Steemit Crypto Academy Contest / SLC S23W5: Steem/USDT Order Book Trading – Mastering Market Liquidity Strategies

Design with canva

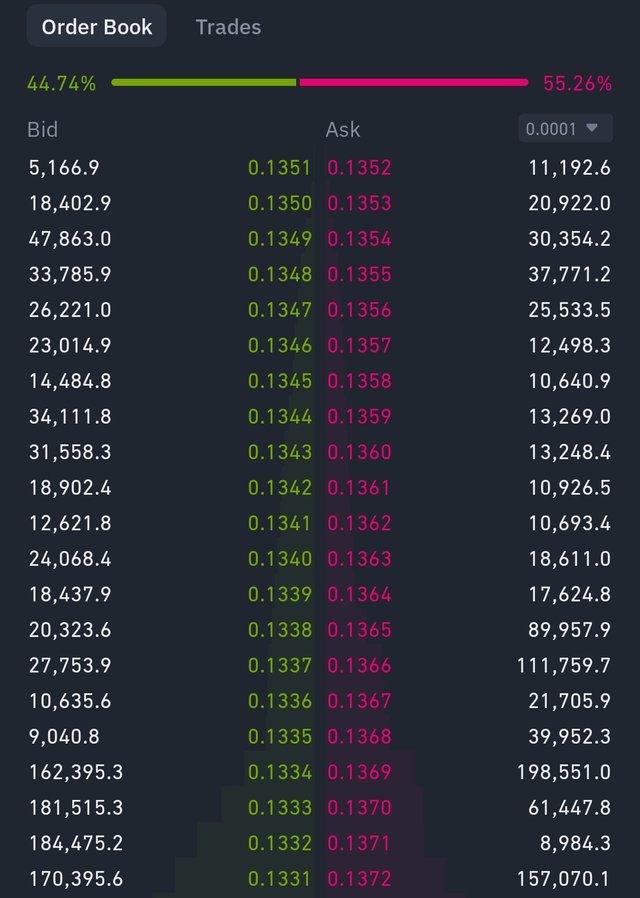

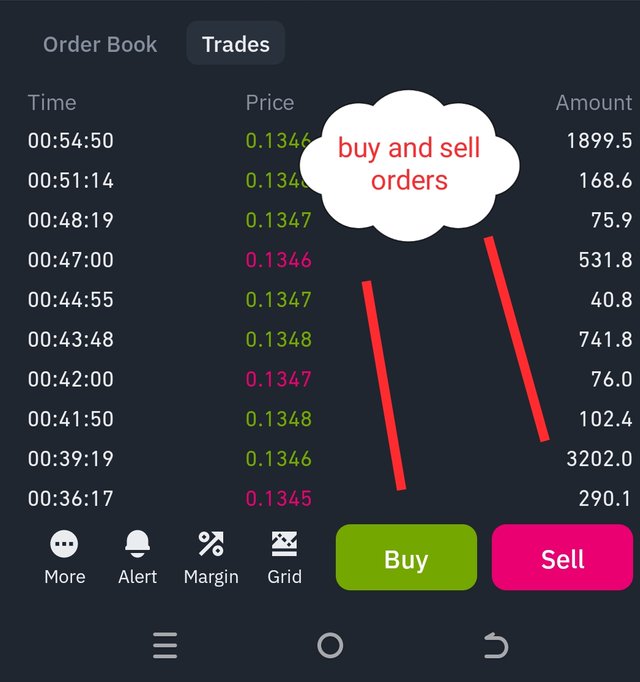

The core elements of the Steem/USDT trading platform are explained through the order book analysis.

Traders who participate in Steem/USDT cryptocurrency transactions require two essential elements which include the order book together with technical analysis as their main tools. Order book and technical analysis supply separate market information which complements industry understanding at different levels. The order book displays live market data but technical analysis uses old price trends as its main tool. This piece examines the basic concepts of the order book together with its functional principles and the critical value it delivers to traders. This research compares the respective benefits between order book trading systems and standard technical analysis to explain effective dual method utilization for traders.

What is an Order Book?

The Steem/USDT order book presents a current electronic compilation of trading instructions between buy and sell orders in real-time. The trading system shows market supply and demand through price-level-organized orders that enable traders to view market information.

An order book contains three main features:

- Traders who wish to acquire Steem by exchanging it for USDT issue their bids through the buy orders (bids). Market participants set their payment parameters as well as the desired purchase dimensions into the order book.

- Traders who want to exchange Steem for USDT place their orders to sell in the market via Sell Orders (Asks). The traders set their selling price and quantity on display.

- The exchange system executes trade operations by matching corresponding buy and sell orders at equal prices which automatically updates the trading positions in the order book.

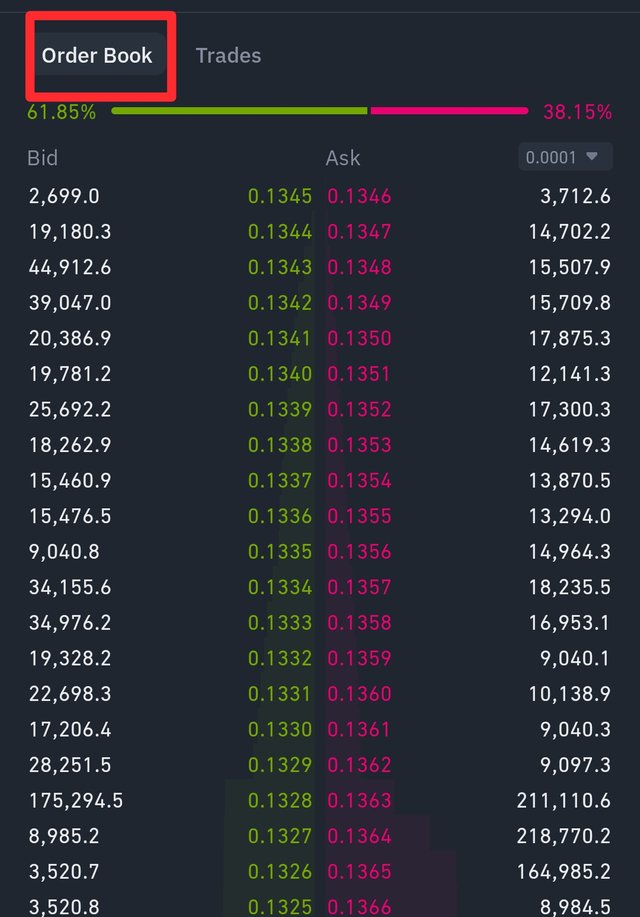

Understanding Bid and Ask Prices

The maximum limit which Steem buyers have established demonstrates their highest acceptable cost for Steem transactions.

