Devastating times for Luna holders with Luna and UST crashing to 0 becoming worthless!!

UST and Luna go to rags after being a solid stable coin that it was till only a week ago

Well…well..well…

Just last month, I wrote an article saying that UST may succeed in its Terra_money’s founders plans to kill Dai, but how stupidly wrong I was.

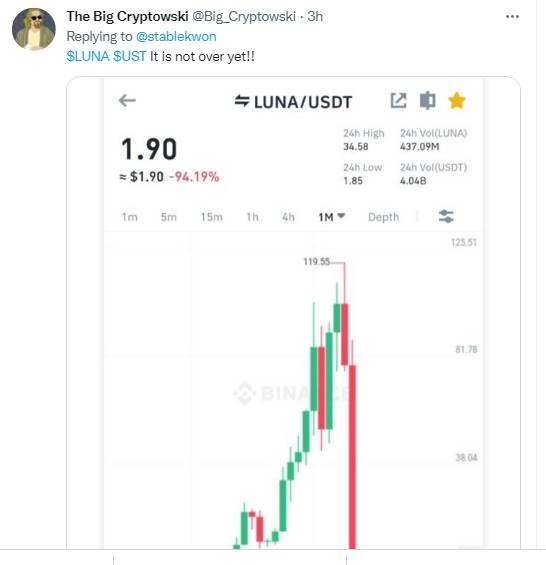

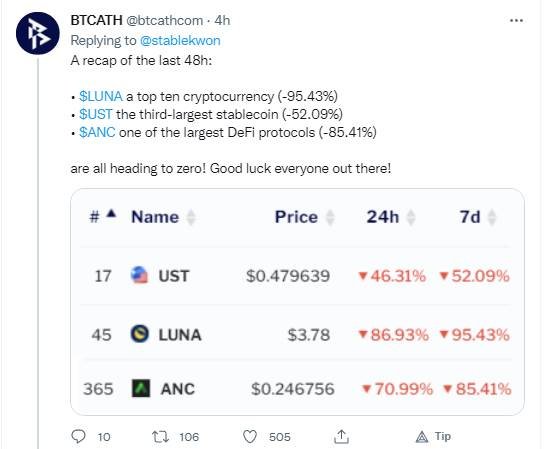

Yes, I am a Luna holder and put a lot of UST in Anchor Protocol and the day before yesterday I could sense something was terribly wrong because Luna’s price fell to 29$ from like 80$ dollars it was just a few days back and yesterday Luna fell to 5$. Before this, UST’s peg tore apart so badly, yesterday when I checked it was 0.4 cents.

TweetUST is 7 cents now it appears

It hit me, my Luna and UST positions are close to getting worthless.

Digesting the reality that I made a costly investment mistake…

(Damn this hurts my self esteem to tell you the truth)

Well sad it is… but twitter was filled full of funny jokes critizing that boastful Terra founder, Do Kwon, it was entertaining, even if as a Luna holder, I am supposed to be devastated.

I realised I must acknowledge my mistake of ever believing in Luna and UST and spread the word because to tell you the truth, I always felt I know a lot about crypto and I have been bullish and even recommended Luna as a good investment on my blogs. So, it’s painful to realise that I have ever make such a rotten investment decision.

That’s why they say, and I emphasize that whatever I write in my blog, is not investment advise, it's just my understanding of crypto and by all means I am no expert , so everyone should be responsible for their own investment decisions and the consequences of it.

Stablekwon jokes on twitter entertaining crypto community except the Luna holders ofcourse

Anyway… lets go to the jokes, because I am bally itching to criticise this Do Kwon charactor. He is great in PR who creates news doing some outrageous things and making boastful statements, which makes good entertainment for sure but well in the end that UST stablecoin and Luna is 0 almost…almost…almost

Ok.

Yeah…the cheek of Do kwon to boost that UST will wipe out Dai stablecoin

This was not very long ago where Do Kwon announced his strategy to kill Dai. I have even written about it and yesterday I read that while Terra was heading to 0 while MakerDao incharge of managing Dai stablecoin was up by 11%.

Tradingview

MakerDao's Dai has maintained its 1$ peg really well!

Do Kwon is not @stablekwon anymore he is @unstablekwon

This is an apt one for Do Kwon who is supposed to be a master of stablecoins and his twitter handle is @stablekwon. Well, it obviously cannot be that anymore, it should be @unstablekwon who magially and tragically for Luna holders converts Luna to Lunarekt.

There was another joke that Do Kwon was the master of crash coin not stable coin.

Crypto community started the countdown monitoring Luna and UST touch down to 0!!

And ofcourse, everyone was keeping a countdown of when Luna would go to zero… ha, ha!, ouch, some pain in my heart can’t help it being a luna Holder, no tears in eyes but pain…ok!!

And ofcourse, it was all so obvious yesterday that Luna was going to 0!!

