: Korea • 한국 • KR • KO $50 No Deposit Forex Bonus with LiteFinance – A Step-by-Step Guide

: Korea • 한국 • KR • KO $50 No Deposit Forex Bonus with LiteFinance – A Step-by-Step Guide Click here to visit the linkhttps://www.litefinance.org/promo/codes/?code=TRYFREE

Introduction: Watch Video NDB

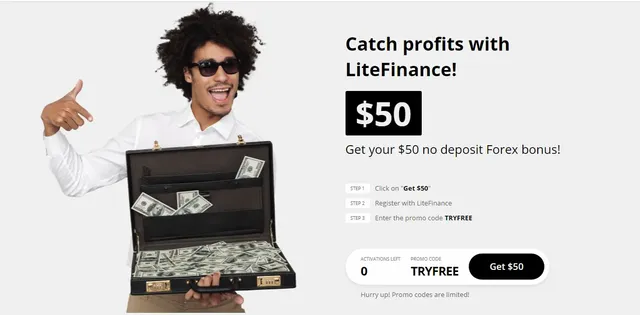

Forex traders are always on the lookout for opportunities to enhance their trading experience without taking risks. LiteFinance offers a fantastic chance with their $50 no deposit bonus, designed to attract new traders. This bonus allows you to start trading without any upfront investment, making it a risk-free way to explore the forex market. In this article, we’ll guide you through the process of claiming this bonus and provide insights into its terms and conditions.

Your $50 No Deposit Forex Bonus

Follow these simple steps to claim your $50 no deposit bonus from LiteFinance:

Step 1: Click on “Get $50“

Visit the LiteFinance platform and click on the “Get $50” button to begin the registration process. Ensure you are eligible for this bonus by being from one of the following countries: Algeria, Morocco, or Singapore.

Step 2: Register with LiteFinance

Once you’ve clicked the button, you’ll need to create a new account with LiteFinance. Complete the registration form by providing the required details such as your name, email, phone number, and address. Make sure to use accurate information as LiteFinance requires full verification before you can fully access the bonus.

Step 3: Enter Promo Code “TRYFREE”

After filling out the registration form, enter the promo code “TRYFREE” in the designated field. This code is essential for unlocking your $50 no deposit bonus. The bonus will be credited to your trading account immediately after registration, but keep in mind that it will appear in the “Credit” column.

Important Details About the Bonus

Here are some crucial points to understand before you start trading with your no deposit bonus:

Eligibility

This bonus is only available to new clients from Algeria, Morocco, and Singapore. If you are an existing LiteFinance client, you will not be able to claim this bonus. Each client can only use the promo code TRYFREE once, so be sure to follow the steps correctly during registration.Account Types

The $50 no deposit bonus applies to the following account types: MT4-CLASSIC, MT4-CLASSIC2, MT4-CENT, and MT4-CENT2. Be sure to select one of these account types when registering.

Verification

You must fully verify your LiteFinance account before you can trade using the bonus funds. Verification involves confirming your email, phone number, name, and address. Until your account is fully verified, it will be in “read-only” mode, meaning you cannot place trades.Leverage and Trading Conditions

The bonus funds cannot be used in accounts with leverage exceeding 1:1000. While you can start trading with the bonus immediately after registration, keep in mind that the bonus and any profits made from it belong to LiteFinance until you meet specific withdrawal conditions.

Withdrawal Conditions

Withdrawing the bonus and any profits made using it is subject to several important conditions:

- Deposit Requirement

You cannot withdraw profits or the bonus itself until you make a deposit into your account. Once you deposit funds, you can withdraw profits made from trading. However, the following processes occur:

All open trades will automatically close.

Funds displayed in the “balance” column will be moved to the “credit” column.

The deposit will appear in the “balance” column, and the bonus funds will remain in the “credit” field.

It’s recommended that your deposit equals or exceeds the amount of the credit funds to make the transition smoother.

- Trade Volume Requirement

To convert credit funds into balance funds (which can be withdrawn), you must complete a specific amount of trades. The volume of trades must total at least 30% of the credit funds. For example, if you have $200 in credit funds, you must complete 1 lot in trades before you can withdraw the bonus and profits.

Here’s a breakdown of the required trading volume based on credit funds:

$100: 0 lots

$200: 1 lot

$500: 2 lots

$1000: 3 lots

- Restrictions on Trading

Certain types of trades do not count toward the total trade volume required for withdrawal, including:

Positions lasting less than 120 seconds.

Positions yielding less than 30 pips of profit/loss.

Fully or partially hedged positions.

Cancelled pending orders or trades executed before receiving the bonus.

Bonus Expiry

The no deposit bonus is valid for one month from the date it’s credited to your account. During this period, you can trade using the bonus, make profits, and meet the withdrawal conditions. After the one-month period, the bonus will expire, and any remaining credit funds will be canceled.

