Steem/USDT Order Book Trading – Mastering Market Liquidity Strategies

Aslamualikum

I hope you are all well. I am writing this post to participate in the learning challenge 5 in steemit.Today we begin this post in an effort to learn and teach each other.

Question 1: Understanding the Order Book in Steem/USDT Trading

The buying and selling of assets takes place at different prices. With an Order Book, those orders are listed in a distinct way. The order book of an asset, in this case a cryptocurrency, captures all market activity; thus for Steem/USDT there are several buy and sell orders for Steem and USDT at varying prices and they are all shown in real time on the order book.

Traders require an order book to check on the depth, liquidity, and the market movement of a certain asset or cryptocurrency. The order book consists of various components and to fully grasp them, we will outline them step by step.

What is an Order Book?

An order book is an asset’s ledger, in this case, cryptocurrency such as Steem, unlike USDT, is shown against all open sell orders. The ledger is updated constantly to reflect newly placed orders and canceled or filled ones.

Highlights of an Order Book:

✅ Displays current buy and sell orders at different prices.

✅ Assists traders in identifying the most optimal price for executing a transaction.

✅ Displays the market's demand and supply visually.

✅ Aids in determining market liquidity analysis.

General Outline of an Order Book

An order book contains two fundamental sections.

Buy Orders (Bids)

Buy orders are also referred to as Bids and these show the price level at which traders are prepared to purchase Steem. Usually, these are shown in green. A buy order has components of:

These Screenshot is Taken by Binance ExchangePrice (Amount of USDT a trader wants to spend to purchase a Steem token).

Quantity (The volume of Steem tokens the trader plans to buy).

Total Value (USDT’s sum which would be utilized if the order is filled).

Buy Orders in an Order Book:

| Price (USDT) | Size (USDT) | Sum (USDT) |

|---|---|---|

| 0.13483 | 51.77472 | 51.77472 |

| 0.13482 | 38.28888 | 90.06360 |

| 0.13481 | 584.26654 | 674.33014 |

| 0.13480 | 1.01K | 1.68K |

| 0.13479 | 57.01617 | 1.74K |

| 0.13478 | 474.56038 | 2.21K |

In other words, the best buy offer is $0.13478 per Steem for 3,521 STEEM. If anyone is willing to sell Steem at this level, their order will be executed immediately.

Asks (Sell orders)

Furthermore, sell orders or asks in this scenario, are positions where Steem is being traded for USDT. Typically, these types of orders are represented in red colors. Each sell order consists of:

Price (The amount of USDT a trader wants for each Steem)

Quantity (Number of Steem tokens that will be sold by the trader)

Total Value (Usdt amount that the trader will receive if his order is fully executed)

Sell Orders in an Order Book:

| Price (USDT) | Size (USDT) | Sum (USDT) |

|---|---|---|

| 0.13481 | 16.58163 | 2.27K |

| 0.13480 | 479.07920 | 2.25K |

| 0.13479 | 691.20312 | 1.77K |

| 0.13478 | 524.69854 | 1.08K |

| 0.13477 | 512.93462 | 555.38402 |

| 0.13476 | 42.44940 | 42.44940 |

Hence, the lowest ask price is for 123 STEEM being sold at the price of $0.13481 per Steem. In case market participants would like to purchase Steem, the order will get executed instantaneously.

. Order Matching and Market Depth

Spread is simply the difference between the highest buy order (bid) and the lowest sell order (ask). A tight spread often indicates greater liquidity while a wide spread indicates lesser liquidity.

When prices correspond, the exchange will automatically match buy and sell orders. A trader that uses a market order, which is an immediate buy or sell order, will have the order filled at the most favorable price in the order book.

Market Order- Execution in an Immediate Manner

The order gets executed instantly for the best market price available. When a trader places a market buy order, the system will try to fulfill it with the lowest sell order pending in the order book. In the same manner, when a trader places a market sell order, the system will try to match the sell order with the highest buy order available in the market.

As an example, for a trader wishing to purchase 1000 STEEM at market price:

The sell orders available in the order book include,

- 800 STEEM at $0.1341

- 1200 STEEM at $0.1342

Once these orders are matched, then 800 STEEM will be bought for $0.1341 and the remaining 200 STEEM will be bought for $0.1342. That means a massive order can be easily filled at several different prices which is known as the market depth, given that sufficient liquidity is available.

Limit Order (Price-Conditional Execution)

A limit order is carried out when the specified price is reached in the market.

As an illustration, consider a limit sell order for STEEM 500 at 0.195. This order will stay in the order book until a buyer is matched who is willing to buy STEEM for $0.195. Traders have control of their execution price, but the order may take a while to fill.

Order Book vs. Traditional Technical Analysis (TA)

Both an order book and technical analysis (TA) are different ways of analyzing the market. While the former focuses on current buying and selling activity, the latter studies past prices to anticipate future trends. Both perspectives are critical in trading.

An order book displays the current market depth and this aids traders in comprehending the available liquidity. An abundance of buy orders at a specific price indicates strident demand. Conversely, TA applies predictive indicators such as RSI, MACD, and Moving Averages to assess previous trends. These indicators enable traders to determine ideal buying and selling conditions.

