ICO or Bust

[1] Over the past month or so, we have been inundated by many ICO being launched, so much so that even the Monetary Authority of Singapore raised issues/public warnings and in China, they went one step further by decreeing to shut down exchanges that trade in cryptocurrencies, alt-coins or tokens. HKSAR also clarified their position. ICO is demonized as the latest online scam and with each success or failure, invite more scrutiny. For those who are not familiar ICO stands for Initial Coin Offering or a pun on the well-known IPO (Initial Public Offering) although, in practice, IPO has to go through a regulated process while ICO is unregulated, executed by merely deploying a smart-contract on the Ethereum network to invite any party to exchange one asset like Bitcoin (BTC) or Ether (ETH) to another (herein token).

[2]I have not seen this amount of interest shown by regulators since the days when online scams from Africa were making their rounds. Both use the same ‘get rich quick’ and slick marketing to soften our defences. Well not exactly, without regulation there are unprecedented sensationalism and direct advertisement in the social media to drum up business. Sounds like the US election again with hypes and half-truths? This is where the regulators are having sleepless nights as they are sworn to protect the mums and pops from the next Ponzi schemer. And with Bitcoins and others, not only are moms and pops exposed to a new asset class where the regulators have no control at all but also crime bosses around the world and even the infamous leader of NK is in the game. They are all playing the game of musical chairs and we know what happens when the music stops. Howard Marks, one of the most respected value investors out there, starkly warned his clients to avoid high-flying digital currencies (https://www.cnbc.com/2017/07/26/billionaire-investor-marks-who-called-the-dotcom-bubble-says-bitcoin-is-a-pyramid-scheme.html)

[3] But while the music is still playing and the feet are marching to the tune, it would be naïve to think that all ICO are equal and equate all purchasers are moms and pops. To begin in order to purchase any token, one need to have an account with an exchange to purchase either Ether (ETH) or BTC in order to exchange. While opening an account is not overly complex, it does require some effort (like reading all the terms) and would take a regular person some 3-8 hours to educate themselves on the various nuances found in each exchanges , to prepare for the mandatory identification process (exchanges want to know who you are) and so on. And there is the legacy baggage about exchanges like Mt Cox and also in recent days like the DAO debacle. Of course, without an exchange, you can still mine those crypto-currencies like BTC or ETH yourself by building a ‘rig’ or pooled with others. $NVDA has recently reported strong sales for its GPUs (NVDA's GTX 1060/1070 cards) targeted at crypto-currencies mining. (http://www.barrons.com/articles/nvidia-crypto-demand-for-gpus-very-strong-could-cool-in-december-says-mizuho-1506091907?mod=yahoobarrons&ru=yahoo&yptr=yahoo)

The Australian government had put laws into place that put the onus on the exchanges to report their customers’ profile. The US in some states like NY has begun to license these exchanges and some are proud to be licensed.

[4] The exchanges have their own wallets/accounts which is only usable to deal with exchange transactions. Users may need to get their own wallets which are a few dozen; many of these wallets may require downloading software or require some knowledge of the underlying features or can be hardware or just a piece of paper. Some of the software may even require technical skills like command line. This will probably take a good 2-6 hours to get a feel about trading in crypto-currencies. In short, by the time ordinary users get online to purchase any token, he or she would have gained some hands-on experience which qualifies knowledge about the underlying assets. But all these skills are lost when it comes to ICO. In general, an ICO has two important elements, the first being a “White-Paper” and the second having a “Team”. A white paper is basically a document that says about how the funds (once raised through an ICO) will be applied to and more importantly to justify how these funds will be spent to give comfort to the token purchaser and is common to suggest some service or means to appreciate the value of those tokens. It is not enough the issued tokens have utilities but they must be able to appreciate faster than ETH to justify. In some cases, it can be a technical paper peppered with formulae. How can one decide?

