Advanced DeFi – Liquid Staking and Real-World Asset Integration"

Greeting,

I hope all will be good and enjoying the pleasures of life. A great competition has been held here and I have come to attend. Many other people who are here are attending here and you can see and join the link to this competition.

Design with canva

Question 1: Understanding Liquid Staking

The document explains in great detail the concepts and foundations of liquid staking

Introduction

Blockchain networks using Proof-of-Stake (PoS) together with its related models operate through staking as their fundamental operating process. Users who participate through the platform secure their cryptocurrency to defend network security while reaching operational consensus for rewards that result from their participation. Withdrawal of assets locked in traditional staking remains unavailable during the complete staking period. Conventional staking Technology limited usage potential thus developers built liquid staking platforms to make locked assets usable for consumers.

Users participating in the liquid staking mechanism can stake their items with crypto assets to gain derivative tokens for trading or DeFi activities that unite lending functions with liquidity generation capabilities. Both Lido and Rocket Pool and Frax establish their position as leading services for liquid staking through their token liquidity provision capability.

The research examines liquid staking principles and analyzes its differences with original staking methods while providing assessments of security risks followed by practical execution examples.

What is Liquid Staking?

Users within the PoS blockchain environment can perform token staking using liquid staking that creates staking derivative tokens known as liquid staking tokens or staking derivatives (LSTs). The flexibility users achieve derives from liquid staking tokens which offer trading capability while supplying loan collaterals and make possible decentralized finance protocol utilization for gaining yield.

Through the platform users can stake ETH so they gain stETH which functions as aholding which represents their tied-up Ethereum deposits. StETH acts as an application token in DeFi yet the original Ethereum user token stays secured inside the staking process.

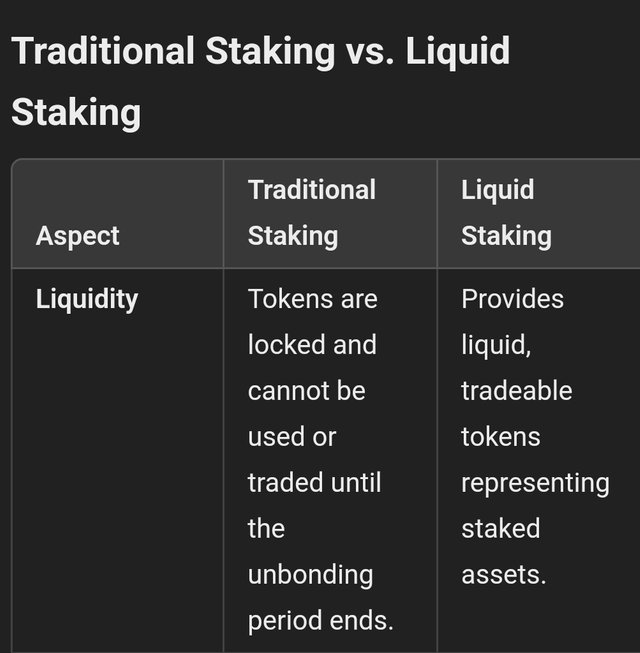

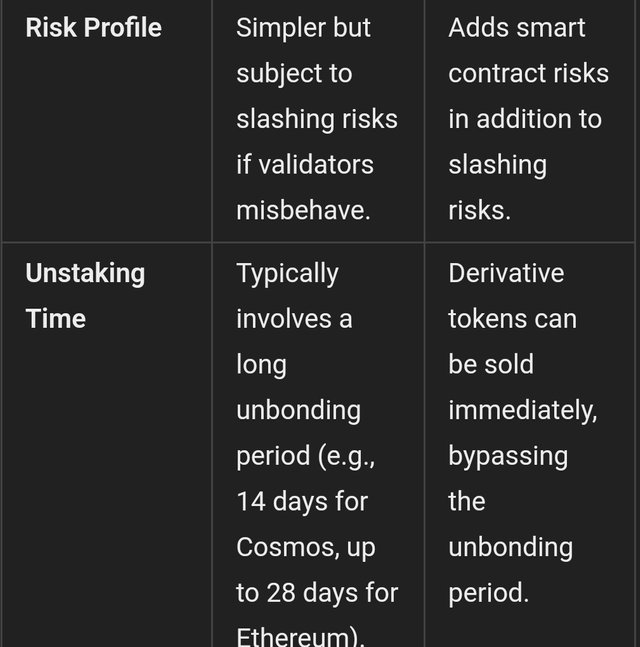

How Liquid Staking Differs from Traditional Staking

Users who use traditional staking to become validator node operators surrender permanent access to their assets because these funds remain inaccessible for varied purposes. The liquid staking token mechanism known as LSTs within liquid staking systems allows users to enhance their asset versatility.

