2 Important Cryptocurrency Investment Tools You Must Know...

My own work

Introduction

The world of cryptocurrencies can be very adventurous if approached with the right kind of knowledge. Be it a knowledge of the technical operations of the market, or a full grasp of the background information around a project; building a sound knowledge base is one easy way out of many troubles in the crypto space.

Knowledge about cryptocurrencies can be gotten from a variety of resources, ranging from books to websites and video contents. Also, tools to help us watch the technical performances of our favorite cryptocurrencies are much. In fact, crypto materials are simply inexhaustible. Sometimes it becomes totally overwhelming for an individual to handle the many tools and materials, and make complete sense of them.

Here comes some good news. There are platforms that have been built to lighten the weight of seeking out whatever information we need on our favourite crypto projects, be it technical or fundamental Information. Coingecko and Trading view are some examples of these tools, and in this article, I will be exploring these platforms in a bid to share the knowledge I've gained in the course of this week's lecture.

CoinGecko: why it is a good cryptocurrency investment tool

Image source

A near-accurate description of the coingecko platform would be that it is a one-stop-shop for crypto-related resources; ranging from the fundamental Information resources, to the technical information resources.

CoinGecko stands as one of the largest crypto data curating platform. The platform tracks and curates data from over 5000 crypto projects and 300 exchange platforms.

According to CoinGecko.com, the platform was founded in 2014 by TM Lee (CEO) and Bobby Ong (COO) with the mission to democratize the access of crypto data and empower users with actionable insights.

Features of the platform include cryptocurrencies' off-chain matrices like Market Capitalization, Maximum supply, total supply, token distribution, circulating supply, trading volume, market ranking, current price/value. Also, Coingecko provides authentic linkage to project websites, whitepaper, block explorer, and social media handles.

Why it is a good Cryptocurrency investment tool

With the class of analysis and information offered on the coingecko platform, and judging from their legacy over the years, it has become a very handy tool for any crypto enthusiast. Oftentimes, it becomes the first point of call whenever a Crypto coin is causing a stir on social media, as people immediately grtbon the platform to obtain relevant information before taking a leap into the waters.

With this approach, coingecko has saved many crypto investors/traders from getting sunk in a scam project. Seeing how much an access to the right information has done to save people from falling for scams, the coingecko platform is indeed a very good tool for an investor to unearth insights about a coin before investing in them.

The CoinGecko platform and its unique features

The Coingecko platform has many interesting features, most of which has already been explored and explained in details by Professor @reminiscence in his lecture post ( click here to see post ). However, there are some exclusively unique features of the coingecko platform that I'd like to explore here:

1. CoinGecko newsletter

Image| Screenshot from coingecko.com

Coingecko newsletter provides a platform for users to sign up with some of their personal information, and have frequent updates about the crypto space delivered their mail address.

2. CoinGecko Buzz

Image| Screenshot from coingecko.com

Here is another interesting feature of the coingecko platform, the coingecko buzz presents guides and top lists within the crypto space.

3. Coingecko Podcast

Image| Screenshot from coingecko.com

Coingecko podcast provides a platform where users can gain knowledge about the crypto via real human interactions like interviews, etc.

4. Beam Updates

My own work

This is a very interesting feature on the coingecko platform. It provides a channel where project teams get to feed users with information about their projects through the coingecko platform. By implication, users no longer need to be swimming through GitHub repos or project websites and social media to get updates. They can access it on the coingecko platform.

5. Coingecko reports

Screenshot| from coingecko.com

Coingecko reports segment documents major indices of the crypto market with a given time period. As seen on the screenshot, a 2021 quarterly report is already on the page.

A brief explanation of the Tradingview platform.

Image source

According to tradingview.com, trading view is a social network of 30 million traders and investors using the world's best charts and analysis tools to spot opportunity in global markets.

The platform is mostly used by traders for technical analysis. It is simple to navigate and has built-in functions that are not difficult to comprehend by even the most ignorant newbie. The user-friendly nature of its interface and the handy tools available on the platform makes it a very good charting tool for both new and experienced traders.

Trades cannot be taken on the trading view platform, as the source code has not integrated such protocol. However, it is a common practice that traders do their charting and technical analysis on the trading view window, while switching over to their diverse broker accounts to take trades.

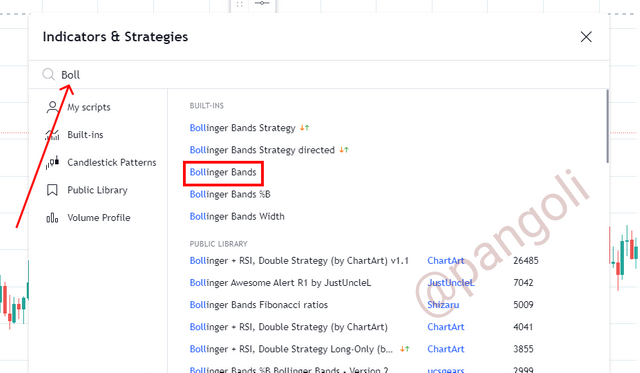

How to add indicators on Tradingview chart.

For this illustration, I will be adding the Bollinger bands indicator to my tradingview chart using the following simple steps:

Step 1

Load the browser and launch tradingView. On the landing page, click on Chart.

You will be redirected to the charting interface.

Step 2

Image| Screenshot from Tradingview.com

Go to the top left corner of the page and click on the "Indicator" icon as seen on the chart.

A pop-up window will appear containing different indicators displayed in an alphabetical order.

Step 3

Image| Screenshot from Tradingview.com

Type in the name of the indicator using the search box and click on your preferred indicator from the resulting list.

The Bollinger bands indicator get automatically added.

