbid to withdraw their funds whenever they so desire. After the auction period elapses, the winner can trigger the disbursement of the accrued funds to their account.

For a limited period of time, a fixed number of tokens will be periodically distributed to users weighted by their net profit and loss during that time period. The distribution will end when a predetermined cumulative number of tokens is distributed.

INJECTIVE PROTOCOL RESOURCES

About the Author

Joseph Johns is a successful Emergency Medicine Physician and an ardent cryptocurrency and Blockchain connoisseur

Bitcointalk Username: Kloppkop

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2809524

%20(1).png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Whoa. Injective Protocol does all this?

Is Binance Dex team amongst Injective? Anyway good one there