Advantages of Liquid Staking

1. Liquidity Retention

A liquid staking system allows users to keep their assets usable while undergoing the staking operation. Through liquid staking users gain flexibility because they preserve their access to stake funds upon locking their assets. Stake holders can access their locked assets through DeFi applications according to this method.

2. Higher Capital Efficiency

The financial purposes which liquid staking tokens serve consist of three main categories:

Users leverage the yield farming feature to back the liquidity provision for decentralized exchanges (DEXs).

The borrowing process allows users to use their LSTs as security assets to obtain loans.

Staking assets that come from borrowing peers allows users to enhance their returns while participating in leverage activities.

3. Increased Staking Participation

The requirement to stay locked in stops most investors from placing their assets for stake. Liquid staking achieves better stakeholder inclusion through its elimination of usage periods because it strengthens blockchain security.

4. Reduced Risk of Centralization

With its described capabilities Rocket Pool creates a decentralized staking framework that enables users to run small validator nodes despite staking pools being operated by centralized exchanges.

Risks of Liquid Staking

1. Smart Contract Risks

Users who stake through these platforms must rely on smart contracts which introduce possible security problems. The fund loss occurs through bugs and exploits discovered inside the contract system.

2. Slashing Risks

The financial losses of stakers occur due to slashing events generated by manager errors and offline status. The risk exists despite certain platforms sharing it. Users should be aware of its presence nevertheless.

3. Depegging Risk

When examining liquid staking tokens their value must precisely match the worth of the stakehold so stETH directly reflects the value of ETH. Depegging poses a danger to users during market instability or emergency situations because it leads to financial losses.

4. Regulatory Uncertainty

Government authorities along with regulatory bodies struggle to determine how they should classify liquid staking tokens. Future regulatory regulations may trigger changes in how users handle and utilize these assets between trading and operational purposes.

Image by Sergei Tokmakov, Esq. https://Terms.Law from Pixabay

Popular Liquid Staking Platforms

1. Lido Finance

Lido functions as the leading liquid staking solution that allows users to interact with Ethereum (ETH), Solana (SOL) together with Polygon (MATIC). The StETH tokens you obtain from ETH staking gain general usability at Aave and Curve Finance but distributed among the broader DeFi platform.

The platform connects users to DeFi protocols while offering its users the maximum level of liquidity.

The staking pool's centralization occurs because it enables limited validators to manage the stake.

2. Rocket Pool

Validation through Rocket Pool becomes possible because users can access validator positions after they meet the requirement of 8 ETH minimum entry. With Rocket Pool users can join the validator network despite having a minimum stake of 8 ETH while Lido maintains an overconcentrated model.

Pros: More decentralized, lower barrier to entry for validators.

The Lido staking pool lacks sufficient availability of liquidity compared to Lido's pool resources.

3. Frax ETH (Frax Finance)

The Frax Finance project initiated Frax ETH (frxETH) as a liquid staking protocol to support Ethereum users through the platform. Users appreciate frxETH's yield system difference from stETH because it creates a unique DeFi solution.

The platform offers revolutionary tokenomics systems and extensive connection to the Frax ecosystem.

Two serious downsides exist for this protocol because it was developed recently and receives less user support compared to Lido.

People currently access liquid staking solutions that let them stake funds without losing their money's ability to be traded easily. The liquid staking protocols provide users with trading opportunities alongside lending services while generating additional yield even though normal staking requires funds to be immobilized.

The users who place liquidity through Lido, Rocket Pool and Frax obtain substantial advantages yet they need to actively understand smart contract vulnerabilities and potential penalties related to slashing and events leading to depegs.

According to industry predictions within the developing DeFi sector liquid staking will develop into the basic foundation for blockchain staking to enhance capital efficiency as well as expand market participant sizes. Users need to fully evaluate the risks associated with liquid staking services before deciding which platform to enter for participating.

Question 2: Opportunities in Real-World Asset Tokenization

Opportunities in Real-World Asset Tokenization in DeFi

The market received an automated financial system based on blockchain technology thanks to DeFi which established advanced and transparent platforms above traditional financial structures. Defi enables the most exceptional feature through its blockchain mechanism that creates digital tokens from physical property assets and financial instruments. Real-world asset tokenization within this TradFi and DeFi integration system gives investors access to novel financial possibilities together with enhanced ownership freedom and improved liquidity and equalized access to financial markets.

This paper studies DeFi network adaptation through RWA tokenization by analyzing platform elements while identifying both advantages and blockchain-based solution hurdles.

The complete operation framework of DeFi undergoes essential modifications because of RWA Tokenization.

