SCOPE OF BITCOIN AND ALTCOINS IN INDIA

##Introduction

Most widely accepted medium of exchange still happens to be in control of governments and their fiat currencies across the world. Presently, India is over 2 trillion dollar growing economy and one among the fastest growing economies in the world. However, growing instability in the global order has given rise to the age of cryptocurrencies due to loss of faith and trust towards the financiers and politicians. The idea of cryptocurrencies surfaced just a few months after the collapse of the global banking sector, which is attributed to the creator know to us as Satoshi Nakamoto. This marked the inception of crypto age which has only grown stronger with the years. Which is now generally accepted across several platforms as mode of payment and accepting donations.

Today the market cap of cryptocurrencies has seen an all time high of $116 Billion USD. Crypto’s like BTC and ETH reaching their all time high nearing $3000 USD and $400 USD respectively, in June, 2017. Following which the crypto market is experiencing correction and recovery.

Notwithstanding the deep correction experienced recently cryptocurrencies have made a case of good investment allow the average investor to hold their investment in fractions against the value of these currencies unlike shares traded on stock exchanges. This certainly allows investors to hold their investment in cryptocurrencies even with small amounts. Which has only increased the interest amongst several individuals in India to hold these highly valuable crypto against the sentiments of holding gold and silver as primary investment amongst other forms. Further, the dangers of demonetization of bank notes as seen in India on the 8th November, 2016 has induced fear amongst individuals in holding fiat currencies.

These contributing reasons have seen India very recently accounting for nearly 10% of global cryptocurrency trade as remarked by trade analyst Chris Burniske in his tweet.

Thus with the increasing popularity amongst people in holding these new age currencies, several Bitcoin and Altcoin exchanges have pushed to increase accessibility amongst India investors looking forward to enter the trend. Exchanges like Coinsecure, Zebpay, Unocoin, ETHEXIndia, BTCXIndia are offering Bitcoins, Altcoins and crypto tokens as standard offering in Indian Rupees making it far more accessible to the average Indian investors. Where previously Indian investors had limited options to access crypto market. Further, the only procedure undertaken so far by these exchanged to account these investors is through KYC (Know Your Customer) and identity proofs (like Aadhar card and PAN) are mandated by these exchanges as part of their approval procedures to trade crypto’s on these exchanges.

The principal laws which may concern cryptocurrencies are:

- The Constitution of India, 1950;

- The Reserve Bank of India Act, 1934;

- The Coinage Act, 1906;

- The Foreign Exchange Management Act, 1999;

- The Securities Contracts (Regulation) Act, 1956;

- The Payment and Settlement Systems Act, 2007;

- Income Tax Act, 1961;

- The Sale of Goods Act, 1930 and;

- Indian Contract Act, 1872.

Logically speaking these ‘virtual currencies’ or cryptocurrencies as we have known them shall not be considered to fall within the definition of currency. The only possibility is to regard these cryptocurrencies as ‘such other similar instruments’, however, these must be notified by the RBI (Reserve Bank of India). Similarly, its status as money or as commodity/goods are subjective to regulatory implications. Cryptocurrencies maybe covered under these existing laws, however, it would need further clarity and jurisprudence on the same.

##What’s there for the Indian government in these cryptocurrencies?

As discussed many people in India have started looking at these cryptocurrencies, as some may say, a form of lucrative investment. Indian exchanges like Coinsecure, Zebpay, Unocoin have racked several million dollars in form of investments as investors have slowly been developing faith in these currencies. Furthermore, some of these exchanges have started ad-campaigns in newspapers and media to reach out to million other Indian investors looking at prospects of lucrative investment. As the case may call, many individual investors are looking to make quick money due to large price variations that these cryptocurrencies may experience. Apart from the benefits that it can reduce transaction fees and provide faster transactions and that it will also help speed foreign investments if so desired.

In 2015, the RBI published a financial stability report on disruptions in financial technology. Highlighting the importance of of ‘private blockchains’ which could revolutionise the banking system. So is the likes of introduction of Altcoin like Ripple which have embarked on the potential these cryptocurrencies have to offer in the banking sector. [Howsoever, Indian banks do not have any known affiliation with this Altcoin, Ripple]

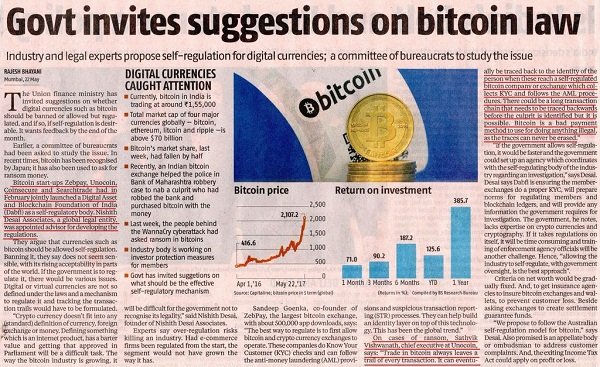

Moreover, April 2017 also saw the Department of Economic Affairs in the Ministry of Finance in India having formed the interdisciplinary committee to examine the framework on virtual currencies and inviting suggestions to understand the cryptocurrencies better.

##Impact of Bitcoin Legalisation and concerns

The first and foremost, legalisation will ensure increase in trade and investment volumes as the investors will have a higher confidence to invest in the crypto market. We hope this may prevent any security breach as seen by Mt. Gox in Japan which is facing trial. This will certainly translate to governments intentions to also tax income accrue or arise in form of Bitcoin or Altcoins. However, this is not yet clear under Indian law which makes it difficult to conclude.

However, there are some major concerns which still linger for developing economy like India. These include both regulatory as well as security concerns.

Following are the Indian Regulatory concerns:

- Taxation of cryptocurrencies

- Cross border transfer

- Tax Avoidance and Evasion

- Money Laundering

Following are the Indian Security concerns:

- Hacking

- Privacy and Data Protection

- Terrorist Financing

- Drug Trafficking

- Identity Theft

- Cyber Terrorism

All these concerns are just to name a few. Save the exception of Bangladesh, Bolivia, Ecuador & Kyrgyzstan where bitcoins and cryptocurrencies are illegal. Countries like United States have passed laws like Combating Money Laundering, Terrorist Financing, and Counterfeiting Act of 2017 to include Bitcoins and Altcoins exceeding value of $10,000 USD which shall be subject to declaration. Though the same has meet with several criticisms. Similarly, China, Canada, Brazil have certain laws in place to regulate cryptocurrencies. Whereas, countries like Norway and United Kingdom intend to tax cryptocurrencies under capital gains and VAT/GST. On the other hand, European Union is committed to Tightening Digital Currency Rules by End of 2017.

##What is the future of Cryptocurrencies in India?

Cryptocurrencies have number weaknesses [subject to improvement] and may have long-term viability issues which are unknown. But trends suggest that these cryptocurrencies are here to stay as the play an increasing role worldwide. Further more, India is yet to experience the surge of Initial Coin offerings (ICO) with start-ups in India which again will call for regulations on part of Securities Exchange Board of India (SEBI) and further amendments to the Companies Act to accommodate such public fund raising. Further, Foreign Direct Investment (FDI) also will form a regulatory parameter as cryptocurrencies can be used to make investments into India.

All these prospects guarantee a huge scope for these cryptocurrencies in the near future, although promised with several uncertainties. The only possible directions where the government shall head presently is to harness the potential that these cryptocurrencies have to offer, limiting threats and adapting to the technology, rather than embarking on some counter productive laws in the name of conservation. Nevertheless, they are attempting to embark on to the journey to explore crypto world.

Congratulations @adityavijayr! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP