Trading the News: Strategies for Steem/USDT

Strategies for Steem/USDT

Strategies for Steem/USDTHi friends greetings to you. So amazing to be participating on this week's learning challenge. Equally this topic is one of the most influential asset in the crypto trading sphere. Trading the news.

Most traders especially short term traders embody their trading strategies, based on technical analysis. This is reading historical chart and monitoring price movement and acting accordingly. In this aspect there are less concern about the happening of news around us.

Whatever goes on in the news, there are not concerned as well as reading what is happening in the economy. This could be accurate for their strategies but not on the long term.

Nevertheless, some traders especially long term traders based their trading solely on fundamental analysis which is driven by market news and events. This could be well profitable as these events greatly influence price movement.

Let's delve into trading the news and see how this could be applied in making informed Market decisions.

Question 1: Understanding News-Based Trading

Discuss the concept of trading the news and its significance in the cryptocurrency market.

In essence trading the news is a trading base strategy which is carried out by traders base on fundamental analysis. This is reliance on News and events which are expected to have a significant influence on the prices of crypto currency.

These News could be regulatory policy changes, improvement in technology, purchase of asset by whales, economic data and social media influence.

Significance of trading the News.

Possibly high return on investments

When new is released which is perceived positively by the market, it can lead to possible price move movement in favor of the affected crypto cryptocurrency and drive prices upward. Traders who are able to anticipate this news and price movement and act accordingly are likely to capitalize in these conditions.increased volatility

News amd events are likely to in stabilize the volatility of the crypto Market. This could pose a potential profitable condition or somehow risk. However it is advisable to trade volatility base on positive news minimize losses.Market sentiment

Market sent to me is something which is much much crucial in trading system. News and influence Market sentiment thereby driving the prices. take for instance positive news about a particular asset, this may boost investors confidence and thereby encouraging them to invest more in this asset which were in time drive the prices even higher.Risk Management

Although news is a great tool in the trading aspect, It is important to be cautious of our investment strategies are sometimes the news may not exactly reflect what is going to happen in the market. So risk management should be implemented at every level of the trading system as the markets are unpredictable and may not act as as we anticipated.

Trading The News Strategy.

By using fundamental analysis, traders can stay informed about the potential impact of news on the crypto market. This involves analyzing factors

Underlying Market adoption, and technology.Technical analysis should be used to identify potential entry and exit based on chats and indicators.

traders should implement a risk management strategies like setting, stop loss orders and exit strategies to minimize potential losses.

staying up to date on the latest news and events developing in the crypto Market is essential tool for trading the news.

No when to fade the news, especially when you are entering into long positions. At times the market noise turn to distract traders And derail them from the real objective. Sometimes these news have to be ignored and focus on the bigger picture.

Highlight its advantages and risks with examples related to Steem/USDT.

Previously mentioned, trading the news could be of potential gain as well as risk. There are a few benefits and Risk factors we should consider before making any informed Market decision. Relating our factors to the steem/USDT pair, We can discuss the advantages and risk factors that may follow.

Advantages

Positive News : positive news come greatly influence the price movement of a particular asset. This news may drive the prices higher, thereby creating profitable opportunities for traders who anticipated this news properly. Take for instance, there is news about the possible partnership of steem with a major cryptocurrency or branch, This Might lead to an increase In demand and consequently price.

Early entry: Traders who are able to anticipate the news a little more earlier and made their entry I likely to be more profitable when The signal is fully formed related to the News.

Markets inefficiency: News can sometimes lead to Market inefficiency, thereby providing profitable opportunities for inform traders to profit from these scenarios.

Risk factor

Trading the news could be sometime difficult as there is possibility of news driven price swings which are highly volatile living so unpredictable Market losses.

incorrect interpretation of news about the particular asset can lead to significant losses when this happens. Take for instance, there is rumors about the potential Security breach on the steam token, This might result to a sharp dropping price even if the rumors are not profound.

False news Can be used to manipulate the market and mislead traders increasing their risk of losing in the market.

Example.

Let's take for a case where, A major change or upgrade has a card on the steam blockchain ecosystem which improves transaction speed and scalability, this positive news could lead to a significant price increase for the steem/usdt pair. Traders who anticipate this news and bought steam early likely to profit from this price surge of this commodity. Nevertheless, if they upgrade the list of faces challenges, the price could drop sharply result into losses for those who bought on the news.

Binance

Binance

On the 28th of December 2024, the price of steem Witness a certain surge. In price from $0.212 to a Whopping $0.35 increasing price, representing a 59.99% increase of the data outside just in a single day. Several factors could have contributed to this increase.

Research indicates that there has been a sudden increase in volume of the token of approximately 663 million + units traded In the past 24 hours. Added to this, there was positive Market sentiment speculation about the steam token which also results to An increase of 25%+ of the steem Price for this particular day.

