Crypto Academy Season 4 | Intermediate Level Course for Week 6 : [In-depth Study of Market Maker Concept] by @reddileep

Cover Image Created by Adobe PS

Hello Steemians!

Now we are in the sixth week of Season 4 and I think you all have gained a good knowledge of the crypto world through Steemit CryptoAcademy lessons. So, as usual, today I have brought another very interesting lesson which is about the Market Maker Concept.

In fact, many people think that the market is randomly increasing and decreasing. But a closer look at the market reveals that it is no coincidence that there is a party to shake up the market. We call them Market Makers. So let's go straight to the lesson.

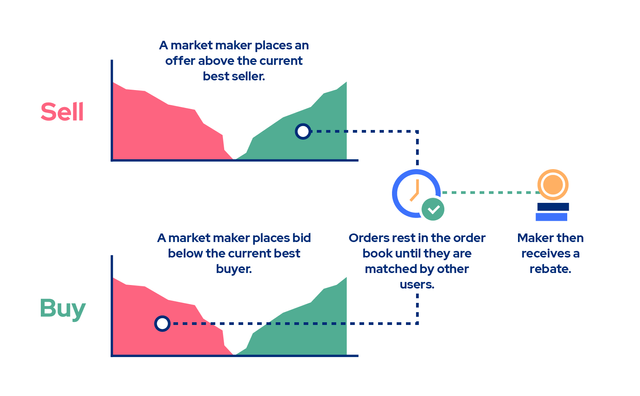

In order to have value for the assets in the cryptocurrency market, there must be people to buy them and people to sell them. So, there is a party here in the market who artificially implements this process. They can be defined as Market Makers. They provide liquidity to the market using their own buy and sell orders. We know that the market system is always shaped in such a way that the money of small traders is drawn to the big traders. So as normal crypto traders it is very easy to make a profit if we can identify their process properly and on time. This is what we call chart analysis in everyday life. I will explain this further in the next subtopics.As I described earlier, many people think that the market is moving randomly for buy and sell orders. In fact, this is due to buy and sell orders but there are separate people in the market to carry out these orders according to their own decisions.

As an example, if a market maker creates a Buy order at 1000$, then again he makes a sell order himself at a slightly higher price. So, in this case, there is a Buy order for 1000$ and a Sell order for 1005$. Now, other traders try to create buy or sell orders between these prices. It means the market maker has provided liquidity to the market using his own major buy and sell orders.

Image Source

In addition to the explanation above, there is another party that has a significant share of the market segment. In most cases, they act as a market manipulator. In the crypto trading field, we call it whale manipulation. Sometimes, they try to fall down the market inducing higher selling liquidity and again buy coins from the dip of the market. They can also be referred to as a group that contributes to the Market Maker concept and they are very dangerous than general liquidity providers. Because they are always trying to extort money from small traders like us. That's why we need to do a better analysis to enter the market at the right time.

It often supports keeping the liquidity of the market. It means they directly contribute to maintaining the value of a new coin by providing Huge Bids and Ask prices.

It can keep the price higher level of any coin. As an example, if the current value of a coin is 5$, market makers can Bring the price to 10$ by providing a 10.05$ Ask price and 10$ Bid price at the same time.

As Market makers can bring the value of a price at a higher level, other market investors can be increased. It means this method can increase the number of participants in a coin.

If we can identify the exact time when the market maker is active, we can make huge profits with quick market entry and exit.

In the crypto world, many market makers are not regulated. It means that they are providing artificial liquidity to the market only for a very short time.

If the market makers' system is not properly identified, all the investments of small traders can fall into the hands of market makers. Such activities are most common in leverage trading.

Market makers' misconduct can bring the value of a coin to a very low level. That is, when they provide a large sell order and small traders are afraid and respond quickly, then they buy the coin again at a very lower price.

There are several indicators that we use in the Market Maker Concept. Below I've included some of them.

Moving Averages

Pivot Points

TDI Indicator

Actually here we are using indicators not to trade. As an example, the Moving Averages we take only to identify the direction of the price movement. They are not used as a trading setup even if they are crossed like traditional trading. I will explain more about this in the next subtopic.

Actually Moving Averages has a reason to be used more in this Market Maker Concept. We already know, Moving Averages are often used to do any kind of chart analysis. So Market Makers are well aware that retail traders are trading with these Moving Averages. That is why they are unnecessarily manipulating the market to extort money from retail traders in these moving averages.

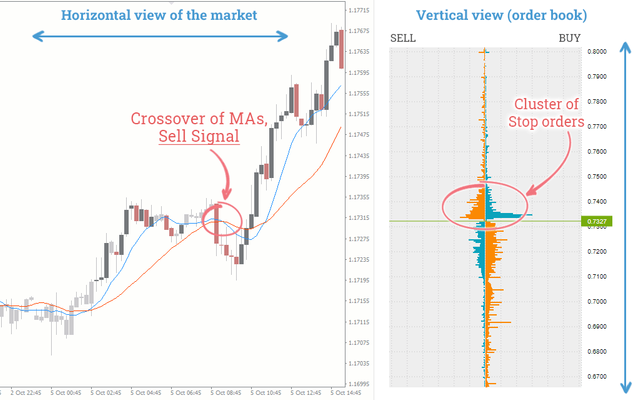

Furthermore, Retail Traders often use charts to analyze the market. But Market Makers don't depend only on the charts. They consider both charts and order books. Although we can explore order books to some extent, a Market Maker can explore a large order book. In fact, it can be said that they have some connection with the exchange.

