Cryptocurrency investors in Asian country hit the howeverton push button

last night because the winter schedule of parliament, ranging from Nov 29, was published. It indicated that a replacement cryptocurrency bill are going to be tabled for discussion, which could but a ban on cryptocurrency commercialism within the country.

the outline of the bill same that it “seeks to ban all personal cryptocurrencies in India, however, it permits certainly exceptions to push the underlying technology of cryptocurrency

whereas this sounds scarey for investors and cryptocurrency exchanges, manyfolks detected that the outline resembles the previous description of the bill, and it'd not be reflective of the particular content.

what's the problem?

within the last week, many authorities have immersed regulation on cryptocurrencies. Jayant Sinha, the chairman of the parliamentary committee on finance on cryptocurrencies told CNB TV18 that while exchanges have claimed to own self-regulatory practices, they need to forestall concealing through digital currency.

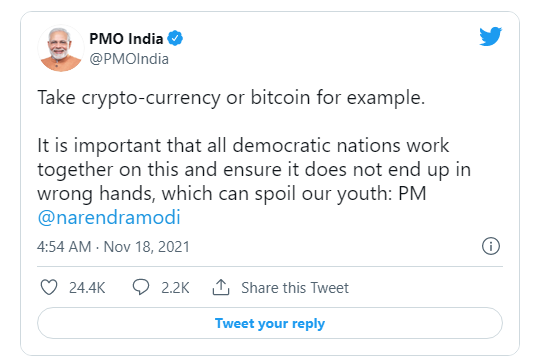

Speaking at Sydney Dialogue, a happening concerning rising technologies, PM Narendra Modi cautioned about the misuse of cryptocurrencies.

What does this mean for cryptocurrency investors?

aside from native exchanges, foreign firms like Coinbase and Kraken, can have to be compelled to bring to a close their operations from the country if the bill is passed. India’s financial organization has been against cryptocurrencies for the previous couple of years, issue circulars to banks to prevent addressing crypto businesses.

when the parliament’s winter schedule was announced, many investors started commercialism their coins.

Ashish Singhal, Founder & CEO, CoinSwitch Kuber, a corporation backed by a16z, same investors shouldn’t create rush decisions:

The crypto business is hopeful that the govt. can involve the industry stakeholders whereas drafting the bill. At CoinSwitch Kuber, we tend to shall follow the directions provided by the government. As of now, I urge all crypto quality investors within the country to stay calm, do their own analysis before inward at a rush conclusion. Investors ought to look forward to a government statement on this matter and not believe secondary thereforeurces of information.”

Nischal Shetty of WazirX tweeted that law markers perceive the market with over fifteen million cryptocurrency house owners in the country, so there’s no have to be compelled to panic.

India’s crypto business has been thrown into a fury again and again because the area is unregulated and there’s been a worry of a sharp shutdown. If there’s no blanket bank on cryptocurrency, this planned bill can hopefully offer much-needed stability and a framework for exchanges and investors.