10 Tips for Evaluating Initial Coin Offerings (ICO) Investments

An initial coin offering (ICO) is a fundraising method that trades future crypto coins for cryptocurrencies which have an immediate, liquid value. Usually, a percentage of the tokens is sold to ICO participants and a percentage kept for the company’s needs (private investors, etc. Terms differ from one ICO to another). An ICO allows both big and small investors to fund the projects they like. The recent year carried thousands of successful ICO stories. The motivation for the project is obvious. The motivation for the investors of the ICO is that the price of the token would be higher (or much higher) than the token’s price during the ICO.

ICOs are really hot among the crypto investors. Recently, Hdac and Filecoin collected respectively astonishing amounts of $258 and $275 million. The success of an ICO is influenced by many aspects. Investors should bear in mind following key elements discussed in this article.

At this point it is right to mention less successful stories like the Mycelium ICO. Its team members just disappeared after raising the money, and later it was reported they used the funds to pay for their own vacation. The lack of regulation might be one of the reasons it happened. Just days ago, $7 millions were stolen as CoinDash’s ICO started. Right before the start of the token sale, their website was hacked and the ICO wallet address was changed to the hacker’s address.

This article will discuss the main keys to pay focus on when evaluating an ICO investment.

- Important warning before we start: ICOs are a high-risk way of fundraising. Never invest anything you can’t completely afford to lose. Keep in mind that due to a lack of regulation, you will have difficulty getting back your lost money in case of any failures.

1 – Team Composition

Find out everything you can about the team, especially the development team and the advisory board. Look up each team member for relevant experience. Google their names. Visit their LinkedIn profiles. Look for famous names among the advisory board of the project. Find out if the team has any crypto experience and more importantly – in which projects, or ICOs, they were involved with and the impact they had.

2 – Bitcointalk.org Thread

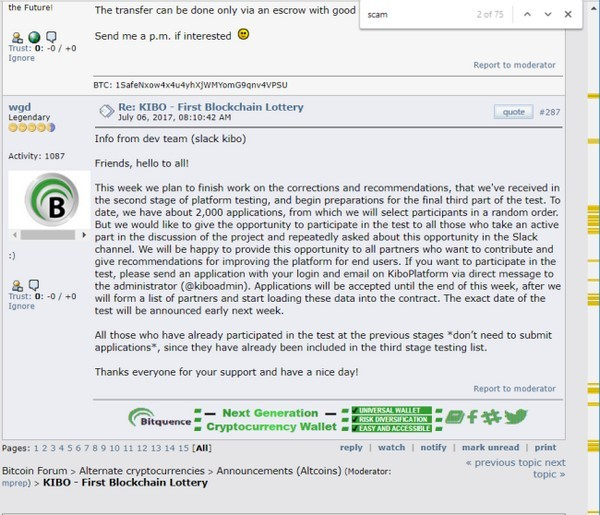

A good starting point is the project’s announcement (ANN) thread on BitcoinTalk.org, as Bitcointalk is the biggest forum for Bitcoin and crypto related issues. It is strongly recommended that you read the messages carefully. Investor’s concerns will be answered (or may be unanswered) in this thread. It is a bad sign when the developers avoid answering certain questions or aren’t collaborating. Sending devs a personal message to see how responsive they are is also a good idea.

Each message on Bitcointalk contains the rank and activity degree (number of past messages) of the sender. Be aware of newbies and low-ranking writers. Reputation has become very important and significant.

Be aware of experienced writers comments, and also look for negative messages, sometimes it could be a warning sign. Use Select [All] to see all comments in the thread and use CTRL + F (Windows) to search for red flag words like ‘scam’, ‘con’, ‘MLM’. See the relation between the search results and the total number of replies as can be seen in the following live example:

3 – Stage of the project and VC investments

Evaluate the stage of the project. Does it only have a whitepaper? A beta version? Is there a launched product with limited functionality? Prefer projects which have “some lines” of working code, however, many ICOs have proven they can become success stories without any code written.

VCs (venture capital) tend to invest and support projects from early stages. Look for this information usually on the main page of the project’s website. It’s likely to be considerable if a well-known crypto VC is involved, like Blockchain Capital or Fenbushi (belongs to Vitalik Buterin – founder of Ethereum).