Stop Out and Account Conditions

LiteFinance implements a Credit Stop Out to manage accounts credited with bonus funds. If your equity level drops to a point where it equals the margin requirement or bonus amount, a stop out will occur, and your positions will be closed.

Additionally, LiteFinance reserves the right to refuse, cancel, or withdraw the bonus at any time without prior notice. This includes cases where suspicious trading activity, such as bonus hunting or fraudulent actions, is detected.

Maximize Your Trading with LiteFinance’s $50 No Deposit Bonus

LiteFinance’s $50 no deposit bonus offers a risk-free way to enter the forex market, particularly for new traders from Algeria, Morocco, and Singapore. The bonus allows you to experience real market conditions without risking your own capital. While the bonus comes with specific conditions for withdrawal, it’s a valuable opportunity to develop trading strategies, understand the platform, and potentially generate profits.

To make the most of this bonus, follow the steps outlined above, meet the trading volume requirements, and ensure your account is fully verified. Happy trading!

Disclaimer:

The content provided in this article is for informational and educational purposes only. It is not intended as financial advice or a guarantee of any financial gain. Forex trading, including any promotions or bonuses, carries inherent risks, and you should be aware that past performance is not indicative of future results.

Participation in LiteFinance’s $50 no deposit bonus promotion is subject to the specific terms and conditions outlined by LiteFinance. Make sure to read and understand the terms fully before participating. We do not assume responsibility for any losses or decisions made based on the information in this article. Always consult with a financial advisor if you are unsure about any investment or trading decision.

LiteFinance reserves the right to modify or cancel the bonus offer at any time, and we are not responsible for any changes or modifications to the promotion. Please ensure you meet the necessary requirements for eligibility and carefully review all associated terms and conditions.

Trading in the financial markets is speculative and may result in the loss of some or all of your initial investment. Only invest funds that you can afford to lose.Risk-reward trading is a crucial concept in forex trading that helps traders manage their risks while maximizing potential rewards. It’s a strategy used to assess whether a trade is worth taking by comparing the amount of risk (potential loss) to the potential reward (potential profit). Here’s a detailed guide on how to trade using risk-reward ratios in forex:

- Understand the Risk-Reward Ratio

The risk-reward ratio (R/R ratio) compares the potential loss (risk) to the potential gain (reward) in a trade. A common ratio is 1:2, meaning for every $1 risked, the trader seeks a $2 reward.

For example, if a trader is willing to risk $100 on a trade, they aim to make at least $200 if the trade is successful.

- Calculate Stop Loss and Take Profit Levels

A key part of risk-reward trading is setting your stop loss (the maximum loss you’re willing to accept) and take profit (the point where you’ll close the trade to lock in profits).

Stop Loss: Protects your account from large losses by exiting the trade if the price moves against you.

Take Profit: Closes the trade once the price reaches your target profit level.

Example:

You enter a long position at 1.1000 on the EUR/USD pair.

You set a stop loss at 1.0950 (risking 50 pips).

You set a take profit at 1.1100 (targeting 100 pips in profit).

In this case, your risk-reward ratio is 1:2 because you are risking 50 pips to make 100 pips.

- Determine Position Size

Your position size should align with your risk tolerance and account balance. Traders often risk 1-2% of their account on a single trade.

To calculate the position size:

Define the amount of capital you are willing to lose (e.g., 2% of a $10,000 account = $200 risk).

Use the number of pips at risk (distance to your stop loss) to determine how much currency to trade.

For example, with a stop loss of 50 pips and a risk of $200, you would trade 0.4 lots in a currency pair where 1 pip = $10.

- Analyze the Market for High-Probability Trades

Before placing a trade, use technical and fundamental analysis to identify setups with a high probability of success. A good risk-reward setup means finding trades where the reward significantly outweighs the risk, but you also need to ensure that the trade is likely to reach your profit target.

Some common technical indicators for analyzing trades include:

Support and Resistance: Identifying price levels where the market tends to reverse.

RSI (Relative Strength Index): Helps detect overbought or oversold conditions.

Moving Averages: Can indicate trend direction and potential entry points.

Stick to Your Plan

Emotions can interfere with trading decisions. Stick to your pre-defined risk-reward setup and avoid adjusting your stop loss or take profit levels during the trade. Let the market hit your targets.Track and Review Trades

After each trade, evaluate how your risk-reward ratio worked. Keeping a trading journal will help you improve your strategy by analyzing which trades worked best and which did not, helping refine your risk management skills.

Benefits of Using Risk-Reward Trading

Consistency: Even if you only win 50% of your trades, a positive risk-reward ratio (e.g., 1:2) can make you profitable.

Psychological Comfort: Knowing that your potential reward is greater than your risk can give you the confidence to stick to your plan.

Conclusion

Risk-reward trading is a powerful tool that ensures you take only the most worthwhile trades while limiting your losses. By carefully calculating your stop loss, take profit, and position size, you can create a strategy that consistently works in your favor over time.

Click here to visit the linkhttps://www.litefinance.org/promo/codes/?code=TRYFREE