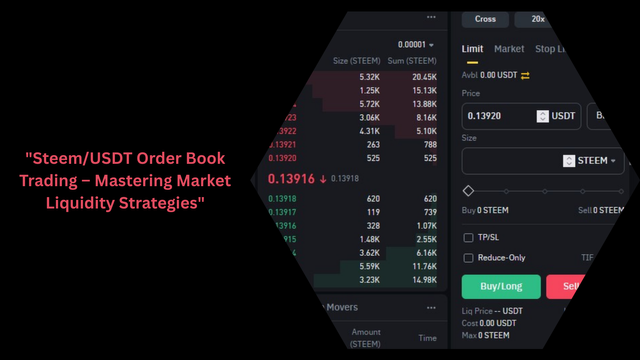

"Steem/USDT Order Book Trading – Mastering Market Liquidity Strategies"

Assalamu Alaikum friends, I hope everyone is well. I have come to participate in the Order Book Trading – Mastering Market Liquidity Strategies Contest from the Crypto Academy community.

Explain the fundamentals of the order book, how it works, and why it is crucial for traders. Compare order book trading to traditional technical analysis..

The financial market depends on order books to organize electronic listings of all pending buy and sell transactions for particular securities or assets. The book's structure arranges data by price value so traders can monitor market demand and supply conditions at present. The order book has two distinct areas where the bid side presents maximum purchase prices while the ask side reveals minimum selling prices. The structure allows users to discover prices so they can determine where market transactions are most likely to happen.

The order book runs in real-time since it automatically updates through the process of new order placements combined with the execution and cancellation of existing orders. Market orders reach the order book where they match with existing limit orders that use price-time priority as the matching rule to select orders first. Market dynamics through the order book feed information to traders about both current market liquidity levels and upcoming price changes.

The order book provides traders with vital knowledge because it reveals support and resistance levels which develop where numerous buying or selling orders accumulate. The analysis of active orders in market flow enables investors to detect fundamental market positions because widespread buy signals mean rising prices whereas many sell orders point to falling prices. Market data from the order book allows traders to develop effective entry and exit strategies in their trading activities.

- Comparison of Order Book Trading and Traditional Technical Analysis

Order book trading systems operate separately from traditional methods of technical analysis in market analysis processes. Order book trading processes authentic-time information to monitor both buying and selling order activities for determining market polarity and liquidity strength. Through order book trading traders gain knowledge about instant supply and demand relationships which helps them conduct time-sensitive market decisions. Traditional technical analysis depends on historical price data from charts to detect patterns which its users use with indicators to anticipate price shifts. Technical analysis allows trades to view broader market trends but order books frequently show modifications that occur before technical analysis indicators catch up. Trading strategies benefit from the integration of market orders and technical analysis because it utilize efficient component detection from both systems.

Discuss how traders can use market depth to determine support and resistance levels. What insights can be gained from analyzing the order flow?

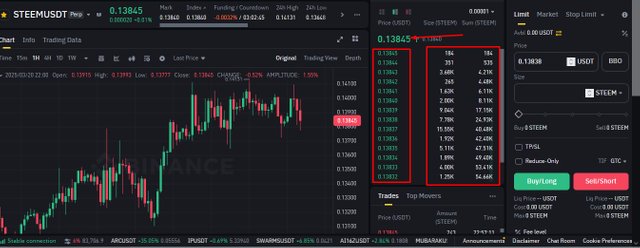

Traders can determine support and resistance levels by analyzing the order book because market depth shows real-time buy and sell orders at different price points. These price levels show strong buying demand due to heavy concentrations of buy orders which define support levels. Large bid order concentrations within a particular price range demonstrate a willingness of buyers to make purchases that prevent the asset price from dropping below that point. Substantial sell orders that build up at higher prices serve as indicator points for resistance levels because they show sellers want to exit positions that could restrain price appreciation.

Changes within market depth indicators reveal information about upswing or downward shifts in supply and demand relationships within the market. A large buildup of buy orders at prices just beneath the market value indicates that support might be forming. Atmospheric sell orders that rise above market prices potentially suggest future resistance since there is a strong possibility price acceleration could cease at this point.

Traders need to evaluate the total trading volume accumulated at these price points because robust support or resistance occurs when trading volume is high. Market depth analysis combined with important technical indicators such as moving averages and trendlines improves traders' ability to determine better entry and exit times when making trading decisions.

How do large buy and sell orders influence the market? How can traders react to "whale orders" to optimize their trading strategies?

Market dynamics get significantly affected by "whale orders" which describe large buy-and-sell deals based on their immense volume. Large trade orders executed by traders and institutions automatically generate rapid price movements in the market. Large orders typically shift supply and demand relations in the market thus triggering this effect. When large buyers enter the market their orders tend to increase prices because selling entities respond to rising demand but large sellers reduce prices and drive buyers away because of increased supply.

Several factors drive market analysts to track whale orders in the market. Market sentiment indicators emerge from whale orders because big purchases display bullish sentiment whereas large sales demonstrate bearish outlooks. Traders use "front-running" as a strategy to predict price movements from these massive orders by taking appropriate trading positions. Traders employ Level II market data tools to check real-time order book modifications which shows them the likely impact of whale transactions.

Different approaches exist for traders to optimize their trading strategies when dealing with whale orders. Gradual position building constitutes one popular technique instead of trading one large position. The strategic placement of orders enables traders to reduce the danger of market price shifts that may develop from negative reactions to their trades. The application of stop-loss orders enables traders to protect their investments when unexpected market shifts happen because of whale orders.