Real-world asset tokenization structures create three fundamental changes in DeFi networks.

1. Enhancing Liquidity

The process to sell real estate properties alongside fine art items extends because intermediaries become involved leading to increased duration in the selling process.

DeFi gains increased liquidity through tokenization because it creates fractional part ownership that becomes tradeable components of assets.

2. Democratizing Investment Access

A conventional asset maintains its high value that traditional institutions along with wealthy private entities can neither obtain nor afford.

The tokenization approach helps retail investors transform big investments into smaller funds which opens opportunities for them to participate in ownership markets.

3. Increasing Transparency and Security

A permanent documentation system on blockchain technology together with complete auditing functions and anti-fraud controls makes tokenized assets more secure for investors to trust.

Since smart contracts eliminate the requirement for typical intermediaries they cause them to become obsolete and thus their service demand declines.

Image by Sergei Tokmakov, Esq. https://Terms.Law from Pixabay

4. Expanding Collateralization Options in DeFi

People prefer Bitcoin and Ethereum as the main investment assets on DeFi lending platforms because the platforms protect transactions with crypto assets.

Users request loans through platform tokenization services that unite their real estate and government bonds and invoices.

5. Bridging Traditional and Decentralized Finance

Traditional financial entities need to create relationships with DeFi projects to build new financial systems that integrate both traditional and DeFi characteristics.

Examples of Platforms Enabling RWA Tokenization

A wide range of blockchain platforms exist to execute digital tokenization operations that lead to real estate digitization. Important tokenization operations run their market activities today.

1. Centrifuge (CFG)

The Centrifuge platform provides corporate customers with an opportunity to produce digital proof for their invoices royalties and real estate properties through the platform interface.

DeFi lending protocols enhance organizational business value by enabling users to convert digital assets into lending creations so they can obtain decentralized funding beyond conventional banking structures.

Members of the Maker system can obtain funding through MakerDAO and Centrifuge integration while existing assets from RWA secure the transactions.

2. RealT

Through RealT users can buy property ownership through a process that includes tokenization of U.S. real estate followed by breaking down ownership into portions.

The stablecoin-based payment system lets users access decentralization in real estate deals through asset exchanges of real estate properties.

3. Maple Finance

Maple Finance runs its institutional loan operations through tokenization which functions as the foundation of its operations.

Maple Finance implements independent loan operations which let users acquire undercollateralized financing through their stand-alone operational systems.

4. Goldfinch

Makers of The Goldfinch authentication system make funding operations deliver secured-loan access to borrowers.

Developing market conditions allow the platform to thrive since traditional lenders do not meet the financing needs of future borrowers.

5. Ondo Finance

The Decentralized Finance section of Ondo Finance allows users to acquire stable financial instruments through their U.S. Treasury bill tokenization platform.

New DeFi technology development becomes possible through these platforms because of their standard financial protocol integration mechanism.

Benefits of Real-World Asset Tokenization

The completion of tokenization at the DeFi marketplace allows traditional market participants to access essential advantages that they need.

1. Improved Liquidity

Largely-owning asset investors gain benefits through tokenization because it distributes large properties into tradeable portions that allow each individual to deal with their part separately from the full asset value.

By using fast trade systems in the secondary market the network ensures its efficient operation as a market entity.

2. Lower Transaction Costs

Asset tokenization performs a complete removal of brokerage services and notary services in order to decrease both property deal expenses and property ownership verification costs.

3. Global Accessibility

Investors across nationalities realized they could share their capital due to elimination of regional barriers.

4. Increased Efficiency Through Smart Contracts

Automatic transaction procedures utilize features for compliance to process operations at a faster pace while cutting down time and errors in dividend payments and ownership changes.

5. New Opportunities for Yield Generation

DeFi protocols give investors access to generate extra income from handling tokenized assets by integrating asset management and borrowing features with yield farming and staking functions.

Challenges of RWA Tokenization in DeFi

Existing markets must tackle technical difficulties and ambiguous market situations in order to roll out tokenized real-world assets effectively across wide platforms.

1. Regulatory Uncertainty

Financial assets processed through tokenization become subject to regulatory uncertainties because states and financial regulators establish new frameworks which generate more complex situations for both operators and market investors within the sector.

The compliance burden faced by financial institutions grows substantial because different jurisdictions maintain independent AML and taxation provisions that affect them simultaneousl

2. Valuation and Price Discovery

Due to professional valuation activities applied to physical real-world assets the decentralized method of determining asset prices becomes complex.

3. Counterparty and Legal Risks

The core challenges to smart contracts in contemporary legal practice relate to ownership disputes and hide attributes of blockchain agreements which create complex issues.

