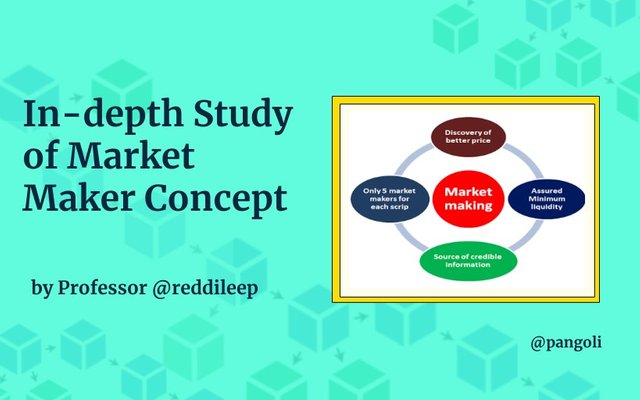

In-depth Study of Market Maker Concept

For trade to successfully take place in any setting, there must first be a case where supply meets demand. In the financial market, assets can only be traded to the extent at which they are liquid. Liquidity here implies that the said asset must be sufficient in amount and readily available at fair prices for purchase or sale.

The process of trading usually involves a buyer and a seller; and at any point where a trade is made there is a party that buys, and another that sells. Market Makers (MM) fill in a gap by providing enough liquidity to ensure that at any point an order is opened in the market, there is sufficient liquidity to push it through.

In other words, market makers are the counter parties in the market who buy from traders who are selling, and sell to traders who are buying at pre-determined profitable rates. Usually, a market Maker sets the "bid (MM's selling price/trader's buying price)" to be higher than the "ask (MM's buying price/trader's selling price).

Image source

In the traditional Financial Market, market making entails a process whereby merchants (usually big investors and banks) buy and sell assets to traders through brokers. These merchants state different prices at which they are willing to "Sell - Ask price" or "Buy - Bid price" an asset for, taking the difference between the two prices as their profit.

In the crypto space, market making takes two forms, and are applicable to centralized and decentralized exchanges respectively.

Since there are no intermediaries like brokers between traders and market makers in the crypto market, market making in centralized exchanges often takes the form of pending orders.

Oftentimes, big traders and institutions who trade with limit orders release their assets to the market, with hopes that certain conditions be met before they are filled. The limit order gets logged in the order book, and the released assets become a ready liquidity for market takers who trade at the prevailing market price.

Image source

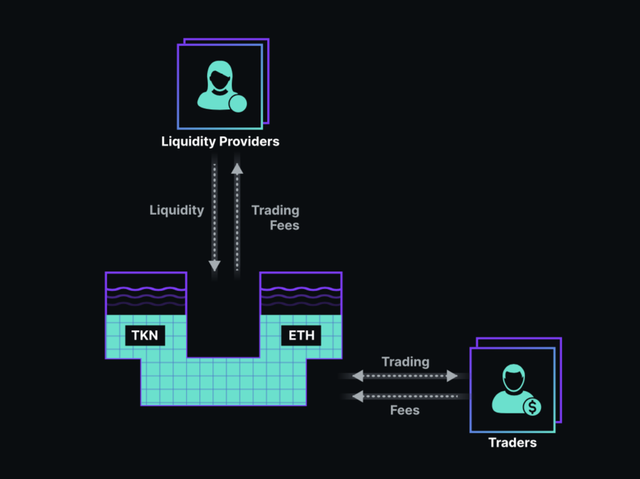

For decentralized exchanges, market making takes an automated process. Here, since there is no centralized system of matching orders, trades are executed against liquidity pools that are regulated by smart contracts.

The psychology behind Market Making

Apart from liquidity provision, market makers, who are mostly the institutional traders and big investors are also in the market to make profits. Hence, they device strategies to always play smart and win in the market.

Using their huge liquidity, the market makers create an upper and lower price limits by placing their "bid" below the current price, and their "ask" above the current price. Thus, providing enough liquidity for other traders to trade within these limits.

For example, let's assume the current price of BAKE/USDT is $4. If a Market Maker creates a pending order to sell $30,000 worth of BAKE/USDT at $5, while the trade is yet to be filled, the liquidity provided here can cater for traders who will place their trades for the price of BAKE greater than $4 but less than $5.

