2 Disturbing Trends That Force Us to Consider: Are ICOs A Failure?

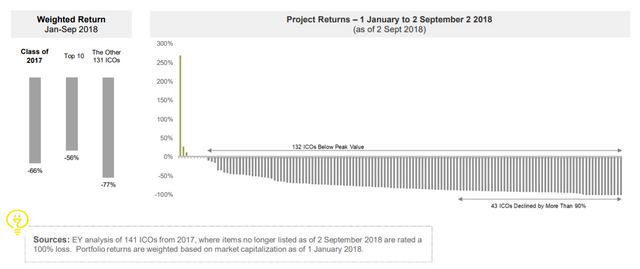

As of the first half of 2018, 86% of the leading initial coin offerings (ICOs) that listed on a cryptocurrency exchange in 2017 are below their initial listing price and a portfolio of these ICOs is down by 66% since the peak of the market at the beginning of this year.

86% of the tracked ICOs in this EY report were below listing price; 30% lost substantially all their value.

Based on this study by EY, the reasons could be:

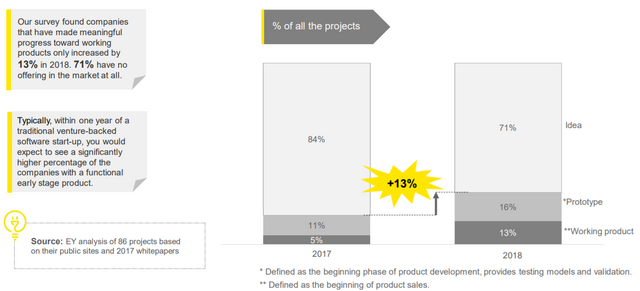

EY found that only 29% (25) of the 2017 ICO projects that EY assessed have progressed to prototypes or working products — an increase of just 13% from December 2017. The remaining 71% have no offering in the market.

There were gains among The Class of 2017 since their ICO, with most gains (99%) concentrated in the top 10 ICO tokens, the majority of which are in the blockchain infrastructure category.

The latest study follows an initial analysis in December 2017, when EY analyzed top ICOs representing 87% of the ICO funding last year. It found that a lack of fundamental valuation and due diligence by potential investors was leading to extreme volatility in ICO performance, which is still an ongoing issue. The study announced today found that ICOs claimed to have raised more than US$15b in 2018, compared with US$4.1b 1 in 2017.

However, Paul Brody, EY Global Innovation Leader, Blockchain, says:

“Despite the past year’s hype around ICOs, there appears to be a significant lack of understanding around the risks and rewards of these investments. In addition, there is a disparity between those who invest in ICOs and the ICO project developers regarding the anticipated timelines of ROI.

While ICOs are an entirely new way to raise capital, those participating should understand that there are factors — such as the slow progression toward working product offerings — that can introduce greater risk in ICO investing.”

The study also examined the 25 companies with working products. Of those 25, seven were accepting payment in fiat currency as well as ICO tokens for their product offerings. As a result, customers can make purchases directly without buying the tokens issued in the ICO process, therefore bypassing the community of token holders and diminishing the value of the ICO tokens. In at least one case, an ICO company has abandoned ICO investors by no longer accepting their tokens (de-tokenizing).

Yuri Gedgafov, EY Tech Media and Telecom Center Leader, Central, Eastern, and Southeastern Europe & Central Asia, says:

“So far, utility tokens aren’t creating the engaged communities anticipated to coalesce around innovative ideas. In fact, many of the most successful ICOs are mired in litigation or conflict over broken promises and unexpected changes in business strategy with little to no rights for the ICO investor.”

Beyond those two findings, the study also found that the Ethereum platform remains dominant in terms of activity among developers on social media, even though new platforms are rising like mushrooms after a rain.

There is apparently no sign that new ICO infrastructure projects have had any success in reducing the dominance of Ethereum as the industry’s main platform.

These developments force us to wonder: are the high risks in ICO investing worth the seemingly minuscule rewards?

We don’t think that these findings discount the whole process altogether, but there needs to be a shift in investor behaviours — the important due dilligence and risk assessment needs to take front and center of one’s ICO investment strategy, as it would be a waste if the diamond ICOs among the rough get the shaft.

At the very least, investors definitely need to be more realistic about how long it would take before a project is completed when it comes to ICOs specifically. And perhaps be wary of utility tokens henceforth.

Source: fintechnews.sg

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://digitators.com/cryptocommune/2-disturbing-trends-that-force-us-to-consider-are-icos-a-failure/