Crypto Academy Season 3 Week 4 Homework Post for (@stream4u) CeFi- DeFi- Yield

Professor @stream4u has explained the CeFi, DeFi and Yield Farming topics down to the last detail. He guided us to understand their advantages and disadvantages.

What Is the Importance Of the DeFi System?

The development of the blockchain, the invention of Bitcoin, the emergence of networks that can write Ethereum and similar smart contracts are very important for human history. With these developments, decentralized structures started to develop in all sectors, especially the finance sector. In the financial sector, great strides have been made in decentralized finance.

Decentralized finance is called DeFi for short. There are many DeFi products available. DeFi system is very important. Now I will enumerate the reasons for this one by one.

With the DeFi system, a more democratic financial system emerged. Users started to trade with lower commissions with the DeFi system. In the traditional financial system, commissions were quite high.

In the DeFi system, the control is entirely up to the user. Users have the freedom to behave as they wish.

Approximately 25% of the world's population could not use the banking service for various reasons. To use the banking service, it is necessary to fulfill various procedures. Getting to the DeFi system is pretty easy. It is possible to access DeFi products without KYC approval.

We have 24/7 access to DeFi products. There are no overtime restrictions. There are many constraints in traditional finance. It is a little difficult to transact outside of working hours.

You cannot feel the presence of the central authority in the DeFi system. The central authority can arbitrarily block your funds.

There are no agents in the DeFi system. Since there are no intermediaries, you can perform your transactions in more favorable conditions and more costly.

We can also say that it is faster and more reliable for central finance. Transactions are fast and reliability is high in blockchains.

Flaws in Centralized Finance.

Central finance has been exploiting people for years. People share some of their money, which they earn under difficult conditions, with the institutions that manage the central finance. With the DeFi system, this exploitation and dependence on centralized structures disappeared. Now I'm going to tell you about the flaws of central finance.

- Transactions in central finance are rather slow. I haven't taken out a loan myself yet. Borrower using central finance

I have friends. They wait a long time for their loan to be approved to take out a loan. In the DeFi system, your waiting time to take out a loan is very short. You have the opportunity to take out a loan within seconds.

The existence of a central authority creates an atmosphere of distrust. Users deeply experience the security problem. Since they have no other alternatives, they use this system by necessity.

In order to perform transactions in the central financial system, it is necessary to fulfill some procedures. Sometimes this lasts for days or weeks.

The costs in the central financial system are very high. Lots of employees have to work. Expenses are constantly increasing. Since the cost is high, they have to increase their commission rates.

There may be more than one intermediary in the central financial system. The presence of intermediaries gradually increases commission rates. Increasing the number of intermediaries also extends the processing time and delays the approval.

DeFi Products. (Explain any 2 Products in detail).

There are many DeFi products available today. We can use all and more of the products in the traditional banking system as DeFi products. The most popular DeFi products are decentralized exchange and lending.

Decentralized Exchange

It is the most popular among DeFi products. Decentralized exchanges were developed a few years ago but are starting to become quite popular. The most popular decentralized exchanges are UniSwap, SushiSwap, PancakeSwap and JustSwap.

Users trade cryptocurrencies on these exchanges without any intermediaries. In such exchanges, there are many options other than barter.

On the decentralized exchange, trading takes place between users. Smart contracts are used to carry out trade. Cryptocurrencies, tokens are exchanged among themselves. For example, on the UniSwap exchange, you convert tokens on the Ethereum network among themselves. You exchange Dot with Ether. On the contrary, we can exchange Dot for Ether.

You can exchange BEP-20 tokens among themselves on the PancakeSwap exchange.

On the JustSwap exchange, you can exchange the tokens in the Tron network among themselves.

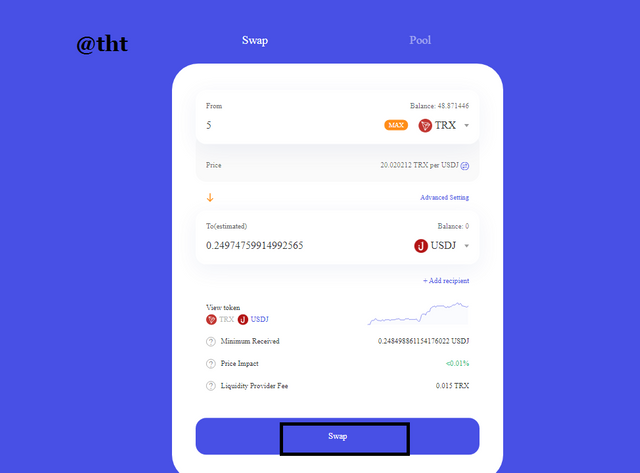

Login to https://justswap.io/#/home to exchange tokens on JustSwap. Then connect to the platform with a decentralized wallet like Tronlink.

