Indian Farming Market Report : Industry Market Size, Share, Growth and Competitor Analysis 2024 Edition

Indian Farming Market Overview 2024-2032

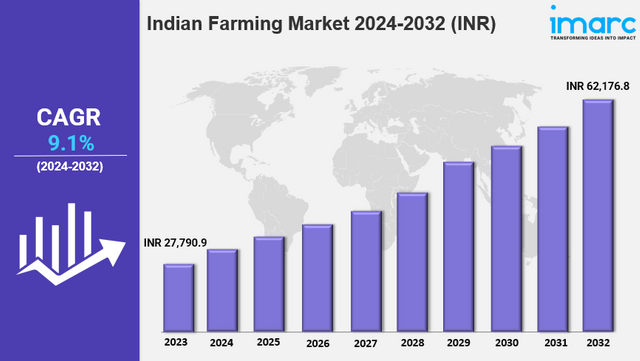

The Indian farming market size reached INR 27,790.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach INR 62,176.8 Billion by 2032, exhibiting a growth rate (CAGR) of 9.1% during 2024-2032. The Indian farming market is set for significant expansion, driven by rising food demand, technological advancements, and government support for modern agriculture. Key trends include the adoption of precision farming and organic cultivation, with major players focusing on sustainability and advanced irrigation techniques.

Key Market Highlights:

✔️ Strong growth driven by increasing food demand and government support

✔️ Growing popularity of organic farming and sustainable agricultural practices

✔️ Rising adoption of precision farming and advanced irrigation technologies

Request for a sample copy of the report: https://www.imarcgroup.com/farming-horticulture-industry-india/requestsample

Indian Farming Market Trends and Driver:

The Indian farming market is evolving. More farmers are adopting sustainable and organic practices. Consumers are becoming health-conscious and eco-friendly, increasing the demand for organic produce. By 2024, many farmers are likely to shift from chemical farming to eco-friendly methods that prioritize soil health.

Government programs are helping this shift. They offer subsidies for organic inputs and certification options. These initiatives encourage farmers to adopt organic practices. Also, consumers are willing to pay more for organic and sustainably grown products. This gives farmers a strong economic reason to go green.Switching to organic farming helps protect the environment. It also boosts farm profitability by improving soil quality and reducing reliance on chemical fertilizers and pesticides.

Indian farmers are quickly using digital tools and smart farming techniques. The rise of Internet of Things (IoT) devices, drones, and satellite imaging is changing farming operations. By 2024, precision farming will likely go mainstream. This will help farmers check soil health, optimize irrigation, and manage crops better.

These technologies boost crop yields and cut resource use, saving money and protecting the environment. Access to mobile apps and agricultural platforms also helps farmers with weather forecasts, market prices, and crop advice. Together, these innovations will reshape farming in India. They will make agriculture more productive, data-driven, and sustainable.

Government policies and rural development programs are crucial for the future of Indian farming.The Indian government recently launched schemes to help farmers access finance, technology, and markets. By 2024, these policies will improve infrastructure and support for agriculture. Programs like the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) and the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) assist farmers in boosting productivity.

They do this by providing financial aid and promoting water conservation methods. Also, improvements in rural infrastructure, such as better transportation and storage, reduce post-harvest losses. This helps farmers reach larger markets. With ongoing government support, the Indian farming sector is set for long-term growth. This growth will enhance food security, create rural jobs, and stabilize the economy across the country.

Indian Farming Market Segmentation:

The report segments the market based on product type, distribution channel, and region: We explore the factors propelling the indian farming Market growth, including technological advancements, consumer behaviors, and regulatory changes.

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Breakup by Crop Seasonality:

- Rabi

- Kharif

- Zaid

Breakup by Crop Type:

- Cereals

- Vegetables

- Fruits

- Plantation Crops

- Spices

- Pulses

- Others

Breakup by Application:

- Fresh Consumption

- Food Processing

- Healthcare

- Feed Industry

- Textiles

- Others

Breakup by Distribution Channel:

- Self Consumption

- Traditional Retail

- Business to Business

- Modern Retail

- Online

Breakup by Region:

- North India

- South India

- East India

- West India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145