The minimum price which sellers are willing to let go of their Steem constitutes the lowest ask price.

The ratio between the highest bid and the lowest ask defines the spread price. Market liquidity levels are high when spread between buy and sell prices remains tight but lower liquidity occurs when spread becomes wider.

The functioning of the order book becomes clear during Steem/USDT trading operations

Active traders accomplish continuous updates through placing or canceling or executing orders in the book. The system functions through the following sequence:

Order Book Trading vs. Traditional Technical Analysis

Order book trading and technical analysis (TA) are two different approaches to trading. Here’s how they compare:

| Feature | Order Book Trading | Technical Analysis (TA) |

|---|---|---|

| Data Used | Real-time order flow, bid/ask levels | Historical price charts, indicators |

| Focus | Market depth, liquidity, and order placement | Trend patterns, moving averages, RSI, etc. |

| Best For | Short-term traders, scalpers, day traders | Swing traders, long-term investors |

| Strengths | Provides immediate insights into buy/sell pressure | Helps identify long-term trends and price patterns |

| Weaknesses | Can be complex to interpret, requires constant monitoring | Lagging indicators may react late to price changes |

1. Placing an Order

Trader limit orders become immediately incorporated into the order book system.

Any purchase order with limited pricing activation will execute only when prices lower than the specified level appear in the market.

While the market price rises, a sell limit order executes at the set level.

On the other hand, a market order executes instantly at the best available price in the order book.

2. Matching Orders and Trade Execution

The trade takes place when a customer and seller settle on pricing terms. A market buy order made by a trader gets executed at the lowest available ask price that exists in the order book.

3. Impact on Market Liquidity

Trading operations remain smooth and volatile factors diminish when exchange platforms maintain a deep order book consisting of various asking and bidding orders at multiple price points. Large trades result in market price changes when the order book contains few available orders.

What makes the Order Book vital for traders working in the market?

The order book provides essential information for traders because it helps them achieve these following objectives:

1. Transparency in Market Activity

The real-time visibility into market depth originates from the order book. Traders gain knowledge about the number of buy and sell orders implemented at various price levels which lets them forecast movement patterns.

2. Identifying Support and Resistance Levels

The accumulation of many bulk buying orders forms support levels which are opposite to the resistance zones created by bulk selling orders. These market levels enable traders to base their entry or exit decisions with better information.

3. Executing Effective Trading Strategies

An investigation of the order book enables traders to select between placing market orders for fast execution or using limit orders to wait for better prices.

4. Spotting Market Manipulation

Market manipulation occurs when whales make phony orders through spoofing techniques. The immediate detection of drastic volume fluctuations assists traders to stay unaware of false trading conditions.

5. Understanding Market Sentiment

A buy order density demonstrates a bullish market sentiment contrary to a bearish market sentiment which shows dominant sell orders. Markets provide this data which traders utilize for upcoming short-term trend forecasting.

The Trading System Combines Order Book Processes Against Conventional Technical Analytical Methods

Each of these techniques proves valuable yet operates according to different market methods.

When to Use Order Book Trading?

For high-frequency trading (scalping)

To detect liquidity imbalances

When trading on low-timeframe charts

When to Use Technical Analysis?

To identify long-term trends

When planning position trades

The order book reveals support and resistance levels which traders should confirm their existence.

To achieve maximum trading efficiency both methods can work together.

Traders achieving optimal results combine technical analysis with order book analytics through their trading strategies. For example:

The order book provides real-time access to liquidity zones detectable by users.

This technical analysis tool verifies whether a particular trend shows strong or weak indicators.

Always check market sentiment from the order book before entering a trade.

Steem/USDT market traders depend significantly on the order book system for their operations. Real-time market information about price levels as well as supply and demand and platform liquidity becomes available through this tool. Proficiency in analyzing the order book enables traders to notice market trends as well as identify fraudulent actions and make better trading decisions.

Technical analysis functions well as a long-term forecasting method but the essential tool for quick trading decisions is order book trading. For achieving maximum trading success one should utilize both methods together.

A trader who learns the order book's entire structure obtains superior competitive advantages within the relentless cryptocurrency trading environment.

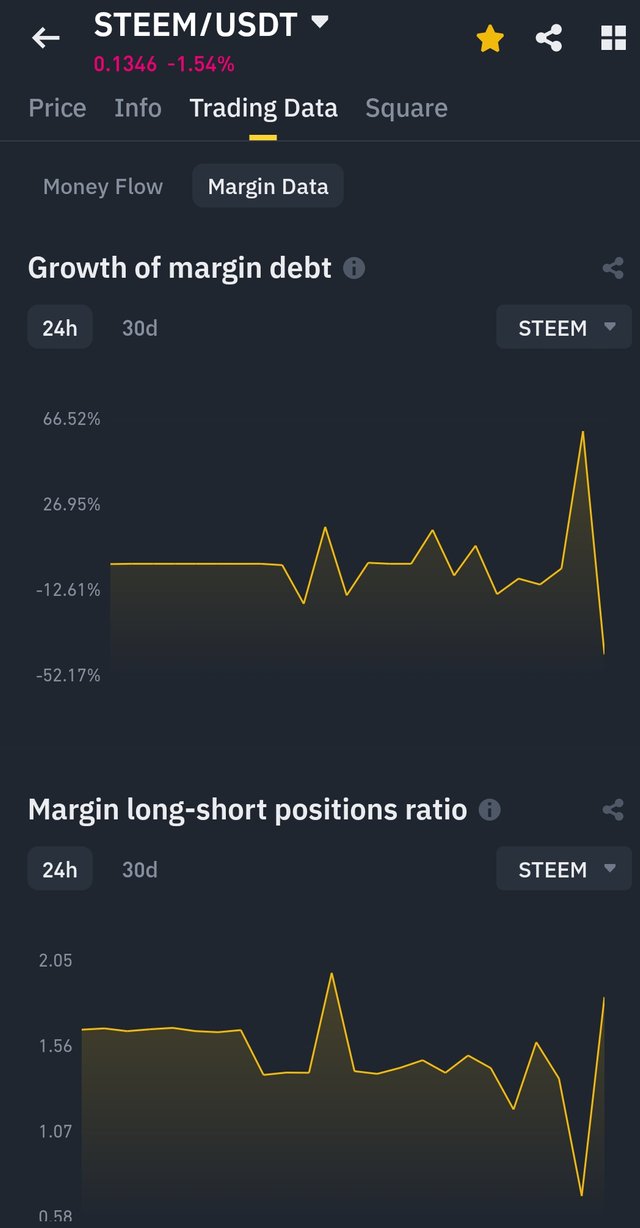

The analysis of market depth together with order flow identification allows traders to locate both support and resistance levels in their trading operations.

