Grassroot Crypto Education (Vol.9) - Cryptocurrency Trading

Introduction

Dear kids in the community, it's another precious time to share with each other and I hope you are doing well. Our grassroot crypto education started a few weeks ago, so far so good, we have been able to reach the 9th volume. We have come this far with the help of the community hosting the lectures and for the support of the Steemit team towards the initiative. It's learning time, so let's go.

Designed with Adobe Photoshop

Background to the Study

Over the last few weeks, we have been able to adequately take care of different topics which start from what cryptocurrency is all about, blockchain, cryptography, wallets, decentralized applications, and so on. Your participation in the homework task of the aforementioned topics is great and I must say, you have learned a lot in the journey.

At this point, I believe you have understood the main basics of cryptocurrency, the technology behind it, wallets, different products that can be utilized in the crypto ecosystem, and so on, you must learn about cryptocurrency trading so that you can know how to handle your crypto assets the way you want it or exchange it for any other cryptocurrencies of choice.

Cryptocurrency Trading

Before talking about crypto trading, from the knowledge of trading, it is the term used for buying and selling a certain product, in other words, exchange of goods for money or other goods. As such, Crypto trading is the act of buying and selling cryptocurrency on an exchange, which can be a centralized exchange or decentralized exchange, you should remember this. Nevertheless, you can check more info about exchanges and wallets in one of the previous lectures here!

In cryptocurrency trading, traders buy and sell crypto assets, this action involves buying a crypto asset with another crypto assets/fiat currency or selling it for other crypto assets/fiat currency. Whichever way the trader chose, at the end of the day, the trader ends up exchanging to the crypto asset of choice. In some cases, users buy crypto assets through bank deposits or using debit/credit cards, as long as there is no restriction on that in the part of the world the user is operating from.

The purpose of trading in most cases is not always based on fun rather on achieving certain profits. In fact, the concept of crypto trading is to take advantage of favorable market conditions to increase profitability, like buying an asset when its market price is low and selling it when it's high. In that case, the trader would have made some profit through exchanging his/her assets.

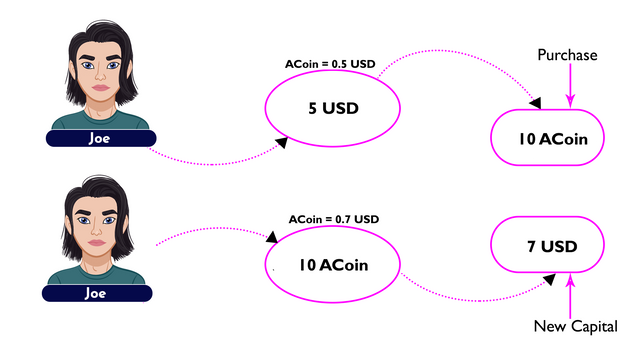

Designed with Adobe Photoshop

For example, in the graphics above, Joe has 5 USD in his crypto wallet while ACoin has a market price of 0.5 USD. After the purchase, Joe would have 10 ACoin neglecting the trading fee. Now, after 1 week, ACoin is trading in the crypto market at 0.7 USD and Joe choose to sell it, that is 10 ACoin x 0.7 USD which gives 7 USD. Obviously, Joe has made some profits, 2 USD to be precise. The illustration tells it all what the concept of crypto trading is all about, although, in some urgent cases, crypto trading can be utilized for money movement.

Spot Crypto Trading

There are various ways to trade cryptocurrencies but for your level, I would be exposing you to spot trading. Spot trading is a trading type that involves the trading of crypto assets on a spot trading platform offered by a centralized exchange. It encompasses buying/selling assets at a market price, limits order, and so on for almost instantaneous effect, on a spot. Let's talk about a few components of spot trading.

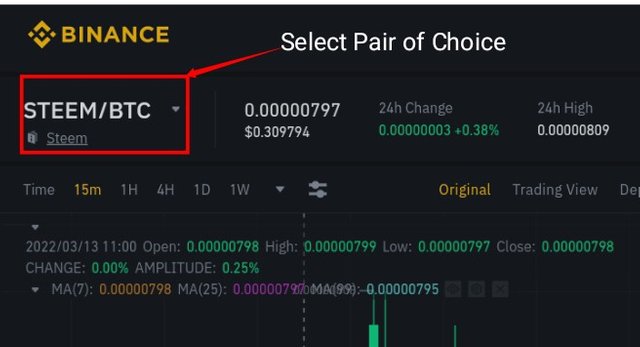

Trading Pair

Crypto assets are traded as pairs on exchanges which means two assets are paired together such that both can be exchanged for each other, that is, you can buy/sell one of the pair with the other. For example, STEEMBTC is a pair listed on Binance which means STEEM can be used to buy Bitcoin or can be sold for BTC and vice versa.