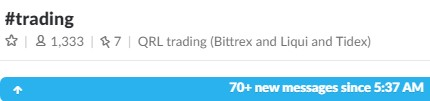

4 – Community and Media

It is crucial to have a wide open supporting community like a public Slack for all investors. Openness is as crucial in gaining our trust as the Github code. Try to grasp the atmosphere within the community. Look at the size of the community and its activity.

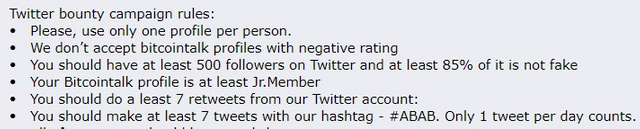

Other sources like Reddit, Twitter or Facebook can be relevant when evaluating the project. Be aware of bounty posts. It is a common practice to launch a bounty thread to reward users for spreading positive information about the project to increase media coverage, or to help out with translations. These bounty threads can stimulate the hype around the project but they are not very objective. On the other hand some investors participate only for some tokens.

5 – What do they need the token for? Is the blockchain necessary?

ICOs mean the creation of a new dedicated token for the project. One of the most important questions each project needs to answer is what is the token for? Why isn’t Bitcoin or Ethereum enough to serve as the project’s token? Yes, many projects just make up a scammy story. Hey, an ICO can’t be an ICO without a dedicated token. The same question needs to be asked regarding the use of the blockchain technology behind the project.

6 – Unlimited / Hard cap

In the early days of crypto ICOs, the difference between open and hard cap didn’t have the same impact as today’s ICOs. An open cap allows investors to send unlimited funding to the project’s ICO wallet. The more coins are circulating, the less unique your tokens become for the trading afterwards – through less demand.

As ICOs become mainstream within crypto land, enormous amounts are collected. Take a look at Bancor, this project raised an astonishing $150 million in just three hours. This resulted in no percentage gain for the investors. Keep that in mind when participating in ICOs with no cap.

On the other hand, you don’t want to be the only one investing in the project. Exchange’s have much less interest in projects that raise very little, which makes it harder to sell these tokens after release.

7 – Token distribution – when and how

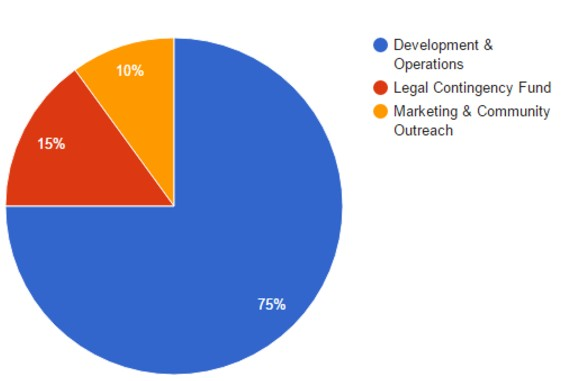

Greed can be defined by a high token distribution to the team members, let’s say, more than 50% of the tokens is suspicious. A good project will link its token distribution to the roadmap. Because each phase or milestone of the project requires a certain amount of funding.

Watch for the token distribution stage. Some projects just release their tokens hours after the ICO has ended. Some projects need to develop a beta version before sending out the tokens. If you look at the percentage gain of Etherium (one year between ICO and token distribution, around 500% gain), Augur (1+ years, 1500%) and Decent (8 month, 350%), sometimes this break creates a very positive hype around the project.

ico_evaluate_03

Source: Augur token distribution – Only info available about the usage of fundings. Roadmap is poorly described without link to this chart.

8 – Evaluating the Whitepaper

Most typical investors actually don’t read through the whitepaper, even though it contains all the necessary information about the upcoming project and the ICO.

Don’t hesitate to read it, or at least the majority of it. Note the strong and negative aspects and add in some of your own research. In the end, the whitepaper is the silver platter to potential investors. After reading it you should be able to answer a simple question – what kind of value does this project bring to our world? You’ll also learn what you’re investing in.