4. Liquidity Constraints in Nascent Markets

Secondary market infrastructure that uses tokenization strategies produces restricted prospects for rapid market transactions among investors.

5. Integration with Traditional Financial Systems

Extensive blockchain-based DeFi solutions limit their expansion because financial institutions coupled with banks show no interest in adopting these platforms.

Real asset anchoring enables DeFi platforms to supply enhanced market liquidity features while creating opportunities for cross-border investments among financial platforms. The RWA tokenization system of Centrifuge RealT and Maple Finance allows their customers to obtain better returns through multiple forms of business value generation.

Mainstream adoption of RWA tokenization depends on regulatory improvements together with better price assessment frameworks under conditions of legal certainty standards. RWA tokenization drives financial system evolution because enhanced regulatory environments produce expanded asset accessibility along with inclusive financial markets worldwide.

Future years will evaluate the effectiveness of RWA tokenization as a DeFi system integration because digital tokenization represents the essential evolution of financial systems.

Question 3: Practical Applications of Liquid Staking in DeFi

Practical Applications of Liquid Staking in DeFi

DeFi serves as an ideal platform for the groundbreaking liquid staking technology through its liquid staking tokens (LSTs) which include stETH (staked ETH) and rETH (Rocket Pool ETH). Through liquid staking users gain access to staking rewards and do not need to lock up their assets since they can actively employ their LSTs across DeFi protocols.

This piece examines the integration of liquid staking features into yield farming alongside their utilization methods for DeFi protocols. The article presents a yield farming plan that incorporates stETH with a risk evaluation segment.

The operation of staking tools within DeFi networks functions as follows

Users can stake cryptocurrency like ETH with a staking provider which rewards them with liquid staking tokens. Users who participate in the process receive LST tokens that equal their staked assets and collect active rewards during the duration. The Lido Finance platform together with Rocket Pool and Coinbase issue the popular staking tokens for widespread use.

Electronic token stETH originates from Lido Finance as a stake-pegged derivative of Ethereum that accumulates staking benefits constantly.

Rocket Pool ETH provides residents with rETH tokens which present staked ETH as a decentralized offering to standard Lido services.

Users obtain cbETH through Coinbase as this token operates with identical properties as stETH and rETH.

The LST assets allow users to access DeFi applications for lending services and borrowing procedures as well as yield farming activities and liquidity provision possibilities.

Image by Sergei Tokmakov, Esq. https://Terms.Law from Pixabay

Incorporating Liquid Staking into Yield Farming

Strategy: Using stETH in Yield Farming on Curve and Aave

People use stETH through liquidity pools and lending protocols as an effective yield maximization approach.

Users can earn stETH by locking ETH on step one of this process.

Staking ETH can be accomplished through Lido Finance during this initial process. Users obtain 1:1 stETH when they participate in this process. StETH maintains its liquidity status and users can utilize it in Decentralized Finance operations.

Users provide liquidity to Curve Finance by deploying stETH during this step of the process.

As a DEX leader Curve Finance allows users to add liquidity to its stETH/ETH trading pool. Users can place their stETH and ETH into this pool for receiving trading fees and additional CRV incentives as well as improved returns.

Why Curve? Curve operates with stable asset trading so the ETH/stETH pair reveals minimal slippage during exchanges. Liquidity providers (LPs) receive stable trading fee returns because of the low slippage on Curve Finance pools.

At this stage users need to transfer their LP tokens to the Convex Finance platform.

Users obtain LP (Liquidity Provider) tokens from Curve after depositing liquidity into the platform which illustrates their distribution within the pool. Individuals can boost their Curve rewards through Convex Finance by depositing their LP tokens which accumulates all Curse incentives.

By managing CRV staking returns optimally Convex Finance makes yield farming more profitable for its users.

The Convex platform offers additional CVX (Convex's governance token) distributions in addition to rewards received from Curve.

Users can utilize the decentralized lending platform Aave to get borrowing power from stETH deposits during Step 4.

The stETH balance of users becomes eligible as collateral at Aave since it operates as a decentralized lending protocol. Through this method users can secure loans of stablecoins (USDC or DAI) from their stETH. Users apply borrowed stablecoins for further DeFi investment opportunities which helps them multiply their earnings.

Why Borrow? Users who borrow stablecoins with their stETH maintain Ethereum network exposure and obtain additional funding sources.

The deposited stablecoins from borrowed funds enable users to participate in yield farming protocols through stablecoin farms or different farming protocols that yield additional interest.

In Step 5 users should handle risks along with tracking yield performance.

The stETH balance increases with time due to the continuous rewards earned by liquid staking tokens. Users must actively check their loans on Aave because large borrowing amounts can result in liquidation when ETH prices decline below the spending threshold.

