HyperLiquid (HYPE) Overtakes Uniswap (UNI) in DEX Sector

The decentralized derivatives protocol is taking over the cryptocurrency rankings, while Uniswap is losing ground in the DeFi ecosystem.

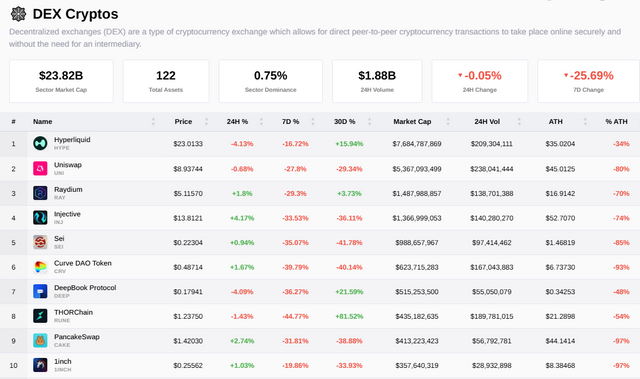

HyperLiquid (HYPE), the protocol specialized in derivatives and futures, has surpassed Uniswap (UNI) in market capitalization, reaching $8.32 billion compared to UNI's $5.6 billion. This milestone marks a shift in investor preferences towards more advanced financial products in the DeFi ecosystem.

According to data from CryptoSlate, HyperLiquid (HYPE) has surpassed Uniswap (UNI) in market capitalization, positioning itself as the leader among alternative DEXs

HyperLiquid Takes Lead in Market Cap

According to data from CryptoSlate, HyperLiquid (HYPE) has surpassed Uniswap (UNI) in market capitalization, positioning itself as the leader among alternative DEXs. With a market cap of $8.32 billion, HyperLiquid ranks 21st on CoinMarketCap’s ranking, while Uniswap, at $5.6 billion, fell to 26th. This rise reflects a growing interest in derivatives and futures within the DeFi ecosystem.

Uniswap maintains its liquidity dominance

Despite the drop in market capitalization, Uniswap remains the king in terms of liquidity. According to DeFiLlama, its Total Value Locked (TVL) is $5.047 billion, well above HyperLiquid’s $1.33 billion. This shows that Uniswap remains the preferred platform for token swaps and liquidity provision, thanks to its AMM (Automated Market Maker) model.

HyperLiquid’s spectacular performance

Over the past three months, HyperLiquid has recorded a growth of 131.66%, while Uniswap barely manages 2.08%. This exceptional performance is due to the growing demand for derivatives and futures, as well as the technological innovation that HyperLiquid offers, including leverage and a hybrid order book system.

Key differences between HyperLiquid and Uniswap

-Focus: HyperLiquid specializes in derivatives and futures, while Uniswap focuses on simple token swaps.

-Liquidity model: Uniswap uses liquidity pools (AMM), while HyperLiquid operates on an order book system or a hybrid model.

-User experience: Uniswap is ideal for beginners, while HyperLiquid attracts advanced traders.

Risks and challenges

HyperLiquid faces fierce competition from platforms such as dYdX and GMX, in addition to the regulatory challenges associated with derivatives. For its part, Uniswap must deal with the saturation of the AMM market and its dependence on Ethereum, despite its expansion into chains like Arbitrum and Polygon.

HyperLiquid's rise above Uniswap in market capitalization marks a turning point in the DeFi ecosystem, reflecting the growing demand for advanced financial products. While Uniswap remains the leader in liquidity, HyperLiquid has captured the attention of advanced traders with its focus on derivatives and futures. Both protocols have complementary roles, and their choice will depend on the needs and risk profile of each investor.

Disclaimer: This news is for informational purposes only and does not constitute financial advice. Cryptocurrencies are highly volatile; invest responsibly and do your own research.

Upvoted! Thank you for supporting witness @jswit.