For example, I will exchange TRX and USDJ between itself. To realize this, I make token selections. I enter the amount. Then I click 'Swap'.

There is a liquidity pool on such platforms. We can benefit from the liquidity pool while performing the swap transaction. They are regular users who make up the liquidity pool. Users earn commission fees as they contribute to the liquidity pool.

Decentralized exchanges use AMM (Auotomated Market Maker) for price. We can define AMM as an automatic market maker. The order books found in traditional exchanges are not found in these exchanges.

Lending

In centralized systems, users can borrow and lend. Such systems use the money they receive from users, lending to others and earning profits. It takes part of the profit for itself and gives the other part to the users. DeFi products have a similar operation, but there is no central authority in between. Since there is no central authority, transactions are more costly and more profitable for both the borrower and the lender.

Today, many users perform exchange transactions with cryptocurrencies. But we can earn passive income by renting out the assets we own.

By making a smart contract, the user who gives the loan and the user who receives the loan are brought together without any intermediary. Since there is no intermediary, both the borrower and the lender take advantage of this situation.

It is possible to earn good profits by lending instead of keeping your assets for a long time. In this way, you will both profit from your assets and earn passive income.

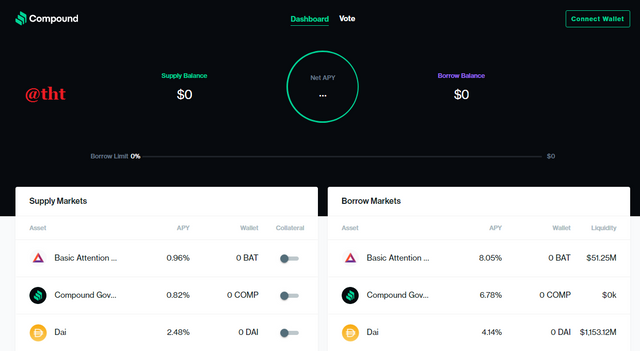

Lending exchanges include platforms such as Justlend, UniSwap, SushiSwap, PancakeSwap, Aave, and Compound. We can access such platforms with decentralized wallets. For example, when connecting to UniSwap exchange with MetaMask, it is possible to access Justlend with Tronlink.

As you can see in the screenshot, there is a difference in Supply and Borrow APY rates. Supply rates are low, while Borrow rates are higher. Users earn passive income by supplying, and borrowers access funds to meet their needs. They pay a small amount of interest compared to traditional financial systems.

Risk involved in DeFi.

The DeFi system is quite advantageous compared to the traditional financial system, but it also contains some risks. I will enumerate these risks shortly.

Transaction fees: The Ethereum network is most heavily used. We know that the transaction fees on the Ethereum network are quite high. However, if you are using networks with relatively low transaction fees such as Tron, Eos, there is no problem.

Security Risk: DeFi platforms built by inept developers have risked hacking in the past. Millions of dollars were liquidated from Compound, the DeFi platform in the past.

Liquidity: DeFi platforms are not very popular yet. For this reason, there is a liquidity problem from time to time. Someone who wants to trade a very large amount may have difficulty in this regard.

Price Drops: Imagine you bought tokens at a high price during the bull period. Then you supply and earn interest. Then you stop making passive income. You want to exchange the token but if the price has dropped too much. Consider what you need too. In this case, you will lose even though you earn passive income.

In case of security attack in traditional financial systems, you can access your funds again. Since there is no authority in DeFi products, you risk losing all your assets in the face of a security attack.

If you forget or lose your passwords to connect to the platform, you will also lose your assets.

The DeFi system is made with smart contracts. Therefore, minor errors in the network while making a smart contract can cause unavoidable problems in the DeFi system.

What is Yield Farming?

It is called "Yield Farming" when people who own cryptocurrencies earn income by lending their assets to others. Cryptocurrency investors generate income by providing liquidity. Any investor increases the number of his assets by locking his assets for a certain or indefinite period. There are many platforms where we can do Yield farming. Platforms such as Compound and Maker are the first established platforms.

If the investor locks the tokens he owns and does not touch the token for a while, he earns a return at the previously determined interest rate. You can either not touch the token within the specified time, or you will not receive any returns for touching the token.

Yield Farming and Staking are two different things. In Yield Farming, the user deposits their tokens in DeFi pools and earns income. In staking, the investor earns returns by locking his assets on stock exchanges or any platform.

One of the downsides of Yield Farming is that. Investors have to deposit more than the amount they want to borrow into the system. The continuation of the system is ensured by using the over-collateral method.

How does Yield Farming Work?