Traders who want to analyze price movements alongside finding important support and resistance levels and anticipate market direction rely heavily on market depth and order flow tools. Traders gain crucial market information about levels of liquidity together with buy-sell order strength and large participant activities by conducting thorough analysis of market depth and order flow.

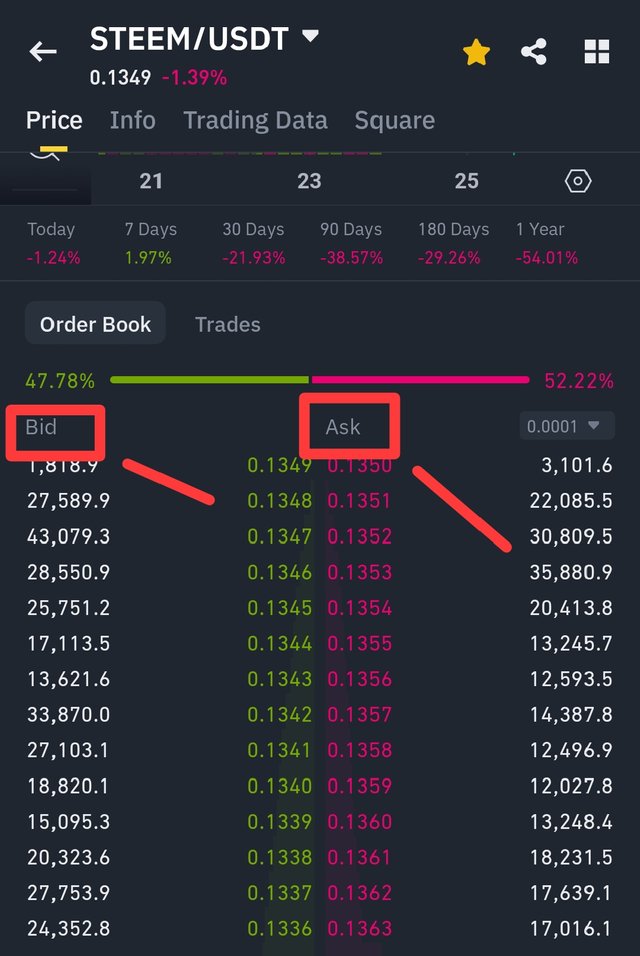

Understanding Market Depth

A market achieves depth through its collection of multiple buy and sell price levels from dealers in the market. The order book displays available orders that await execution in a specific arrangement. The information in the order book helps traders find support and resistance levels since it reveals market supply and demand conditions.

Components of Market Depth

- The market depth shows the maximum price at which buyers bid (bid) together with the minimum price at which sellers ask (ask).

- Bid and Ask Volume – The number of shares or contracts available at each bid and ask price.

- Markets show higher price stability because deep order books indicate high market liquidity whereas thin order books indicate low market liquidity.

Market depth provides support reactions at price layers where buying activity meets resistance at selling activity.

- Major transaction points exist at support levels as numerous buy-order clusters converge at these price points. The increased demand that occurs at this level creates a barrier that stops prices from declining any lower. Market traders take this information to trigger their long position entrees.

- Many traders place their sell orders at these particular price points known as resistance levels. Market demand rises upon price reaching this specific level thus impeding additional price increase. Investors use the supply-level to open positions that bet on declining prices.

Market depth analysis allows traders to detect the positioning of resting orders at their peak levels. Trading activity and market price movements both depend on these psychological barriers which traders encounter in specific price levels.

Order Flow Analysis

Assessments of the marketplace are conducted through actual transaction operations which constitute order flow. The analysis of executed trades forms the basis of order flow examination while market depth presents information about pending orders. Traders who analyze order flow can determine genuine market supply and demand conditions across different price points.

Components of Order Flow

- Market orders serve as one type alongside limit orders when traders place their requests.

Orders placed as market orders trigger executions without delay at the most favorable present market price.

A limit order executes only after reaching its pre-set price level which trading participants have defined.

2. Aggressive vs. Passive Trading –

The practice of market orders indicates trader angst to perform transactions quickly.

Traders who use limit orders will let prices trigger their specified values before executing trades.

- Volume Profile displays the quantity of trading activity for every price point thus allowing traders to detect areas with robust market participation.

