"I Hear Drake Has An ICO Coming..."

Authored by Kevin Muir via The Macro Tourist blog,

When you see the waft of ICO’s (Initial Coin Offerings) hitting the market, you have to ask yourself what these “investors” are smoking.

Let’s put aside whether bitcoin, ethereum, or some other transactional coin, ends up being a medium of exchange with real value. Instead let’s focus on these ICO’s.

If cryptocurrencies were not difficult enough to understand, ICO’s have added a layer of complexity that confuses most of the public. ICO’s use blockchain technology, but they are nothing more than digital shares of some enterprise. The attraction is that they allow for the easy raising of money with little regulation, low cost of transaction and ability to trade extremely small units of the offering. Although many of the ICO’s business plans are related to cryptocurrencies, there is no need for that to be the case.

Here is an example of a recent ICO that raised money to produce synthetic rhino horn erection pills.

Yup, you read that correctly - this “company” is raising money through a sale of an ICO to develop a fake rhino horn pill. The absurdity of these stories are like the OTC pink sheets - only way worse. And the public is gobbling it up at an alarming pace.

If you don’t think this mania will not produce a tremendous amount of fraud, you are dreaming. So far in 2017 there has been more than $1 billion of ICO sales. A billion dollars. F’ me. Money is flowing into an asset with absolutely no protection for investors with no regulation. Just dreams.

Now they are not all scams. I am sure there are some legitimate companies in here. But the hype surrounding these ICO’s is unbelievable.

Paris Hilton is leading the charge of celebrity endorsements.

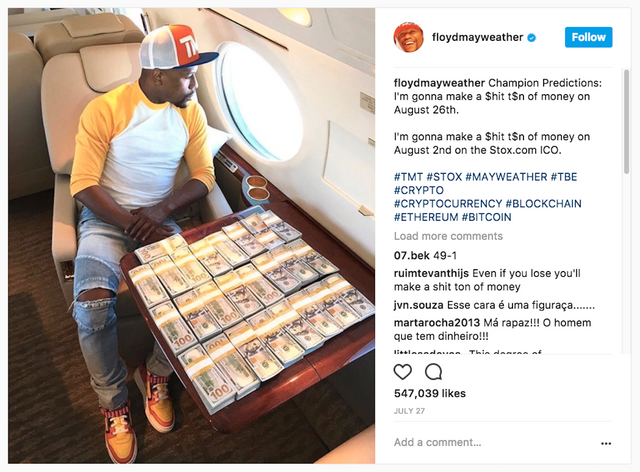

And right behind is Mayweather.

“I am going to make a $hit t$n of money on Stox.com ICO” is quite the investment proposition.

Or how about this guy (h/t to Jared Dillian of Dirtnap fame for this one)?

Over the last couple of years, I have watched all sorts of hedge fund gurus forecast how stocks were in a bubble. During this period, they were actively shorting the market, and often preaching the gospel about the dangers from the frothiness of stock market speculation. I have long been perplexed how it could be a bubble if so many experts were negative.

Yet here we have a legitimate bubble, and instead of warning about the dangers, many of these hedge fund gurus are actively encouraging investors to get involved.

And yeah, I get it. If you are a crypto believer, you are probably labeling me as some old finance guy who doesn’t understand cryptos. But lest you think me some buffoon that doesn’t know the first thing about bitcoin, we were mining and trading bitcoin well before most of these hedge fund guys were recommending it (My Great Bitcoin Bungle). So no, I am no buffoon - I am the idiot who knew about bitcoin when it was trading at $5 and refused to get long.

I am a crypto skeptic, and I have been wrong about the sustainability of this rally, so it is easy to dismiss my opinion.

Yet I am a student of the market, and I can assure you, bubbles are never easy to call when you are in them. Most market pundits believe themselves to be contrarians. But so few actually are.

Do you think it was easy to be short DotCom stocks in the late 90’s? Not a chance. You were teased as an idiot for not getting it.

To get an idea of the sort of thinking that prevailed at the time, here is a Jim Cramer speech from February 29th, 2000:

You want winners? You want me to put my Cramer Berkowitz hedge fund hat on and just discuss what my fund is buying today to try to make money tomorrow and the next day and the next? You want my top 10 stocks for who is going to make it in the New World? You know what? I am going to give them to you. Right here. Right now.

OK. Here goes. Write them down – no handouts here!: 724 Solutions ( SVNX), Ariba ( ARBA), Digital Island ( ISLD), Exodus ( EXDS), InfoSpace.com ( INSP), Inktomi ( INKT), Mercury Interactive ( MERQ), Sonera ( SNRA), VeriSign ( VRSN) and Veritas Software ( VRTS).