Another key distinction is the support and resistance levels. In TA, support and resistance level are established with respect to past price actions. However, from the order book's perspective, they can be identified in real-time by observing the positions of big orders. When a certain price has a significant buy order, it forms a support price since traders deem that level favorable to buy. Large sell orders also form a resistant price.

Each approach comes with its advantages. The order book is beneficial for short-term trading since it enables traders to respond swiftly to market fluctuations. On the contrary, TA is more useful for long-term strategies because it captures overall market movements. Professional traders combine them—TA gives them the broader picture of the market, while the order book assists in decision-making just before the trade is executed.

As an illustration, if a trader believes that STEEM is about to breakout, he or she should verify that there are strong buy orders in the order book before the breakout. The breakout is more likely to happen when there is adequate buying pressure. The breakout is less likely to happen when there are excessive sell orders due to the price having difficulty rising.

In summary, order book trading is not the opposite of technical analysis; each approach enhances the other. A trader who masters both approaches is better equipped to make sound and confident decisions.

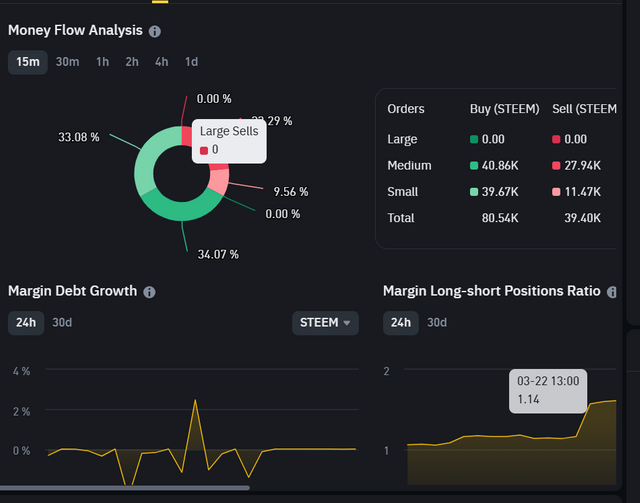

Question 2: Market Depth Analysis and Order Flow

Both market depth and order flow analysis are important for knowing how market participants interact in real time. These concepts assist traders in determining the magnitude of price adjustments and anticipating future market activity.

Market depth is the quantity of buy and sell orders waiting to be filled in the order book at given price levels. A deeper market is one that has a higher volume of open orders, which makes it more difficult for a single trader to manipulate the price. In instances of thin market depth, even small orders would result in significant price fluctuations.

Order flow deals with the execution of bu and sell orders at a given period. It allows a trader to determine whether there is greater buying activity (bullish side) or greater selling activity (bearish side)**. By tracking order flow, traders can predict breakouts, price reversals, and other types of price action before they show up on a standard price chart.

Example:

If for example, a trader is watching the market order book closely and sees an overwhelmingly long list of buy orders being placed on a certain price level, it indicates potential support level and therefore an increased probability of the price moving upward. On the other side, if a trader sees massive sell orders at a certain level, it is an indication of resistance which means the price will find it hard to go beyond that level.

The concept of market depth together with order flow offers traders a complete perspective of the market. The former focuses on the ‘where’, while the latter is concerned with ‘how’ in regards to the orders being placed on the market.

| Market Depth | Order Flow |

|---|---|

| Shows buy and sell orders that have not yet been filled at various price points. | Captures completed trades and activity associated with them. |

| Employs fixed information to point out important price points. | Employs changing information to monitor orders that have been filled and canceled. |

| Assists in defining support through clusters of significant buy orders. | Validates buying pressure as huge orders are filled rapidly. |

| Discloses resistance through sell orders or a combination of sell orders. | Indicates selling pressure when there is a high volume of sell orders that are executed. |

| Facilitates the configuration of trade entry and exit points based on order activity. | Facilitates strategic change in response to the direction the market is taking. |

Integrating Market Order Flow and Depth

By blending market order flow and depth, active traders understand the market better. Market depth shows the orders and how they work illustrates the sentiment of the market. Supporting both views allows a trader to find optimal times to minimize risks while maximizing open trade.

Question 3: Identifying and Reacting to Large Orders

In the order book, large orders have specific prices, which when reached by the market, tend to break it. A large buy order at a price level can act as a very strong support, while a large sell order can easily create resistance. Being able to spot these large orders early places the trader in an advantageous market position.

How to Identify Huge Orders?

Searching for Bids or Asks That Are Far Larger Than Ordinary: This means if a buy order is significantly higher than superior orders at certain price level, it is indicative of a good buy. Similarly, it indicates a weighty sell if there exists a particularly massive sell order.

Checking Depth of the Order Book: An area with a large number of orders that are close to each other is a cluster.

Monitoring The Filling Of Orders: Great deals of orders being filled with little delay indicates strong momentum in that direction.

