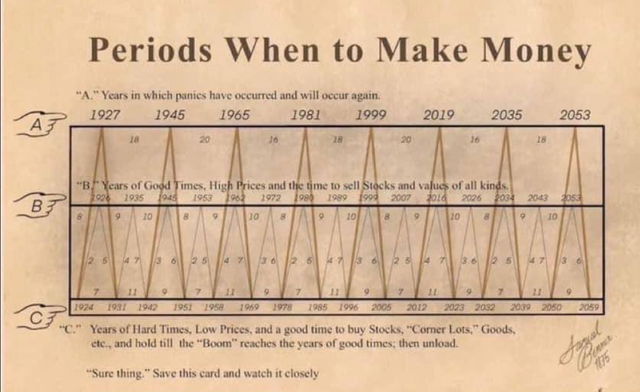

Future of economy and Benner's chart.

Greetings!

(AI generated image)

Samuel Benner was an American farmer in the 1800s. He observed that the prices of crops followed a cyclical pattern, which also correlated with the stock market’s bull and bear runs. According to Benner’s chart, a depression may occur in 2026. However, it appears that we may already have entered the depression phase. The extensive Bull Run after the COVID-19 period, stock market peaks, excessive participation of retail investors in markets, either directly or through mutual funds, and the hoarding of gold by central banks in many countries are strong indicators that something is wrong and sooner may translate into recession.

But why does a recession occur? There are multiple reasons, such as natural calamities, wars, political uncertainty, declining incomes, job cuts, over-reliance on a single sector of the economy, and financial crises.

Recession is an inherent characteristic of a capitalist economy. No government, company, or individual can drive markets upward indefinitely. So what goes up must come down. When the economy grows, it increases the wealth of governments, companies, and individuals. As disposable income rises, consumer demand also increases. This surge in demand encourages companies to expand production, which in turn pushes banks to issue more loans. Consumers also prefer spending over saving. However, this leads to an imbalance between supply and demand, resulting in surging of inflation. To curb inflation, central banks raise repo rates and interest rates, which reduces liquidity in the market. Loans become more expensive, placing a burden on over-leveraged companies. At the same time, consumers have less disposable income, making it harder for businesses to maintain profits. As a result, companies resort to layoffs, leading to rising unemployment, decreased consumer spending, further reduced profits. This led to the formation of a vicious cycle.

When a recession hits, job cuts, lower incomes, and GDP contractions follow. Governments often introduce bailout packages to rescue companies, benefiting capitalists while the common people suffer significant losses. For example, if a wealthy individual has $100 million and a common man has $10,000, a recession that causes a 20% decrease in asset values would reduce the wealthy individual's holdings to $80 million but he would remain rich. Meanwhile, the common man, who may lose his job, will quickly exhaust his savings just to survive. Additionally, the rich often benefit from bailout packages. Reduced inflation also increases the real value of their money over time.

Recessions extract wealth from lower-income individuals while simultaneously increasing the real value of money held by the wealthy. They also serve as a market correction mechanism. Common investors are forced to sell stocks at lower prices, which are then purchased by the rich, further consolidating their wealth. Thus, recessions present great opportunities for the wealthy while proving disastrous for the average person. This is why some of the wealthiest individuals prefer recessions as they emerge even richer after each economic downturn.

Following the COVID-19 pandemic in 2020, governments worldwide injected massive amounts of money into markets, causing stock indices to skyrocket. Many new investors entered the stock market during this period without experiencing a bear market. Now, they are trapped and will eventually be forced to cut their positions. Meanwhile, Donald Trump’s tariff policies are exacerbating the situation, disrupting global economic activities and driving inflation in the U.S. Russia-Ukraine war, unrest in many countries are also creating circumstances that are disrupting economic activities. Due to these circumstances, the world economic outlook appears grim, aligning with the predictions of Benner’s chart.

What do you think?

Same thing has happened to me too. I feel Donald Trump is playing a big game.

He is playing the game but world economy is already in stress. He is just pushing it so that procedure may start earlier.

Well I am really so sure that the chart will still perform as it should be in the near few years to come. It will certainly adjust per time. Even though it might take a way, I am so sure that it will definitely adjust