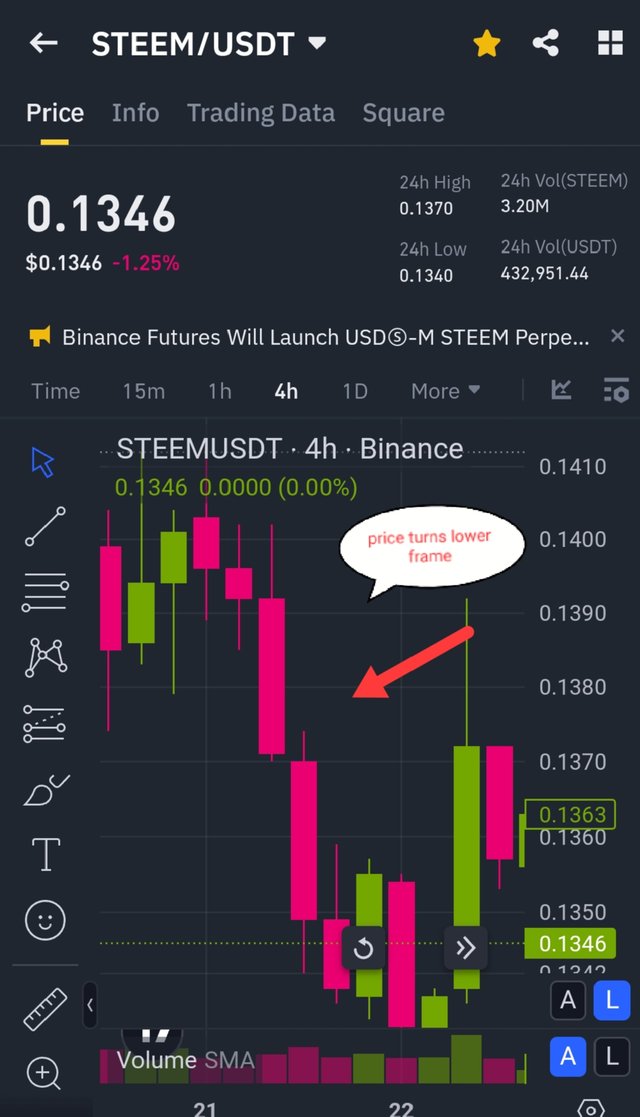

Insights from Order Flow Analysis

1. Buy and Sell Pressure –

A greater number of aggressive purchase orders will cause the market price to increase.

The market price tends to decrease when aggressive selling orders outnumber other orders.

2. Absorption and Rejection –

Large buy orders which fail to drive prices higher make sellers absorb outstanding purchase requests and signal market trend inversion.

Absorption by buyers becomes evident when large sell orders fail to trigger price decreases because it indicates strong market support.

3. Imbalances and Breakouts –

A resistance level break to the upside tends to occur when buy orders heavily outnumber sell orders.

When support levels experience excess sell orders their possible outcome becomes a downward break.

Traders combine assessment of Market Depth combined with Order Flow analysis for comprehensive market condition evaluation.

Market depth analysis when combined with order flow data provides traders with integrative market condition insights. Interpretation of these two tools occurs as follows:

- Confirming Support and Resistance

Proof of strong support occurs when substantial buying orders appear at levels within the order book alongside evidence of genuine buying activities.

The confirmation of a robust resistance area takes place when many sell orders appear within the order book accompanied by intensive selling pressure signals in order flow data.

- Detecting Fake Orders (Spoofing)

Market traders often place massive limit orders as fake indicator bids or asks before canceling them.

The process of analyzing order movements helps traders determine genuine trades from artificial orders.

3. Anticipating Market Moves

The entrance of numerous market buy orders at resistance levels might forecast a market breakout.

The intense buying pressure during support increases the odds of a decisive price drop.

Practical Applications for Traders

Scalping and Day Trading

Market depth together with order flow helps short-term traders determine fast entry and exit points during trading sessions. Large orders at specific levels allow them to assess market demand and supply intensity.

Swing Trading

Buy and sell positions enable swing traders to spot extended-term support and resistance zones which guide them into stable trading levels.

Algorithmic and High-Frequency Trading (HFT)

High-speed trading through automated systems uses order flow data along with real-time market conditions for executing trades.

Market depth and order flow analysis supply vital information that reveals market frameworks and price movement patterns to trading participants. The strategic placement of large buy and sell orders helps traders determine crucial support and resistance levels for predicting price movements which improves their trading approaches.

Traders can separate genuine market demand from artificial manipulations through coordinated use of these tools to make better decisions in unstable market conditions.

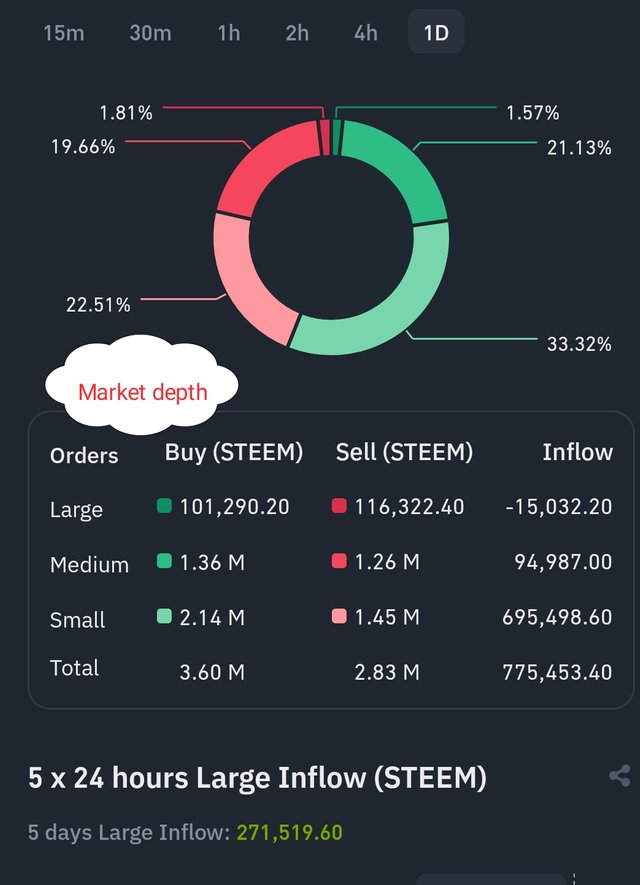

Market players need to detect substantial orders together with appropriate market responses

Financial market price movements alongside liquidity and investor sentiment substantially shift when whale orders of large consumers and sellers enter the market. Large orders enter the market through institutional investors and hedge funds and high-net-worth individuals who are known in the market as whales. Small retail investors together with individual traders should learn about major order influences since they need respective response tactics. The document examines market modifications from big trading orders alongside effective trader adaptation strategies.

- The Impact of Large Buy and Sell Orders on the Market

a. Market Liquidity and Price Impact

Large orders that get placed for either buying or selling will consume market liquidity. A massive whale buy order will exhaust all available sell orders at a specified price thus pushing the market value upward. Deducing vast amounts of buy-side liquidity through large sell orders results in price reductions. Large orders exert significant market price movements because of weak liquidity conditions in specific markets.

b. Slippage and Order Execution Issues

Liquidity at the best price level cannot satisfy orders that exceed its available capacity so slippage takes place. Such orders perform execution at various price levels that creates a less beneficial final execution price. When a trader executes a massive buy order the market price rises making the cost of purchase more expensive for buyers.

