Crypto Academy Season 4 | Intermediate Level Course for Week 4 : [Cryptocurrency Triangular Arbitrage] by @reddileep

Cover Image Created by Adobe PS

Hello Steemians!

Today I've taken an interesting lesson related to Cryptocurrency Trading. Most professional traders are very adept at this method and the general traders unknowingly engage in this method. We call this method Triangular Arbitrage Trading. So let's go straight to the lesson.

We already know the meaning of Arbitrage in real life. Same as that, Arbitrage trading is something like dealing with two or more markets in an effective manner. Actually, here we have to circulate our assets between selected markets gaining simple profits from each market. However, during these transactions, we can generate profit without much more risk. These transactions can take place between different exchanges or between different coins. It means in Arbitrage Trading, a trader can buy coins from an exchange and sell it through another different exchange. Here he can sell the coins he got from one exchange at a higher price in another exchange. Furthermore, he can circulate his assets between different coins then back to original coins with profits. I will explain this further in the next subtopics.We can see a lot of types of Arbitrage Strategies are present in Trading. Sometimes, the same method is also defined as another name. So, when you do research on these topics you will be able to see many different types. However, here I've explained main two different types of Arbitrage trading in my view.

This is a very famous Arbitrage Trading Strategy among professional Traders. This simply involves buying a coin at a slightly lower price in one exchange and selling it in another exchange for a higher price.

Image Source

If we closely look at the above-attached image, we can easily understand this method. As an example, a trader can buy a specific coin at $1000 in exchange "A" and he can sell that coin at $1050 in exchange "B". At the end, he makes a profit of $50. We know that, in some exchanges, the price of a particular coin may take some time to update due to trading volume and other related matters. So traders can take advantage of this time gap and trade profitably. This is basically what happens in this method.

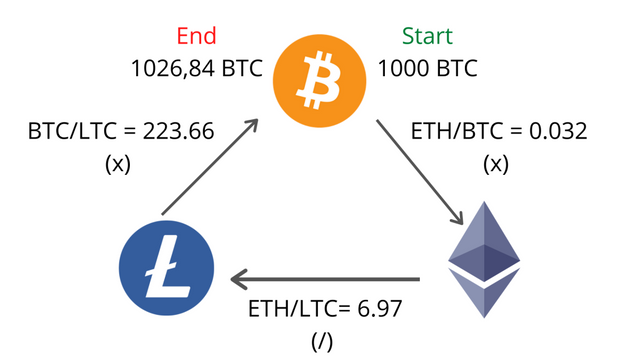

This is the most common method in Arbitrage Trading Strategy. In this method, traders circulate their crypto assets between different coins and finally converting it back to the first crypto asset. This process does not require two exchanges. Even in one exchange, we can follow this method without taking too much risk.

Image Source

We can get a better idea through the above-mentioned image. For example, a trader has 1000 BTC as current assets. Then he exchanges his Bitcoins with Ethereum coins. After that, again he exchanges that Ethereum coins with Litecoins. Finally, he exchanges that Litecoins back to Bitcoins. Then we can clearly see that he has received more bitcoin than the original amount. I will explain more about this process in the next subtopic.

I've already discussed the basic idea of the Cryptocurrency Triangular Arbitrage Strategy. Now I will clearly explain it step by step through an example. Here we have to select at least 3 currency pairs in order to work with this Strategy.

Assume I have 1000BNB in my exchange wallet.

I will demonstrate all these transactions through the Binance Exchange.

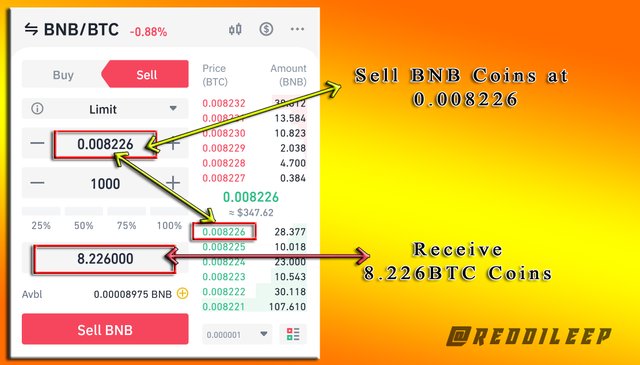

Now I am going to buy BTC coins from my 1000 BNB coins. So, here I have to sell my BNB coins at the latest Bid price. Actually, we need to do this as soon as possible to avoid unnecessary market changes. That's why I selected the latest possible price as we can sell our BNB coins immediately.

