[REVIEW ICO] MoneyToken - Potential Project 2018

MoneyToken is an extended financial ecosystem. This platform will include and provide a number of different financial services, such as loan platforms. In addition, they want to create their own stablecoin, which is safer and more efficient than other types of electronic money that are prone to changing market prices.

MoneyToken is a blockchain-based financial ecosystem that in many ways works as a bridge between cryptocurrencies and traditional currencies. It serves as a decentralized exchange service that will provide loans that are backed by cryptocurrencies. The company is also selling its own cryptocurrency, which is currently in the pre-sale round.

Website: https://moneytoken.com/

Money stable

The main idea and feature of the lending platform is to create a lending system where people can use electronic money, despite their frequent and sudden price fluctuations. No one wants to borrow money with the thought that by changing the market, he will need to repay ten times the amount he has borrowed.

At present there are few other stablecoins, which can act as an example of how it works. The most convenient option is the USD Tether. The exchange rate for the USDT is still stable compared to Bitcoin, and it is easily exchanged for dollars as it is backed by dollar mortgages. Tether's market capitalization has risen from $ 55 million in April 2017 to $ 430 million in September 2017, showing the ongoing demand and the high demand for such financial solutions.

Loan platform

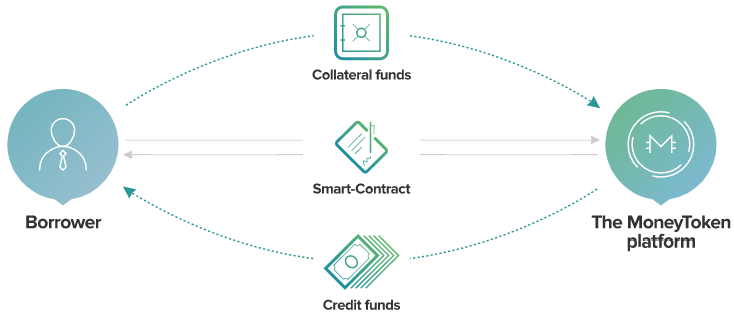

MoneyToken wants to allow as many users as possible to borrow money and be a borrower, regardless of their financial status or credit score. Approval of the loan will take a few seconds, while the amount can be issued almost immediately thanks to the smart contract. Interestingly, in MoneyToken, credits were raised from a credit fund, which resulted in unnecessary collection of credit, as opposed to conventional p2p platforms.

The only idea is quite simple. A borrower, mortgage with many volatile assets such as Bitcoin or Ethereum for example. In return they received an agreement loan in a stablecoin. Once the loan is repaid, they will receive back all the collateral, even in the case of multiple value increases due to market changes.

Safeguards secured

All transactions and loans are recorded and executed by the Ethereal-based contract. Deposits are kept in a wallet, protected by multiple signatures. To access the wallet, 3 out of 4 signatures are required. The first is one of them belongs to the borrower, the second is the lender, and the other two belong to the foundation. This guarantees no part, even MoneyToken platform can not access the fund without the help of others. That way, there is no risk that one of the parts will steal money or cheat someone. Such assurances can not be made by most regular and orthodox platforms where users must trust their platform owners with money and their transactions. Furthermore, future Multichain-traded and multi-contract smart-contracts will be available,

Exchange hierarchy

For full control over funds and collateral, MoneyToken will also include a decentralized exchange of their services. Users will be able to purchase electronic money at their option with fiat money and also swap loans with a currency they need. In addition, the exchange will be used to liquidate the collateral automatically in the event of mortgage currency devaluation to avoid any significant losses.

Token

The IMT Token will be used as a platform payment method with the primary role of allowing users to purchase customer membership, a 60% discount on platform fees. In addition, one can become a creditor when sending IMT for lenders. In addition, it will also allow the token holder to participate in the decentralization vote on important issues of the project.

ICO phase

The first token is provided from March 22 to April 12. The initial price is set at $ 0.00 per Token. During this time, they are expected to raise about $ 1.5 million. The main ICO period is from May 2 to June 6. During the sale of the token, they offer different bonuses, so the more you decide to buy the more money you can get. . Once the main stage is over, it will be able to buy the cards at retail, however the price may be 10 times higher. The money received from the retail will be transferred to the Safety Fund to secure the lender's interest.

Team

The team behind MoneyToken is relatively small, however it includes many experienced professionals. There are people who have worked in the financial sector and worked with large corporations and banks such as Deutsche Bank, Citibank or many WallStreet companies, while programmers and software developers worked to deliver Develop automated trading systems in equity, options and futures.

Conclude:

The project looks quite certain when it comes to technical aspects and solutions to the problems presented in the articles. The marketing aspect, with website design and infographics is also done very well and the project seems to be user friendly. All aspects are transparent in detail in the materials and articles. Financial services such as lending are very popular and demand among potential users. So, MoneyToken can attract and encourage users through low fees, secure loans and automated system solutions.

website | Whitepaper | Telegram

Author: terry17

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1450768

Hello! Good article! I'm interested in the them of ICO and crypto-currency, I'll subscribe to your channel. I hope you will also like my content and reviews of the most profitable bounties and ICO, subscribe to me @toni.crypto

There will be a lot of interesting!

Hey. I signed up for your blog. I'm a developer of bots! If you need to promote something in automatic mode or a poster, you can write to me in the @coinshelper telegram. I also sell programs for telegrams. User parser and the inviter in groups. Subscribe to me @bot.creator! I signed and licked you!