Large market moves and psychological reactions of traders influence markets during periods of significant trading.

The quantity of orders sent to the market becomes an important indicator to traders about bullish or bearish market sentiment. By submitting substantial purchase orders whales generate positive market expectations that bring additional buyers to the market before price appreciation occurs. A big sell order creates panic selling behavior among traders since they expect a declining price soon after. Fundamental market factors alone do not account for the altered price movements that psychological factors tend to enhance.

d. Spoofing and Manipulation

Large traders conduct spoofing activities by entering big buy or sell orders which they never intend to finalize. To achieve this deception traders want to trick fellow marketplace participants into perceiving big price waves are developing. The spoofing trade makes other traders react to their fake orders before canceling those orders to obtain price reversals for themselves. Legal restrictions cannot fully eliminate spoofing activities because cryptocurrency and unregulated financial businesses experience this illegal practice.

- Large orders become detectable for traders through various methods.

The effectiveness of whale order response requires traders to develop their abilities for whale order detection. Here are some key methods:

a. Order Book Analysis

The market shows all available buy and sell order information through its order book system. Blocks related to large orders can be easily identified through their substantial size as well as their fixed pricing points. The evaluation of order books helps traders identify the position of potential support and resistance levels established by whales.

b. Volume and Price Action Monitoring

The market produces sudden real-time volume increases whenever large orders enter the market. Price movement during a volume surge signals the involvement of whales in the market. Data regarding market changes enables traders to foresee upcoming trends.

The second technical level provides both Level 2 Market data alongside Time & Sales information.

Level 2 market data displays the depth of the market by revealing the order quantities located at various price points. The Time & Sales feed enables traders to detect significant transactions displaying signs of whale activity by showing all executed trades in real time.

d. On-Chain Analysis (For Crypto Markets)

The analysis of cryptocurrency wallet transactions are recorded through on-chain analytics systems. A whale wallet transfer of significant funds to an exchange usually initiates a market sell-off behavior while substantial withdrawal activity signals acquisition behavior.

- The desired method to deal with large orders involves specific trading approaches.

After detecting whale activity traders can modify the approach they use in the market.

a. Riding the Whale Wave

The traders' moves do not need to oppose whale movements since they should follow the whale trend instead. The market trend generated by substantial buying orders allows traders to achieve profits by opening long positions at an early stage. Discovery of large sell orders enables traders to short during upcoming market dip.

b. Placing Orders Near Whale Levels

When whales choose to buy they frequently purchase their stock through bulk transactions at crucial support points and use the identical approach to sell orders at resistance levels. When a trader places their orders close to these whale-arranged support or resistance levels they can profit from both upward market motions and downward market rejections.

c. Avoiding Stop-Loss Hunting

Whales stimulate price movements to activate stop-loss orders which they sometimes follow with a reversal. Stop-losses should have wider parameters or use mental checkpoints to prevent getting prematurely liquidated.

d. Scalping and Arbitrage Opportunities

Big orders sometimes result in prices which fail to match market value during temporary periods. The fluctuation of digital currency values gives scalpers quick trading opportunities which arbitrage traders develop into exchange price differential benefits.

e. Traders should monitor spoofing signals which appear as fake orders on the feed.

A massive order that vanishes from the order book typically means spoofing was underway. Trade execution confirmation should serve as the indicator for traders to react because fake order traps can be avoided through this method.

Major buy and sell orders strongly shape market processes because they affect price movements and create both market liquidity and mental states among traders. Analysts who examine order books and monitor market depth together with volume spikes can determine whale activities to modify their trading approach. Market navigation for informed traders becomes better when they use whale detection techniques combined with strategic order placement and avoidance of stop-loss hunting tactics.

By studying whale behavior traders learn how to make informed decisions which produce better results than the competition during market movements.