Reacting to Large Orders

A prominent transaction in the order book, specifically a large buy order, is an example of strong support in an order book which, as traders suggest, comes with the likelihood of the price increasing. In anticipation of this price movement, traders tend to buy close to this level of support before aiming to gain profit when the price increases. In further analysis, a large sell order is most likely to function as an indirect resistance, meaning that it will come into play as the price is attempting to increase. In view of a vast sell order, traders will perhaps first wait before buying or go ahead and liquidate their holdings, confident that the price will eventually undergo a drop.

An order book-based strategy depends on a very detailed analysis of current buy and sell orders to determine the optimal entry and exit points for a trade. This approach enables traders to make more educated decisions regarding the market by tracking trends, liquidity, and possible future price changes.

The “best trades” and “high success ratio” that I make when trading Steem to USDT is speculation free as it is calculated and backed by live market data decision making. Below is the step-by-step approach that I use for Steem/USDT trading which utilizes all key factors.

First Market Research

Every trade begins with a detailed research of market conditions which includes viewing the price chart of Steem/USDT, looking into the recent price action, and judging the overall market sentiment. These steps help me comprehend the underlying volatility and also account for several key potentially price-changing fundamental factors.

This research assists me analyze and determine, if the market is trending or displaying a ranging behavior which helps in selecting the appropriate trading methodology. During a high volatility phase, I brace myself for quick price changes, but if the market is stable, I directly address gradual price shift and accumulation zones.

Identify Key Levels

For successful trades, I make sure to “identify key support and resistance levels” through “historical price data.” This data is crucial because it help me capture the reaction of the price zone multiple times in the past.

Most of the time, these significant levels are matched with fast buying and selling margins which show intensive scope and value interest. When the price is close to a support level, I actively try to “buy the market” while on the side of the resistance level, I am keenly waiting to “sell the market.”

All these sets of zones allow me to take insight of the count of movements in the market and be sure that the neck is very high while making this trade position.

.png)

At this point, I notice a demand zone because the price showed a strong reaction and bounced back almost immediately. This suggests that there is high buying interest in the area, therefore, it marks an important support level.

As I analyze the order book, I see that there is a large cluster of buy orders at this level. This helps confirm that there is buyer market participation, thus, elevating the probability of a price reversal.

Entry Point

Exist Point

Stop-Loss Settings

For effective risk management, I always place a stop-loss order beneath the last support region. This guarantees the least losses in cases where the market suddenly turns.

For this particular case, I decided to stop-loss at $0.1289, resting it a little while under the support zone. This added distance aids in ensuring that my trade does not get stopped out by small movements while still defending my capital in the instance of a sudden drop.

Liquidity Issues

In my trading practice, I try to focus more on liquid pairs to eliminate the risk of spreads and slippage. A sufficient trading volume means that my orders will be filled efficiently and within reasonable time frame without long wait times or irrational price movements.

With good liquidity, the Steem/USDT pair is acceptable for placing trades. There is sufficient volume that allows for timely execution of trades making it a great candidate for buyers and sell orders with low slippage.

| Trading Pair | Steem/USDT |

|---|---|

| Trade Type | Long |

| Entry Price | $0.1316 |

| Stop Loss Price | $0.1289 |

| Take Profit Price | $0.1386 |

| Leverage | None (1x) |

| Total Steem | 10,332 STEEM |

| Investment (USDT) | $1,360.73 |

| Risk (Loss if SL Hits) | -$27.90 (-2.05%) |

| Reward (Profit if TP Hits) | $72.03 (+5.31%) |

| Risk/Reward Ratio | 1:2.58 |

| Profit | $72.03 (Take Profit Hit ) |

Question 5: Real-World Order Book Case Study

Zain the trader intensely studies the order book and notices a whale placing a large buy order at 0.20 USDT while there is a strong sell wall at 0.27 USDT. This situation presents two possibilities.

Zain enters a long position at 0.21 USDT hoping to profit as the market moves in his favor. With buyers stepping in, this charge propels the price towards 0.26 USDT. Confidently, Zain starts to take profits at 0.26 USDT. Simultaneously, he continuously monitors the order book, adjusting the stop-loss using a trailing mechanism to lock in profits and capitalize on bull movement.

There is also a bearish scenario where the large buy orders slowly fade away with the volume failing to hold the prices. Zain’s stop-loss would get hit at 0.19 USDT which would leave him with unrealized losses.

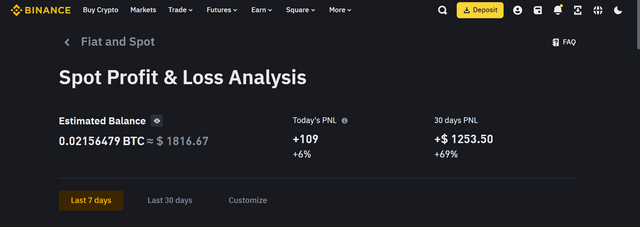

Today My Binance Spot Pnl

Now i am inviting some steemit users:

@waterjoe

@cryptoyzzy

@suep56

@wirngo

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

%20-%20Copy.png)

Great Brother @sheraz123

You have made a really great post. It is really important to understand and I learned a lot from it. Keep sharing such content. May Allah protect you. Thank you.

Thanks