ICOs - how to find the good ones

ICO stands for Initial Coin Offering and is quite similar to how crowdfunding works. But ICOs differ from crowdfunding in that the backers are motivated by a prospective return in their investments. For these reasons, ICOs are often referred to as crowdsales.

ICO stands for Initial Coin Offering and is quite similar to how crowdfunding works. But ICOs differ from crowdfunding in that the backers are motivated by a prospective return in their investments. For these reasons, ICOs are often referred to as crowdsales.

The problem is to sort the good ones out from the bad.

The way I go about is this:

Step 1: Find what's going on

If you haven't already got a tip about a particular ICO, use a free service like:

https://icorating.com

https://tokenmarket.net/ico-calendar

https://www.icoalert.com/

https://icodrops.com/

to see upcoming ICO:s. Read the short summary of each ICO and see if there's something that you believe in.

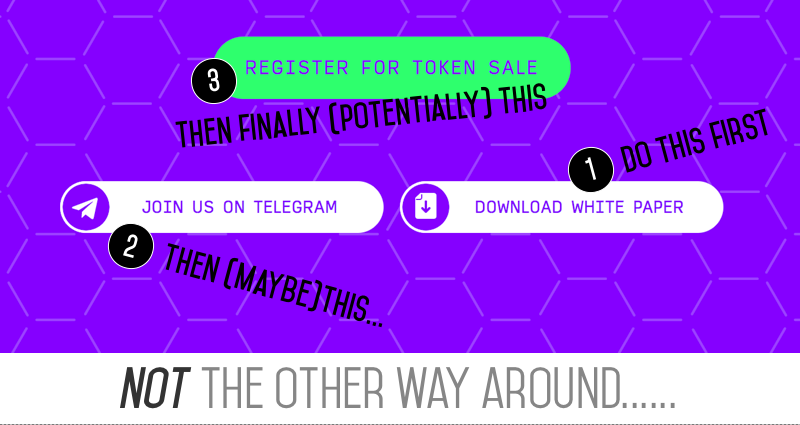

Step 2: Check website & whitepaper

This should be mandatory for every ICO investor. So many times I've seen potential investors not even knowing the ICO web address. Visit their webpage! If it looks like a scam, walks like a scam and talks like a scam it probably is a scam and you can turn your attention somewhere else.

Then check the whitepaper and get a better understanding of what they want to accomplish. If they have a working prototype that's great! Try it out! Also look into the token distribution and economics of the project.

Look at the team! In my view the team must consist of both blockchain experts AND experts within the field.

Step 3: BE CRITICAL

Always. Be. Critical! Use your common sense and have two questions in mind:

A. Will a regular user ever use their service/product - or will it be too complicated?

B. Will a business ever their service/product and implement it - or will it be too costly?

If the answer to any of these questions is/are "no" then you shouldn't invest, because then they will probably fail.

Step 4: Filter out the noise

This is maybe the hardest part. It's very easy to get affected & distracted by what everyone else says about an ICO. Try to stick to what you actually believe in. I promise: you will get rewarded for this in the long run.

Step 5: Scout the landscape

Usually when I've made up my mind and have a shortlist of potential investments I go out and read what others say. This means going back to the noise, but at least I've made up my mind before wading through it all. Some of the sources I use are Discord, Reddit and of course Youtube and Twitter. https://bitcointalk.org/ is usually quite good too. If the service is about "energy" for example I also try to find expert forums and websites about this particular area. Always good to hear info from people who already works in the field.

Final thoughts

The good thing about going through this process is that you actually have your own opinion about a certain ICO. Either you know you don't want to invest in it. Or you know you're going to invest. No matter what others are saying.

Good luck and remember: sometimes NOT investing in something is the best investment! :)

Oh, and if you're just starting with cryptos and ICOs feel free to use these links to set up your accounts:

Coinbase - transfer fiat to BTC or ETH

Binance - my preferred exchange