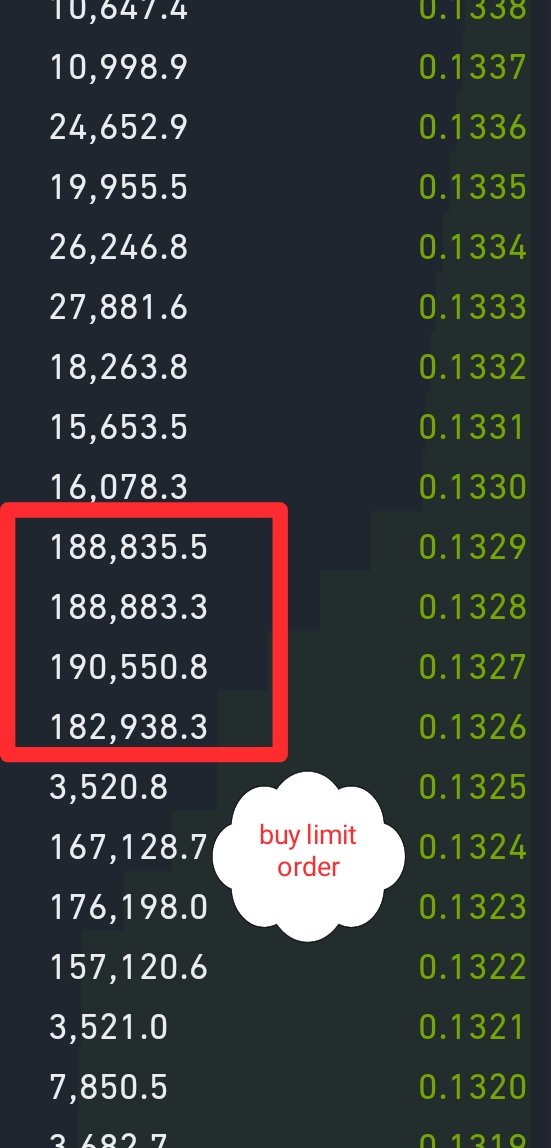

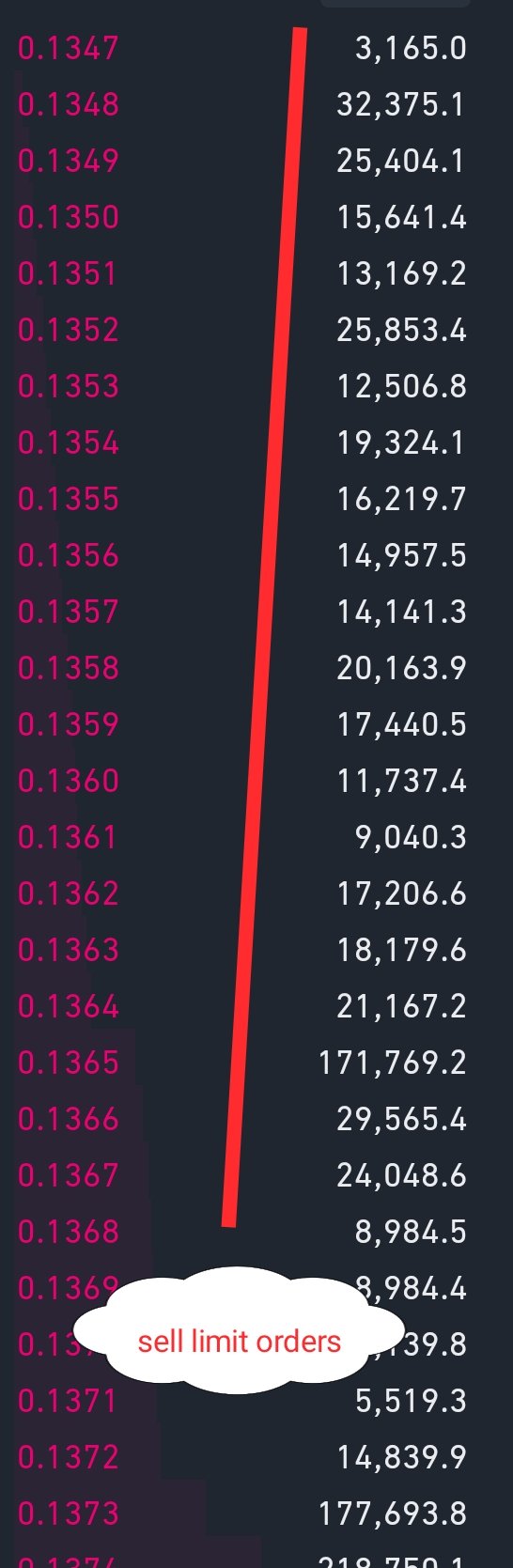

This trading system examines Steem/USDT order books to develop trading decisions

The order book trading system requires traders to study existing market orders while looking for areas that offer liquid trading zones before making their trades according to current supply and demand dynamics. Traders can determine their best execution moment by evaluating Steem/USDT depth and bid-ask spreads as well as support and resistance levels with this order book-based trading plan.

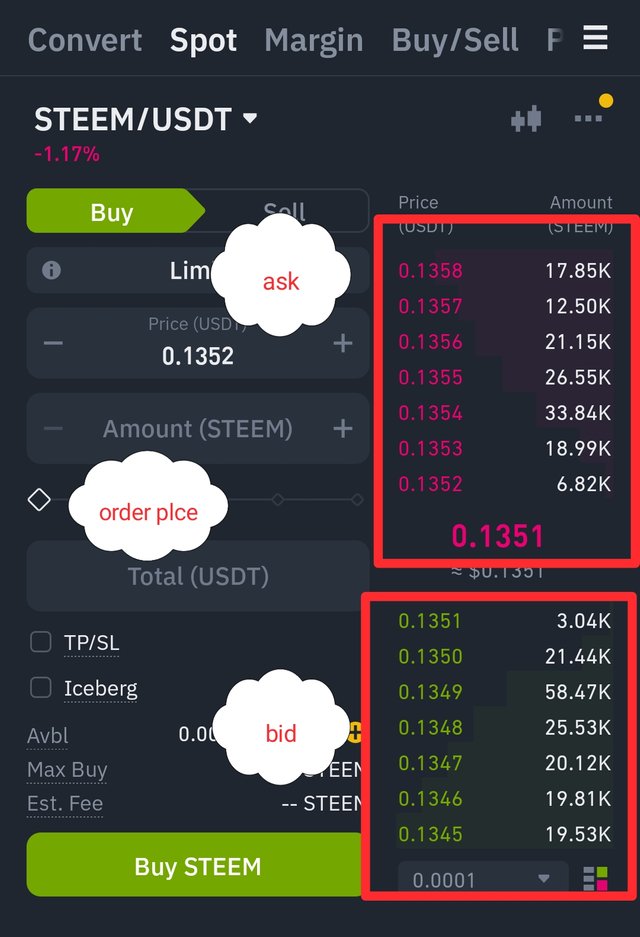

Step 1: Understanding the Order Book

Prior to trading one must gain comprehension of order book principles. The order book consists of:

The marketplace demand is represented by buy orders in the system. Markets that feature traders who display their commitment to buy Steem through submitting specific price levels form part of the group.

OrderAsk provides the same market functionality as selling orders do in the marketplace. Traders in the market can be defined as individuals who require buying Steem at specific price levels.

Bid-Ask Spread: The difference between the highest bid and the lowest ask. Market liquidity remains high when order price fluctuations stay minimal thereby creating significant price differences when market liquidity becomes low.

Processors track market orders to analyze future price movements because of selling force and buying momentum.

People intending to acquire STEEM/USDT will prioritize Step 2 which demands finding the best entrance point.

Proper buying time determination becomes possible at the following points:

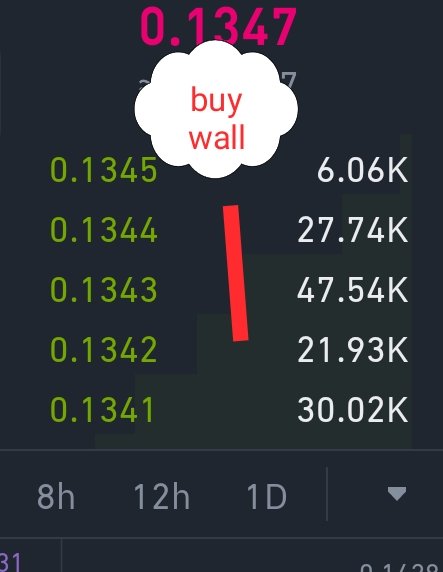

- Spotting Support Zones

Closely monitor large accumulation of buying orders that form price clusters. The attractive nature of support zones becomes evident when market demand reaches its peak making these areas suitable trading entry points.