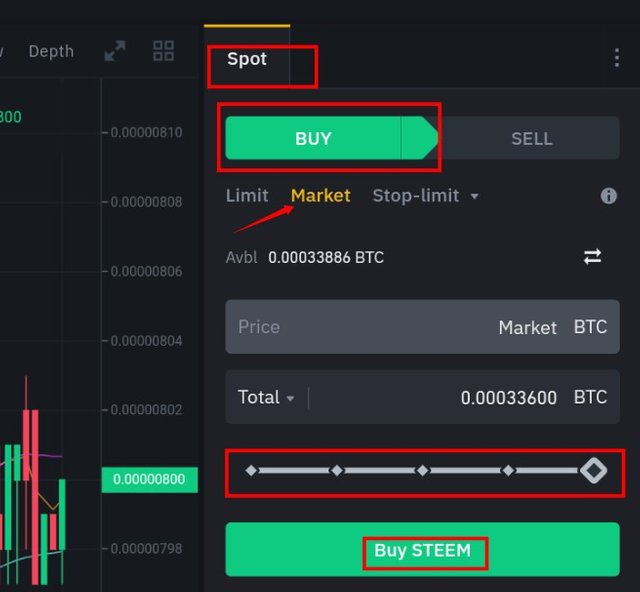

Market Order

This is an order type on a spot trading platform whereby a trader chooses to buy/sell a crypto asset at the current trading price, this type of order is instantly filled or triggered immediately the order price equals the market price. For example, if ACoin is trading at 0.5 USD and the user chooses to buy at 0.5 USD, this is a market order that would be filled instantly.

Limit Order

Limit order is an order type on a spot trading platform that's associated with traders buying/selling their crypto assets at a predetermined price and the trade would only be complete when the price hits the price set by the trader. For example, if ACoin is trading at 0.5 USD and a trader placed a buy limit order price at 0.48 USD, this means that he/she awaits the price to drop before buying. In that case, the order would be opened and would only be filled when the price hits the limit order price, the same thing is applicable to sell limit order.

Order Book

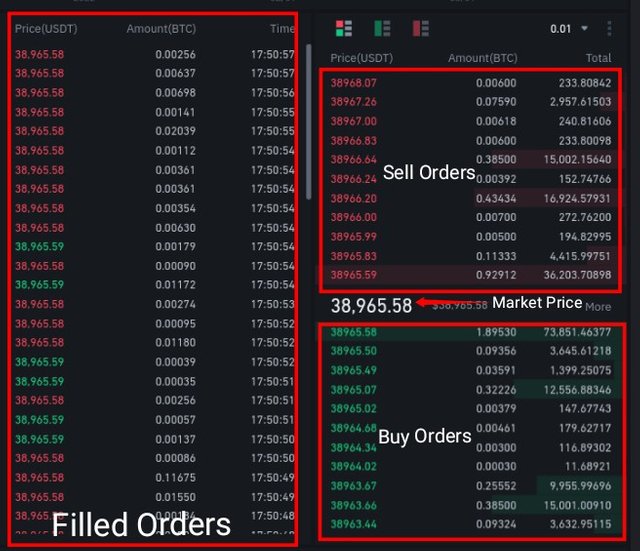

Blockchain has the benefit of transparency and being a technology behind cryptocurrency, cryptocurrency also exhibits transparency. The order book is the list of all orders (buy/sell) that has been placed by traders in the market of a crypto asset that reveals the prices at which different traders have placed their individual buy/sell orders in a market. This is sometimes utilized for some kind of analysis to have an overview of how traders are getting involved in the asset market.

https://www.binance.com/en/trade/BTC_USDT?layout=basic

From the screenshot above taken from Binance, that's the order book, by the right of the image is the buy and sell orders, the order price, and amount of the asset placed for trading. The buy orders are written in green color while the sell orders are written in red color. At the right of the page is the filled orders which include both buy and sell orders, the amount of the asset, price, and the time the order was filled.

How to Perform Spot Trading on Binance - Market Order

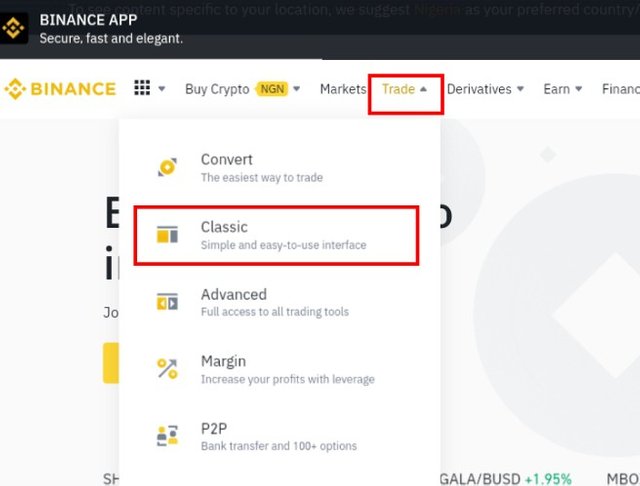

- Visit https://www.binance.com/en from your device, log in and at the top of the page, select trade then classic to access a simple trading platform like spot on Binance.

- From the pair at the top left of the page, select the asset pair you intended to trade (strictly the asset you owned- at least you must have one of the pair in your wallet). In my own case, I selected STEEMBTC because I have some BTC I wish to trade for STEEM. See the screenshots below.

https://www.binance.com/en

https://www.binance.com/en/trade/STEEM_BTC?layout=basic

- Now I ensured I'm on the Spot trading platform of Binance. If you want the order to be filled immediately, switch to Market (your order would be matched to the market price and get it filled immediately). Choose the transaction type, buy/sell, I am buying in this case.

- After that, select the amount of the asset you are trading for the other asset by drawing the bar to a percentage of choice. In my own case, I drew it to 100% (full) which means I am buying STEEM with all my BTC assets then click the Buy/Sell button and the order was filled. See the screenshots below.

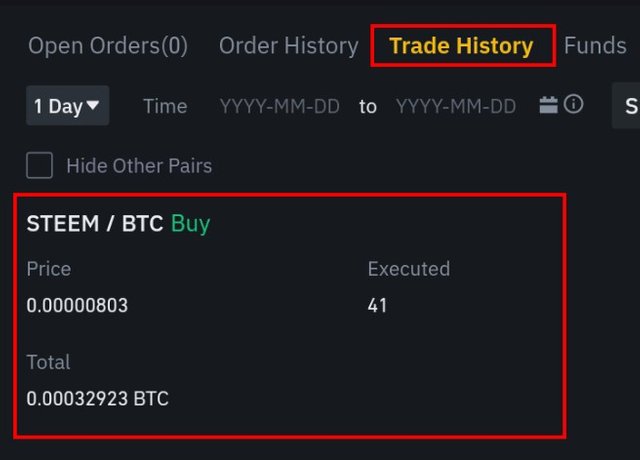

https://www.binance.com/en/trade/STEEM_BTC?layout=basic

https://www.binance.com/en/trade/STEEM_BTC?layout=basic

In the last screenshot above, you can see that I have been able to buy 41 STEEM with 0.00032923 BTC at the market price 0.00000803 BTC per STEEM. Remember that my order was filled immediately because I have used a market order to perform the buy operation.

Conclusion

In conclusion, crypto trading is another way of benefitting in the crypto ecosystem by exchanging one asset for the other through buying/selling, to buy low and sell high. Likewise, sell high and wait for it to drop in value before repurchasing the asset to acquire more of the asset. it could be exchanged for other crypto assets or fiat currency. It can also be utilized for money movement as desired by the user.

In this piece today, we have discussed spot trading as the simplest form of trading, highlighting trading pairs, market orders, limit orders, and order books. A user can choose to make his/her buy and sell an instantaneous action by buying or selling at the market price to get the trade filled at the spot. I hope you have learned something great again today, next week would take you on another eventful trip. Thanks for attending the lecture and I look forward to your entries.

Homework Task

- What's your understanding of Cryptocurrency Trading? What are the platforms used for trading cryptocurrency? Explain one (Hint: Centralized and Decentralized exchange).

- What is Spot Cryptocurrency Trading? List and Explain the Order types discussed in the lecture. What is an Order Book?

- What is Trading Pair? Show the steps on how to Perform Spot Trading on a Centralized exchange. Use any exchange of choice and a real trade is not necessary. (Screenshots required).

Guidelines

- Write an article of at least 250 words. Keep your explanation as simple as possible.

- Include the tag #grassroot-education9, #crypto, #steemexclusive, and your club status among the first 4 tags. Also, tag me @fredquantum in your homework entry.

- The participation in this lecture/homework task is open to everybody but only entries made by verified kids would be reviewed.

- I will check your articles and drop comments on the entries submitted now till 11:59 pm UTC, 19/03/2022.

Cc:-

@steemkidss

I had thought this lesson was so hard when I looked at the homework task first. But going through the lesson, I think I am ready to try it. Let me read abit more and attempt. Thank you sir

Thank you dear professor @fredquantum for taking time to educate us on cryptocurrency Trading. Everyone will enjoy this lesson. Let's see how it goes

You are welcome, @steemkidss. I am glad I've been a part of this development and I look forward to doing better for the kids, subsequently. Thank you, @steemkidss.

Your post has been successfully curated by our team through @shemul21. Thank you for your committed efforts, we invite you to do more and continue to post high-quality posts for a chance to win a valuable upvote from our curating team and why not be selected for an additional upvote later this week in our Top Seven.

Note: Always use the tag #fbcrypto to quickly access your post.

Here is my entry sir

https://steemit.com/hive-139765/@david-o/grassroot-crypto-education-vol-9-cryptocurrency-trading-15-payout-to-steemkidss