SLC | S21W4 | Costs for entrepreneurs - Budgets.

What is budgeting and how does it relate to costing? |

|---|

Budgeting and costing are key elements of financial management. They collaborate to support businesses in reaching financial stability, improving operations, and achieving strategic objectives.

Budgeting is a plan that outlines what an organization expects to achieve over a certain time, like a fiscal year. It covers income, expenses, investments, and cash flow. Budgeting are usually created based on different departments or areas of the business. A business can use a budgeting to ensure it can maintain its operations, track actual results against the planned goals, organize its finances, and simplify tax reporting.

Costing is about finding, assigning, and handling the expenses related to making products or services. Budgeting involves predicting and planning for future financial results. Together, these two areas help businesses reach financial stability, improve operations, and meet their strategic objectives.

Relationship between budgeting and costing

Strategic Planning: Budgeting connects financial resources to the organization's goals, making sure that funds go to the most important areas. Costing gives a clear view of costs, aiding managers in making smart choices about pricing, product selection, and ways to cut costs.

Decision-Making: Costing and budgeting give the financial details necessary for smart business choices. Whether setting a price for a new product, entering a new market, or investing in new technology, having precise cost and budget information is crucial for making good decisions.

Allocation of Resources: Budgeting help decide how to distribute resources among different departments, projects, and activities. This makes sure resources are used wisely and effectively to meet the goals of the organization.

Financial Control: Costing and budgeting create a system for tracking and managing financial resources. They help spot differences between what was planned and what actually happened, allowing for quick corrective measures.

Conclusively, costing and budgeting are key elements of financial management. They help in making good decisions, allocating resources wisely, and maintaining financial control. By learning about various costing and budgeting methods and applying best practices, companies can improve their financial stability, efficiency, and overall success.

If you work as a business manager, accountant, or financial analyst, becoming skilled in costing and budgeting will allow you to support your organization’s financial well-being and future growth.

Explain the importance of budgeting in determining costs |

|---|

Budgeting is key to figuring out costs because it gives a clear plan for tracking, managing, and analyzing expenses. Here are why budgeting matters for cost determination:

Resource Allocation: Budgeting allows for the distribution of resources to various activities or departments based on their importance and expected results. It ensures that key goals and operations receive proper funding while minimizing waste.

Cost Control: A budget serves as a standard for comparing planned costs with actual expenses. It also helps identify and analyze differences between the two, aiding in the prevention of unnecessary spending.

Set Financial goals: Budgeting keeps all activities within the available money. It also helps define spending limits for departments, personal costs, and projects.

Enhance Decisions: Budgeting offers a clear view of a business's expected costs, which supports informed financial choices. For example, businesses can determine whether to invest in new projects, reduce expenses based on budget estimates, or boost production.

Cost Statement: Budgeting helps people and businesses foresee their financial needs and avoid overspending, which can lead to bankruptcy. It also involves predicting future expenses, allowing for better estimation of costs related to specific tasks, services, or products.

Prepare the budget as explained, for the preparation of cakes. Consider a 4% adjustment |

|---|

Ingredients:

| Ingredients | Amount(#) |

|---|---|

| Flour | 1000 |

| Eggs | 500 |

| Sugar | 300 |

| Butter | 400 |

| Flavors & designs | 800 |

| Total Ingredients | 3000 |

Overhead cost:

| Items | Cost(#) |

|---|---|

| Packaging | 1500 |

| Maintenance | 3000 |

| Gas/Electricity | 5000 |

| Total overhead | 9500 |

Time for Labour: (12 hours) I hour cost = #500

Total hours would be 12×500= #6000

Total Cost

Ingredients+Overhead+Labour

3000+9500+6000 = #18,500

4% adjustment:

#18,500 × 4%= 18,500 × 0.04 = #740

Total Cost of Adjustment:

#18,500 + #740 = #19,240

Final Budget shown below

| Ingredients | 3000 |

|---|---|

| Overhead | 9500 |

| Labour | 6000 |

| Adjustment | 740 |

| Total Budget | 19240 |

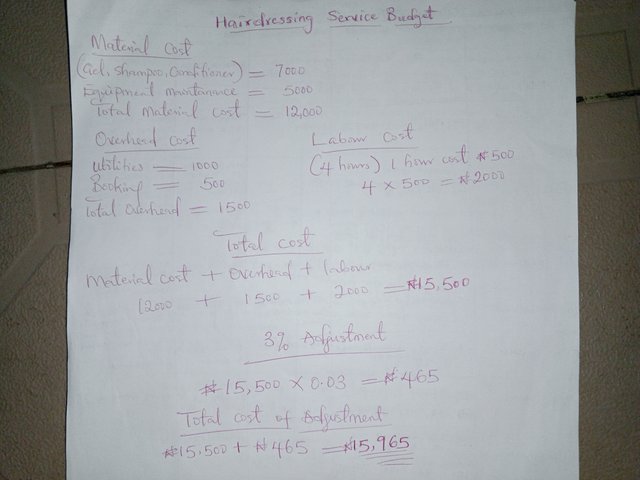

Prepare the budget as explained, for the hairdressing service. Consider a 3% adjustment |

|---|

| Materials | 12000 |

|---|---|

| Overhead | 1500 |

| Labour | 2000 |

| Adjustment | 465 |

| Total Budget | 15965 |

https://x.com/ninapenda2023/status/1858970724998017438?t=o4M788n4ESGJowgYrzMcpw&s=19

Budgeting and costing are critical to business success. It ensures efficient utilization of resources and financial stability. A budget for a cake-making or hairdressing service provides a clear outline of items, overheads, and labor. Calculating the surplus helps in better financial planning. Such budgets help businesses control costs and make better decisions. And more success is in your destiny

Greetings @ninapenda

1.- You have presented the concept of budget, and the relationship that exists with cost, where you have considered that these provide a clear vision of the finances of a company.

2.- You have mentioned the importance of the budget, making it understood that it provides a tool for distribution and control of costs in the short, medium and long term..

3.- You have developed the proposed exercise applying the 4% adjustment in an acceptable manner.

4.- You have developed the proposed exercise applying the 3% adjustment, in an organized manner.

Thanks for joining the contest