[5] There are some folks (paid promoters) who argue that one need a STAR team. I would be cautious here because STARS usually mean they are already committed to more than one project. STAR teams usually have advisors too, with full-time jobs elsewhere. There are instances of fake STAR teams by linking to fake Linkedin accounts (check out the year when the account was created). How important is the team will depend on what is being touted here? For example, if the dream project is about exploring MARS (planet) and recording each data on a “block-chain” to save costs then it will be necessary to have experienced scientists on board and a team of all-stars high school dropouts may not do. In some cases, team members would rate themselves as experts. It is well known that the programming language “solidity” used to code smart-contracts is fairly new (first proposed in August 2014). Surely anyone with 2 years plus experience does not make one an expert unless one goes by the names of Gavin Wood or Christian Reitwiessner or Alex Beregszaszi or Yoichi Hirai.

[6] In most cases ICO involves business methods or known methods in the real world being adapted by fixating a “block chain” to its functions. There are real-estate, betting, lending, banking, market making or generally intermediary platform and even one for sustainable forest and so on. There was even one that was funded close to USD 250 million for an idea to pay the user for using their spare hard-disk space. In most cases, there is not even a prototype or MVP. The often quoted rationale seems to be that if it works in the real world, then it should work with a block-chain; being distributed is cost effective and transparent etc. However, there may be other considerations like speed and privacy. Encryption may not be completely tamper-proof.

[7] Therefore, it would be prudent to find out whether such ideas if implemented will be subjected to real-world regulation too. I recently had disagreements with some promoters touting ICO for betting on sports or online games using its tokens. The promoters seem to suggest that as a Swiss law firm had endorsed their “idea” this somehow unexplained had satisfied all regulatory requirements. What is not stated is that; there is no regulation against ICO anywhere on this planet and as long as tokens are not identified as “securities” then it is not unlawful unless expressly banned as happened recently by China.

[8]As a lawyer myself, a good ICO should carry a due diligence report from an independent law firm about its proposed business and any conflict with the law. It would be strange to seek funding to get a banking license or gambling license when there is not even an underlying platform. Even ‘easy’ jurisdiction where banking license application is a mere formality had placed banking practical experiences as a minimum requirement. The better view is to procure the banking license first before doing the ICO. An analogy is would any sane parent give their car-keys to their underaged children who have yet procure a driving licence.

[9]Even where the company’s memorandum and articles expressly permit services such as betting online games or banking, local authorities may still require one to submit an application to be exempted or otherwise. In fact, there are not many countries in the world that will issue a LOCAL casino license.

[10] Further, mounting a Block-Chain as the means to better traditional model is completely divorced from reality unless one happens to live on an island without regulations. I was not thinking about Singapore. Remember in the early days of the Internet, those that survived today also relied on more than just the Internet, for example, Amazon and Google both have US Patents that prevented others from their business at the door. Amazon’s infamous “one click patent” which has expired recently was actually collateralised to raise funds then. Google’s patents were actually assigned to Stanford University, overseeing its enforcement and licensing. Of course, the US Patent system is not the same as the days prior to the Leahy-Smith America Invents Act (introduced by the Obama’s administration in 2011; its central provisions went into effect on September 16, 2012 and on March 16, 2013). The recent amendments (H.R.9 (Innovation Act) and S.1137 (Patent Act)) actually made it much more difficult for startups as compared to established companies (like IBM, Microsoft and Google) to assert their IP portfolio. And it is almost “game-over” for those wanting to litigate.

[11] Be that as it may, I recently read about an ICO for a platform to originate loans with digital currencies as collateral. The ICO was to issue tokens for memberships on yearly basis. The rationale here is that the more tokens user buys the borrowing limit increases subject to the amount of digital currencies as collateral. Lending or financing is clearly a regulated business and this promoter touted itself as the platform where the loan originator is a SEC registered investment advisor or other on board are registered banking entities because it has no banking license. There was yet another which raised close to USD 30 Million in Pre-ICO Round wanting to replicate banking facilities when it does not even have a banking license at all. In its whitepaper it favoured a scheme that sounds like a dividend payout for token holders, it says “20 per cent of the transaction net revenue earned by …… and paid to …. token holders on a weekly basis”. From what I see they make about 5% (gross) from every payment (debit) transaction which is more than paypal and no figures on costs/expenses (no financials to date).

[12]In my view lending by whatever means (licensed or otherwise) is a ruthless business entrapping borrowers to debt (some would say economic slavery). It is not institutions nor systems to be blamed but smart people who consciously created schemes like ‘subprime lending’ as the end-game, so not surprisingly public funds and having to sacrifice one or two banks along the way is all part of the business. On the other hand mums and pops are equally blameworthy for flipping properties as a side career in the easy credit era to fuel this end-game.

