India Data Center Market Report 2025 Edition: Industry Size, Share, Growth and Competitor Analysis

Market Overview 2025-2033

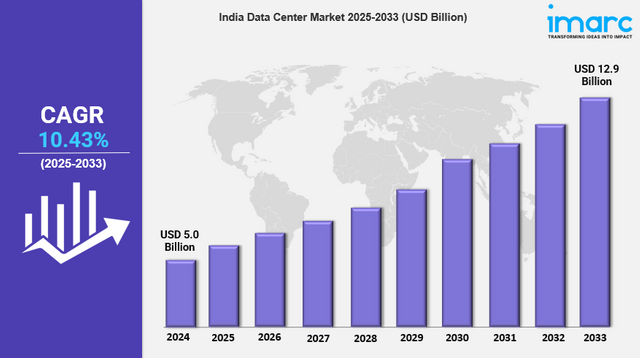

The India data center market size reached USD 5.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.9 Billion by 2033, exhibiting a growth rate (CAGR) of 10.43% during 2025-2033. The growing adoption of digital technologies in several industries, such as e-commerce, banking and healthcare, rising supportive policies by the Government, and increasing popularity of cloud-based services among industries are some of the major factors impelling the market growth.

Key Market Highlights:

✔️ Strong market expansion driven by digital transformation & rising data consumption

✔️ Growing demand for high-performance and scalable data center solutions

✔️ Increasing adoption of energy-efficient and sustainable infrastructure

Request for a sample copy of this report: https://www.imarcgroup.com/india-data-center-market/requestsample

India Data Center Market Trends and Drivers:

India data center industry is witnessing rapid growth, propelled by the increasing digitalization of businesses, rising internet penetration, and widespread adoption of cloud computing. Organizations across multiple sectors, including IT, finance, e-commerce, and healthcare, are embracing cloud-based infrastructures to enhance efficiency and scalability. The proliferation of smart devices, the introduction of 5G technology, and the surge in digital transactions are generating vast volumes of data, intensifying the need for secure and high-performance storage solutions. By 2025, this escalating data demand will drive the development of both large-scale hyperscale data centers and smaller edge data centers, which offer quicker processing and lower latency.

Government policies, including the Digital India initiative and data localization mandates, are encouraging enterprises to establish domestic data centers, further stimulating market expansion. Additionally, the growing reliance on artificial intelligence (AI), machine learning (ML), and big data analytics is prompting significant investment in high-performance computing infrastructure to support next-generation digital applications.

As cloud computing and AI-driven technologies become more integral to business operations, the need for resilient data center networks is intensifying. Global technology firms and cloud service providers are investing heavily in hyperscale data centers to accommodate this rising demand, while the adoption of edge computing is driving the deployment of smaller, decentralized facilities that bring processing power closer to end users. This approach enhances network performance, reduces latency, and ensures seamless digital service delivery.

By 2025, businesses are expected to increasingly implement hybrid and multi-cloud strategies, further accelerating demand for agile and scalable data center solutions. The push toward smart cities, IoT-powered industries, and Industry 4.0 advancements will also boost investments in edge computing infrastructure, ensuring better connectivity and real-time data processing across various domains. As cloud competition intensifies, organizations are prioritizing data security, disaster recovery solutions, and regulatory compliance to strengthen their market position.

One of the key challenges facing the industry is the substantial energy consumption of data centers. In response, there is a growing emphasis on energy-efficient and environmentally sustainable solutions to lower operational costs and minimize ecological impact. Many enterprises are embracing green data centers powered by renewable energy, advanced cooling technologies, and intelligent power management systems.

By 2025, sustainability will play a crucial role in data center development, as businesses align their infrastructure with global environmental goals and government sustainability regulations. The adoption of liquid cooling solutions, AI-driven energy management, and carbon-neutral operations is expected to rise, enabling operators to optimize efficiency while maintaining high performance. Government incentives promoting renewable energy use and tax benefits for eco-friendly data center projects will further accelerate this transition, positioning India as a leader in sustainable and energy-efficient data center operations.

Speak to an analyst : https://www.imarcgroup.com/request?type=report&id=7801&flag=C

India Data Center Industry Segmentation:

Our comprehensive India data center market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the market and capitalize on emerging opportunities.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Application:

- Banking Financial Services & Insurance (BFSI)

- Government

- IT and Telecom

- Media

- Retail

- Manufacturing

- Others

Breakup by Type:

- Enterprise Data Centers

- Colocation Data Centers

- Edge Data Centers

- Hyperscale Data Centers

Breakup by Component:

- Hardware

- Software

- Service

Breakup by Size:

- Small Data Center

- Mid-Size Data Center

- Large Data Center

Breakup by Region:

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Gujarat

- Karnataka

- West Bengal

- Rajasthan

- Andhra Pradesh

- Telangana

- Madhya Pradesh

- Delhi NCR

- Punjab

- Haryana

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800