Potential Risks of This Strategy

There are multiple risks associated with the above yield generation plan while it promises substantial yield improvement.

1. Smart Contract Risk

The usage of multiple DeFi protocols which include Lido, Curve, Convex, Aave produces more entry points to potential bugs in smart contracts.

Loss of funds results from any bug or exploit that targets these protocols.

2. Impermanent Loss

Users face impermanent loss as a result of adding liquidity to the stETH/ETH pool on Curve. The increased price ratio of ETH to stETH may result in losses for LPs who withdraw their liquidity.

3. Liquidation Risk

Users take on liquidation risk that occurs when they obtain stablecoins through stETH borrowing on the Aave platform.

The price drop of ETH below a required threshold will force liquidators to sell stETH holdings because it leaves the collateral ratio insufficient.

Image by Sergei Tokmakov, Esq. https://Terms.Law from Pixabay

4. Depegging Risk

StETH tokens experience a 1:1 dollar value to ETH under normal conditions yet their exchange ratio versus ETH may fail during periods of market instability.

Users exchanging stETH into ETH will suffer financial loss when the token has a market value below its current price.

5. Regulatory Risks

The regulatory environment that shapes the operations of both liquid staking solutions and DeFi yield strategies continues to transform. The ability for users to engage with liquid staking providers such as Lido and DeFi lending protocols including Aave could get affected by upcoming regulatory alterations.

Users can now obtain staking benefits by using liquid staking solutions which let them keep their assets available in DeFi markets. Users who integrate stETH into protocols including Curve, Convex and Aave obtain the ability to maximize yield farming results by creating various revenue streams. These strategies come with several risks that users need to monitor including impermanent loss and liquidation as well as smart contract vulnerabilities.

People who want to achieve maximum DeFi income through liquid staking must learn how to handle risks and actively manage their portfolios despite the appealing nature of this method. Your investment success depends on independent asset analysis as well as responsible risk control through protecting your assets with protected collateral ratios plus investing in different DeFi platform options.

Question 4: Building a DeFi Strategy with Liquid Staking and RWAs

A DeFi strategy requires simultaneous deployment of liquid staking and RWAs during its development process.

The development of new methods to enhance yield returns and reduce risk defines the constant growth of the DeFi sector. The response integrates two fundamental DeFi capabilities by combining different aspects of liquid staking and real-world asset tokenization. Investors achieve balance in their DeFi portfolio through hybrid implementation of liquid staking and RWA tokens that generates high yields and adjusts to market changes.

This strategy focuses on:

- Investors can increase their earnings through capture of rewards from liquid staking and RWA-based financial appreciation opportunities.

- Risk reduction takes place when investors distribute their funds between fluctuating crypto assets as well as tokenized representations of actual world assets.

- The market delivers liquidity through both LST derivatives and RWA markets.

- The process of understanding both RWA Tokenization and Liquid Staking

Liquid Staking

Liquid staking lets people supply their ETH or DOT assets to proof-of-stake (PoS) charts for liquid staking token (LST) issuance. DeFi protocol users gain access to services by means of the liquid staking derivative tokens stETH and rETH from Lido and Rocket Pool while their stake assets remain in payout status.

Real-World Asset (RWA) Tokenization

Blockchain-based tokens emerge from the tokenization process that converts physical assets including real estate bonds or commodities using Real World Asset (RWA) tokenization. The network activates tokenization to create assets which enable DeFi platforms to trade them through this system.

Participation in peak yield output can be achieved by implementing strategic investment plans with minimum exposure to cryptocurrency market changes.

