Dissection of my first trading experience in Zero Maker Fee Loopring privacy DEX

I started my crypto trading in a centralized exchange (CEX). Most people start trading in crypto like this only. Maximum CEXs need the user’s KYC, phone no etc. to access easy and fast trading experience. It was a bit awkward to give all such details but I didn’t know any other option. Convenience! Yes that is the USP of the CEXs. I got to know about decentralized exchanges (DEX) a bit later in my trading career. Actually when I came to know about exchange hacking, fraud & bankruptcy of a few CEXs; one of my wise friend suggested me to explore DEXs like IDEX, Switcheo etc. and I tried quite a few since then. My wise friend uttered the old crypto proverb, “Not your keys – not your coin”. It caught my attention. Most probably, many people prefer DEXs because of that reason. In a DEX, you can trade without compromising with your privacy. Funds also are kept under your control and any third party can’t play with your fund. Deposits and withdrawals also are not supervised by any third party like in the case of CEXs and you can trade with peace of mind.

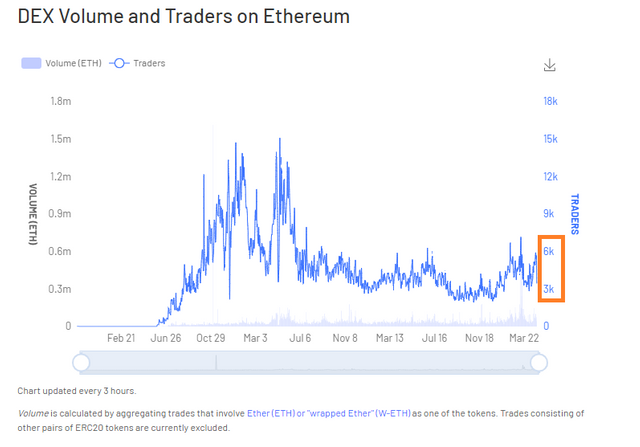

I liked the concept of DEXs. Maximum popular DEXs are built on Ethereum platform. Ethereum itself is very slow and it has scalability issue. My trading experiences in majority of the DEXs were not excellent as trading volume was low and settlement of the order book was poorly managed. EOS based DEXs worked fine for me due to EOS’s capability of faster on chain transactions. I was looking for a better Ethereum DEX. I came to know about the newly launched zero fee DEX of Loopring. Loopring did ICO 2 years back. Finally they released the Beta.

Image Source – Ethereum DEXs active traders are varying between 3K-6K only

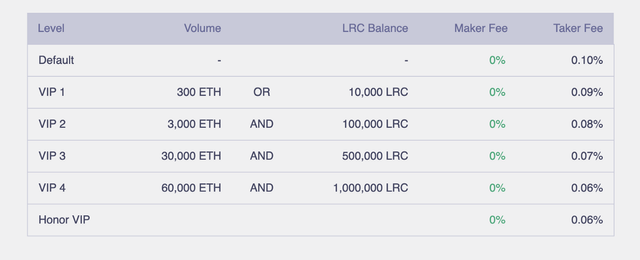

Zero fee exchange! What’s that? There are two kind of trading fees in an exchange – Maker & Taker fee. Maker is the person who places the order first and Taker is the person who fills up the order. Often these jargons are confusing for crypto newbies. Basically Loopring DEX has zero Maker fee. Good enough! That’s a reason to trade obviously. The default Taker fee is 0.1% in Loopring. Uniswap charges approximate 0.3%, dYdX charges 0.15% to 0.5%, and several CEXs charge up to 0.5% Taker fee. Okay, another good reason to trade!

Image Source – Maker & Taker fee of Loopring DEX

Crypto Black Thursday Crash was really scary for Ethereum network. Gas price rose up abnormally due to bottleneck. Many users paid astonishingly high trading fee in several DEXs. It was disastrous DEX trading experience for many traders. I read that Loopring was the first scalable DEX protocol built with ZkRollup for Etheruem. ZkRollup is basically a layer-2 (off-chain) scalability solution. With help of that, Loopring DEX is able to settle 1000+ trades per second and they promise to scale up more. Sounds marvelous for a DEX standard. With their technology, the trade settlement gas fee should be extremely low in comparison to layer 1 (on-chain) DEXs like IDEX or Etherdelta and trading should be fast. I wanted to check the claim of Loopring and did my first trading in Loopring. Let me share my experience.

