How to Run HK Company under CRS?

China Launched CRS

1.The Definition of CRS:

The Common Reporting Standard (CRS) is an information standard for the automatic exchange of tax and financial information on a global level, which the Organisation for Economic Co-operation and Development (OECD) developed in 2014. Its purpose is to combat tax evasion.

2. Chinese CRS Started from July 1:

Shenzhen citizen Mr. Zhang kept busy in the past a month with preparing documents but still failed to open a Hong Kong company bank account. The bank manager repeatedly asked him the capital source, and its purposes; double check his personal information, and requested him to fill a variety of complex documents.

With the cooperation of Hong Kong, Chinese CRS took effect from July 1st. This specifically aims at investigating certain domestic financial accounts, including bank, security and insurance accounts.

It's a national investigation managed by the State Administration of Taxation, the Ministry of Finance, China Central Bank, China Banking Regulatory Commission, China Insurance Regulatory Commission, the Commission, etc.

CRS sets barriers for those attempt to use offshore accounts to escape from paying tax.

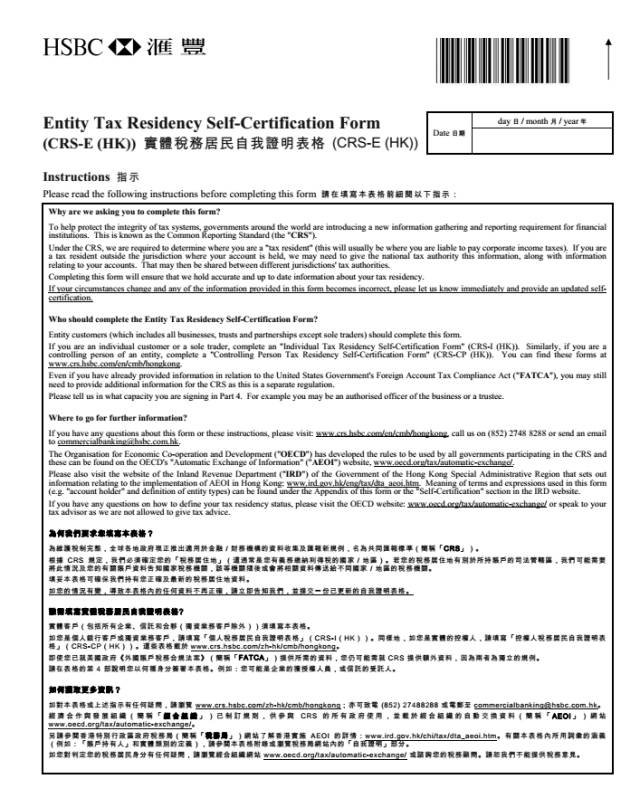

Started from January 1st, 2017, HSBC requests applicants to fill a form when they open a Hong Kong bank account. It's an agreement which you give a permission to leak out your asset information to the government.

How to Do in front of CRS?

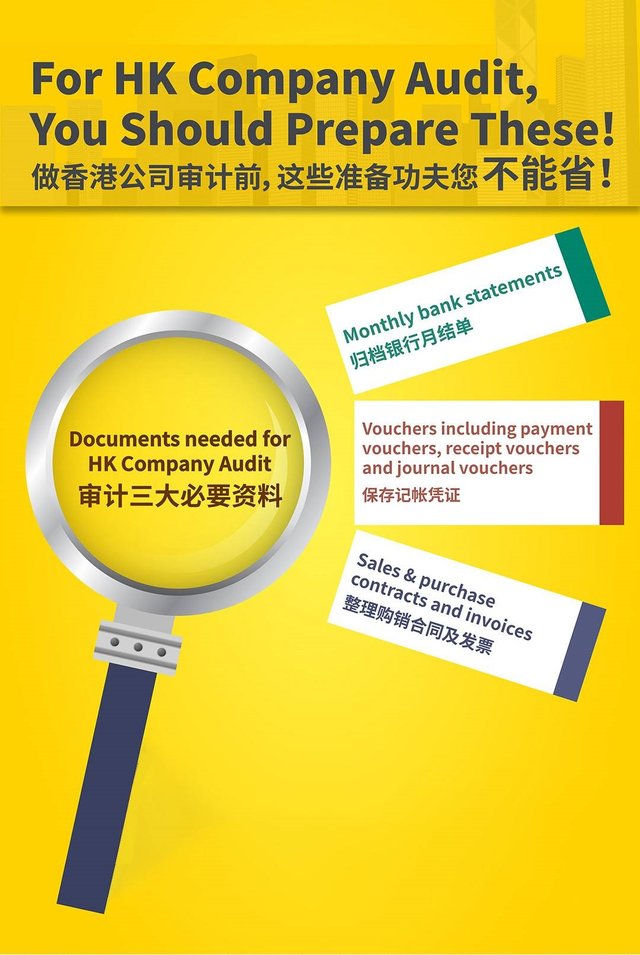

CRS just works to punish corporations involved in tax evasion and illegal transactions between offshore accounts and of assets to overseas. As long as you obey Chinese tax law, it's unnecessary to over worry.1. Audit ReportOne of the most recommendable ways to build a good reputation is submitting an audit report. An auditor's report is considered an essential tool when reporting financial information to users, particularly in business.

Since many third-party users prefer or even require financial information to be certified by an independent external auditor, many auditees rely on auditor reports to certify their information in order to attract investors, obtain loans, and improve public appearance. Some have even stated that financial information without an auditor's report is "essentially worthless" for investing purposes.

2. Why Audit Report So Important?Generally speaking, there are two types of the tax return for Hong Kong companies,zero declaration and accounts audit tax return.

According to the law in Hong Kong, the government gives strict taxation fines if any companies keep running but submit zero declaration, they define it as a fake declaration. Much worse, the person breaks the laws may face 3-year punishment in prison.

You are also required to provide the audit report to the bank, or they have the right to cancel all your accounts.