Another complementary Factor has been turned. Some traders may have spotted a bullish button in the steem. Such as analyzing the trading view, the price is recurrently trading above the EMA 200 and EMA 50 moving average. This signal a potential bullish trend And some traders would find this as an opportunity to buy that phone pushing the price to run high.

Question 2: Analyzing the Impact of News Events

Choose a past event (e.g., a major exchange listing, regulatory update, or macroeconomic announcement) and analyze its impact on the Steem/USDT market.

Listing of steem on Binance.

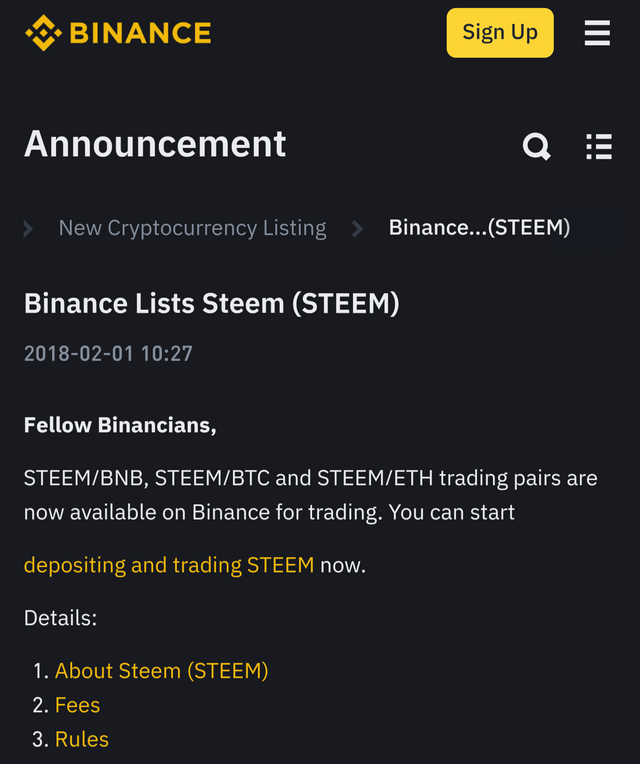

Steemit has rolled One of the largest dapp blockchain on the crypto ecosystem. Since its creation, it has rapid innovation, increase visibility, liquidity and accessibility worldwide. One of the major impacts which led to the more visible phase of steem was it listing on a major cryptocurrency exchange platform like binance.

Overview

In Dec 2017, binance listed steem as one of its trading pairs. The listing of this token and this trading pair greatly enhanced the visibility, liquidity and accessibility of the steem token on the crypto sphere. This capitals improve the overall Market profile of steem.

Impact

Following the announcement of the listing of steem on binance, the price saw a significant increase of the token which Rose from it's current trading price of approximately $1.5 at the time to a high of $3.5 approximately gaining approximately 125% increase in price in the following week.

This increase in price, follow ed a. Speculative buy ing which was led by a boost In investors, confidence following binance reputation.

Following the listing news, there was a sudden search in volume of this commodity. The trading volume was observed to have increased from approximately 10 million to a high of 49.999 million reflecting traders influx from binance extensive user base.

This sudden searching price made steem unless vulnerable token And attract both retail and institutional traders to invest in the token token.

Following the lesson of steem on binance He just made the token more visible to many other traders and investors and in the crypto ecosystem at large leading to renewed interest from the commodity and potential investors.

Binance being a trusted exchange, and following the listing of steem. It made it look more legit and attract investors who were initially unaware Off of today token.

Although the price is were seen soaring high, plunge back to a limiting price below the listing price. Of $1 approximate. This indicates that the surge in price was just a shutdown temporary run due to the listing factor.

As the rest of the crypto Market witness a bear run, The the Steemit price follows the trend equally. However, this is to make claims that even though the price were seen trading high, It doesn't guarantee a long-term profitable Trading or price stability.

Note

The listing of a commodity on an exchange platform usually follows by an increase in price and volume of that commodity. However, this is due to the fact that there is increased accessibility and visibility.

This surge in price Is usually temporal short run and this does not guarantee a continuous stability in price. However the stability of price depends solely on the assets utility adoption and a wide Market trend.

Conclusion

The listing of steem on binance was a turning point for this commodity providing a short-term boost in price, increase trading volume and visibility. Nevertheless, just like any other cryptocurrency, this increase is short-run and depends on the market's ability to maintain user engagement and address ecosystem challenges. It is wise for traders to profit on short-term trades whenever a coin is listed. While looking in for the fundamental aspect on the lining the long-term Trading of the commodity.

Discuss the price action and market sentiment surrounding the event.