The screenshot is taken from Binance Mobile app and modified through Adobe PS.

According to the above-attached image. We can clearly see, I have the ability to sell my BNB coins for 8.226 Bitcoins.

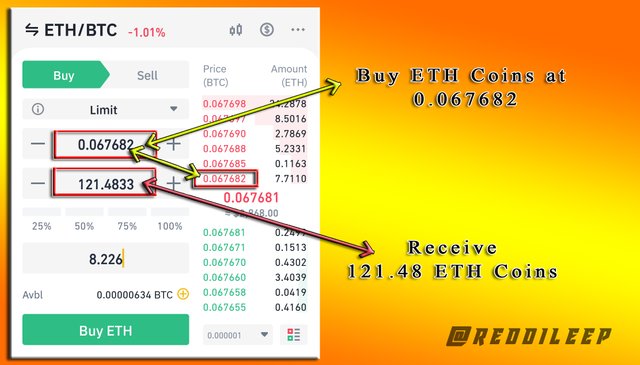

After that, I can buy ETH coins for my 8.226 Bitcoins. So, here I have to buy ETH coins at the latest Ask price. Currently, the latest Ask price is 0.067682

The screenshot is taken from Binance Mobile app and modified through Adobe PS.

According to the above-attached image. We can clearly see, I have the ability to buy 121.48 ETH coins for 8.226 Bitcoins.

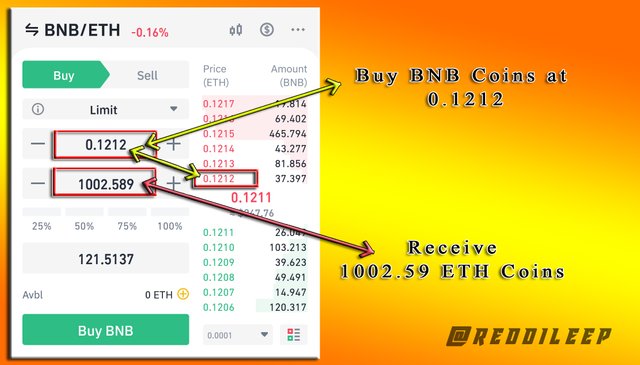

Finally, I can buy BNB coins back for my 121.48 ETH coins. So, here I have to buy BNB coins at the latest Ask price. Currently, the latest Ask price is 0.1212

The screenshot is taken from Binance Mobile app and modified through Adobe PS.

According to the above-attached image. Now we can clearly see, I have the ability to get 1002.589 BNB coins for 121.48 ETH coins. It means I have additional 2.59 BNB coins after a successful Triangular Arbitrage trading. So, you can see at the time of compiling this lesson, I had made a profit of over $900. (Within 3 minutes)

This is the way of making a sudden profit without taking much more risk. If we are able to get the correct entry point, we can gain more profit. And also, you should keep in mind that this method does not always work and you may lose your entire investment by engaging in this type of trading without any experience.

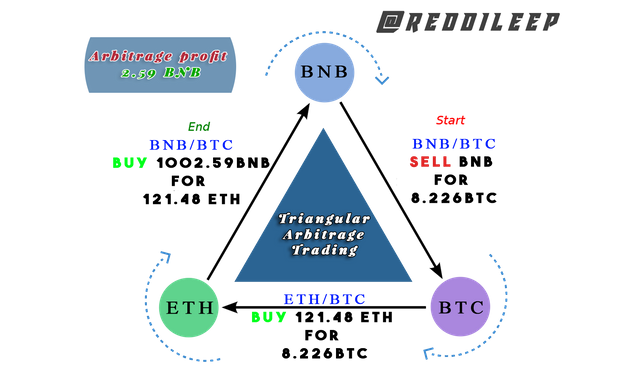

Now I will illustrate this Triangular Arbitrage trading Strategy through the previous transactions.