On the reverse, if the Market Maker creates a pending order to buy $30,000 worth of BAKE/USDT at $2; while the order is yet to be filled, the Liquidity provided can service trades that will be places for prices of BAKE/USDT greater than $2 but less than $4.

Also, some market makers known as whales target key support/resistance levels to manipulate the market and make quick gains off retail traders. Support/Resistance levels are key levels that suggest where retail traders are comfortable with market price.

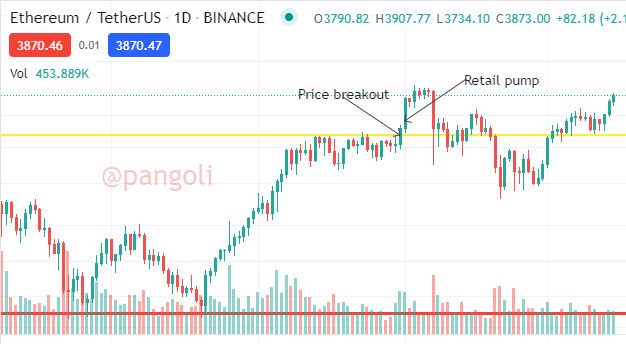

Let's make an illustration to see how Market Makers profit from retail traders

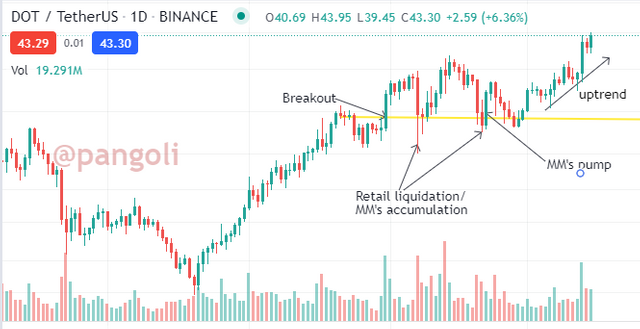

Image source

From the chart, we can see the price breaking out of a resistance zone. Retail traders see this as a bullish signal and jump in to open "buy" orders in anticipation of a bull run. These numerous retail "Buy" orders create a temporary pump in the market.

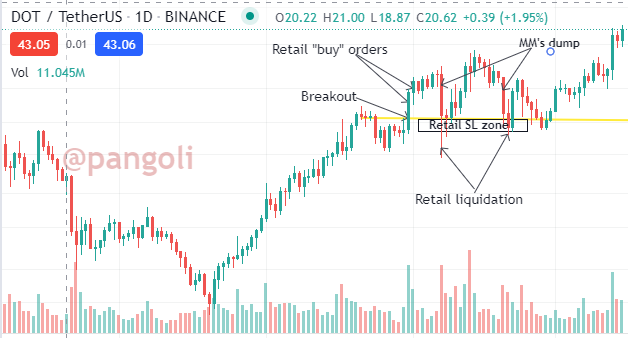

Image source

Here, we can see the Market Makers manipulating the market and taking out the retail orders twice, and subsequently resuming the original bullish trend. Through this subtle manipulation, the market makers have stacked up enough assets to land them in profits during the bull run.

Benefits of a Market Maker

Readily available liquidity: An asset is only useful to the extent at which it can be exchanged and used. Market Makers contribute to the utility of crypto assets by ensuring that liquidity is sufficient for transactions to take place.

Impact on an asset's trading volume: when there is a high liquidity base for an asset, it brings more players into the market to trade in that asset because it is easy to open and liquidate positions.

Impact on the cost of trading: As more and more Market Makers flock into providing liquidity for an asset pair, prices become highly competitive and the spread between "ask" and "bid" prices get reduced. Hence, traders can pick trades at a minimal cost implication.

More stability to asset prices: once there is high market liquidity for an asset, it becomes a lot more difficult for prices to make unnecessary swings as a result of manipulation. Market Makers make it more expensive to manipulate asset prices because a good amount of volume inflow or outflow is required to cause a significant move in price.

It impacts a project's credibility: when there is a good trading volume and a high market liquidity from various Market Makers on an asset, it brings credibility to the project behind it. That is, people get confident about the fact that they will not be rugg-pulled.

What are the to potential downsides to markets with market makers ?