First of all, we need to know that Yield Farming and Staking are different things. Yield Farming is the locking of tokens on decentralized exchanges, liquidity pools.

Liquidity pools are created by a method called automatic market makers. There are no order books as in traditional exchanges. Users do their transactions instantly.

In exchange for the locked token, the system gives coins to the investor. For example, you are Yielding Farming on the Tron networked platform. To do this you need to add some TRX or LP tokens to the liquidity pool. In return, you get Trx, TRC20 and extra SUN tokens.

There are many platforms where you can do Yield Farming. Platforms such as MakerDao, YFI, Aave and Compound run on the Ethereum network.

In order to farm Yield on the Compound platform, you need to lock an ERC-20-based token in the pool. For example, this is ETH. The system gives cETH in return. You also earn jTRX on DeFi platforms on the Tron network. When the lock period expires, the cETH given to you turns into the ETH we know.

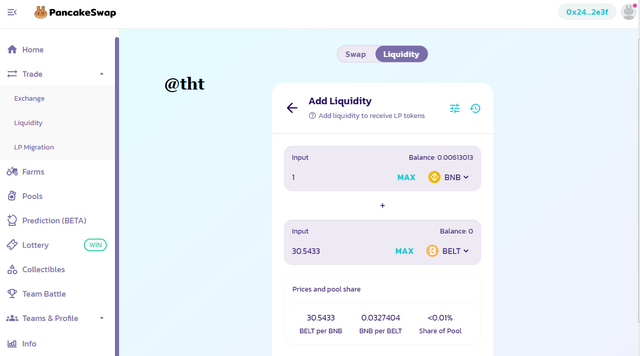

If you are a small investor, you can do Yield Farming on platforms running on the Tron network. Apart from that, you can do Yield Farming with small amounts on the PancakeSwap exchange operating on the Binance Smart Chain network. In doing so, you pay a minimal transaction fee when triggering a smart contract. Platforms running on the Ethereum network are not suitable for small investors.

Finally. Investors lock their tokens in pools called liquidation pools on DeFi platforms. If you cannot lock all the tokens on these platforms, these tokens must be the tokens supported by the platforms. If you lock your tokens for a certain period of time and in return, you will earn income. Other users also use the tokens you lock, and they pay interest for it. The interest they pay is actually your earnings.

What Are the best Yield Farming Platforms and why they are best.

With the development of decentralized applications, DeFi platforms have become quite popular. Today, there are many platforms where "Yield Farming" is done.

Yield Farming platforms offer different opportunities and rates of return. Some Yield Farming platforms are a good choice for large investors, while others are a good choice for small investors.

PancakeSwap

PancakeSwap is a decentralized cryptocurrency exchange. Being supported by the Binance exchange, working on the Binance Smart Chain network is one of the features that make the exchange stand out.

There are many DeFi products on this exchange. Users can trade here, contribute to the liquidity pool and earn income, place bets in the prediction section, and buy tickets in the Lottery section. You can also perform various operations in the Collectibles section.

PancakeSwap is a decentralized cryptocurrency exchange. It was founded in 2020 and has gained a lot of acclaim. It is a stock market preferred by both large investors and a stock market preferred by small investors. Some small exchanges are not preferred by large investors. Small investors do not prefer exchanges with high transaction fees.

The platform token is CAKE. Currently, Cake price is $12,061. Being supported by the Binance exchange, working on the Binance Smart Chain network is one of the features that make the exchange stand out.

An automatic market maker is used to set prices on the PancakeSwap exchange. Therefore, there are no order books like the stock markets.

Why is it the best

Compared to other platforms, the stock market provides many opportunities and possibilities. It is a great advantage that it is supported by the Binance exchange. The platform's token CAKE may reach high prices in the future. You already get CAKE when you do Yield Farming.

The platform runs on the Binance Smart Chain network. Transaction fees on the Binance Smart Chain network are quite low. It is in a very suitable place for a small investor. We can say that the liquidity is at a sufficient level. Therefore, large investors also prefer this platform. It will surpass platforms that have recently been built on the Ethereum network. The only downside is that it's not popular enough.

UniSwap

UniSwap was one of the first decentralized exchanges to launch. Hence one of the most popular decentralized exchanges. It is built on the Ethereum network. The platform token is UNI. Currently the price is $15.47.

Because it is built on the Ethereum network, users have to pay ETH for the transaction fee when the smart contract is triggered. Transaction fees are often very high. For small investors, this poses a big problem. High transaction fees are not a big deal for large investors. Because the platform's reliability and high liquidity are important to them. Since these two features are included in the UniSwap platform, large investors prefer the UniSwap exchange.

You can exchange ERC-20 tokens among themselves on the UniSwap exchange. For example, you can exchange DAI for ETH. On the contrary, you can also exchange Dai for Eth.