We are buying some of every one of these this morning as I give this speech. We buy them every day, particularly if they are down, which, no surprise given what they do, is very rare. And we will keep doing so until this period is over – and it is very far from ending. Heck, people are just learning these stories on Wall Street, and the more they come to learn, the more they love and own! Most of these companies don’t even have earnings per share, so we won’t have to be constrained by that methodology for quarters to come.

And before you dismiss Cramer as a shouting nincompoop, don’t think his views were out of the ordinary. During this period there were plenty of serious articles about how Warren Buffett had lost his touch. How he didn’t get it, and his time under the sun was done.

It was unbelievably hard to be negative on tech stocks in 2000. Just like it is unbelievably hard to be negative on crypto currencies today.

Saying anything less than positive gets you labeled a know-nothing knob who doesn’t get it. Classic bubble stuff.

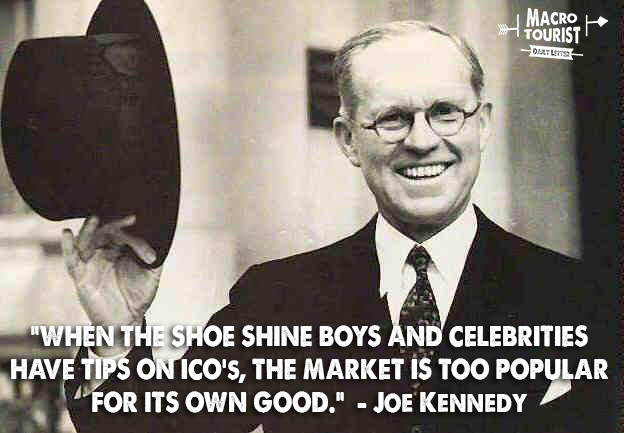

I can just hear the ghost of Joseph Kennedy telling you to get out.

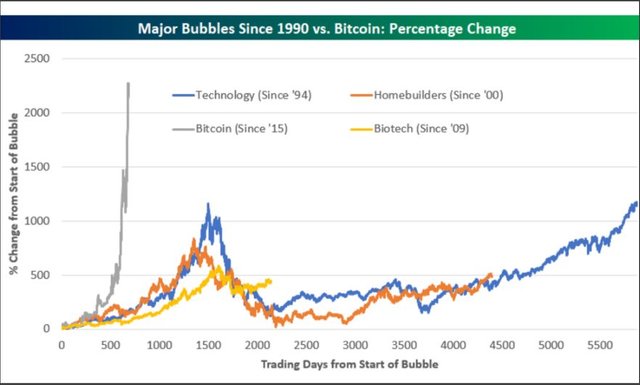

The other day, Geroge Pearkes from Bespoke Investments (a must follow on twitter), tweeted out this terrific chart of the Bitcoin bubble.

Yet whenever someone uses the word “tulips” to describe the crypto market, the fanatics come out in full force to quash any notion that it is a bubble.

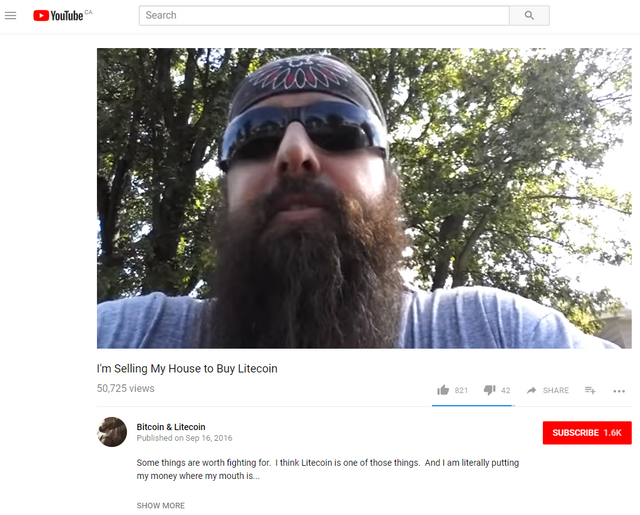

Remember the last bubble? US real estate. Well, this guy is so convinced that LiteCoin is the true store of wealth that he is selling his house, and putting it all into LiteCoin.

I have to give him credit. He is balls-to-the-wall all in. No one can accuse this guy of being a sally. (Click here to watch the greatest “all in” commercial of all time.)

And up until now, anyone who has doubted the staying power of cryptos has just looked like a chump. So who knows? Maybe this dude will get the last laugh.

Yet although I am busy splashing cold water on the crypto rally, I haven’t answered any questions about why this is happening. But I have a theory.

Remember the terrific gold presentation titled “Nobody Cares” by Grant Williams? Superb analysis that detailed how small the gold market was in comparison to the capital markets, and how a little change in sentiment would create a monster move in gold. It has been one of my main tenants of my gold bull thesis - Pimco, gold bull?.