As I described earlier, Market Makers try to produce fake signals through Moving Averages. Actually, They can't directly control the market as they desired. But they can push the market up to a certain level.

Image Source

From the above-attached image, we can identify such a situation clearly. At this time, Market Maker wanted to produce selling liquidity in the market. Therefore, he has produced selling liquidity by pushing the market downward until MAs cross each other. Then, other retails sellers think of it as a signal of a big downtrend Market and they tend to sell their coins. Now, Market Maker has good selling liquidity and he tends to buy all the coins through this large selling pressure. This is basically happening in the market and the market is structured in such a way that the money of the small traders is drawn to the big traders.

In my lesson, I have described only a summary of these topics and you should do better research and answer all the following questions in your own words. You are totally free to use any language. But when you mention something in the screenshots, you must use only English.

1- Define the concept of Market Making in your own words.

2- Explain the psychology behind Market Maker. (Screenshot Required)

3- Explain the benefits of Market Maker Concept?

4- Explain the disadvantages of Market Maker Concept?

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

You must submit your Homework Posts in the Steemit Crypto Academy community.

You have to include all the details in your own words without including someone's words in your content. The concept can be the same but your content should be unique.

You must include at least 800 words in your homework posts.

Plagiarism is strictly prohibited in the whole Steemit platform and you will not receive any privileges.

All the screenshots and images should be fully referenced and the referenced images should be copyright-free. And also, include your user name as a watermark in every screenshot.

You should use tags #reddileep-s4week6 #cryptoacademy and your country tag among the first five tags. Furthermore, you can include relevant tags such as #market-maker, #crypto-manipulation, #moving-averages.

Your homework Title should be

[In-depth Study of Market Maker Concept]-Steemit Crypto Academy | S4W6 | Homework Post for @reddileepHomework task will run from Sunday 00:00 October 10th to Saturday 11:59 pm October 16th UTC Time.

If you have a reputation of 60 or above, and a minimum SP of 400, then you are eligible to partake in this Task. (You must not be powering it down and your effective SP should not be delegated-in SP). And also, if you have used any buying vote services to build your reputation, you will not be eligible to partake in this Task.

If you didn't receive the score for your homework post within 48 hours, you can put the link in the comment section. Otherwise, don't leave your post link here.

If you have any queries related to my lesson, you are totally free to ask anything in the comment section.

Cc:

My professor @reddileep my home have not being checked, below is the link, thank you.

https://steemit.com/hive-108451/@kingworldline/in-depth-study-of-market-maker-concept-steemit-crypto-academy-or-s4w6-or-homework-post-for-reddileep

Hello, please my homework task has not been graded

https://steemit.com/hive-108451/@charis20/in-depth-study-of-market-maker-concept-steemit-crypto-academy-or-s4w6-or-homework-post-for-reddileep

Thank You

Don't worry mate. I will review it soon.

Ok, thank you so much

Will try to complete my homework soon sir !

Thank you mate. Hope to see your submission.

Very nice topic and very good questions. Will definitely participate

Thank you mate. Hope to see your submission.

Excelente clase profesor! Buenas tardes

Podria explicar nuevamente esta pregunta? Tengo que realizar algo movimiento financiero con una cuenta demo para realizar esta satisfactoriamente esta pregunta?

You don't need to do any demo trading here. You can explain it using two indicators through charts.

I think this is really good topics and explanations professor, I will take part in this task. But professor, I still confused with question number 2, do you mean market psychology like Euphoria?

Do not be afraid of those words, my friend. Just do better research on those topics and explain at length what market markers are doing.

I want to do my best because this is my first participation in your class and homework.

https://steemit.com/hive-172186/@ranashumiaz/or-or-achievement-2-or-or-task-or-or-basic-security-or-or-by-ranashumiaz-or-or

Sir verify my achievement

Hey professor @reddileep, nice lecture but I have a query.

What is expected of us to do in this question as I didnt get this question properly and I am unable to find order book of a certain time or at the time of a false signal.

Please, if you may help!

Hi @sarveshnegi2811,

It's very simple, as an example, in my lesson, I've taken MAs and explored them through charts. In that way, show special cases in the chart that show the behaviour of Market Makers. Contact me for anything else.

Thanks

The thing is I'm unable to find order book for past false signals, is there any way I can put order book in conjunction with the price chart.

Here you don't need to show past false signals through order books. In the other hand, it's difficult to find false signals through order books as many exchanges don't provide adequate information on their exchange order book for retail traders. You can show it through charts in conjunction with different indicators such as MAs, TDI and Pivot Points.

Ok thank you professor, I wish you convenience in your work!

You are most welcome

Hello professor here is my home work

https://steemit.com/hive-108451/@mustafaasif/in-depth-study-of-market-maker-concept-steemit-crypto-academy-or-s4w6-or-homework-post-for-reddileep

My entry

https://steemit.com/hive-108451/@josantos/in-depth-study-of-market-maker-concept-steemit-crypto-academy-or-s4w6-or-homework-post-for-reddileep