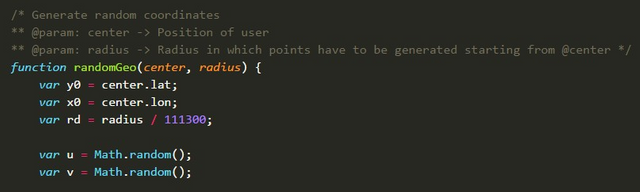

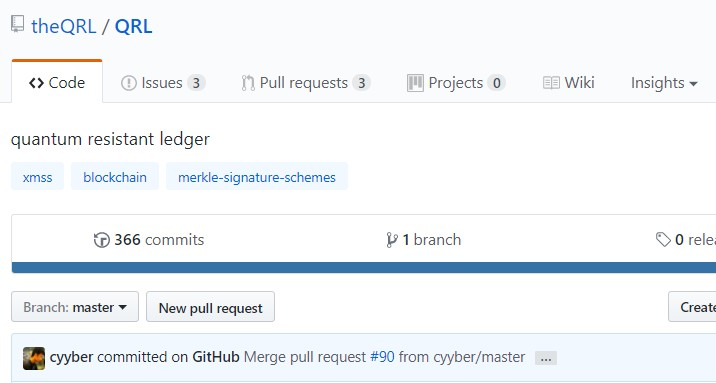

9 – Quality of the code – Meet Github

If you have a little bit of programming experience, you should be using it here. The quality of a developer can be understood by analyzing some of their code. As a non-techie, it is still possible to evaluate their quality by looking at the consistency of the code. Another good indicator, is the usage of proper commenting. Avoid messy developers. A piece of code reflects the attitude of a developer.

Next, the length of a function is another indicator. A function containing more than 50 lines of code should raise a red flag. Modularity is important and makes the code more readable and maintainable.

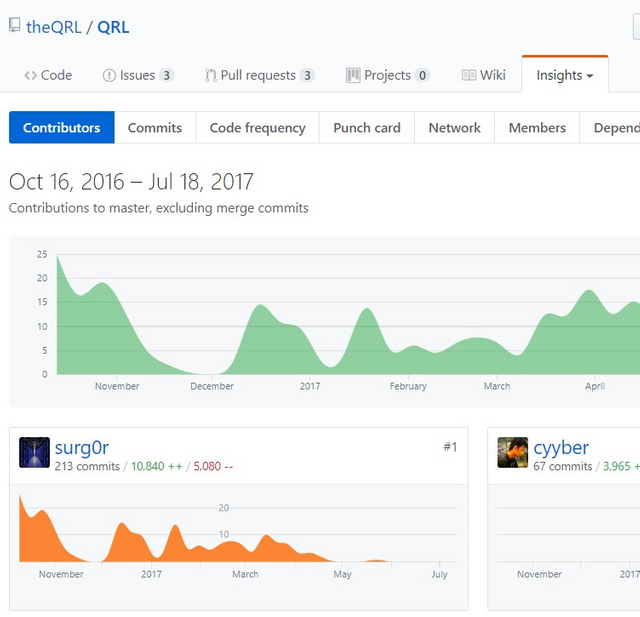

Crypto projects tend to have open-source code. This creates trust among the project’s community, encouraging devs from the community to make suggestions or improvements. An open-source project provides the opportunity to look at the commit logs. A commit is essentially developer slang for pushing a piece of code to the Github code repository.

You can see each commit by clicking on the text saying “366 commits”. This allows you to investigate each change. The “Insights” tab gives you a more general summary of the developers activity. This tab shows a graph with the amount of commits daily. Beneath the graph, you can see the activity of each developer individually. This information is key for investigating the development team.

It is even possible to see how popular the project is by looking at the amount of stars it receives.

Bonus: Ask yourself why the project chose to run on the specific blockchain. Whether it’s on the Bitcoin’s blockchain, Ethereum’s (smart contract), Waves, and more. Recent months have shown the rising popularity among the ERC-20 Ethereum based smart-contract’s ICOs. These tokens can be stored easily on Ether’s based wallets (like MEW – Myetherwallet), sometimes they don’t require exchanges to be traded, and they usually have high liquidity.

10 – The Bottom Line

ICOs will become more and more ‘mainstream’ as a method for raising funds. There will be plenty of projects to choose from, hence it will become even harder to assess these projects.

It is key to investigate and read as much information as possible and write down all the important aspects, positive and negative, before making an investment decision.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptopotato.com/10-keys-evaluating-initial-coin-offering-ico-investments/