[13] If the problem is that users want to keep ETC or ETH or BTC etc, instead of getting a loan why not consider a deposit albeit lesser? The idea that these digital currencies are used as collateral to enable a loan simply means users may be tempted to borrow to the maximum when the prices of those currencies are inflating and suffer the consequences of liquidation on the way down, even having to borrow further by mortgaging their real property. The borrower may be forced into bankruptcy if unable to make payments.

[14] In my view, the better way is to provide a platform for users or holders of digital currencies to deposit them with licensed institutions in return for some “interest” as opposed to getting loans. In this way, holders will have monthly income (not payments) and not be worried about fluctuations in the value as the rates are fixed or as agreed. Well, the problem is there is no “interest rate” for digital currencies yet as there is no central body dictating the costs of digital currencies.

[15] In fact, I came up with the idea that users can also ask depositee to bid for the digital currencies by providing competitive bids that may not necessarily be in digital currencies or fiat currencies, it can also be in other assets like shares/equity or gold bars etc. In fact, I filed a patent application for this and received a US Patent in 2008 (See US PATENT 7,376,612). I feel so confident of this that I even coded this as well. (See www.depositoffer.com)

[16] Unfortunately, I am an ONE man band and not well versed in marketing. I would like to do an ICO so that I can add more attractive features like a BLOCK-CHAIN and hire more hands to do all the fancy UI/X stuff to dazzle gen-X or Y users. Actually, I am preparing to offer tokens for membership privileges which should be launched by the end of Oct 2017. I am currently busy testing a new crowdfunding contract that allows users to redeem their tokens within a certain period instead of locking them in permanently with no way to cash out other than by selling or using it. I think this is fair but subject to refinement. You can check it out here https://github.com/bokkypoobah/BokkyPooBahsEtherRefundablePrize/blob/master/contract/BokkyPooBahsEtherRefundablePrize.sol

What is DepositOffer ?

[17] You can check out www.depositoffer.com website which is a working prototype in beta using a centralized database (MySQL). What I hope to do and it is not that difficult, is to create a blockchain backed deposit platform, and in lay man terms, depositor can expect his digital currencies to earn some “interest” by way of a smart-contract . Of course, this has its downside too, ie the depositor has no right to make an earlier withdrawal (currently with regular banks this can be done by imposing penalty or forfeiting interest). The current platform allows for users to seek bids from licensed institutions for regular deposits. The reason for a licensed institution is that at the very least it would be insured. Hence my system is seeking licensed institutions/brokers who will take digital currencies for their own portfolio to on-lend or to trade (like shorting). It is envisaged this system will allow bankers to compete for crypto-currencies (other than in exchanges) and also allow bankers to switch or derisk their portfolio holdings by offering alternative assets to cash (fiat currency). This is the real disruption to the investment market as costs of funds (assets) can be swapped or exchanged for less liquid assets which is currently not available to most depositors (unless you have your own private banker).

[18] As I said, there is NO central bank dictating the interest rate for any digital currencies and I like to keep it this way. The only way to decide on the cost of digital currencies is for licensed Institutions to bid. This will also create data feed (using LIVE BIDS) which will be available for those who have procured tokens. As a further incentive, users who do not have any digital currencies may like to predict where the costs will be by wagering (again using the tokens). I know this sounds like gambling but I can assure you it is not as this requires more skill than luck. It is an educated figure based on market demand and supply as well as affordability ie how much one is willing to pay, assuming there is no potential liquidity issue. Collectively, because there are a number of auctions carried in real time, we would be able to get an “aggregated” value which is a better indicator than by surveying which is done for LIBOR now. Most importantly is transparency and hence it would not be easy for anyone or a group of some to 'fix' the rates for their own benefit.

[19] Is this good or bad ? Digital currencies or crypto-currencies are new, an untested asset class and can be chaotic at times as compared to traditional assets backed by some entity or something but nevertheless, the market makers are the same. There may be a need to “fix” within a price band at some point to stabilize and to keep equilibrium but without the ability to manipulate one-sided transactions.

