India Paints and Coatings Market Growth, Size & Trends Forecast 2024-2032

India Paints and Coatings Market Overview 2024-2032

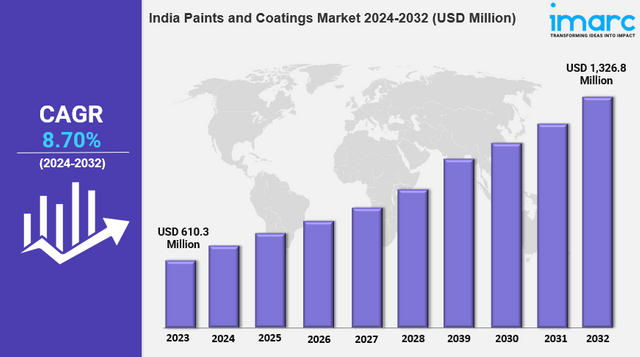

The India paints and coatings market size reached US$ 610.3 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,326.8 Million by 2032, exhibiting a growth rate (CAGR) of 8.70% during 2024-2032.. The rising infrastructure development, the increasing urbanization levels, and the evolving consumer preferences for durable and environmentally conscious solutions are primarily driving the market growth across the country.

Key Market Highlights:

✔️ Growing demand for premium and weather-resistant coatings

✔️ Increasing adoption of eco-friendly and low-VOC paint solutions

✔️ Rising investments in smart coatings and advanced protective technologies

Request for a sample copy of the report: https://www.imarcgroup.com/india-paints-coatings-market/requestsample

India Paints and Coatings Market Trends and Driver:

The shift towards sustainability is transforming the India paints and coatings market, with increasing consumer awareness and regulatory policies driving the demand for eco-friendly products. Rising concerns over air pollution and indoor air quality have led to a surge in demand for low-VOC (volatile organic compound) and water-based paints, which emit fewer harmful chemicals compared to solvent-based alternatives. In 2024, both residential and commercial sectors are adopting green coatings, with manufacturers focusing on bio-based formulations and advanced technologies like anti-bacterial and self-cleaning paints.

The government’s push for sustainable building practices under initiatives like Smart Cities and green infrastructure development is further boosting the demand for environmentally friendly coatings. Additionally, architectural and decorative paints are witnessing innovation with heat-reflective and energy-efficient coatings that enhance sustainability while reducing energy consumption. As sustainability continues to be a priority, eco-conscious consumers and businesses are reshaping the market landscape.

India’s booming construction and infrastructure sectors are key drivers of growth in the paints and coatings industry. Rapid urbanization, real estate development, and government-led initiatives like Housing for All and the expansion of metro rail networks are increasing demand for high-performance coatings. In 2024, large-scale projects, including roads, bridges, and commercial buildings, are fueling the need for industrial and protective coatings that offer durability, corrosion resistance, and weatherproofing.

Rising disposable incomes and shifting consumer preferences are also driving demand for premium decorative paints, with a growing focus on aesthetics and customization in home interiors. The increasing use of advanced coatings, such as fire-resistant and anti-microbial paints, in residential and commercial construction is further boosting the market. With infrastructure investment on the rise, the demand for innovative, long-lasting coatings is set to grow significantly in the coming years.

Technological advancements are reshaping the paints and coatings market, with increasing demand for smart and functional coatings that offer more than just aesthetic appeal. Consumers and industries are shifting towards coatings with enhanced features such as stain resistance, anti-microbial properties, and thermal insulation, catering to evolving needs across residential, automotive, and industrial applications. In 2024, self-healing coatings, nanotechnology-based paints, and energy-efficient coatings are gaining traction, driven by innovation and sustainability goals.

The automotive sector, in particular, is witnessing growing adoption of smart coatings that improve vehicle durability, UV resistance, and fuel efficiency. Additionally, the rise of digitalization and e-commerce is enabling consumers to explore personalized and tech-driven paint solutions, further transforming the industry. As smart coatings continue to evolve, they are poised to play a crucial role in meeting the diverse demands of modern infrastructure, manufacturing, and consumer preferences.

India Paints and Coatings Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest india paints and coatings market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Product Insights:

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

Material Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Application Insights:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145