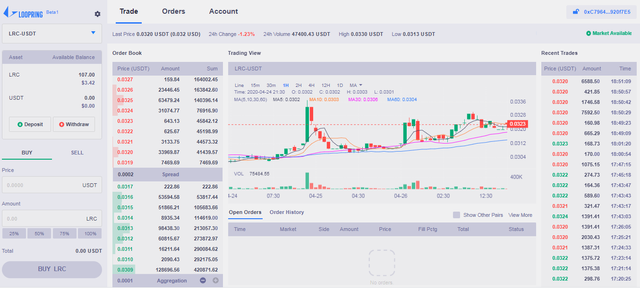

Image Source – Loopring DEX screenshot

I registered in the Loopring DEX through Metamask. Registration fee was zero. Registration consumed nominal gas of 0.5$. The DEX looks decent enough. The trading view charts are cool and user friendly. The site loaded pretty fast. Then I transferred 25 DAI from my ether wallet to the DEX. Gas fee was 0.5$ including transfer and contract interaction cost.

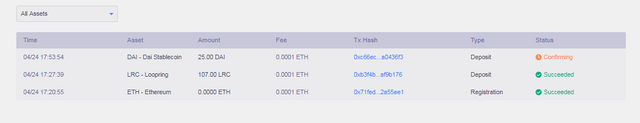

Image Source – My deposit in Loopring DEX

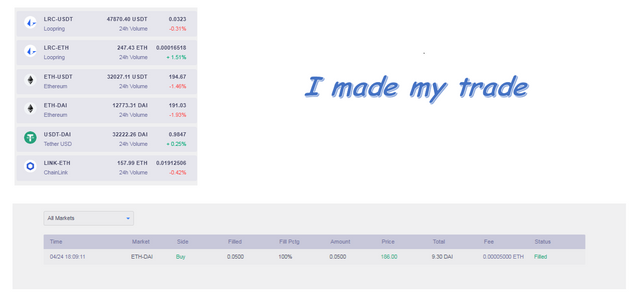

Dai got transferred to the DEX by 1 minute. Loopring is in Beta, so they are offering only 6 trading pairs. Trading takes place similar to any CEX trading process. I placed order to buy 0.05 ETH with 9.3 DAI. The order got executed by next 10 minutes. Hassle free trading. Ethereum gas fee was stable then but Loopring has been made to tackle situations of fluctuating gas fee. Remember, some people spent more than $124 to settle a single trade on the ‘Black Thursday’. In case of Loopring, it can’t happen basically.

Image Source – Loopring trading pairs & my executed trade

I wasn’t trading in a DEX for the first time. I found Ethereum DEXs clumsy. Loopring experience was cool. The minimum trading size in Loopring is 0.05 ETH for maximum pairs. It seemed a bit high although.

So What?

Loopring is in Beta. It has been launched very recently. Yes, it is working well and can take care of your privacy. Does the reason incentivize me to do trading there? Well, trading pairs are very less and trading volume is not very high. They should improvise. Loopring came up as a very promising project with Binance & some other big exchanges listing. Loopring is a protocol for building high performance, non-custodial, orderbook-based exchanges on Ethereum. Whatever they have shown in Beta, is very impressive. If they can scale up more and introduce more trading pairs, we can see a game changer in the crypto market. Look, It is known that Ethereum DEXs aren’t popular because of gas fee. Ethereum is migrating from POW to POS as Ethereum 2.0 launch is going to be launched very soon. Imagine Loopring DEX with zero gas fee! It’s going to be a reality with Ethereum 2.0 expectedly. Can a DEX compete with CEXs? Hold your horses. Something extra-ordinary has arrived. Keep a close watch on the on-going revolution!

Note: The images (if not cited), are generated by the author using free vectors.

@tipu curate

Upvoted 👌 (Mana: 12/20 - need recharge?)

Hello, @paragism. Once I wanted to use a DEX, but it seemed so complicated and strange that I gave up. I didn't really get it. Your experience has given me a better understanding of the issue. Thank you for your contribution ^_^

Many thanks for appreciation. We need DEXs for mass adoption but those need to be more user friendly.

Yes, you're right. They need to be very friendly. Here, we have a saying: People eat with their eyes.