Bet that Do Kwon loses because Luna has fallen way way below 10$

And there were several other jokes, this Do Kwon had a bet with some one in twitter, which if you come to think about it may have been a prophecy because its come true. That person said Luna will come to be below 10$ in 2022 but no one will be wanting to buy it… I don’t know where that tweet is now, but I saw it yesterday.

Right…!!

My defence on why I stayed invested in Luna.

Felt Algorithmic decentralised stablecoins make good decentralised stablecoins

Well, I wanted a stablecoin that’s not collateralized by the dollar and not centralised and UST was top on that. There were over collateralized stablecoins sure but having one through minting was stressful because have to do a lot of balancing work to keep the crypto collateral overcollateralized during periods of abrupt price changes.

It was like taking a loan in DEFI, if the value of your crypto collateral falls below a threshold, your crypto collateral can be liquidated, so that time you either can supply more crypto collateral or pay back your loan.

Although over collateralized stablecoins can be procured without minting by just buying it, still I did not like this way of actually making an over collateralized stablecoin.

Also Hive’s HBD also is an algorithmic stablecoin, so I thought UST was a nice algorithmic, popular and safe to hold decentralised stablecoin.

Luna has been a prominent popular Blockchain of late and always in news

Anchor and Mirror Protocol are very popular and used savings protocols

Next, news all over that Luna Blockchain is popular because of Anchor Protocol that pays 19% interest on UST etc. Luna’s Anchor Protoccol, Mirror Protocol have been really popular and been talked about as a good way to save and earn passive income. These kind of things hang on to one’s subconscious mind, so I started my journey in Luna few months ago with Anchor Protocol.

Luna Blockchain attracting high TVL from investors

Then media news of course, I read that Binance Smart chain and Solana, that were once hot blockchains were losing TVL today as investors have gone to Blockchains like Luna and Fantom,

Do Kwog doing grandiose moves of making a BTC reserve to maintain peg of UST

Then of late, this over confident Do Kwog has been making news. He’s been buying loads of Bitcoin, infact was the 3rd highest purchaser of Bitcoin so that it can serve as reserve currency for backing UST in times of turmoil.

He kept buying BTC since Jan and his aim was to build a 10 billion dollar worth of BTC reserves. This news had caused the rise of Luna’s price as well because it increased investors' confidence on UST.

Very recently, Luna’s price was on AtH’s even when other crypto prices were falling hard.

Also recently, Tron’s Justin Sun, inspired by success of UST planned to launch the same kind of algorithmic stablecoin too which he launched very recently saying that it will give 30% interest and give financial freedom to people holding that stablecoin that’s built on Tron.

Also the screaming news that UST is the third largest stablecoin after USDT and USDC and the No 1 decentralised stablecoin in the crypto space!!

So these were the logic behind me staying bullish on Luna and UST, and it sounds like good reasons because lots of crypto investors also believed in Luna and USt for similar reasons.

After all, UST was used also for making payments through the Chai app, this was pretty impressive to me.

Now, let me try to explain what’s happened to this UST.

As far as I know 3 days ago itself problems stated for terraUSD with UST struggling to hold the peg and peg went to 95 cents. Even that time, Kwog Do in his style made some statements that everyone are freaking about like girls (sexist comment) and there was no need to freak over UST maintaining it’s peg, you can check his tweets.

Luna entered a death spiral because sell offs of Luna along with its price decrease was taking place

So when the crash happened, Luna’s price also fell which is problematic and it lead to Luna’s death spiral.. I am sure lots of selling of Luna took place while UST got exchanged for USDC and other stable coins in Curve and got dumped.

So, during a price crash situation algorithmic stablecoins have a real risk of entering a death spiral because the price of Luna falls with huge sell offs of the asset .

So when UST’s peg falls, its supply is decreased to increase its peg value, for which UST is burned for 1 Dollar worth of Luna, I am guessing no one wanted to buy Luna with its falling price as it won’t be profitable and so that balancing peg mechanism did not work out.

Luna Foundation Gaurd which was established to oversee that UST maintains its peg, failed to do whatever balancing was required to maintain UST’s peg.

Later, to bring the peg of UST back, I don’t know if Luna had used its BTC reserves, where it can burn UST for 1 dollar worth of BTC, if it did, it failed to maintain UST peg. Maybe, Luna was indirectly responsible for the fall of BTC’s price.

Luna did enter a death spiral this time, and could not be used at this time to bring the UST’s price peg up.

Lost money in a unexpected way due to Luna failing to maintain UST peg

Anyway, I am truly feeling very foolish for being Lunatic(Luna community tribe), even though this Kwog Do fellow is clearly an idiot with too much pride. Although I lost a lot and I am not someone with loads of money, I feel really bad for other Luna and UST investors.