The position of substantial buying orders established at $0.20 establishes potential direction change for the price.

- Analyzing Market Imbalances

A favorable long position entry occurs after buy orders surpass sell orders because this market structure demonstrates solid rising pressure.

- Waiting for Liquidity Gaps

A liquidation gap indicates the time when platform users lack orders at certain price areas. The price accelerates rapidly when it enters a gap between existing available orders on the market.

Before liquidity gaps arrive a trader who submits a buy order increases their chances of positive market price movement.

- Using Market Depth Analysis

The depth chart indicates the sections of bidding and asking prices which traders can access through their visible wall structures. A successful trading experience requires placing your buy order close to but slightly higher than existing large buy walls.

Example Buy Order Placement:

Current price: $0.23

Your order to buy at $0.215 will be filled because multiple large buy orders sit on the book at $0.21.

Users must determine suitable selling points for STEEM/USDT through this third process step (Step 3).

The maximum profit potential depends on the trader making the correct decision about closing their open market positions.

- Spotting Resistance Levels

The complete opposite concept of support describes resistance. The market encounters difficulty in breaking past resistance areas that form when many traders discharge their assets at particular price points.

When price reaches $0.25 the market becomes suitable for traders who need to sell their long positions.

- Monitoring Order Book Dynamics

When the number of sell orders increases, market control shifts to sellers and forms a warning for potential price decline.

- Selling into Strength

Shift from your current position through programmed part sales at multiple prices instead of holding for peak price levels.

Example:

Sell 50% at $0.24 (minor resistance)

Sell 25% at $0.245

Sell remaining 25% at $0.25 (major resistance)

Example Sell Order Placement:

Entry price: $0.215

Target price: $0.25

The stock should be offered for sale by using a limit sell order at $0.245 to maximize trading conditions.

Step 4: Managing Liquidity Considerations

Trading speed together with price shifts depend primarily on market liquidity levels in determining these aspects.

- Avoiding Low Liquidity Conditions

The execution price reveals large slippage because trading conditions with minimal order depth make the implemented price change from the intended target.

Check if the trading activity maintains 24 hours of operation before placing substantial orders.

- Strategic decision exists between placing either limit orders or market orders for trading purposes

The execution speed of market orders is fast yet their low liquidity conditions may trigger price slippages.

Limit orders protect traders from losses through slippages because they allow trade execution at desired prices.

- Watching Bid-Ask Spread

To obtain high market liquidity select a tight spread worth 0.001 USDT.

Higher market trading risks emerge when the 0.01 USDT specifies the bid-ask spread since this indicates sparse market liquidity.

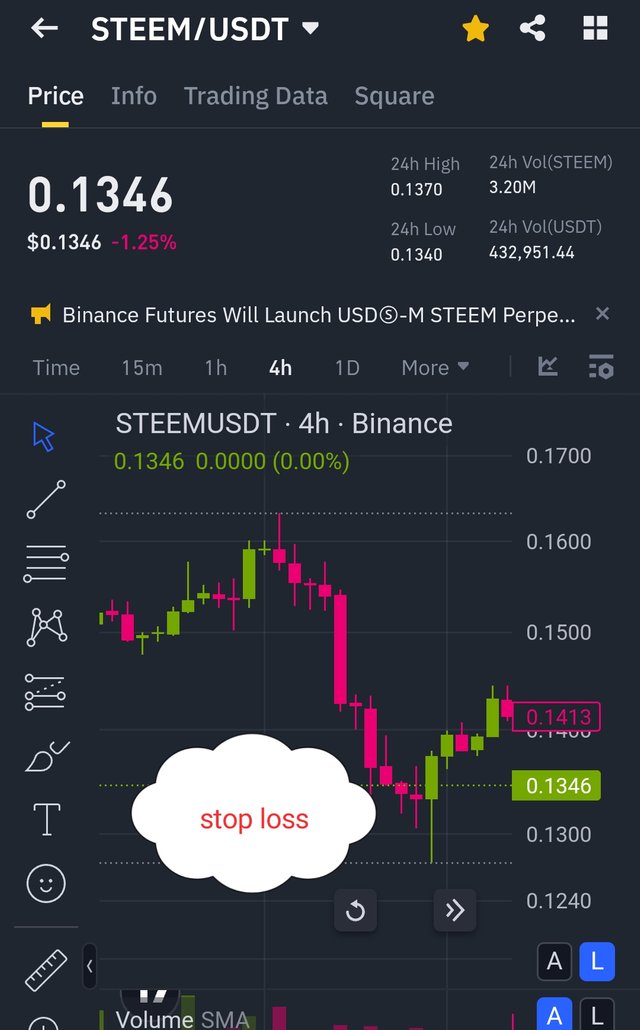

Step 5: Risk Management Techniques

Capital risks need proper risk management initiatives for their protection.

- Setting Stop-Loss Orders

Maintaining stop-loss orders becomes essential for restricting money loss during trading.

Example:

Buy at $0.215

Stop-loss at $0.205 (below support)

Risk per trade: 5%

- Using the Risk-Reward Ratio

A risk-to-reward configuration presented for acceptable risk promises continued profitability throughout the long term.

Example:

Risk = $0.215 - $0.205 = $0.01

Reward = $0.245 - $0.215 = $0.03

The trade offers a suitable risk balance because the anticipated reward covers the investment with triple returns.

- Avoiding Over-Leverage

The potential risks for an investment grow larger when measuring investment leverages at 5x or higher levels.

The first trading experience of new traders should include a maximum of two times leverage to shield their monetary investments.

- Monitoring Market Sentiment

Keep watch for significant market-moving orders that whales place on the market.

Large order-based selling pressure generates conditions that might shift the market toward negative trends.

Large buyers entering the market would lead to market uptrends and future rise in prices.

Step 6: Trade Execution & Monitoring

- Placing Orders Smartly

To obtain price discounts you should use limit orders that you place inside support zones.

The position of highest possible profit for investors involves placing their limit orders near resistance levels.

- The utilization of observation systems shows actual market orders through real-time order flow examination tools.

