Record $5.9 Billion Flows Into Crypto ETPs as Bitcoin Hits New High Amid US Shutdown Concerns

Crypto investment products just had their biggest week ever, as investors rushed into digital assets during fears of a US government shutdown.

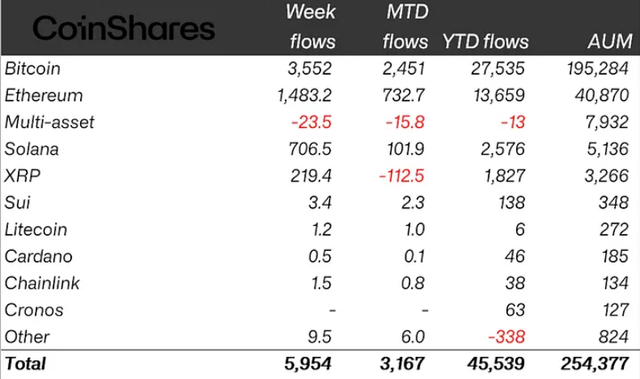

According to data from CoinShares, global crypto exchange-traded products (ETPs) saw $5.95 billion in inflows for the week ending Friday — the highest on record.

James Butterfill, CoinShares’ head of research, said the spike likely came from “a delayed response to the Federal Reserve’s recent rate cut, weak US job data, and growing concerns over government stability following the shutdown.”

The inflows coincided with a market-wide rally that pushed Bitcoin (BTC) to a new all-time high above $125,000 over the weekend

Bitcoin Leads the Charge

Bitcoin dominated the week, pulling in $3.6 billion, breaking its previous record. For comparison, total inflows in all crypto ETPs were just $4.4 billion during the previous record week in July.

Unlike earlier surges where Ethereum shared the spotlight, this time BTC was the clear leader. Butterfill noted that despite Bitcoin’s price nearing all-time highs, “investors didn’t move into short products,” signaling strong confidence.

Ethereum (ETH) ETPs also performed well, adding $1.48 billion, pushing year-to-date inflows to $13.7 billion, nearly triple last year’s figure.

ETF launches despite shutdown-triggered delay concerns

Crypto ETPs’ historic inflow records came amid the US Securities and Exchange Commission (SEC) shutting down operations last week, sparking concerns over potential delays of highly anticipated exchange-traded fund (ETF) approvals this October.

According to Crypto in America’s Eleanor Terrett, the SEC can still act on fraud and market emergencies, but the shutdown is widely expected to introduce routine work delays.

“It’s like a rain delay,” Bloomberg’s senior ETF analyst Eric Balchunas said last week.

Despite the anticipated slowdown, Grayscale Investments — the second-largest US crypto ETF provider, after BlackRock — debuted the first US-listed spot crypto ETPs, enabling staking, on Monday.

The new staking-focused products, Grayscale Ethereum Mini Trust ETF (ETH) and Grayscale Ethereum Trust ETF (ETHE), now allow investors to receive additional staking rewards, in addition to gains on the funds’ market performance.

While the SEC can still handle fraud and emergency cases, analysts expect most regular processes to slow down. Bloomberg’s Eric Balchunas compared it to a “rain delay.”

Even so, Grayscale went ahead and launched two new US-listed spot crypto ETPs focused on staking — the Grayscale Ethereum Mini Trust ETF (ETH) and the Grayscale Ethereum Trust ETF (ETHE). These funds now allow investors to earn staking rewards in