Image by StartupStockPhotos from Pixabay

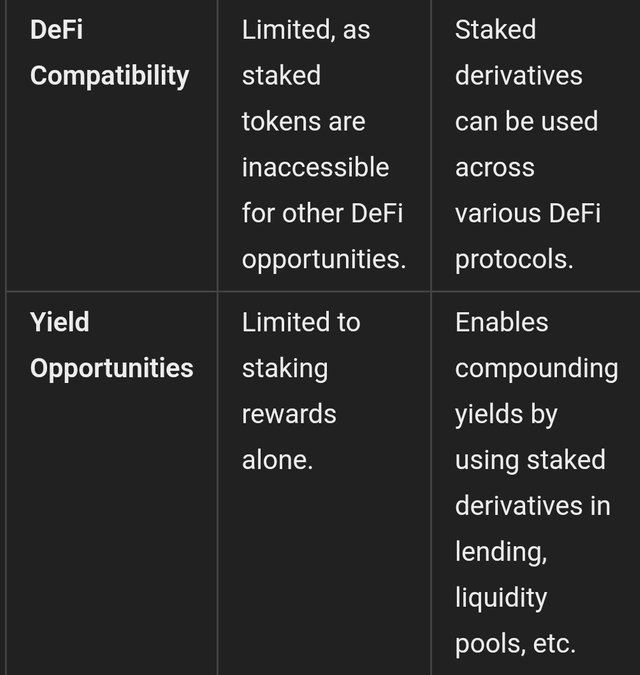

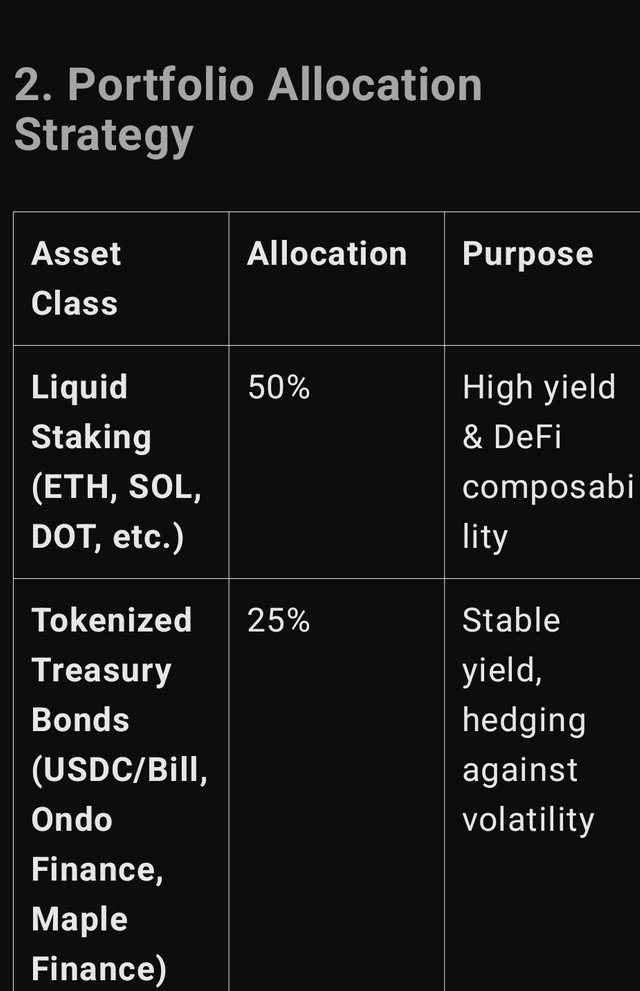

2. Portfolio Strategy: Balancing Liquid Staking and RWAs

Investors obtain robust decentralized finance returns together with solid real-world returns through distributing their funds between liquid staking derivatives and RWA-supported tokens.

Portfolio Allocation:

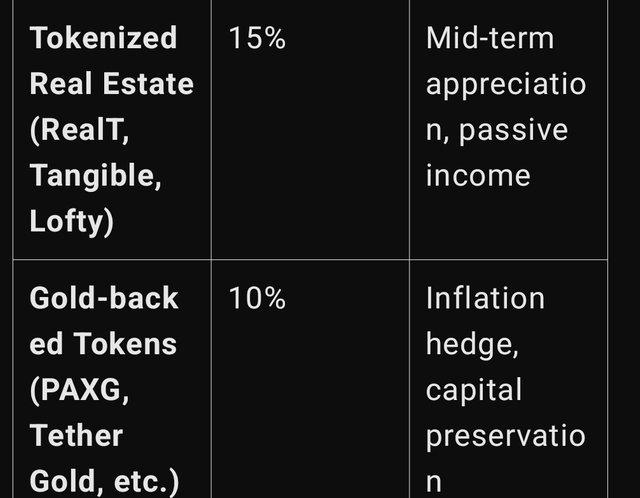

50% Liquid Staking (stETH, rETH, maticX)

The RWA Tokenization approach includes tokenized bonds that comprise 30% while real estate-backed tokens constitute another 30%.

10% Stablecoins for Liquidity (DAI, USDC)

10% DeFi Strategies (Lending, yield farming)

Through such distribution of assets between crypto reward growth and real-world value preservation and digital liquidity management investors can access integrated opportunities.

3. Optimizing Yield: How It Works

The path to base yield begins with liquid-staking vehicles that use stETH rETH and maticX as examples.

The liquid staking tokens can be obtained by users through their stake of Ethereum (ETH), Polygon (MATIC) and Polkadot (DOT) at Lido, Rocket Pool and Ankr.

A user acquires LSTs from liquid staking providers through which staking rewards generate monthly returns at a rate between 4-6%.

Users should place their acquired LSTs into DeFi applications for both lending functions and yield farming functions to earn an additional 2-4% in returns.