Market price typically experiences downward movement when sellers gain control because purchasing orders vanish rapidly from the market.

A fast consumption of sell orders will lead to resistance barrier breakthroughs while providing further price advancements.

- The trading strategy requires adjustment based on actual volatility levels between high and low market conditions.

The width of both stop-losses and profit targets needs expansion during periods of high market volatility.

A stable market environment of low volatility requires traders to restrict their trading operations within tight price margins.

The Steem/USDT strategy founded on order books allows traders to execute productive trades through the analysis of real-time market liquidity. Market participants who combine order flow with total market liquidity and current bid-ask values for analysis can improve their profitability through resistance breakthroughs. Strategic risk management techniques involving stop-losses, position sizing together with market sentiment analysis protect capital while delivering sustained profits.

Real-World Order Book Case Study: Steem/USDT Trading Strategy

Introduction

The application of order books remains essential in cryptocurrency trading because it reveals critical information about market dimensions and liquidity levels and trading price movements. This study examines a typical yet authentic instance of Steem/USDT trading activities based on order book interactions. The analysis will examine the trader's opening plan as well as market activity and essential learning points that led to trading adjustments for better optimization.

The trader established their first strategic moves and observed the market conditions.

The trader we will call Ali remains actively involved in Steem/USDT trading operations at a centralized exchange platform. Through technical indicators combined with price action assessment and order book analysis Ali implements his short-term trading strategy on the market.

Initial Market Conditions

Steem Price: $0.24

Moderate trading activity marks this market due to 100,000 USDT trading volumes per day.

The order book shows reasonable market depth apart from occasional thick walls that match purchase and selling orders

Large trading orders cause moderate changes to the market price due to its current liquidity levels.

The current market shows tight trading spread at 0.002 USDT because this sector demonstrates strong competition.

Ali pursues two trading approaches for generating profits through day trading and scalping during brief trading periods.

Ali conducts his initial market entry by executing a limit buy order and observing the order book.

At $0.238 Ali sets his limit buy order to purchase while maintaining a small gap below market value to anticipate a momentary price decreasing trend.

Key Order Book Observations:

- Large Buy Walls at $0.235 - $0.238

The market shows strong backing and potential stabilization of prices at this point.

- Large Sell Walls at $0.250

The price encounters tough resistance at this height thus making it challenging to overcome this barrier.

- Frequent Small Market Orders

The market shows ongoing involvement because orders for various small quantities are filling within the $0.238 - $0.242 price zone.

- The market spread contracts just before a price movement occurs the following step.

The price differences between ask and bid prices decrease just prior to sharp market movements.

Trade Execution:

Seizing a purchase opportunity Ali places an order at $0.238 to acquire STEEM which pushes the market price immediately from $0.245 within half an hour.

Ali sells the STEEM at $0.244 after setting the order price at $0.250 for a fast return of 2.5%.

The second phase explores adjustments of buying strategy according to market depth information.

Following the first order execution Ali conducts additional order book research for a strategic refinements.

New Strategy Adjustments:

- Recognizing Spoofing and Fake Orders

Every time the 5000 Steem buy order emerged at $0.240 it vanished after the price became close to it.

Through market analysis Ali becomes aware that some traders spread fake orders as a method to change price perceptions.

The new adjusted approach prevents dependence on orders that are visible and large.

- Following the Bid-Ask Pressure

Ali observes that the market purchases exceed sales activity which shows positive market direction.

The trader strategically puts in place buy orders slightly higher than prominent bid groupings to protect their entry.

- Quick price movements can be exploited through simultaneous buy and sell order applications (Market Making Approach).

Ali initiates multiple simultaneous market deals through both purchasing and selling at sequential price levels.

Buy: $0.239

Sell: $0.245

Why? During predictable 2-3% daily price movements in the Steem market Ali takes advantage of the small price variations.

The third phase involves managing risks through experiencing high market volatility.

When a Steemit-related announcement occurs, the market shows sudden high volatility.

New Market Conditions:

Price Spikes to $0.270 in Minutes

Bid-Ask Spread Increases to 0.01 USDT

Stop-Loss Hunting becomes evident through sharp wicks that activate protective stop orders.

A brief period occurs where order books show significant thinning of available liquidity.

Adjustments:

- Avoiding Stop-Loss Hunting

Standpoint stop-losses serve Ali instead of traditional automated stop-losses which many other traders choose to implement.

Ali tracks price changes by hand and abandons static stopping at $0.235.

- Fast execution occurs through Market Buys.

The high amount of volatility makes limit orders fail to execute reliably.

The strategy started by buying in the market at $0.242 and stopping at $0.265 generated a fast 9% profit.

- When markets experience high volatility traders should decrease their investing position dimensions.

The risk management decision results in a 50% reduction of trading volume so as to decrease exposure during market volatility.

Final Takeaways and Long-Term Adjustments

Ali learned important lessons from executing several profitable trades and experiencing some learning opportunities which led him to determine key points.

- Order Book Manipulation Exists

Market participants can get misled through the intentional misleading of order walls known as spoofing.

The trading strategy requires better assessment of live market orders together with present-day execution methods rather than depending solely on order book volume.

- Market Trends Can Change Instantly

The depth of orders in the book plays an important role in periods of low market volume.

Market momentum determined by aggressive orders becomes more significant when market conditions reach high volume status.

- Position Sizing and Stop-Loss Adjustments

Expansion of trader positions should remain smaller as volatility rises in order to control market risk effectively.

Stop-loss parameters with larger widths stop liquidations which are not necessary.

- An examination of the bid-ask spread enables users to make better forecasts of market price movements.

The market indicates an approaching price movement when order spreads remain tight before major trades take place.

When spread values are wide and uncertain investors should postpone their market entry.

The order book analysis together with dynamic strategy adaptations enable Ali to succeed in the Steem/USDT market. Ali implements their market analysis of depth data and calculate bid-ask spreads and identify liquidity traps and spoofing patterns to develop better trading strategies which enhance their trading success.

The forthcoming development for Ali includes implementing algorithmic reading tools for quick order book evaluation together with performance enhancements of trading executions. The developer positions themselves ahead of other competitors by consistently adapting their strategies in the competitive crypto trading industry.

i would like to invite @wilmer1988 @pelon53 @josepha to take part in this contest