The resulting chart has the Bollinger bands indicator wrapped around the candlesticks.

How to modify an indicator on your chart

Modifying an indicator implies tampering with its default setting to suit a trader's preference. Hence, to modify the Bollinger bands in the above chart, I will follow the steps below:

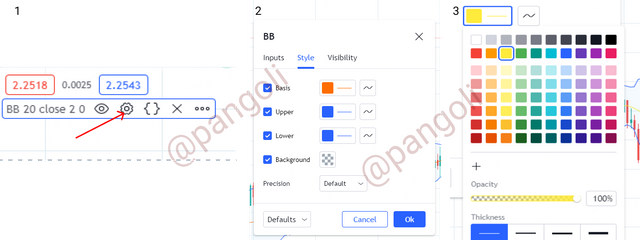

Image| Screenshot from Tradingview.com

Click on the indicator menu bar on the screen - Screenshot 1. On the menu, click the settings icon marked with the arrow.

A pop-up window will appear - screenshot 2, showing different modification options for the indicator. Here, you can make changes to parameters like color, opacity, density, etc.

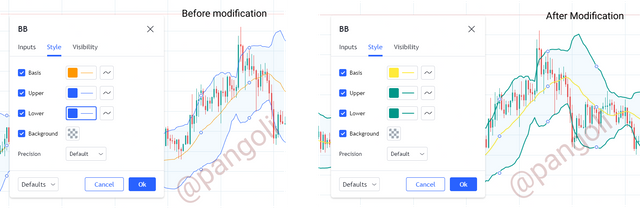

I changed the colors and line thickness of my Bollinger bands

Image| Screenshot from Tradingview.com

From the chart above, a representation of my chart interface before and the modification.

Cryptocurrency Portfolio and Watch list: what you should know

Portfolio

Whenever an investor releases funds for the purchase of any crypto asset, such an asset is said to be added to his portfolio of crypto investments. As simple as that sounds, it defines what a portfolio is.

A Cryptocurrency portfolio is seen as a comprehensive record of an investors' active investments. In other words, it is a list of crypto assets purchased and held by a crypto investor hoping to make long-term gains from value appreciation.

Watchlist

At any point in time, there are thousands of cryptocurrencies begging for an investor's attention. Oftentimes, many of these thousands are potentially good investments. However, it would be a Herculean task for an investor to track the performance of all these Cryptocurrencies at once.

Therefore, it is a common practice for crypto investors/traders to select some currencies of interest and study their fundamental/technical performance over time. This is done with an intention to invest their funds into these projects if they have a good enough performance over time.

The process explained above is typical way of watchlisting cryptocurrencies. By way of definition, a watchlist is simply a list of choice assets being monitored by an investor for proper validation before engaging funds.

Why is Portfolio management so important?

Image source

Portfolio management is a huge necessity for investments of any kind. It involves a deliberate diversification of an investor's portfolio into different asset types in order to minimize losses in bad market situations.

Since the goal of every investment is to generate returns in profits, it would be a very risky adventure to not have a properly managed portfolio. In other words, a properly managed portfolio should comprise of assets that do not all go down what the market bleeds. Or, if they do go down, they do so at different paces such that the loss incurred by the investor is very minimal when compared a portfolio that is not properly managed.

A typical example of a poorly managed portfolio is the practice of investing lump sums into one crypto asset in one fell swoop. This puts the Investor's funds at a much higher risk than necessary, because, a single market move in the wrong direction can drown such portfolio in a pool of losses.

Simple portfolio management techniques that can be employed by investors include:

- Dollar-Cost averaging: buying specific units of an asset at different points in time, over a long-term period. This method saves the investor from the agony of going in 100% at a market top, just before a rebound.

- Multiple asset types: this implies diversifying portfolio to include more asset types, especially those assets that are uncorrelated.

Exploring my cryptocurrency watchlist: what coins? and why?

Image| Screenshot from Tradingview.com

The above image captures my crypto asset watchlist and my reason for choosing them are as follows:

Ethereum (ETH):

As a platform that is smart contracts compatible, there has been a huge development of DApps on the Ethereum blockchain. This is most likely to continue, and the Ethereum blockchain might see even more growth with the planned upgrades to its protocol.

Binance coin (BNB):

Being the world's leading exchange with lots of subscribers and a team that is given to innovations in the crypto space, I intend to hold some BNB coin as I expect it to gain serious value appreciation.

Chiliz (CHZ):

I added Chiliz to my watchlist because it is an NFT token that intends to revolutionize the sports and entertainment sector. These two sectors have large followings that is capable of exploding the value of the token once it gains mainstream adoption.

Pancakeswap token (CAKE):

The world is beginning to pay more attention to decentralized Finance, and Pancakeswap happens to be the largest enabler of decentralized Finance through its Decentralized exchange. With many more DeFi projects coming onboard, it definitely will have an effect on the value of the Cake token.

EOS:

EOS boasts as the most Scalable blockchain at the time built to cater for enterprise needs. As the world adopts blockchain and businesses begin to find ways to incorporate blockchain solutions, it is believed that the EOS blockchain will gain more traction, and as a result, more value.

Conclusion

Crypto investment/trading are very risky actions. However, with sound knowledge, risk management (for traders) and portfolio management (for investors), the risk of making unimaginable losses are greatly reduced. By utilizing the tools and concepts discussed in this article, an investor can have a better view of the market and also make better trading/investment decisions.

Hi there! If you read to this point, I am sure you enjoyed the article. Let's take this further, I'd like to connect with you on a more personal level. Feel free to hit me up on any of my social handles below:

Hello @pangoli , I’m glad you participated in the 6th Week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

You have produced a quality content. Thank you for completing your homework task.