Price action..

When the news break out on the listing of Steam on binance, the same price sweetness and immediate increase in price.

Before the listing, the price is recurring the surging around $1.5 and after the news, it drove the price sharply to a high off $3.40 reading a potential percentage increase of 126.

This rapid increase was brought about by speculation of traders who anticipated the news of the listing of this token on binance sings there was going to be a more improved access on the exchange platform.

There afterwards, prices fluctuate immediately has traders scramble to benefit from this price volatility. The price stay up high for a few days and drop a little as traders take out their profit.

This price stay up and the peak ranging from A low $2.9 to $3.1 for a few days. Just fluctuation indicate an unstable nature of the market due to wider market conditions and reduce speculative activities.

Halfway 2018, the price was sent to have dropped far more below the listing price to know of $1.0. this resulted us the general crypto Market Witness a bearish phase.

Market sentiment.

The listing of steem on binance gave traders capacité Vibe, since Binance is known to be highly reputable and trusted exchange platform, the steem token was going to gain more visibility and adoption.

This positive sentiment was discussed on platforms such as Twitter, where users praised a wider visibility of steem token.

The speculation of the sudden price search attracted more long-term and short-term traders ready to capitalize in the short term price movement. This was the course for the surgeon surge In volume of the commodity.

Within the Steemit community, was seen as an accomplishment of project validation however Some concerns on governance And scalability persisted which interfere with the long-term run of this commodity.

Finally, although the price will rising, probably some season traders were so cautious.. following previous examples on listing of token which are often characterized by a pump followed by a sharp decrease thereafter ward and took no action eventually.

These factors illustrate how the price of a commodity varies during listing phase. However, there's a lot more to be done in order to keep price search as fundamentals, utility adoption are widely needed to keep the price high.

Question 3: Designing a News-Based Trading Strategy

Propose a strategy for trading the news in the Steem/USDT market:

Training the news is one of the most important and crucial aspect in the Crypto ecosystem. News represent events and happenings around us And this influence price, movement and Market sentiment directly or indirectly. They are a key things traders should take not off when trading the news.

A better approach for trading. The news should incorporate the following key things.

1. Criteria for selecting impactful news

The new sauce must be relevant and must directly impact the Steemit block Chain under ecosystem. They are a few things to look out for when setting up this strategy.

credibility:

The news Source must be reliable and trustworthy. We should avoid rumors and unverified information or sources which may mislead or misinform us..The news must directly impact Steemit token significantly in ways such as magnitude of the event, the labor of Market interest and potential cases of short term volatility.

The news must impact major changes on the Steemit blockchain such as new features or improved scalability

It should be able to impact the Steemit blockchain when new laws or regulations that affect the cryptocurrency Market in general are passed on.

Cases such as partnership integration and collaboration with other business projects should be able to affect the Steemit blockchain directly

2. Tools for monitoring and analyzing news events

We don't just get news from anywhere else, but it should be gotten from reliable source which are able to act the blockchain directly. Some of the major site we get me news from include:

social media: By making use of tools like tweetdeck To scan the Twitter social media platform and get all tags and informations related steem Which can be helpful to identify a breaking news and incinoids Market sentiment.

By subscribing to giant news platforms like coindesk, coin Market cap, To stay updated about the latest news development in the crypto markets

By implementing technical analysis with use of historical data and price charts, analysis could be carried on on platforms such as trading view which could be used to trade the cryptocurrency based on news driven sentiment In order to get a better confirmation together for proper entry and exit positions.

3. Entry, exit and risk management rules tailored to news-driven volatility.

Trending the news could be one of the most profitable opportunities in the crypto Market. However, care needs to be taken as some of this Market noise May results so potential losses. We should also watch out for cases of Market manipulation and fake news. Let's see how this could be applied in trading the news.

Entry:

We should be able to enter a long position after a positive news breakout influencing a significant price movement.

consider the case where the market retraces to a certain level, but then the overall Market trying is still bullish, We should be able to enter alone position after a sharp product following a positive news.

Exit

based on your risk tolerance, Set profit Target with a half of technical analysis and indicators.

implement trailing stop loss to maximize profit in case the market moves in your favor

In cases where the news, narrative changes, or prices indicate a potential retracement, Exit your positions.

Risk Management

Trading is an unpredictable game as no one knows exactly what the market buy is capable of. Even with the technical knowledge, the market can behave account ing. Irrespective of what we perceive. Therefore It is always important so implement weeks management.

It is advisable to allocate small portion of your Trading Capital to news driven trades, To minimize losses in case the market goes against us.

To use automated stop losses to exit positions in case of potential sharper reversal in highly volatile markets.

