Will the March CPI Report Save Altcoins or Sink Them Further?

Greetings everybody,

The cryptocurrency market faces persistent serious difficulties during the current period. Many altcoin prices today have fallen to figures even below their initial launch prices. It's concerning, isn't it?

Adding to this complex scenario, the U.S. Consumer Price Index (CPI) report for February 2025 was released on March 12, 2025.

Canvas source The reported data serves as an essential metric to understand how prices from an urban consumer selection of goods and services transform with time. Essentially, it reflects the inflation rate.

As you that Market analystz predicted that the Consumer Price Index would decrease thus indicating possible relief for inflationary trends. The latest February headline CPI measurement dropped by 2.8 percent compared to 3 percent from January while the core CPI numbers also declined. The positive inflation trend experiences restrictions because price fluctuations persist within the categories of used cars and shelter alongside insurance costs.

The connection between cryptocurrencies particularly altcoins remains unclear to you. A lower inflation rate would usually lead central banks to adopt accommodating policies which create more market liquidity and foster additional investment activity including altcoins. The present conditions show a more complex set of circumstances.

The market is being affected by additional forces even though inflation has shown softer growth. Economic growth faces concerns due to recent tensions between countries that involved U.S. tariffs. Low inflation levels in the market may lose their positive influence because of other current market developments.

Cointelegraph post Cointelegraph post |

|---|

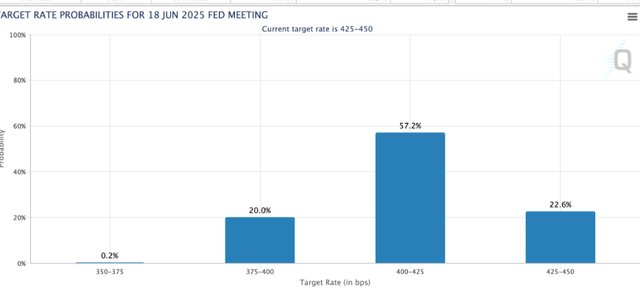

A majority of market participants believe the Federal Reserve will cut interest rates by June 2025. "Cointelegraph"

The cryptocurrency field operates under multiple difficulties at present time. The primary cryptocurrency exchange Bitcoin is currently undergoing a major price decline while experts suggest it could crash to $73,000. The recent market devaluation mirrors the crypto bull market decline from last year thus troubling both investors and requiring better risk management approaches.

Fewer stable altcoins withstand the market movements as well as Bitcoin does because their prices tend to be more volatile. The price of Solana dropped by 59% since its peak while it struggles to secure sufficient market backing. The present market conditions challenge altcoins which leads to this downward trend.

Investors should prioritize what factors they must contemplate. The cryptocurrency market reacts to many different factors even though important macroeconomic data like the CPI produces useful knowledge. Trade policies together with market sentiment and technological advancements and regulatory developments determine key market factors.

The present market conditions emphasize that altcoin investors should conduct extensive analysis before making any investments while taking conservative approaches. The understanding of fundamental concepts through team evaluations and real-life application assessments lets investors reduce potential risks.

Keeping track of general economic indicators is fundamental for investors who want to make sound decisions. The recent CPI report generates economic impacts which extend throughout standard markets together with impacting investments in assets ranging from conventional to cryptocurrency types.

The predicted reduction in March 2025 U.S. CPI index points to a favorable economic climate yet the cryptocurrency market primarily focusing on altcoins retains significant market pressure from multiple aspects. Market participants need to watch for potential changes while performing detailed research as they should anticipate ongoing marketplace volatility.

Regards

artist1111

https://x.com/HamadkhanMWT/status/1900241578880598266?t=KtA58nGk0nMkKzXSJfed0w&s=19

Note:- ✅

Regards,

@jueco

Well let's see how time will perform but I am so sure that the market will definitely recover in due time. We can't continue to have a bad market like this certainly. I am so sure of that certainly