Personal Credit Lending

As part ONE of my strategy for passive income, I will be looking into sharing my strategy for Lending Club. Lending Club is a peer-to-peer lending platform in which individuals can request loans from the community with terms that are normally more favorable than other financing that is available.

Originally there were Grades for the loans ranging from "A-G," but recently grades "F and G" were removed due to increased risk and high default rates. Grades are determined by credit score, debt to income ratio, credit utilization, and several other factors. The factors that go into rating these borrowers is as strict if not more so than many credit cards or personal loans.

.png)

I have been a borrower before and have to say that the process is easy and the interest rates are very competitive for things like credit card pay down.

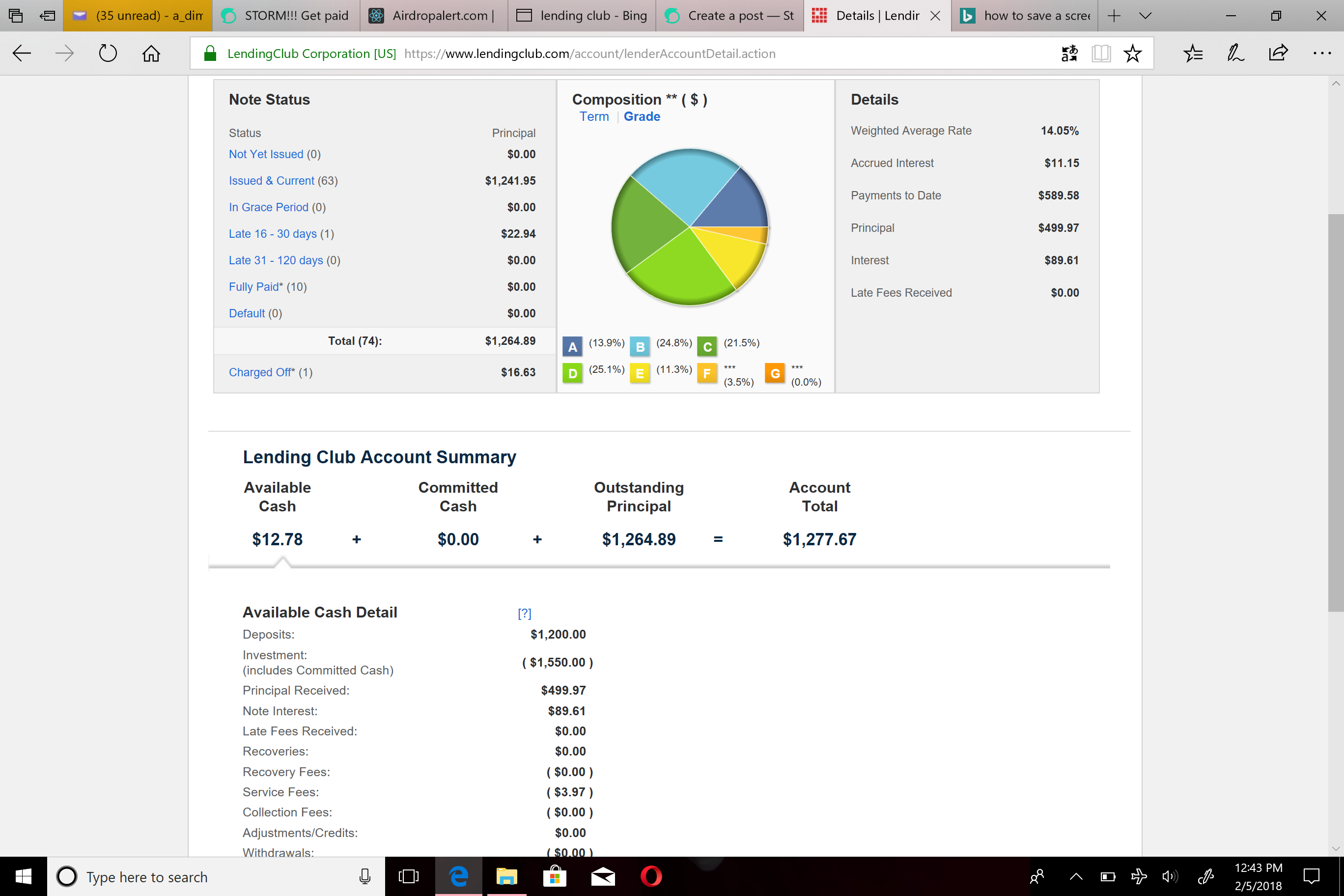

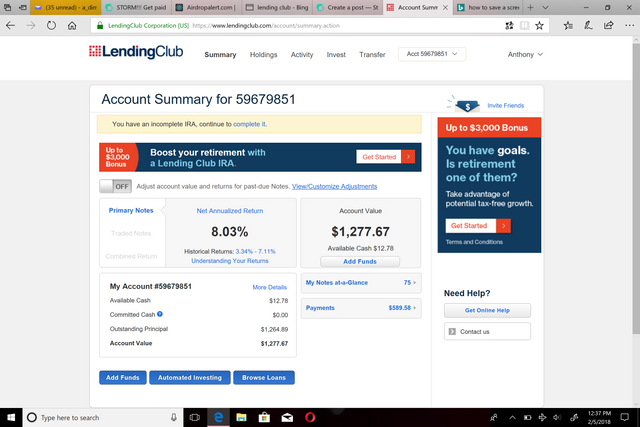

Ok, now let me get into my strategy. My current portfolio earns a combined 8.60% Net Annualized Return after fees. The combined value come from my direct investments and the notes I have invested in on the Trading Platform, more on that a little later. Lending Club gives you an option to look at your returns based on an adjusted average taking into account possible default rates or just to look at it as a straight percent. I personally look at the unadjusted rate to build my target. My average for noted invested is 8.03% and traded notes is 27.45%.

The key to creating a strong portfolio that produces a good return and limits the risk of default is to diversify by only investing $25 in each note and having strict investing guidelines.

These are the guidelines I follow for direct investing:

Purpose has to be refinancing of some sort. I will not lend for a purchase, home remodeling, business, or other. My thinking is that they are getting a reduction in money out when they refinance and are more likely able to repay this loan.

Payment can not be greater than 15% of income and I try to stay closer to 10%. If credit payments start to eat into too much income, they are the first to go when finances get tough.

Credit score above 675. While the rates do factor credit score in, I feel better starting with a decent credit score because it shows me that this person has at least tried to maintain their credit.

No "A" grades and as few "B" grades as possible. The return on these is typically around 4 or 5% and I do not feel the risk outweighs the benefit. I look at "C" grades mostly and the occasional "D" grade that clicks all the boxes.

I like to find rates between "12 and 20%." With fees and default rates, these loans tend to fall into the 7-8% range of return. They represent a good reward for a fair risk.

No public records, delinquencies, or negative marks on credit for the past 2 years. Originally I did not look at anybody with a negative mark no matter the time frame, but after doing more research I settled on 2 year as a good cut off.

Those are my hard and fast rules for finding my loans. Sometimes it will take me a couple of days to find a good loan, but sticking to a system and being patient always pays off in the end.

With an 8% return I will need $15,000 in order to reach my goal of $100 a month. While that is better than my original starting figure, it is still a ways away from my goal of 10k.

Stay tuned as I continue to update on my progress.

Congratulations @crazynp! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP