SBD and Stablecoins: Challenges, Opportunities, and the Future

|

|---|

Welcome to class once again. Our discussing this week is on SBD and Stablecoins and what the stands for, their functions and challenges in the crypto space.

Most users of Steemit like me and you might have come across SBD in our rewards and wallets, but then as the seasoned users may know what it stands for, we can't say the same for some other users, is it not? There are some users who may not have even the slightest idea of what SBD is, hence stay glued to this lesson to broaden your mind on it. I hope you get to learn something new too.

Understanding the Role of SBD as a Stablecoin |

|---|

Steem Blockchain Dollar (SBD) is a digital currency just like the Steem we use on the Steem blockchain. But then, it is not just seen as the Steem we are often familiar with. If we are paying closer attention as we use this platform, we notice the presence of SBD when Steem hits a certain price range is it not? Exactly, so why is it like that? Well we can see the answer to that in the screenshot below from the Steem white paper.

|

|---|

From the above screenshot, we can read that SBD was created to bring about stability in the Steem ecosystem. Stability is like having a solid ground to stand on and in the world of money and economies, stability means that people can trust that their money will hold its value over time. So, if there is stability, it is easier for people to buy things and save money without worrying that their money will suddenly lose value.

Steem Dollars (SBD) therefore are a type of digital money created to bring that stability to the world of cryptocurrencies. Think of Steem Dollars (SBD) as a way for people using the Steem network to have a reliable currency, just like how we use Dollars or Naira or any other currency in our everyday life.

Now, how do Steem Dollars (SBD) work? Well they are created using a system similar to something called convertible notes, which are used in the startup world. A convertible note is like a loan that can be turned into ownership of a company later on. So, if you lend money to a startup, instead of getting paid back in cash, you can choose to own a part of the company later.

|

|---|

Hence, when you hold Steem Dollars (SBD), it is likened to you having a piece of the Steem community and the value of SBD is connected to how well the Steem network is doing. And to keep the value of SBD stable, the system relies on something called a price feed, which is a way of keeping track of how much SBD is worth by comparing it to other currencies and for this to work well, the system has to consider:

Minimizing Incorrect Feeds:

This has to do with eliminating or reducing errors in price because if the price feed gives wrong information about the worth of SBD, it can cause problems. Hence, the system tries its best to make sure that mistakes in the price feed don’t affect the value too much.

Maximizing the Cost of Incorrect Feeds:

That is, it should be costly or hard for anyone to feed incorrect prices in order to discourage such behavior. Therefore when someone tries to manipulate the price feed to make SBD to look more valuable than it really is, they have to spend a fortune.

Minimizing the Importance of Timing:

This means that the timing of when the price information is updated shouldn’t be super critical. I.e., even if there is a slight delay in getting the latest price, it should not cause big swings in how much SBD is worth.

Rules to Prevent Abuse:

Guidelines are in place to make sure that the system is fair to all and that people cannot also take advantage of it.

Therefore, by focusing on these factors, Steem Dollars (SBD) aim to provide a more stable and trustworthy currency for people who use the Steem network, helping individuals feel more secure when they trade or save their money.

|

|---|

So then, how does SBD function as a stablecoin within the Steem Ecosystem? Well, SBD functions as a stablecoin within the Steem ecosystem in the following ways:

Pegged Value:

SBD is designed to maintain a value close to one US dollar, which means that when you have SBD, you can expect it to be worth about the same as a dollar, which helps users feel more secure when they earn and spend it.

Earning through Engagement:

Users earn SBD by creating and curating content on the STEEM platform. When a user posts something that others enjoy, they can receive upvotes, and those upvotes can translate into SBD, creating a direct link between the quality of content and the rewards users receive, encouraging more participation.

Market Mechanism:

The Steem blockchain has a built-in mechanism that helps keep the value of SBD stable. If the value of SBD starts to drop below one dollar, users can convert their Steem into SBD, which can help increase demand and push the price back up. This balancing act helps maintain its peg to the dollar.

Trading and Liquidity:

SBD can be traded on various cryptocurrency exchanges. Therefore, if users want to cash out their SBD, they can exchange it for other cryptocurrencies or even cash. This liquidity makes it easier for users to use their SBD in the real world, further enhancing its role as a stablecoin.

Usage in the Ecosystem:

Within the STEEM ecosystem, SBD can be used for tipping other users, purchasing services, or even saving for future use. Hence, this versatility allows users to engage with the platform more freely, knowing they have a stable currency to rely on.

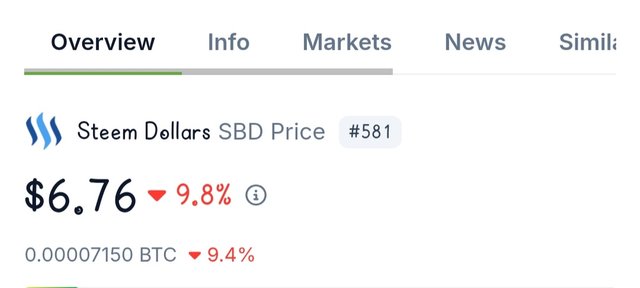

Now, if Steem Dollars (SBD) is supposed to be a stablecoin pegged to the US Dollar, how come about the difference in value as we can see SBD is either higher or lower in value to the US Dollar like right now, SBD is equal to 6.76 US Dollars as at this time of this post.

|

|---|

Well, as much as Steem Dollars (SBD) is designed to be pegged to the US dollar which means it aim is to maintain a value close to $1. However, there are a few reasons why SBD might trade higher or lower than the USD, which are;

Market Demand and Supply:

Just like any other currency or asset, the price of SBD can fluctuate based on how many people want to buy or sell it. If more people want to buy SBD than sell it, the price can go above $1. While, if more people want to sell it than buy it, the price can drop below $1.

Liquidity:

The ease with which SBD can be bought or sold affects its price. If there aren’t many buyers or sellers in the market, it can lead to larger price swings. Low liquidity can cause SBD to deviate from its peg.

Market Sentiment:

The overall sentiment about the Steem platform and cryptocurrency markets can influence SBD's price. If people are optimistic about Steem, they might be willing to pay more for SBD, pushing its price up.

External Factors:

Events in the broader cryptocurrency market or changes in regulations can also impact SBD's price. For example, if there’s a surge in interest in cryptocurrencies, it might drive up the price of SBD.

Arbitrage Opportunities:

Traders might buy SBD at a lower price on one exchange and sell it at a higher price on another. This can create temporary price differences between exchanges, causing SBD to fluctuate above or below its intended peg.

Now that we have come to know what SBD is all about and its functions on the Steem ecosystem, can we discuss its benefits and limitations in comparison to other stablecoins like USDT or DAI?

As much as SBD is considered a stablecoin, certain characteristics set it apart from other stablecoins, such as;

It's Backing:

Many stablecoins, like USDT or USDC, are backed by actual reserves of US dollars or other assets held in a bank. SBD, on the other hand, is tied to the Steem blockchain and its ecosystem, which means its value is more dependent on the platform's performance and user activity rather than direct dollar reserves.

Use Case:

SBD is primarily used within the Steem platform, which is focused on content creation and social media. Other stablecoins are often used for trading, payments, or as a safe haven during market volatility across various platforms and exchanges.

Price Stability Mechanism:

Stablecoins usually have mechanisms in place to maintain their peg to the dollar, like automated trading strategies or collateralization. SBD relies more on market dynamics and user demand within the Steem community, which can lead to fluctuations in its value.

Therefore, when comparing SBD to other stablecoins like USDT or DAI, there are certain benefits and limitations to consider. Such as;

Benefits of SBD

Decentralized Earning:

SBD is earned through participation in the STEEM platform. This means users can generate income by creating content or curating others' work, which is different from USDT or DAI that usually require buying or trading.

Built-in Stability Mechanism:

SBD has a mechanism that helps keep its value stable by allowing users to convert Steem into SBD. This helps maintain its peg to the dollar without relying on external reserves.

Community Engagement:

Using SBD encourages community participation as users are rewarded for their contributions, fostering a more engaged and active user base on the Steem platform.

Limitations of SBD

Less Liquidity:

Compared to USDT and DAI, SBD may not be as widely accepted on different exchanges or platforms. This can make it harder for users to cash out or use SBD in various transactions.

Price Volatility:

While SBD aims to maintain a value close to one dollar, it can still experience fluctuations, especially if there are changes in the demand for STEEM or the overall market. USDT and DAI often have more established mechanisms to maintain their value.