The image is created by using Adobe PS.

| Advantages | Disadvantages |

|---|---|

| Ability to trade at low-risk profits | Sometimes, trade may stagnate due to less liquidity in the market |

| Ability to engage in transactions without spending too much time | The trading fee may be higher when trading with some of the coins |

| Can increase the liquidity of the market | Final coin amount can be decreased due to unexpected price fluctuations |

| Trading speed can be increased using different softwares | Failure to obtain the correct entry point on time will result in huge losses |

In my lesson, I have described only a summary of these topics and you should do better research and answer all the following questions in your own words. Especially, when screenshots are requested, you should provide screenshots through your own effort without including sourced images. You are totally free to use any language. But when you mention something in the screenshots, you must use only English.

1- Define Arbitrage Trading in your own words.

2- Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

6- Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

You must submit your Homework Posts in the Steemit Crypto Academy community.

You have to include all the details in your own words without including someone's words in your content. The concept can be the same but your content should be unique.

You must include at least 800 words in your homework posts.

Plagiarism is strictly prohibited in the whole Steemit platform and you will not receive any privileges.

All the screenshots and images should be fully referenced and the referenced images should be copyright-free. And also, include your user name as a watermark in every screenshot.

You should use tags #reddileep-s4week4 #cryptoacademy and your country tag among the first five tags. Furthermore, you can include relevant tags such as #arbitrage-trading, #cryptocurrency-triangular, #trading-strategy.

Your homework Title should be

[Cryptocurrency Triangular Arbitrage]-Steemit Crypto Academy | S4W4 | Homework Post for @reddileepHomework task will run from Sunday 00:00 September 26th to Saturday 11:59 pm October 2nd UTC Time.

If you have a reputation of 60 or above, and a minimum SP of 400, then you are eligible to partake in this Task. (You must not be powering it down and your effective SP should not be delegated-in SP) And also, if you have used any buying vote services to build your reputation, you will not be eligible to partake in this Task.

If you didn't receive the score for your homework post within 48 hours, you can put the link in the comment section. Otherwise, don't leave your post link here.

If you have any queries related to my lesson, you are totally free to ask anything in the comment section.

Cc:

Interesting lecture professor however I have a confusion in question 5. Are we supposed to use BTC and ETH or do we have to use other coins except for these two?

You are totally free to use any coin incincluding above mentioned coins.

https://steemit.com/hive-172186/@steembabu/achievement-1introduction-to-myself-steembabu

Please verify my achievement 1 @reddileep

The question 5, can the prof do well and give me some hint, I don’t understand how to figure out the profit all my calculations are no where close.it really annoying me

Hi @olabillions,

You can do it same like the lesson. Try Spot orders.

Nice lecture and very practical as well, thank you. I have really learnt something very important.

Thank you mate

Honestly, I will need help in understanding fully the process, I hope you will do part 2 of this lesson

Hello Prof,

Please with regards to question 4 wanted to ask if I’m not familiar with lots of exchanges say I have only one exchange platform I know, can I just buy low and sell high on the same platform?

Actually you need to sell it in another exchange. Try to familiar with at least one more exchange.

Ok sure thanks

Do you mean that any coin including BTC and ETH can be used??? @reddileep

Of course

Hello professor @reddileep, please in question 2 do you want us to define the arbitrage types on a general basis or only in relation to cryptocurrency trading?

You can include any type. But try to explain them according to cryptocurrency trading 👍

Hello professor here is my home work.

https://steemit.com/hive-108451/@mustafaasif/cryptocurrency-triangular-arbitrage-steemit-crypto-academy-or-s4w4-or-homework-post-for-professor-reddileep

This is my Homework Post:

https://steemit.com/hive-108451/@manuelgil64/cryptocurrency-triangular-arbitrage-steemit-crypto-academy-or-or-s4w4-or-or-homework-post-for-reddileep