The Logical Brain: How AI is Taming the Emotional Beast of Crypto Trading

Hello, SUDX community!

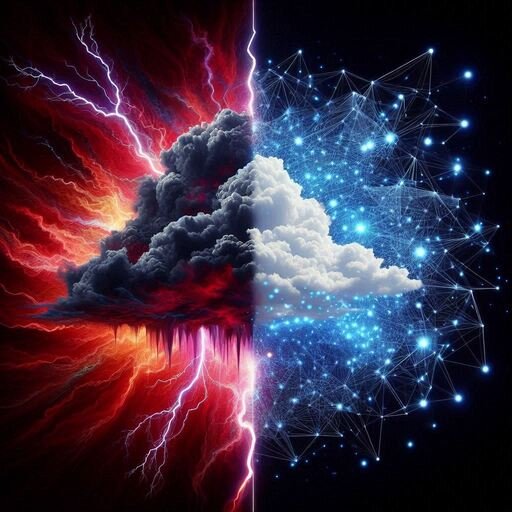

There's a fundamental battle that every investor faces, whether they're trading stocks, gold, or crypto. It's the internal tug-of-war between gut feeling and cold, hard data. It’s the voice of panic that screams "sell everything!" when the charts turn red, versus the quiet whisper of a well-thought-out strategy that says "stick to the plan." This conflict is as old as markets themselves—a deeply human struggle between our emotional instincts and our logical reasoning.

For generations, traders have tried to master this internal conflict with discipline, research, and sheer force of will. But what if a new tool could tip the scales, giving logic a powerful new ally? A recent study by the crypto exchange MEXC has revealed a fascinating trend: the youngest generation of traders is doing exactly that, and it's changing the way they navigate the market's stormy seas.

The MEXC report found that a staggering 67% of Gen Z traders are now using AI-powered tools to guide their investment strategies. The result? A 47% reduction in "panic selling" incidents. They are turning to AI not as a replacement for their own judgment, but as a co-pilot, one that isn't susceptible to fear or greed. They activate these AI bots specifically during periods of high volatility, effectively outsourcing the emotional labor of staying calm.

Think of it like this: imagine you're a pilot flying through a violent storm. Your instincts might tell you to pull up sharply or make a sudden turn. But an advanced autopilot system, analyzing thousands of data points per second, can make micro-adjustments to keep the plane stable and on course, navigating the turbulence with a "calm" that a human simply cannot replicate. The AI isn't flying the plane alone, but it's providing the unwavering logic needed to survive the storm.

This shift towards data-driven, logical decision-making in trading is a perfect mirror of the core philosophy behind SUDX. The problems of "panic selling" in markets are symptoms of a system where emotion and centralized points of failure can lead to irrational outcomes. Our goal with the SUDX protocol is to address this at a foundational level for open-source projects and DAOs.

By creating a transparent, decentralized framework for governance and funding, we are building the logic directly into the system's DNA. The rules of engagement within the SUDX DAO aren't subject to the whims of a single entity or the panic of a market downturn. They are clear, verifiable, and executed by a protocol that operates on pure logic, much like the AI tools used by Gen Z traders. We are building a system where trust is not based on emotion, but on a shared, immutable logic that ensures stability and predictability. Our vision is to create an ecosystem where the "rules of the game" are so robust and transparent that panic becomes obsolete.

As we see AI bringing more logic to trading, it begs the question: what other areas of the Web3 world could be transformed by building more

resilient, logic-based systems from the ground up?