DISTRIBUTED CREDIT CHAIN

Distribution credit line (DCC) is the world's first bank ecosystem built on public sector chains. The DCC's mission is to develop global financial integration. Redistribute credit card rights with the help of technology to block books and restore ownership of personal data, DCC's mission is to change the real financial and financial situation. DCC seeks to create a decentralized banking ecosystem for financial service providers around the world. To achieve this goal, the new bank type is based on distributed technology - "Distributed Bank". This bank is not a traditional bank, but the integrated ecosystem of financial services is decentralized.

Within the project framework, the core chain - the credit distribution chain (DCC) has been introduced to set business standards, reach consensus on data, implement business contracts, maths, etc.

Digital content is any form of digital data. This form could be text, audio, video, image, graphics, etc. It can also be classified as analog or digital. Cloud, social and mobile is new trends that allow companies, startups to work better and create innovative ideas. Progress in digital content is growing rapidly and the way we create and generate information. As technology evolves, access to content and content increases. Security breaches, IP data breaches have become a trend in the digital world. In addition, revenue generated by content platforms is more of a cake than content creators. There are many online scams involving online data theft, as recent KYC information has been hacked through form types. In September 2017, the Vevo streaming service was searched via LinkedIn with 3,12 terabytes of stolen company data. DACC will use blockchain technology to address digital content and expand digital content.

MISSION:

Paying tribute to the technology blockchain and restoring the ownership of these individuals, the mission of DCC is to transform various financial situations and implement real financial integration.

The main supply chain will be created - DCC to establish business standards, unify books, fulfill business contracts, payment and payment services, etc.

The project team hopes that after a long period (5-10 years), the banking system will become an important node of new finance, and traditional enterprises can participate in ecosystems. Distribution through distribution banks.

The project will begin lending operations in DCC and restore the traditional loan-based ecosystem through decentralized thinking and distributed technologies.

ADVANTAGES:

Overcoming the monopoly of power: with the global decentralized banking ecosystem, DCC's goal is to violate the monopoly power of traditional financial institutions. This allows the owners of cyberspace and users to receive alternative benefits when using banking services, helping stakeholders to benefit from ecosystem development. The number of banks will eventually become the way to a truly comprehensive financial system.

Thinking about decentralization: thinking of decentralized banks to change the paradigm of decentralized cooperation in traditional financial services, develop an inter-sectoral model between regions and territories. with the participation of all parties and another account.

Changing the structure of business: from the point of view of business, banks decided to completely change the debt, assets and intermediate business structure of a traditional bank. It converts the traditional tree structure into a flat-level hierarchical bank, setting a standard for many business areas. Therefore, that contributes to improving the overall business performance.

Governmental Regulatory Regime: Regarding the rules, regulators are able to access real estate in real time, for example, information about blocking registration cannot be faked. Large data analysis organizations can also help authorities understand and respond to industry risks based on block analysis of data.

INNOVATION:

Own personal data: DCC allows you to provide your own privacy rights based on blockchain technology, rather than a centralized credit service that manages all data.

Identity is unique and can not be disproved: transaction data for individuals and organizations are strictly confidential because of a hierarchical nature, rather than rejected and pushed by a blockchain.

Decentralized credit system: individuals have the right to own and store data. Therefore, if an agency or organization wants to use this data, they must obtain personal consent. Data service organizations can no longer use caching or the freedom to use data.

Low cost and the high cost of data and networks: distributed log systems and hierarchical architecture, independent of one-level authentication, have distributed authentication nodes and increase efficiency in authentication. real cooperation.

Decentralization allows marketers with interest rates: people can choose their borrowers, and in a decentralized market with many competitors, the power of evaluation will depend more on the market than on the home. production on the market.

Creation of an open ecosystem of the DCC platform: all parties involved in consensus processes consider many issues of the centralized credit process, including forgery, high costs and abuse of rights. confidentiality.

TOKEN DETAIL:

TOKEN METRICS

TOKEN: ERC20

TICKER: DACC

ICO DATE: 30 June- 7 July

ICO PRICE: 1 DACC = $0.0023 (0.000005 ETH)

HARDCAP: $13,000,000 (30,000 ETH)

TOTAL SUPPLY: 30Billion tokens

KYC: Yes

ACCEPTS: ETH

DCC value:

Protecting the privacy of users. One of the problems with the security of information is the leakage of information about users to third parties, which leads to illegal trade in personal information. With DDC, the original personal information and data that is not displayed will not be permanently stored in a third-party organization. This prevents misuse of data by third parties or data leakage.

Reducing the cost of using data: personal data can be checked automatically. Thus, users can freely use or access data without re-confirmation. This reduces the cost of data usage and saves time for users

Exclusive Data Exclusion: Blockchain technology allows individuals to own and use their data and exclude surplus payments due to centralized storage and data from third-party verification.

State and government loans: since these transactions are accepted by both parties as public, credit history reports are generated in the blockchain to prevent problems such as long-term loans and Repeated test loans.

Depository Clearing Company:

User data in the chain: using the DCC authorization information checker, the main user information is checked, processed, and stored locally until the hash is written to the DCC. This speeds up the processing of personal data, personal data can be checked and used many times in the future. Credit agencies do not always have to ask users for access to their data, which saves time and money on both.

Get user data: when an employee wants to use a person's personal data, he sends a personal data report and checks it using DCC Credentials Intelligence. This verification process will be rapid and cost-effective due to its nature

Credit service providers: credit dealers can enter into contracts with DCC's creditors, provide risk management services, analyze user and loan data, and then decide on Loans based on risk control results. Personal data without data storage. Thus, it helps financial institutions improve their risk management skills in accordance with compliance requirements.

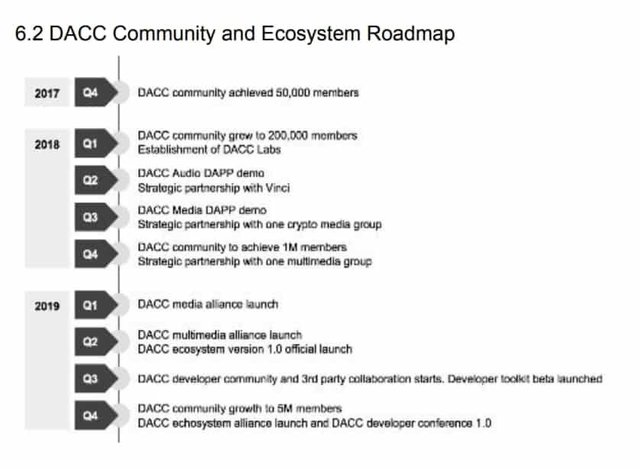

ROADMAP

CONCLUSION:

The DCC platform is a combination of the financial industry and the blockbuster industry. DCC has made significant progress in continuing the use of technological innovation, the provision of new credit services, etc.

If you have questions about DCC, please join the group to receive answers and explanations from the DCC team.

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Facebook: https://www.facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Telegram: https://t.me/DccOfficial

Author: bjongt

Bitcointalk profile URL: https://bitcointalk.org/index.php?action=profile;u=1223092