- Whale movement: when Market Makers inject large amounts of liquidity into the market over a very short period of time, the create short terms market shocks that can run retail traders into huge losses.

- Regulation: Market makers act on freewill. Since there are no outstanding regulations to guide their market operations, there is no limit to how much should be injected or withdrawn from the market in order to maintain a smooth price action.

- Liquidation of small accounts: Oftentimes, retail traders get liquidated by the action of Market Makers. Since Market Makers place their trades away from the obvious price points, it becomes very easy for unsuspecting retail traders to fall into a trade trap and get liquidated.

- There is a tendency for price slippage to occur when the market reacts to a news event. That is, the Activities of Market Makers during news releases can cause a trader's order to be filled at a rate that is totally unfavorable to their trade analysis. This is because of the huge liquidity that often accompanies news releases.

- An asset's price can be negatively impacted by an excess supply of liquidity. That is, when there is an excess supply of Liquidity, the circulating supply of an asset gets diluted, and as a result, the price drops.

Indicators that Capture Market Maker Activities (illustrations with charts)

Some indicators that are used in the Market Maker Concept includes:

- Support and Resistance levels

- Bollinger Bands

These are common indicators that are used by retail traders to analyze the market and predict its move. However, the Market Makers also ride on the signals from these common indicators to boycott the trades of retail traders. Let's see how Market Makers utilize these Indicators to rid retail traders of their profits.

Support and Resistance levels

These are generally taken to be inflection points in the market where there are sufficient open orders to push the market trend in a certain direction. Traders often buy near a support zone, and sell at a resistance zone. Let's see an illustration below

Image source

From the chart, we can see that price had broken out of a previous resistance level to settle on a new support. The common reaction of retail traders to this price action will be to open long trades, anticipating that prices will keep going up in a bullish momentum. Here, the Market Makers see an opportunity dump in on the retail traders and liquidate their trades.

Image source

The retail traders open their "buy" orders and set their stop-loss just below the support line. Since the Market Makers are already aware of the retail traders' move, they dump the market and liquidate all the retail "buy" orders before; and then buy up the dip to continue the bullish trend.

Bollinger Bands

The Bollinger bands have some similarities with the Moving Average indicator. It comprises of three lines - the upper band, the middle band, and the lower band. The middle band is a simple moving average, and the upper and lower bands are plotted at 2 standard deviations away from the middle band.

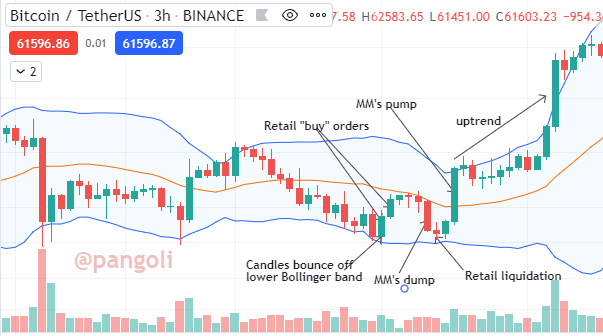

Using the normal Bollinger Bands strategy, traders are psyched to open sell orders whenever price bounces off the upper Bollinger Band; and "buy" when the price bounces off the lower Bollinger Band. Let's also see how Market Makers use this strategy to boycott retail traders.

Image source

Image source From the screenshot above, we can see price bouncing off the lower Bollinger Band. The retail traders have opened long trades thinking the market is about to go up, and set their stop orders just below the initial point. Then, Market Makers stepped in to clear out their trades before continuing the bullish trend.

Conclusion

Market Makers play a very important role in the Financial Market. They buffer between traders to ensure that buying and selling takes place whenever the need arises. However, they can be the progenitors of a trader's downfall by injecting liquidity at key zones of the market.

Hence, there is need for traders to not only enjoy the Liquidity provision from Market Makers, but to understand their Market behaviors and playbook, and employ appropriate counter measures to minimize the rate at which their trades get stopped out.

Thanks for reading....

Hi there! If you read to this point, I am sure you enjoyed the article. Let's take this further, I'd like to connect with you on a more personal level. Feel free to hit me up on any of my social handles below:

Hello @pangoli Thank you for participating in Steemit Crypto Academy season 4 week 6.

Thank you very much for your review, Professor. I will do better in subsequent tasks.