be:-The February Contest#2 by sduttaskitchen|My budget with$200

Hello, friends welcome to my post in which I have discussed "Make a monthly budget of $200" as part of my participation in this 👉contest organized by @sduttaskitchen

Make a monthly budget with your country's currency,

dollar and steem price! Make sure you can't exit $200

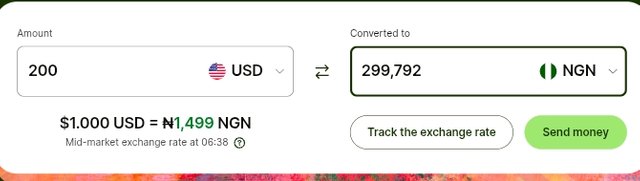

In Nigeria, $200 is a huge money as of the time of writing it is worth ₦299,792 which is an I have money that sustains for a month. A monthly budget is very important as it is a guide to how we have planned to spend for the month. For this, my monthly budget would be as follows.

My Monthly Budget For $200

| Expenses | Amount In USD | Amount In NGN | % of Budget |

|---|---|---|---|

| Rent/Housing | $20 | ₦29,979.20 | 5% |

| Food | $60 | ₦89,937.60 | 40% |

| Utilities | $10 | ₦14,989.60 | 5% |

| Transportation | $30 | ₦44,968.80 | 10% |

| Savings | $30 | ₦44,968.80 | 10% |

| Miscellaneous | $50 | ₦74,948 | 30% |

As for the miscellaneous, the money would go into supporting family and friends if the need arises and part of it will be for entertainment and meeting unexpected expenses. I like saving my money for rainy days.

Do you manage your home with a monthly budget? Share your view.

Yes, I do manage my home, with a monthly budget. As of yesterday that I went to the market it was based on my monthly budget that I went to the market. I also have a weekly budget which is drafted out from my monthly budget.

Managing my home with a monthly budget has been so good for me as it is helpful to me, as it prevents me from spending my money on unnecessary things that I don't need to spend on.

Do you believe we must save some money for emergency purposes? Share if you have such experiences when your hidden money assisted someone.

Yes, I believe we must save some money for emergency purposes. Economists would say there are three motives for holding money, which is (transaction, speculative, and precautionary motives). All these three motives help us to manage money well the precautionary motive is the motive that teaches us how to safeguard our money for unexpected expenses, such as sudden repairs, job loss, or medical emergencies.

Saving money for emergency purposes has helped me to avoid begging people for assistance when I am in a serious need. There I had an issue that was the only one that I saved that helped me clear my mess. Saving money for emergencies is real and it has been helpful to me.

How costly is living life in your country? Share with us by mentioning some item prices with pictures.

In Nigeria almost everything is now so expensive, ranging from petrol to foodstuffs even services are now so expensive. ₦1,000 cannot sustain someone today in Nigeria because of how things are expenses.

Yesterday I went to a mini shopping mall (kinni) I bought Neva body cream for $7 which is equivalent to ₦10,492.72, the Neva rollon $1.2 equivalent to ₦1800, and other items. Even foodstuffs are expensive compared to the way they're been sold before.

_20250130_064622_0000.png)