Limited Use Cases:

SBD is primarily used within the STEEM ecosystem. In contrast, USDT and DAI can be used across a wider range of platforms and services, making them more versatile for users looking to transact in different environments.

Addressing SBD’s Stability Challenges |

|---|

From the above section I have earlier mentioned how SBD being originally created as stablecoin differs from other stablecoins we know, therefore we can also these are challenges it faces in maintaining its stability. Such as;

Market Demand Fluctuations:

The value of SBD can change based on how much people want to use or trade it. If fewer people are interested in the STEEM platform, the demand for SBD may drop, causing its price to fall.

Dependence on STEEM Value:

SBD is linked to the value of STEEM. Therefore, if Steem's price goes down, it can affect SBD's stability because people may convert their Steem to SBD, but if Steem is losing value, it can create uncertainty for SBD's price.

This hence explains why when Steem price is down to a certain level, we don't get to earn SBD on our contents until Steem price resurfaces to a certain level often around the $ 0.26-0.28 per Steem mark.

Limited Adoption:

SBD is not as widely accepted as other stablecoins like USDT or DAI, that means fewer places to use it, which can lead to lower demand and make it harder to maintain a stable value.

Conversion Mechanism Pressure:

The way SBD can be converted back to STEEM creates pressure on its price. If many people are converting SBD back to STEEM at once, it can lead to a drop in SBD's value.

External Market Conditions:

Changes in the overall cryptocurrency market, like sudden price drops or regulatory news, can impact SBD's stability. If the market is volatile, it can create uncertainty for all cryptocurrencies, including SBD.

These challenges make it difficult for SBD to consistently maintain its value.

Now, that we have known the challenges SBD faces to be a stablecoin, what do you think can be done for it to attain that stability? Well, to strengthen the peg of SBD and ensure reliability in volatile markets, here is my proposal.

Increase Adoption:

Encouraging more platforms and businesses to accept SBD can help increase its demand. The more people use it, the more stable its value can become.

Improved Communication:

Keeping the community informed about changes and updates on the Steem platform can build trust. If users understand how SBD works and its value, they may be more likely to hold onto it during tough times.

Liquidity Reserves:

Creating a reserve of SBD that can be used to buy back tokens in times of price drops can help stabilize its value. This would act like a safety net during market fluctuations.

Dynamic Conversion Rates:

Adjusting the conversion rates between Steem and SBD based on market conditions can help maintain stability. This means that if SBD's price drops too low, the conversion could be adjusted to encourage people to hold onto it.

Community Incentives:

Offering rewards for holding SBD instead of trading it can encourage users to keep their tokens, which can help reduce volatility. This could be in the form of interest or bonuses for long-term holders.

Therefore, by implementing these strategies, SBD can work towards maintaining its value more reliably, even when the market gets shaky.

Expanding SBD’s Utility |

|---|

To expand or increase SBD's utility beyond the just Steem ecosystem, I would suggest the following to increase its useability and functions.

Integration into DeFi Protocols:

SBD could be used as collateral in decentralized finance (DeFi) platforms. Which means that people could borrow or lend SBD, earning interest or getting loans without needing a bank. This would definitely make SBD more useful and valuable in the DeFi space.

E-commerce Platforms:

Partnering with online stores to allow customers to pay with SBD can increase its usage, just as sir ubongudot does with his Steem electrical shop. Therefore, if more people can buy products using SBD, it will encourage others to hold and use it, which in turn will boost its value.

Cross-Border Payments:

SBD can be promoted as a way to send money internationally. It could be used for remittances, allowing people to transfer money to family or friends in different countries quickly and with lower fees than traditional methods just as they use the USDT today.

Payment for Services:

Encouraging freelancers and service providers to accept SBD as payment can also increase its utility. This could include anything from graphic design to writing services, making SBD a go-to option for online transactions.

Rewards and Loyalty Programs:

Businesses could create loyalty programs where customers earn SBD for purchases. This would not only encourage spending but also introduce more people to using SBD.

By exploring these options, SBD can become more integrated into everyday life, increasing its value and stability.

Adapting to Exchange Suspension of deposits |

|---|

To adapt to actions taken by centralized exchanges like Upbit, here are some strategies that can be beneficial;

Emphasizing Decentralized Exchanges (DEXs):

Decentralized exchanges allow users to trade directly with one another without a central authority. This means that even if a centralized exchange imposes restrictions or changes its policies, users can still trade freely on DEXs. Therefore promoting the use of DEXs can help maintain liquidity and trading volume for SBD.