RWA Tokenization functions as the second passive income phase which belongs to Step 2.

Capital stakeholders should use Ondo Finance to obtain U.S. Treasury-backed tokens for achieving bond yield stability at 5-7% rates.

Investors receive rental income streams through the real estate tokens issued by Tangible and Lofty thus they should direct their funds into these platforms.

The strategy enables banking operations on tangible assets that offer regular earnings yet reduce risk exposure to cryptocurrency price fluctuations.

The liquidity of market timing opportunities comes from stablecoins investors use during Step 3.

The investment should maintain a 10% stablecoins proportion of USDC and DAI as a risk mitigation measure.

The funds allocated to stablecoin lending protocols on Aave and Compound enable maximum profit during market favorable conditions.

These funds will serve as a method for mitigating negative impacts from market volatility.

.Generation of supplementary yield potential happens through integrating DeFi solutions during the fourth phase.

Stablecoin DeFi loans become accessible through borrowing assets backed by RWA tokens or by utilizing LSTs followed by seeking alternative yield opportunities.

The available funds should either be placed into Curve stablecoin pools or deployed into RWA lending activities for obtaining constant yields.

This strategy will maximize investment returns while maintaining risk-free reward relationships.

4. Risk Management: Reducing Exposure

The risk management strategies remain crucial for investors who wish to maximize their revenues through this approach.

1. Smart Contract and Protocol Risks

To implement this approach one should select dull yet audit-trail proven RWA and liquid staking platforms which include Lido, Rocket Pool and Ondo Finance.

Your investment strategies should include multiple protocols because separate single-point failures will not harm your assets.

2. Market Volatility Risk

Market devaluation periods become opportune moments to acquire assets through the utilization of stablecoin reserves.

Optimum management of LSTs or RWA tokens must be practiced to prevent the chance of liquidation events.

3. Regulatory Risks

The deployment of official regulations forces RWA investors toward compliant platform solutions which defend their investment rights.

Investors should spread their assets across multiple real-world asset types such as bonds and real estate and commodities while doing so they will lower their exposure to regulatory changes.

Image by Pexels from Pixabay

5. Adapting to Market Conditions

This risk management plan gets its adaptability from market trends which affect different market conditions.

A bull market calls for investors to increase their DeFi strategy investments that use liquid staking as rising capital flows boost yield returns from cryptocurrency assets.

During the downside market investors need to move their savings toward bonds as well as use stablecoins for minimizing risk exposure.

The sideways market calls for investors to adopt passive yield methods that consist of stakeholders and RWAs together with lending practices.

By strategically shifting between crypto and RWA asset classes investors protect their capital while achieving their highest possible return on investment.

6.Why This Strategy Works

By integrating RWA tokenization into liquid staking protocols it forms a strong investment method within DeFi that offers these benefits:

Users can achieve their highest profits by uniting liquid staking benefits with RWA investment sources.

✔ Reduces Risk: Diversification between crypto and real-world assets.

Users can keep running DeFi protocols with stable assets through the fusion of LSTs and RWAs.

The system adjusts its investments to different market states for better performance.

When investors strategically implement these components at once their crypto market volatility decreases and profitable returns become sustainable for long-term DeFi participation.

Question 5: Lessons from Real-Life DeFi Innovations

Lessons from Real-Life DeFi Innovations: The Impact of Liquid Staking and RWA Integration on a Trader’s Success

Through decentralized Finance (DeFi) the financial world now offers liquid staking services and real-world asset (RWA) integration methods to connect traders better to blockchain-based financial items. The market introductions have achieved higher capital operating efficiency yet the creators must handle unpredictable risks. The research analyzes a verified transaction between liquid staking and RWA integration that showed positive results for a trader who shared valuable information useful for new investors.

Case Study 1: The Success Story of Liquid Staking in a Bull Market

James started using liquid staking during early stages of Ethereum blockchain as part of his cryptocurrency trading practices. ETH holders offer their assets for stake and obtain derivative tokens from Lido (stETH) or Rocket Pool (rETH) that enable utilization of DeFi protocols. Staking reward collection operates more flexibly through this specific design of the system.

The Strategy

1. Initial Staking Decision

In the initial months of 2023 James participated in Lido Finance to lock his 50 ETH which returned 50 stETH to him.

The integration of Ethereum staking contract protection did not stop James from using or trading his stETH derivative token in DeFi protocols.

2. Using stETH in DeFi

James started a DeFi lending account at Aave by depositing his stETH from Lido Finance.

A stETH borrowing deal from Lido Finance granted him 30 ETH which gave him extended investment capabilities in Ethereum.