[20] In short, crypto-currencies holders need not cash out for fiat currencies to satisfy their unplanned needs. They merely need to deposit it with institutions for possible capital gains and at the same time earn interest or costs of funding of their own choice. Currently, depositoffer.com allows the users to select the winner (bidder) instead of allowing the institutions to offer their rates as seen in traditional practice. The reason is again back to the theme that we do not have a central authority to decide the rates. In arguendo, with more and more digital currencies coming on board, institutions may begin to dictate their own terms given the quality outside the main crypto-currencies.

[21] With this proposed ICO, the entire process may be streamlined by using a smart-contract to take the deposit, paid out the agreed interest and released the principal when the period is finished. It is not rocket science but where it gets complicated is instead of “interest” it can be a conditional asset swap which relied on externalities.

Who will use DepositOffer?

[22] Well, it's mostly for individuals who are holding digital currencies or cash and for Institutions who wish to access them without the need to purchase over at an exchange. An escrowing facility may be required to support this for those ultra conversatives but in my view is not necessary because if you can't trust a licensed institution who can you trust ? Investors will invest in crypto-currencies given a long-term horizon and be paid in interest just like official fiat currencies. Also, they can be exchanged for any ERC 20 tokens or vice versa whichever method works best for them. It is envisaged the licensed Institutions will loan them to who-ever by including a markup just like regular cash. This will have a multiplier effect and the rest is regular economics at work.

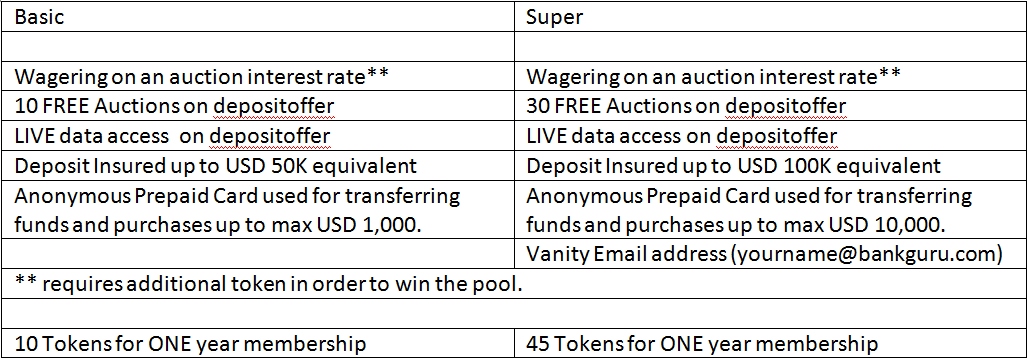

Please see below different tiers and benefit plans (proposed).

Users used their tokens based on their membership plan or can exchange them within the period back to ETH. These are ERC 20 tokens with proposed identifier “DEP”.

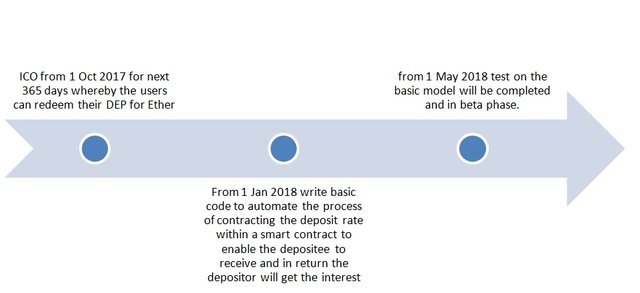

Please see below the timeline to implement the smart-contract.

Team Members.

[23] Currently I am the only founder and I have two contractor coders to assist me. My background is in law, and in the past - banking and mining. I am always looking for good-coders, if you are interested please email me “admin at depositoffer dot com”. Payment will be in DEP tokens. I also invented several fintech patents like US PATENT 8,650,126, US PATENT 8,001,035, US PATENT 7,493,279 which are earmarked to complement this project. If you are feeling generous you can donate some ether to 0xB353cF41A0CAa38D6597A7a1337debf0b09dd8ae (mainnet and ropsten).

Disclosure:

I am also running a Token Offer at https://token.ozrealestates.com. More information at https://bitcointalk.org/index.php?topic=2175583.msg21816030#msg21816030