Platio: Bridging the gap of traditional banking sector to the crypto community

Despite the immersive growth of the digital economy, many still remain indifferent towards this growing market. Crypto currencies, as many believed, has little to no value given that its integration to the physical world is of limited application as of this moment. To highlight this even more, the digital market has little access to the traditional financial services making it even more difficult for the mass to appreciate the growth and benefits it has in store.

The crypto sector is yet to be fully integrated to the global economy. Access to traditional financial services are note being fully deployed for crypto currencies. Once applied, this integration will greatly put the growth of the crypto community at a huge scale and mass adoption of the crypto market will start growing in a ramp. When such financial services become more easily accessible for the crypto community, will bridge the gap of the physical and digital world.

To have a platform that greatly understands this existing challenge, the team behind Platio is revolutionizing the crypto currency integration to the traditional banking services and make crypto currencies easily used as a mode of payment and increase its utility.

Banks are slowly accepting crypto services, however the community still lacks a full integration of the two markets due to the selective nature of traditional banks on providing services for the crypto community. This may be due to political or geographical laws that do not allow them to do so, but nonetheless, this fact hinders the world to embrace the world of crypto and its benefits.

Platio will serve as a bridge in patching the gap between the physical and digital world by being “fully compliant, regulated and technologically advanced” by tokenizing assets and supporting crypto, fiat and stock assets.

There are various existing challenges around the current crypto financial services that Platio hopes to address. This includes utilization of multiple accounts, price volatility risks, access loss risks, irreversible crypto payments, selective banking and the lack of crypto adoption.

With the current crypto management platforms, crypto users are having a hard time managing their assets due to the requirement of creating multiple accounts and logins to crypto wallets, banking and brokerage accounts. This activity increases chances of risks for having their accounts forgotten, stolen or hacked. But with Platio, the use of a single log-in features to all services and assets heighten the security level of the platform.

Crypto currencies’ price volatility gives more risks for crypto holders. With Platio’s Auto Exchange capability, the damage will be lessened as Platio can automatically transfer funds between different types of assets when a condition is triggered. This feature lessens the possible loss and risks to be carried by the asset holder.

Another existing issue is the possible access loss risks. Crypto assets are being secured with private keys and the loss of such means the total loss of all assets therein. Platio’s solution is the Standby Transfer feature where it can detect an idle account and transfer funds to a fiat account to avoid loss of assets along the loss of the private keys.

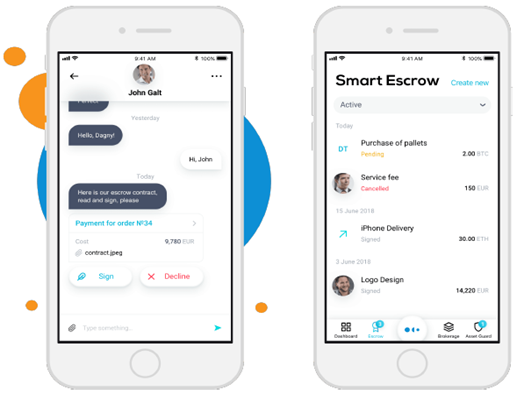

Once crypto payments have been made, there is no longer a way to recover the transaction or funds sent. In cases where funds are being transferred and a dispute happened, loss of funds become permanent. With Platio’s Smart Escrow, it can be guaranteed that payments will be made only after a predefined criteria is met. This gives fairness and efficiency to any transaction.

Lastly, traditional banks limiting the integration of crypto and traditional banking services also lessens the overall crypto adoption in businesses. But with Platio’s seven essential products that will help bridge the gap between fiat and crypto for businesses and the whole crypto community in general, Platio hopes to improve how the world perceives the crypto market as a whole.