Develop a step-by-step order book trading strategy for Steem/USDT, detailing entry and exit points, liquidity considerations, and risk management techniques..

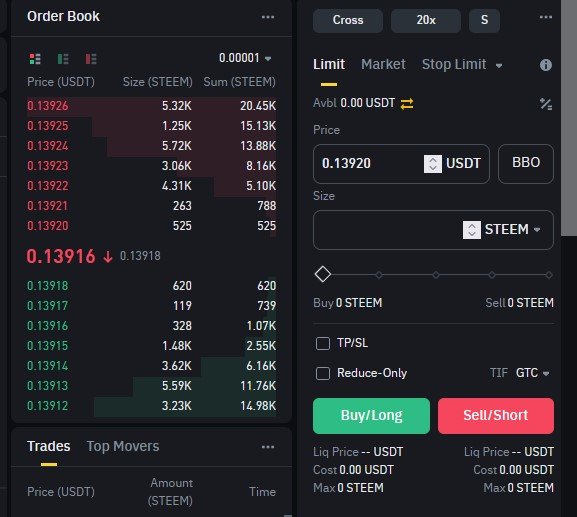

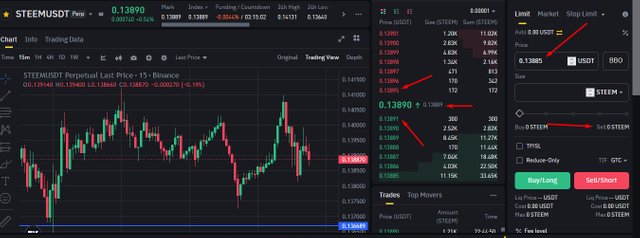

Step 1: Analyze the Order Book

The first stop should be the Steem/USDT order book on an established exchange platform. Analyze major price trigger points through the densest clustering of buy (bid) and sell (ask) order points. Check for substantial buy orders that might represent significant liquidity points because they tend to resist price variations.

Step 2: Define Entry Points

The analysis of the order book should determine entry positions. Most traders adopt the approach of purchasing long after the price reaches a robust support area filled with major buy interests. You should open a short position when market prices approach major resistance zones containing many sell orders.

Step 3: Set Exit Points

The strategy uses profit targets in addition to stop-loss levels to establish the exit points. Long position traders should establish exit targets at resistance level positions below the area while stopping losses at support levels close to the bottom to contain losses. Short position traders must have their profit targets positioned above support levels together with stop-loss orders assigned above resistance areas.

Step 4: Monitor Liquidity

Market liquidity requires constant assessment because it shows wide and unexpected shifts during active trading hours. The market's level of liquidity enables fluid trading with minimal price impact through slippage however low liquidity results in greater price spreads which heightens the trading risks.

Step 5: Implement Risk Management Techniques

Your trading capital should remain mostly untouched through techniques that restrict single-trade participation at below 1-2% of your available funds. Position sizing techniques enable traders to handle market losses within safe limits even during unfavorable trading periods. Portfolio diversification should be your strategy to reduce the potential risks that come from focusing on one particular asset.

This logical framework provides traders the tools to handle order book trading risks in Steem/USDT operations.

Analyze a real or hypothetical order book trading scenario involving Steem/USDT. What key takeaways did the trader gain, and how did they adjust their strategy accordingly?

If we suppose we have a trader who wants to enter (or exit) the cryptocurrency pair Steem/USDT, he will analyze the order book in order to identify possible entry or exit points. Live buy and sell orders are displayed in the order book which gives an idea of the market sentiment and liquidity. At first glance, the trader notes the purchase pressure is felt strongly at $0.1373 when there are a lot of buy orders piled up, meaning strong support. On the other hand, plenty of sell orders exist on the $0.1400 resistance level as well.

With this, the trader decides to make a buy order at the price of $0.1373 as he believes that the price will bounce off the support level of $0.1373. They read this by baseline and as the price gets near to this threshold, but when they check the volume metrics they see an increase on the buy side which confirms their notion of the market sentiment. But it doesn’t take long for the price to reverse once they execute the buy order, as it does not break through the resistance at $0.1400.

This experience covers key takeaways such as:

Market Sentiment Analysis: The trader realized that one should be aware of market sentiment by analyzing order book dynamics.

The first strategy didn’t generate the results they sought as they hadn’t anticipated the selling pressure and so they adjusted their strategy and put in place stop-loss orders to ameliorate any potential losses.

Adaptness: The trader tilted at making trading strategies adapt as opposed to steering his or her focus on the short term gains for the sake of being cautious with long-term investment.

Volume Analysis: realizing that volume spikes most of the time precede substantial price changes, they decided to include volume analysis for future trades.

Based on these experiences, the trader wanted to increase his profitability in the following Steem/USDT trades by eliminating the surprises in the market, which includes things like adjusting the strategy, such as tightening the stop loss around their target and paying attention to the volume trend.

Real-time insights into the supply and demand dynamics for securities is what the order book represents: an order book is a key instrument in financial markets. The order book allows the traders to analyze the market sentiment, identify the potential trading opportunities and make trade decisions depending on liquidity and price moves. Its structure buy orders, sell orders, and market depth can be understood by the traders as it simplifies the whole trading process. With continued evolution in technology, future trading strategies will depend on order book data to optimize trading strategies and increase market participation.

- By the way screenshot from Binance.com

Thanks to everyone here is an invitation @stream4u, @josepha , @fjjrg

https://x.com/mostofajaman55/status/1902775219867226386