However, in today’s world people lose their savings because they put money in banks which later disclose that they have become bankrupt with big Corporates having defaulted on loans, leading to NPAs. So, depositors have lost out on their principal deposits they have deposited in banks. Fiat currencies have devalued in some countries, so all the money that people had turned to be worthless.

I have lost money not due to some DEFI hack, although that could have also been possible, but because Terra failed at its mechanism to maintain peg of UST.

HBD, Hive’s decentralised algorithmic stable coin too unable to maintain 1$ peg

From https://www.tradingview.com/

Right, maybe we should not blame Terra that their decentralised algorithmic stable coin experiment failed because I checked that on May 9th, Hive’s algorithmic stable coin HBD failed to maintain its peg as well…

As you can see on May 9th HBD’s price fell below 90 cents and came up to 1$ on May 10th but its struggling to main 1$ peg and its constantly falling to 86 cents these past 2 days.

Maybe decentralised algorithmic stablecoins can’t maintain 1$ peg during serious price crashes. So, over collaterised decentralised stable coins are better. Shrugs.

Conclusion

It's possible that this Do Kwog becomes more humble after this incident, good for him if he does. He still is tweeting everything will be restored etc, etc... I am not having hopes on this, the fact his envisioned UST stablecoin failed its test in maintaining 1$ peg, and so Luna has definitely lost its credibility.

Anyway...

You can also read my recent article about this crypto market crash here -

The loud crash of the Crypto Market jerked up my sleeping crypto cat Mochu!!

Thankyou for reading.

It's me again with one more comment @mintymile

I've just noticed that LUNA printed 6trillion new tokens within recent few days. So even with enormous price drop - they still have market cap above 2$ trillion.

Which is more than BTC or ETH :/

Isn't shocking?

They must figure out how to burn some of current supply. or price of LUNA will tank even more. It is simply not possible for them to be the number 1 crypto (in terms of market cap)

What do you think?

Yours, Piotr

@tipu curate

Upvoted 👌 (Mana: 0/6) Get profit votes with @tipU :)

Dear @mintymile

It's indeed such a challenging (and devastating) time for so many investors out there. And for all those people, who decided to store their wealth in UST - people who didn't accept risk of losing their funds (as we do, when we invest in crypto project). All those people hold UST, assuming that they do not take any risk and are just preserving their capital in something which was supposed to be a stable coin.

Many things had happened since LUNA and their UST expolded. In just a couple of days we've already witnessed blame game starting: Blackrock and citadel (together with Gemini) has been accused of market manipulation and they were already blamed for well coordinated attack.

I'm not sure where that rumour came from. Also I dont think that Blackrock or Citadel would ever confirm if they indeed were behind this crash. It seem to be obvious that both would deny. So we may have to wait to know the truth (we may never learn it either way).

It's also hard not to have an impression, that LUNA became a target because they were the first large project which wanted to back up their stable coin reserves with another crypto (BTC). That could anger many powerful people and it would challenge USD as a reserve currency. So perhaps this was the reason why LUNA had to be "an example". So others would not follow ...

Welcome to the club ;)

PART 2:

I truly wonder if LUNA may find a way to get out of current trouble. They apparently have solid community and many developers building on their blockchain. So perhaps someone new may take over LUNA, get rid of current CEO (Do Kwon), remove UST from their ecosystem (and replace with some traditional stable coin) and try to kick-start this project.

Any thoughts on that? Also: do you hold any LUNA yourself? I bought like 300k during recent dump (spending only small amount of $$$). I accepted that it may be worth ZERO, but having some "skin in the game" is making me research more about this project and follow upcoming news related to it.

Enjoy your weekend buddy,

Yours, Piotr

Your post was upvoted and resteemed on @crypto.defrag

Dear @mintymile each word of your post echoes just how I feel.

We are in the same boat I guess

and those jokes hurt as well.

I see the current situation has brought the whole market down.

May we have the courage and strength to overcome this

Yeah... wish thy and all of us strength of mind to overcome this... its crushing for USt an Luna holders!!

This must be real hard time for luna holders UST fail to hold its $1 peg was a real problem which resulted to increase supply of UST with LUNA high pressure sell off the idea of algorithm decentralized back stable coin need to be reviewed with more strategic plans.

I hope all LUNA holder get strength to survive this market dump do stay positive.

Yes, your right, algorithmc stablecoins have to review and have management over crisis situations, Luna's decentralised algorithmic stable coin experiment fails...but that coin was very centralised because it depended on the swapping and balancing move LFG made...Luna Foundation Gaurd made...anyway...

Oh yes, Luna was a unique crash, because it was not exactly a shit coin for this to happen, so its a lot worst, because it had solid development team and community... so its hard to digest, atlest for Luna and UST holders who failed to exit!!

The post is very long, the analysis is interesting, but predicting what happens with each cryptocurrency is always an adventure.