Well, the idea was correct, the asset was wrong. Instead of investors looking at the financial repression and deciding to own a little bit more gold, they chose the new technology, and went with bitcoin.

Over the past few months, I have noticed an increased desire by institutional investors to have some exposure to the asset class. It started with Fidelity, but it has spread to normally conservative money managers. Even usually skeptical Reformed Broker Josh Brown has gotten into the action.

So you are now free to dump all of your crypto-currencies because this surely marks an all-time top.

But I thought I’d mention it anyway.

For those who are curious about why and how, I’ll just say the following…

I’m old enough to realize that just because I don’t see a use for something, that doesn’t mean I won’t be proven wrong by others who do. At the current moment, I don’t see the financial industry use for Bitcoin other than some marginal activities like settling commodity trades that are very far divorced from my day to day existence. I understand the benefits of these things – the blockchain acting as verification that the counterparty has made payment instantly, etc. I’ve probably read all the stuff that you have. I’m skeptical.

I also think it’s hard to imagine the IRS, Treasury etc allowing anonymous transactions without any reporting becoming a global standard for US persons.

But I’m willing to look beyond that because the goddamn thing won’t go away. I was talking with Justin Paterno (StockTwits) the other day and his attitude toward it is pretty much where I am – “Anytime something just refuses to die, you probably have to pay attention to it.” Bitcoin, if it were complete and utter nonsense, probably should have died already. But 7 years since it burst into the public consciousness – with all of the attendant volatility and criminal activity you’d expect to come along with something so new and unproven – and it’s still here. Despite the hacking and stealing and malfunctions and crashes, it’s still a thing. It’s the f***ing rooster. Ain’t found a way to kill me yet…

Anyway, I’m not a disruption hippie or an early adopter or a visionary or an evangelist. But I’m too curious to not experience Bitcoin ownership for myself. Oh, by the way, I don’t see myself trading it on price swings, more on that in a second.

The Information Technology Revolution began in the early 1980’s when the computer became first a ubiquitous business tool and then eventually a household appliance. It should come as no surprise when I tell you that this moment also was the inflation-adjusted high for gold, still unsurpassed almost 40 years later.

Blockchain technology may have just permanently disrupted traditional currencies. It’s obvious to me that even if this is true, we will not know it for sure until decades have gone by.

Crypto currencies hit a point where it has become more scary to not own any than the other way round. Investors suddenly became worried they were missing “the next big thing.” So they buy a little. And in the grand scheme of things, it’s not a big market. So it went up. And they bought more. And then it fed upon itself, and next thing you know, Paris Hilton is an expert on the next great asset class.

I am not afraid to call this a bubble. It’s a bubble. When you get celebrities pumping ICO’s, you know you are in the midst of a mania. More sophisticated investors will correctly point out that ICO’s are not cyrptocurrencies. They are two different things. Yes, that’s true. But it’s only because of the stunning returns of cryptocurrencies that ICO’s are able to raise this sort of money. It’s like at the end of a stock market bubble when the shittiest stocks go public.

I don’t doubt that decades from now we will look back at blockchain as a truly revolutionary technology. Much like we did with the advent of the internet during the DotCom bubble. But we still had the 2000 crash to deal with, and although today’s biggest companies were built on the back of that bubble, had you invested in the nasdaq market in 2000 (ala Jim Cramer’s advice), you would have had years of painful capital destruction.

I am not sure if today’s bitcoin mania is the equivalent of the year 2000, 1999, or even 1996. Bubbles have a way of going on much longer than anyone expects. It might be only when skeptics like me have thrown in the towel that it will finally top.

In the mean time, I am switching back to Instagram to get my next great ICO tip. I hear Drake has a new coin he is about to float.

Source : http://www.zerohedge.com/news/2017-09-07/i-hear-drake-has-ico-coming

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you! Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

Wouldn't be surprised if Drake's coin was called CRY.

Thanks for sharing...

Kevin needs to be ready to be wrong for a long time. Cryptos need to go up 50x just to reach the Nasdaq bubble size. 50 f**king times... He should try doing a little research.

LAToken started with listing equities on their platform LAToken offers unique opportunities for investors of any size to own fractions of assets previously accessible only by large investors (e.g. real estate , bitcoin trading, forex, etc they want to completely transform access to capital, and enable cryptocurrencies to be widely used in the real economy by making real assets tradable in crypto.https://sale.latoken.com/?r=cfb74eff2e

I do believe the ICO space is getting a bit insane; but that is just sucking up the fresh money. Maybe that will teach them the golden investment rule (always research where you put your money).