Peer-to-Peer Trading:

This method allows individuals to trade directly with each other, often through platforms that facilitate these transactions. Hence, by encouraging peer-to-peer trading, users can bypass centralized exchanges entirely and this can be done by creating user-friendly platforms that connect buyers and sellers, making transactions easier and more secure.

Community-Driven Liquidity Pools:

These are collections of funds provided by community members that help facilitate trading. By creating liquidity pools specifically for SBD, users can contribute their tokens to help others trade. In return, they might earn rewards, creating an incentive for community members to participate. This builds a stronger ecosystem around SBD and can help stabilize its price.

Education and Awareness:

It's essential to educate the community about the benefits of using decentralized options and peer-to-peer trading. Providing clear information on how to use these platforms can empower users to make informed decisions and reduce reliance on centralized exchanges.

Building Partnerships:

Collaborating with other projects, platforms, or communities can enhance the visibility and usability of SBD. By integrating SBD into various applications and services, it can gain attraction outside of centralized exchanges.

By focusing on these strategies, SBD can create a more resilient trading environment that is less affected by the actions of centralized exchanges and this approach not only fosters independence but also strengthens the overall community around SBD.

Future Prospects for SBD |

|---|

In an ever volatile environment like the crypto world, the future of any crypto is tired around adapting the changes, therefore the future of Steem Dollar (SBD) in such a. environment solely depends on how well the Steem community adapts to these changes. Such as;

Adapting to Market Needs:

The Steem community should focus on understanding what the users want and align SBD with the needs of the community, so that it can remain relevant and appealing.

Enhancing Usability:

For SBD to grow in relevance, it should be easy to use in everyday transactions. This means integrating SBD into various platforms, apps, and services where users can spend or trade it easily, as the more accessible it is, the more likely people will adopt and use it.

Building Strong Partnerships:

Collaborating with other crypto projects and businesses can also help increase the visibility and utility of the SBD. Hence, by forming alliances that will allow SBD to be accepted in more places can attract new users and create a bigger ecosystem.

Fostering Community Engagement:

There is strength in numbers, they say. Therefore the strength of the Steem community is very important. Hence we should be encouraging active participation, rewarding contributions, and promoting a sense of belonging among the users to help maintain user loyalty. Having in mind that a strong community can advocate for SBD and help it thrive.

Innovating and Evolving:

The crypto world is constantly changing, so the Steem community should be open to innovation. This could mean exploring new features, improving security, or enhancing the overall user experience.

Education and Awareness:

Many potential users may not understand what SBD is all about or how it works. Therefore, the community can take it upon themselves to educating people about the benefits of SBD and how it differs from other stablecoins.

DISCLAIMER: Everything on this publication is not in any way a trading advice but just a piece of my understanding for learning purposes.

I wish to invite @bossj23, @ngoenyi, and @ruthjoe.

Thank You for your Time

NOTE: Always have a smile on your face, as you are never fully dressed without one.

Well explain and accurate, does this mean that users who have SBD in their Steemit wallet also earn interest has you described that SBD is in form of loan

If you read between the lines and the screenshot shared, you will know that it was use to draw comparison between Steem Dollars (SBD) and convertible notes.

That is to say, just like convertible notes provide a way for investors to hold a debt that can later be converted into equity, SBD allows users to hold a currency that can later be converted into Steem or other assets within the Steemit ecosystem.

This mechanism is therefore designed to encourage participation in the community while providing a stable asset that can be used for transactions.

By allowing SBD to be convertible, it helps to enhance the network effect of the Steemit platform, with the hope of attracting more users and creating more value for those who hold the tokens.

Therefore, SBD itself does not earn you interest like a traditional savings account, instead it can be used to trade, invest, or convert into other currencies, including Steem or fiat currency.

When you hold SBD, you only get to benefit from price appreciation if the value of SBD increases over time. The idea of SBD being in the form of a loan comes from its mechanism of being a stablecoin, pegged to the value of one U.S. dollar. This means that while you hold SBD, you are essentially holding an asset that can be exchanged for a stable value, but it does not generate interest or rewards by simply holding it.

Thanks for this clarification it help me to understand more about how SBD work.

You're very much welcomed.