Bitbond STO - Project Review

The entry of cryptocurrency into our lives has changed not only into money but also many things. The rapid spread of cryptocurrency not only changes individuals but also changes company policies.This year, the biggest companies in the world such as Microsoft, Starbucks, Amazon and Facebook set out to integrate blockchain technology into their systems.While the adaptation of the blockchain is spreading rapidly, requests for cryptocurrency which are images of them are increasing day by day. In this article, the price of Bitcoin is around $ 8,000. This price, which is the beginning of the bull season, has a positive impact on Bitcoin, which dominates 57% of the current market, and other altcoins.During the last period, price increases have begun to satisfy the pleasure of cryptocurrency investors. How should we evaluate our investment in these days when we enter the bullish season?

What is the method for making crypto in the Blockchain world?

1) Become a Trader: Being a Trader is a different line of business that has nothing to do with blockchain technology. Traders in the crypto world are generally groups that aim to profit by taking advantage of price speculation and making appropriate trades.This business, which is quite risky, generally appears as a digital currency when the price is low and the price is high. Like the same stock market, it can increase or decrease the price of crypto currencies depending on the news, developments, investments and movements of token holders about the crypto currency. This business line is not a method that I like personally, like reading a graph, being alert at all times and looking forward.

10 golden rules that you must avoid when trading

1). Consider cryptocurrency trading as a solution to your financial problems.

2). To trust Twitter calls, Telegram signals, YouTube shillings, etc.

3). Stop the learning process.

4). Fall in love with your bag.

5). Being arrogant and overconfident.As in almost every discipline, sharing and comparing your ideas with third parties is a good habit. However, keep in mind one main thing: it's always better to do it in a limited group of friends that you can trust. This way you will be able to cut out the sounds of the crowd, bad intentions and uneducated graphics.

2) Proof of Work (Mining) (PoW): Mining methods are the beginning of the philosophy of getting cryptocurrency. A collection of prizes, which were obtained for block approval on the blockchain, distributed to those who helped with this mining.Before proceeding to the details of this method, it is important to note that Mining is not an easy method for crypto monetization. Because it requires a strong CPU and GPU. There are also electricity and time costs. If you are not sure if you do your job professionally, I cannot say it's an effective way to make money. So what is the basic logic behind what we call Post?To implement a distributed peer-to-peer timestamp server, we need to use a proof-of-work system similar to Hashcash Adam Back, rather than a newspaper post or Usenet.Proof of work involves scanning for values

that are when hashes, such as with SHA-256, hashes start with a number of zero bits. The average work required is exponential in the number of zero bits needed and can be verified by executing a single hash.For our timestamp network, we implement proof-of-work by adding nonce in the block until the value found that gives the block hash is zero bits needed.After the CPU effort has been issued to make it meet the proof of work, the block cannot be changed without repeating the work. As the blocks are chained afterwards, the work to change blocks will include repeating all blocks afterwards.Evidence of work also solves the problem of determining representation in majority decision making. If the majority is based on one-IP-address-one-voice, it can be overthrown by anyone who can allocate a lot of IP. Proof of work is basically one-CPU-one-sound.The majority decision is represented by the longest chain, which has the greatest evidence work effort invested in it. If the majority of CPU power is controlled by honest nodes, honest chains will grow fastest and exceed competing chains.To modify the previous block, the attacker must repeat the proof of the block and all the blocks thereafter and then catch up and go beyond the work of the honest node. We will show later that the possibility of a slower attacker catching up decreases exponentially when the next blocks are added.To compensate for the increase in hardware speed and the variety of interests in running nodes over time, the difficulty of proof of work is determined by the moving average that targets the average number of blocks per hour. If they are produced too fast, the difficulty increases.

Security Token (STO): It is important to distinguish between a security token and a security token before removing a security token. Utility tokens are also referred to as user tokens or application tokens, and are used to access company products or services.The typical feature of Utilities tokens is that these tokens are not designed for investment purposes. If properly configured, utility tokens are not subject to securities laws. The ERC-20 Token from the Ethereum platform is a service Token.Security tokens are supported by real assets such as stocks or commodities from limited liability partnerships. They are also subject to securities law. The security token will make a radical change in the company's stock representation. In addition, there are intensive studies on the use of Security tokens in the real estate sector.Companies use this as a way to offer part of their business to investors, in return for short-term cash injections that can help them to realize their latest goals and plans. Investors are also entitled to profits, dividends and interest rates.So, Security Tokens are crypto tokens that can give rights owners a share of business profits, shares in the business itself or other forms of rewards in exchange for their own money.

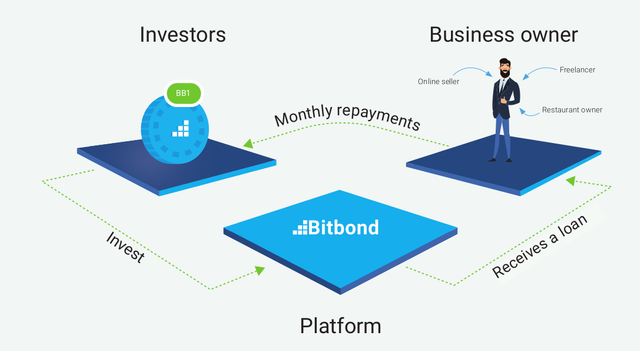

Example of a successful STO: Bitbond

I want to give an example to you about Security Tokens. This German-based token is already a company and has been serving the market for years. Permits taken by BaFin, the German regulatory body, can be examined in the following prospectusBitbond was founded in 2013 and based in Berlin, Germany in equity financing from venture capital funds and business angels worth SME loans funded in more than 80 countries.More than 3,000 loans have been funded on this platform. Retail and institutional investors fund business loans globally. BaFin's first blockchain company in Germany

Bitbond generates revenue by charging originating fees to borrowers and payment fees to investors:

tokens that have a nominal value of € 1 and represent debt instruments (Bonds) that pay an annual interest of 4%, payable in quarterly installments.In addition, he will pay a variable interest amount equivalent to 60% of the profits realized by Bitbond GmbH in its business activities (if any). BB1 tokens will be issued on Stellchain blockchain . The duration of the bonds is 10 years.

Token holders

Investment into BB1 Tokens carries a risk of loss to the total capital invested.

1% of the amount invested 4x per year (4% pa)

Variable components are paid annually (60% of pre-tax profit from Bitbond Finance)

BB1 RETURN SCENARIO: Potential value of investment of € 50,000, after 10 years = € 94,432

THE CONCLUSION

As a result, blockchain technology has many revenue methods. An important part of this method is the method of passive income generation. After making the necessary investments, you can make money without doing anything.Especially the PoS system is one of my favorite systems. In most PoS systems, you only have the opportunity to generate revenue by leaving your wallet open. STO is also one of the favorite investment tools.

More Information :

Profile Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=2602252