Platio Solution

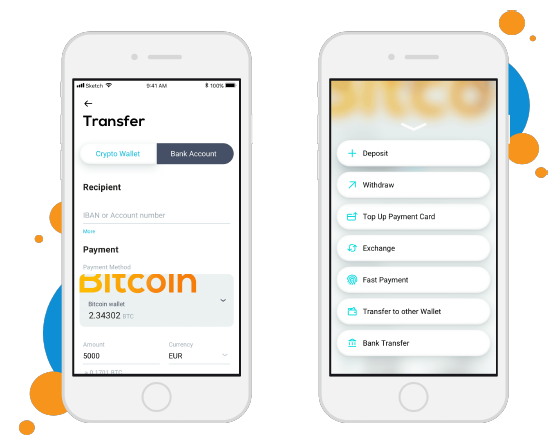

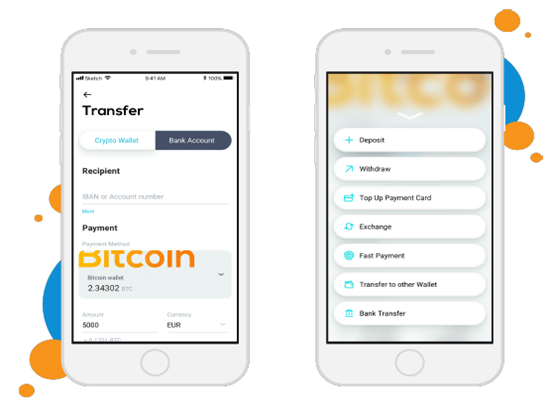

Platio’s application will be made available both in mobile and web version. This includes various banking and financial services that are all aimed to provide seamless, transparent and efficient transaction to the users. To provide the best of both worlds, Platio’s solutions will address both the need of private individuals and businesses all at a single platform.

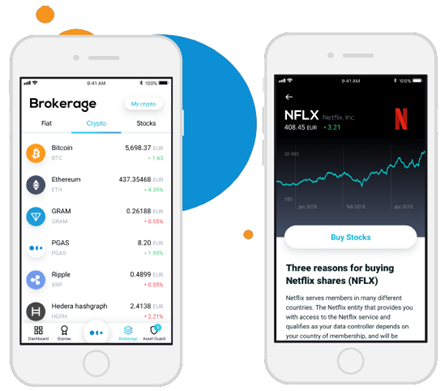

Exchange and Brokerage

The Platio community can seamlessly do exchange and trade both in fiat and crypto. The ecosystem will allow access to tokens of various crypto projects and buy and sell tokens for a much greater profit.

The brokerage feature of Platio is what allows the safeguarding of crypto assets. The rapid conversion from traditional assets to crypto assets and vice versa helps protect users’ digital assets from either getting stagnant and lose its value by converting them to traditional assets or whichever is of higher value as per conversion.

In general, The Exchange and Brokerage feature of Platio with its traditional and crypto derivative financial instruments provide more freedom for users to do whatever they want with their assets.

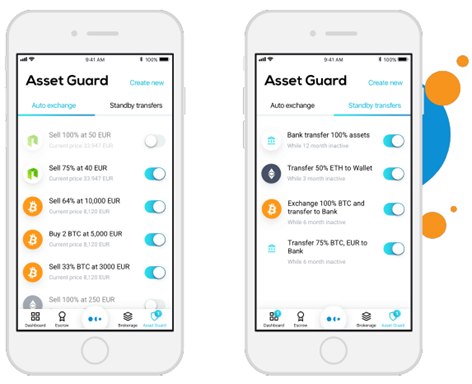

Asset Guard

Platio’s Asset Guard is composed of two types of smart contracts that facilitates protections from asset loss and due to high market volatility and possible loss of account

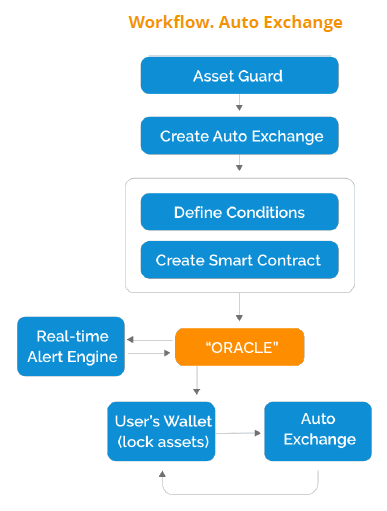

The first contract is the Auto Exchange Smart Contract. This automates exchange from fiat to crypto, crypto fiat, from crypto or fiat to stocks and vice versa. A certain pre-set condition will determine when the smart contract will be activated to facilitate the exchange. This method protects users from the price volatility of crypto assets and maintain a good portfolio.

The image below shows the process flow of how the Auto Exchange Smart Contract is being carried over.

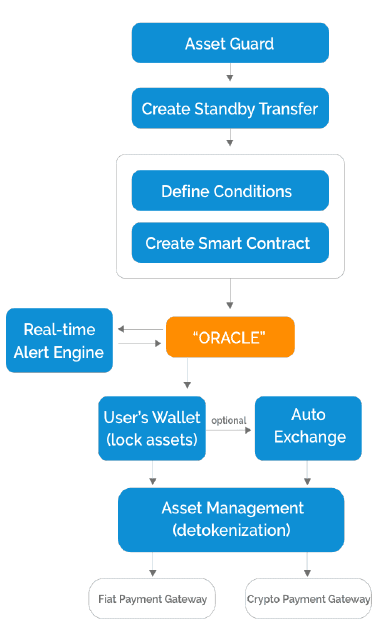

The second type of Smart Contract is the Standby Transfer. This contract will be activated once a per-defined period of time where no activity is done within a user’s account. This also acts as a protection of asset value and protect the assets in case of the user’s death, for example. Transfer will be carried out according to the user’s instructions.