Additional tips

It is always advisable to use sentiment analysis tools to gauge the overall Market sentiment around steem related news

Always backtest your strategy to see its validity and areas of improvement before applying it in the real world market.

By incorporating these stores and making sure we use them properly dictating Market sentiment and price action, we could be able to trade news-driven trades with ease and maximize our chances of capitalizing profit.

4 Question 4: Managing Risks in News-Based Trading

Managing risk in news base trading system it's so crucial as they are a lot of factors that may lead to critical losses in the market. Let's discuss on factors like:

- Slippage

In times of high volatility which are caused by breaking news about a particular assets, slippage or cause which is a condition or a situation where traders are unable to execute trade due to rapid movement of the price. First, I have witnessed this most often in the trading market of which the volatility is too high in such a way that entering a trade is so impossible. At some point the trade might execute on its own point which is not at your desire. Suppose the market goes against you, this might lead to severe losses before you could even adjust Southwest orders or do anything.

- Overreacting:

Over reacting is a situation where exaggerated news about a particular asset lead to temporal spike in prices which do not actually reflect the actual market value. This can trick traders who are in losing position to hold longer. Hoping for retracement or the other way around cause them to leave the market so early thereby missing out on profit.

Misinformation

There are a lot of rumors and misinformation running in the crypto Market at some point. Therefore, traders who execute their trades based on misleaded information might lead so potential losses in their trade.Emotions

Trading the news can sometimes evoke emotions leading to fear and greed. This can cause traders To act accordingly. Performing impulsive trading without proper analysis and judgment which deviate desmond from a well defined strategy.

Risk factor mitigation

However, they are various ways which we can use to mitigate this Risk and improve our decision making in trading the news. They are:

Proper verification of News source

- We should be able to check information from multiple reliable source before taking actions in trading.

- stay a lot of Market sentiment and rumors about The crypto markets sphere.

Risk management criteria

apply stop loss orders irrespective of how sweet and profitable the market is to minimize losses in case anything happen in the market .

allocate only a small portion of Of your portfolio in trading to limit potential losses.

maintain your Trading strategy and avoid cases of overtrading trading, In other words, multiple ancient and exits.

Using technical analysis

use historical data and chats to determine the behavior of price in similar conditions and compare it with the current ones to see how the market behaves around this point.

incorporate your news with Technica indicators such as moving average RSI to support potential turning points or reversal.

Back testing your strategy

- simulate your trading based on the news and be so sure of yourself using historical data to evaluate your performance in different Market conditions.

- evaluate your overall performance and note areas of improvement.

State updated with the latest news

Use reliable news source To monitor developing news

While exercising patients and avoiding impulsive tradingWait for confirmation based on the news impact before executing any trade.

Patience and discipline

- stay true to your trading plan and avoid chasing the price or profit.

- However, trading the news requires traders to exercise a lot of discipline and controlled emotions.

Question 5: Leveraging Technology for News Trading

Trading the news it's quite a crucial text which can be very profitable And sometime poses a risk factor. However, we can leverage some technological tools for trading the news such as:

Sentiment analysis algorithms.

Sentiment analysis tools can be used to analyze the market structure for a particular cryptocurrency or the overall crypto market by scanning social media post, news articles and discussion forums based on crypto trading. Both positive, negative and neutral news By tracking changes in sentiment, traders can identify transmission emerging and potential shift in the market direction.

Some of them most popular used sentiment analysis are Google cloud natural language API and hugging phase transformers which are popular language processing tools that designed to track and analyze news sentiments.

Trading bot application

Trading bots can be redesigned, programmed and trained to trade the news based on one's strategy. These Bots could be able to read Signal generated news sentiment analysis, algorithm or retime news triggers.

By implementing these bots, We can improve the speed under efficiency of our trading as this but are faster than humans and able to capitalize on profiting markets opportunities. Example of common Bots which could be implemented 3commas, crytohopper Which allowed users to redesign And deploy them Bots to trade various crypto currencies.

** Application of real-time news aggregators**

Real Time news aggregators I used to filter cryptocurrency news sources, and relevant information prioritizing that users get the most accurate information. Also, these aggregators are able to provide traders with immediate access to breaking news and movement in Market events. Examples of these include Google News and cryptoslates which provide real-time updates on a variety of topics, including crypto currencies.

By combining these tools, traders can be able to Create sophisticated trading analysis tools which are used to trade The news effective and efficiently.

To conclude, trading, the news could be a very easy and possible task and at some point it could be a bit confusing as there are risk of misinformation Which can sometimes mislead traders decision leading to potential losses. However, using appropriate sources and implementing Trading the new strategy and more effective and profitable one.

Rounding up. I'll invite the following persons to join me participate @chant, @siminnwigwe, @fombae

Disclaimer this post is for educative purpose only and not a financial advice.