On this platform, you can perform transactions such as staking and Yield farming that you will gain income. To do this, you must have the ERC-20 token in your wallet.

Prices are formed through the automatic market maker. Each token, each pool has different rates of return.

Why is it the best

UniSwap exchange is heavily used by users because it is one of the first exchanges. In addition, the volume in the stock market is quite high. It is preferred by many users because of its high volume. APY rates are good compared to most Yield Farming platforms.

Being on the Ethereum network gives users confidence. Its support by Ethereum developers has attracted the attention of investors. This being the case, many investors are heavily used not only for Yield Farming, but also for staking and swap transactions. In this respect, it is among the best decentralized exchanges.

The Calculation method in Yield Farming Returns.

Farming Yield is calculated in two different ways. These are the Annual Percentage Rate (APR) and Annuel Percentage Yield (APY).

Annual Percentage Rate (APR):

It shows the annual cost of borrowing. It is very different from APY. The APR is fixed, meaning it remains constant throughout the loan period you will pay. Also available in variable APRs. We may associate variable APRs with credit card usages.

APR Calculation

Let's say I stake 100 CAKE for 1 year with 65% APR on PancakeSwap exchange. In this case ; APR is calculated with time x amount x ratio formula.

Duration: 1 year

Quantity: 100 CAKE

Ratio: 65% = 0.65

1 x 100 x 0.65 =65 CAKE

I earn 65 CAKEs for two years.

I originally had 100 CAKEs. I got a return at 65 CAKE. In total I had 165 CAKEs. If the CAKE price has not decreased in this process, my earnings will continue exponentially.

Annuel Percentage Yield (APY):

The annual gain you get from any of your assets without increasing or subtracting them all year. The interest you earn on your main asset is added to the interest you earn from the earnings.

APY Calculation

APY Calculation

The formula (1 + r/n)n -1 is used in calculating APY.

r: interest rate

n: period

Let's say I locked $100 worth of tokens into the liquidity pool for 1 year. Let the APY rate be 50%.

(1+0.5/365)365 - (1)

(1+0.00136986301369)365 - (1)

(1.00136986301369)365 -(1)

1.648155441-1 = 0.648155441

I had locked $100 worth of tokens.

0.648155441 x100 = 64.8155441$

$100+$64.8155441 = 164.8155441$

My $100 token totaled $164,8155441.

Advantages & Disadvantages Of Yield Farming

Farming Yield has many advantages as well as many disadvantages. Now I want to explain them one by one.

Advantages of Yield Farming

The biggest advantage of Farming Yield is that you get passive income. You think any token (a popular token) will gain in value after a very long time. This period should be at least 1 year. If you keep this token in your wallet, the number of tokens will remain as they are. However, with the Yield Farming method, you increase your token number.

It is possible to earn high profits on Farming Yield platforms. Since there are no intermediary institutions or authorities here, the investor has all the profits.

Farming Yield platforms are very secure as there is no centralized structure. The security of your funds on their centralized platform is at stake.

No KYC approval and no membership requirements. Using such platforms is quite easy. With a decentralized wallet, you connect to the platform very easily and start performing transactions.

You may terminate Yield Farming at any time on such platforms. There is flexibility.

On Yield Farming platforms, investors have a say in governance. To have a say in governance, you must own and stake the platform's token. You will then have the right to vote.

Disadvantages of Yield Farming

There have been attacks on some DeFi projects. Since it is a decentralized structure, there is no insurance or funding. In the event of an attack, users risk losing their assets.

The network fee in some blockchains is quite high. For example, if you do Yield Farming on platforms built on the Ethereum blockchain, you have to pay a lot of gas fees.

The main disadvantage is that the prices are not fixed. Imagine that you bought a token at a high price during the bull period. If you have to sell cheap during the bear period, you are likely to lose in total.

Large investors have better terms and advantages. Small investors are both less effective in governance and earn less in earnings than large investors.

Conclusion on DeFi & Yield Farming.

Decentralized finance is truly revolutionary. It can accommodate all products in traditional banking. However, there are some disadvantages as it is still too early. I think these disadvantages will disappear over time. Thus, people will have a more democratic and more liberal financial life.

It is a great event to carry out financial transactions without any authority, without any identity, document approval.

I can recommend Yield Farming to people and investors. Because people both keep their assets for a long time and have the chance to earn income. At this point, there are some situations that should be considered. In order to avoid loss while Yield Farming, we should trade with stablecoins or the asset price should be quite low at the time we buy assets.

Cc:

@steemitblog

@stream4u

Hi @tht

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Thank you.

Twitter sharing

https://twitter.com/Steemtht/status/1417835025748406279

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 22 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 6 SBD worth and should receive 34 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePig