SLC | S21W4 | Costs for entrepreneurs - Budgets.

Welcome to my blog! Today I am participating in the learning challenge a second time and I can't wait to share my cost for entrepreneurs and which is budget.

Before I begin, I am inviting @eliany, @goodybest and @bela90 to participate in this learning challenge.

What is budgeting and how does it relate to costing?

The art and science of creating a financial plan in which limited funds are managed and allocated to verious resources so as to achieve our financial goals.

Each time we have some money and we take the time to consider what to do with the money based on our need, just to make sure we do not spend the money on less important things or spend too much or too less even on an important thing.

Such a consideration of what to spend on and how much to spend on it is budgeting.

The main components surrounding the idea of a budget are listed below:

- It is an intentional plan.

- it is based on our current need.

- funds are fairly allocated.

- using a scale of preference.

- to avoid wastage, over or under spending.

Types of Budgets:

- Personal budget (individual or household)

- Project budget (specific project or initiative)

- Government budget (public sector)

- Business budget (company or organization)

Budgeting and costing

The act of budgeting and costing are two closely related concepts in financial management.

While budgeting allocates our limited funds to achieve financial goals, estimating revenues and expenses, and prioritize spending. Costing, on the other hand, analysis and calculate expenses, determining and classifying the costs associated with products, services, or projects.

Relationship between Budget and Costing:

It is costing that informs budgeting, providing accurate and realistic values for each item in the budget. Such that when budget says we will spend on food, it is costing that tells how much.

Budgeting, on the other hand, helps us know which items needs costing. Only make a costing for the items in your budget.

Explain the importance of budgeting in determining costs.

Budgeting helps identify areas where costs will be incurred. It mentions what will need a cost analysis.

Budgeting sets realistic cost targets, ensuring expenses stay within limits.

Budgeting reduces any uncertainty, ensuring better preparation for future expenses as it prioritizes spending, allocating resources to essential items. Ultimately controlling costs by monitoring actual spending vs. budgeted amounts.

Budgeting provides a framework for making informed decisions about costs.

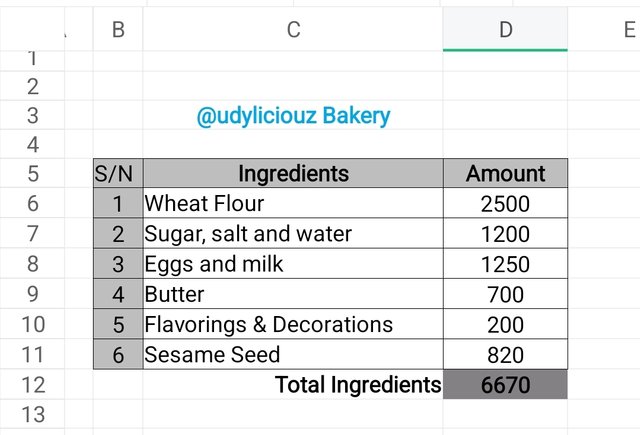

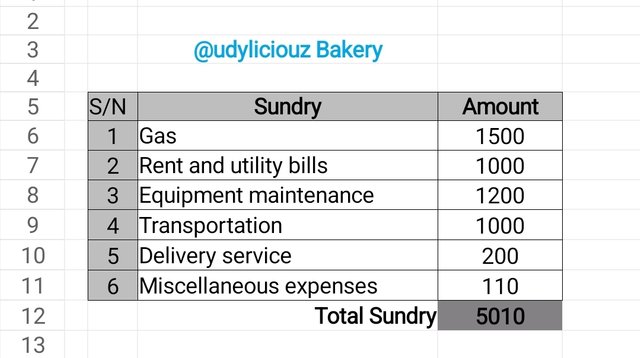

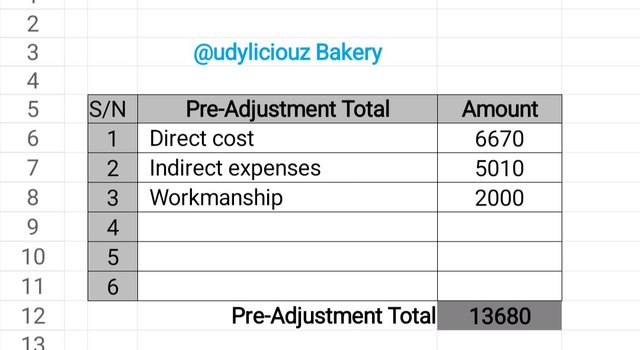

Budget as explained, for cake making. Consider a 4% adjustment.

Cake Preparation Budget

Direct cost

Indirect expenses

| Workmanship | 2000 |

|---|

| For 4% Adjustment |

|---|

Find 4% of 13680

= 4/100 x 13680

Adjustment = 547.2

Adjusted Total Cost = 13680 + 547.2 = ₦14,227.2

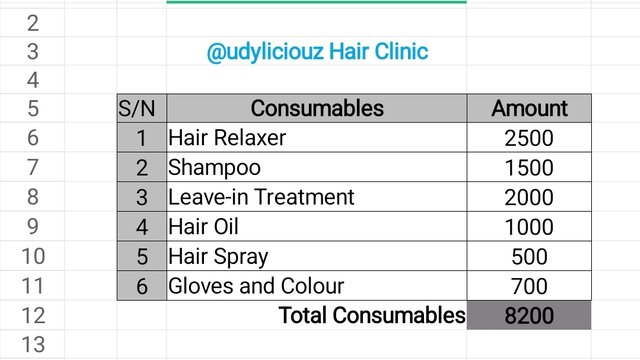

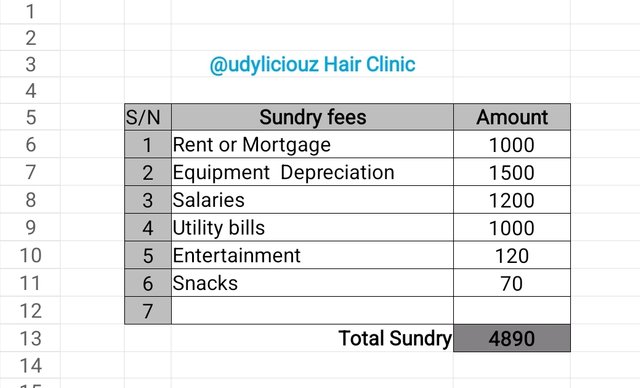

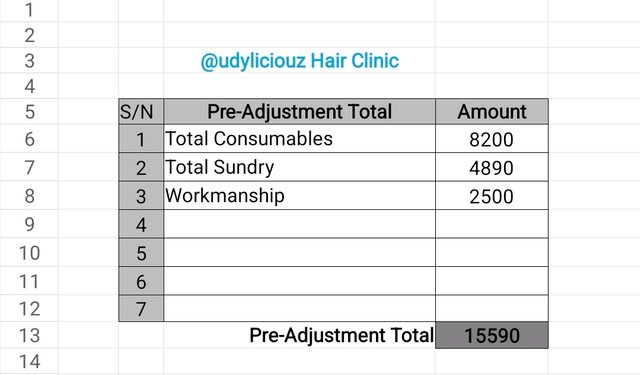

Quote as explained, for the hairdressing service. Consider a 3% adjustment.

| Workmanship | 2500 |

|---|

| For 3% Adjustment |

|---|

Find 3% of 13680

= 3/100 x 15590

Adjustment = 467.7

Adjusted Total Cost = 15590 + 467.7 = ₦16057.7

Thank you so much for reading through my post and my budget for bakery and hair dressing services.