The process flow of Standby Transfer is presented below.

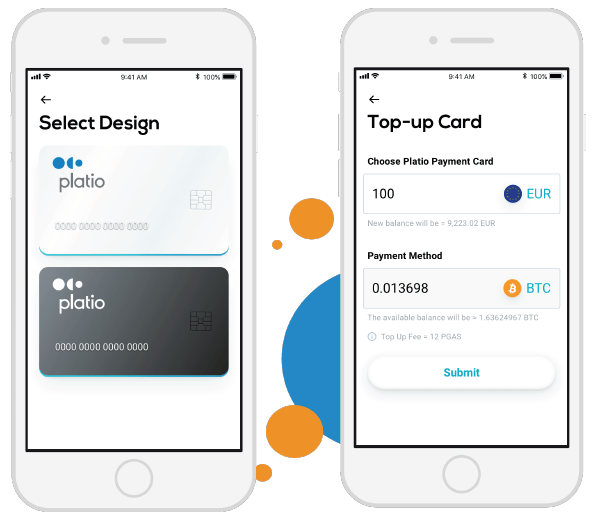

Platio Payment Cards

Platio will be offering plastic and virtual payment cards that users can use to pay for partner merchants. The seamless exchange from crypto to fiat though an integrated exchange facilitates this process. Users can choose to top-up with crypto currencies and fiat. Through Platio’s application, users can choose to request, activate, suspend and top-up their chosen card.

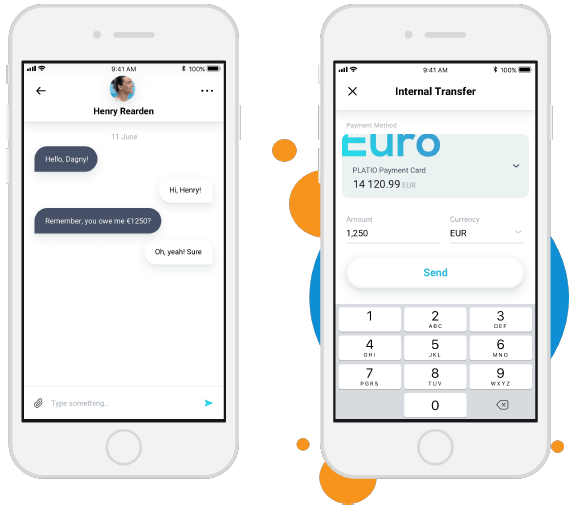

Internal Transfer

Platio support internal transfer of any of its supported assets: fiat, crypto and stocks. Through its internal messenger service, both sender and receiver can negotiate the transfer which includes what type of assets to be transferred, the amount and other necessary details. The transferred assets will be transferred through the Platio Blockchain and all transaction history will be stored in Platio.

Payments and Remittances

Platio supports payments and remittances services in two modes: The SWIFT/SEPA/Ripple and OCT transactions.

The first mode allows supports the inter-asset conversion of Platio that gives both the sender and receiver more freedom in choosing which type of asset they wish to receive as payments or remittances.

Platio’s OCT or Over the Counter transactions is also feasible to both private and business users once conditions are met.

Invoicing and Processing

This feature was first made for business users who wish to facilitate invoicing through Platio’s any supported type of assets. However, users of any type wo want to keep track of their incoming payments can make use of this feature from Platio.

Smart Escrow

Platio’s Smart Escrow has a built-in dispute resolution process. This smart contract-based feature helps protect users from high risk or high monetary value deals both in crypto and fiat. One major issues surfacing when dealing with payment through fiat and crypto is that fund transfers are irreversible and once conflict arises, one party will always remain at lost.

To solve this, Platio’s Smart Escrow feature will assure users that send funds to any selling party that their payments will only be facilitated once all terms and conditions stated in the smart contract is met.

Summary of Features and Competitions

Platio Token Sale Details

Token: PGAS

Price: 1 PGAS = 0.0007 ETH

Platform: EOS

Soft cap: 5,000,000 EUR

Hard cap: 34,500,000 EUR

To get the latest updates on this ICO, visit their official social media pages and view their website and whitepaper.

Website: https://platio.io/

Whitepaper: https://platio.io/static/docks/platio-whitepaper.pdf

One Pager: https://platio.io/static/docks/platio-onepager.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=4985747

Twitter: https://twitter.com/Platioecosystem

Facebook: https://www.facebook.com/platio.io/

Telegram: https://t.me/platioecosystem

Medium: https://medium.com/@platio

Reddit: https://www.reddit.com/user/Platio_io

LinkedIn: https://www.linkedin.com/company/platio-limited/

Author: Hypervira

Author Link: https://bitcointalk.org/index.php?action=profile;u=1419911