3. Reinvesting for Leverage

Through staking this acquired ETH he was able to obtain stETH while taking another ETH loan on staking.

Repeating the staking process helped the investor obtain increased staking rewards in addition to maximum DeFi yield.

4. Market Movement and Profit

ETH prices surged from $1,500 to $3,000 in six months because the merging of Ethereum-established financial institution adoption and the associated positive market sentiment.

The strategy yielded James a worthwhile result that incorporated enhanced stETH values accompanied by growing borrowed ETH worth alongside supplementary staking bonuses and DeFi yield gains.

Outcome & Key Takeaways

Success Factors:

Liquid staking enabled James to optimize asset capital utilization which awarded him DeFi benefits together with staking profits from his digital resources.

The changing market environment made leveraged staking more lucrative through the market boom that boosted investor earnings.

Lessons for Future Investors:

Investors need to utilize leverage when markets rise since bear market occasions significantly boost the chance of forced asset selling.

The stETH measurement against its peg faced devaluation events in critical periods which made it riskier to use as loan security.

People need to consider the risks of depending on staking tools because protocol failures will produce severe consequences.

Case Study 2: The RWA Collapse and a Trader’s Failure

Background

The commitment of Sarah to DeFi became obvious when she focused on Real-World Asset integration since this technology implements smart contracts on blockchain for real estate bonds and commodities. RWA tokens provided institutional-minded defi investors maximum stability in contrast to regular crypto assets while enabling financial strategies for loan investments.

The Strategy

1. Investing in Tokenized Bonds

At the beginning of 2024 Sarah invested her $50,000 USDC funds into a DeFi provides tokenized U.S. Treasury bonds that offered an annual return of 8%.

All US regulatory requirements together with legal asset backing mechanisms were implemented by the platform.

2. Using RWA Tokens as Collateral

Because she needed higher investment returns Sarah accessed MakerDAO borrow functionality to get DAI stablecoins by depositing her bond-originated tokens as collateral.

She bought more tokenized bonds with the borrowed funds and performed yield farming through leverage.

3. Regulatory Crackdown & Market Panic

Unregistered security products from DeFi protocols received enforcement from the U.S. SEC during the second part of 2024 causing significant harm to tokenized RWA protocols.

An absence of verification about bond ownership by the real-world bond custodian caused a crisis across the RWA-backed DeFi market.

When RWAs depreciated by 50% and surpassed their minimum safety level the amount of collateral Sarah held dropped below necessary maintenance requirements.

Image by Roy Buri from Pixabay

4. Liquidation & Losses

Sophie's positions went into liquidation by MakerDAO to recoup monetary debts leading to a loss of 80% of her initial capital.

Thankfully the legal crisis blocking withdrawals made her unable to access remaining RWA tokens.

Outcome & Key Takeaways

Failure Factors:

Unpredictable risks developed for Sarah because she invested more capital than safe limits allowed through non-regulated RWAs.

Between the time when poor transparency allowed for asset destruction and regulator intervention to take control of the situation passed.

The unstable financial infrastructure resulted from uniting DeFi smart contract weaknesses with unknown legal off-chain elements.

Lessons for Future Investors:

RWAs operate under established legal constructs while they remain exposed to unpredicted policy shifts that happen within these systems.

When performing diligence checks for asset ownership it becomes necessary for expert traders to verify possession together with legal rights of real asset owners.

The leverage of Real World Assets depends on counterparty groups whereas crypto-native assets do not need such groups to collapse because of defaults or mandatory legal actions.

Comparative Analysis: Liquid Staking vs. RWA Integration

The last part establishes vital aspects which need consideration for investing in future marketplaces.

1. Risk Management is Critical

The process of managing liquidation risks remains essential for all those intending to participate in various decentralized finance opportunities.

Large financial losses result from excessive leverage use during liquid staking operations and RWA business activities.

2. Regulatory Awareness is Essential

Every RWA needs to follow standard world regulations because the real-world laws protect their long-term operational stability.

People who want the best legal protection in their investments must divide their funds between crypto-based assets as well as real-world investments.

3. Technology vs. TradFi: Finding a Balance

Liquid staking innovations offer efficiency improvements to crypto-native investments with proper user handling needed for optimal usage of these benefits.

Prior to investing in RWAs regents must verify that both DeFi and TradFi functions together alongside transparent asset management.

Liquid staking and RWA integration offer promising opportunities to investors although each model creates defined risks for capital holders. Market condition analysis together with risk assessment help traders decide how to regulate their return levels based on their investment risks.

i would like to invite @josepha @beautiful12 @pelon53 to take part in this contest

https://twitter.com/shabbir_saghar/status/1898414285232943121?t=SvkZM4SHLCHpZIngmdOtAA&s=19