Steem/USDT Scalping – Mastering Short-Term Trading Strategies

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Mastering Short-Term Trading Strategies. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

1️⃣ Question 1: Understanding Scalping in Steem/USDT

Explain the fundamentals of scalping and how it differs from other trading strategies like day trading and swing trading. Discuss why Steem/USDT is a suitable (or unsuitable) pair for scalping.

Scalping is a short term trading strategy. This focuses on the quick profits by using the small movements in the price. The traders use this approach to make profits on multiple trades. They do not hold their positions for the long term. But scalping is not easy it requires precision, speed and good understanding of the market movements. If a trader does not have a good understanding of the market movements then scalping is hard for that trader.

Fundamentals of Scalping

Scalping is a high frequency trading strategy. In this strategy the traders enter and exit the trades in the seconds to minutes. They use small price movements.

Scalping depends upon the following elements:

- Rapid execution: Scalping requires rapid execution of the trades. The traders enter and exit the trades in a short timeframe.

- High trade volume: In the scalping the traders make multiple trades each session. Multiple trades are made to accumulate a good amount of profit.

- Minimal price movement: The scalpers take profit from the small changes in the price. They do not wait for the large trends but avail each small opportunity to get profit.

How Scalpers Profit?

The scalpers make profit in these ways:

- Exploiting bid-ask spreads: The scalpers are very smart and they use bid and ask spreads. They buy at the bid price and then sell their assets at the ask price. They get profit from the difference in the price.

- Using leverage: There are also many scalpers who use leverage to generate profits from the small movements of the price.

- Identifying micro trends: The scalpers always try to find the micro trends for the execution of successful trades. They use technical indicators such as moving averages, RSI and order book depth to predict the price movements.

Scalping vs. Other Trading Strategies

Here I have combined different trading strategies to compare them with scalping to easily understand the difference of those with scalping.

| Strategy | Trade Duration | Profit Target | Number of Trades | Risk Exposure |

|---|---|---|---|---|

| Scalping | This is executed in seconds to minutes. | The targets are very small which are easily achievable in seconds to minutes | There are many trades per day | The risk factor at each trade is less because of trading on the small movements |

| Day Trading | It is carried out in minutes to hours | Profit target in this strategy is moderate | In this strategy a few to several trades are executed per day | Risk factor is also moderate in this strategy |

| Swing Trading | This is longer than scalping and day trading. It is a day to weeks strategy | Profit target is large | A few trades per week are executed | Risk is high because of the market exposure. |

Key Differences

Here are some key differences between these trades:

Timeframe: Scalping uses a very short term timeframe for trading. The day traders can hold their positions for hours and the swing traders hold their trades for the days.

Profit Per Trade: The scalping gives small profits on a number of trades. Day traders look for normal larger profits than scalpers. The swing traders look for the large profits over an extended timeframe.

Number of Trades: In the scalping dozens or hundreds of trades are executed on a daily basis. The day traders pick some trades in a day. On the other hand the swing traders do only a few times a week.

Risk and Stress: Scalping needs quick decision making. It has high stress levels. Day trading has moderate stress levels. But the swing traders take more time for the analysis to cope with the risk. It has low stress levels.

Suitability of Steem/USDT for Scalping

Scalping works best in those markets which have high liquidity, tight spreads and frequent movements of the price. I will analyse Steem/USDT scalping on these elements:

Potential Advantages

Here are some potential advantages which explain that why Steem/USDT may be a good coin for the scalping:

Liquidity

- If Steem/USDT has high trading volume in the market then it allows the traders to enter and exit positions quickly without significant slippage.

- Low liquidity of Steem/USDT can make this quick trading hard and the scalpers will not be able to execute trades at their desired prices.

Volatility

- Scalping goes wonderful in the volatile market because the price fluctuates frequently and the scalpers take benefit from this sharp fluctuation.

- If Steem/USDT has frequent price swings then it provides scalpers with multiple opportunities to take profit within the short timeframes.

Low Spreads

- A tight bid-ask is very important for the scalping. Because it ensures that profits are not eaten up by the large price differences between buying and selling prices.

- All the exchanges which have low spread of Steem/USDT the scalpers can make quick trades with the minimal losses.

Technical Indicators Work Well

- The scalpers use different indicators such as moving averages, Bollinger Bands, MACD and RSI.

- If Steem/USDT follows technical patterns consistently then it becomes easier to predict the short term price movements in the market.

So if Steem/USDT pair follows all the above perks then it can be a good option for the scalping.

Potential Disadvantages

Here are some potential disadvantages why Steem/USDT may be unsuitable for scalping:

Market Depth Issues (Can Cause Slippage)

- If there are not enough buy/sell orders in the order book then the execution of the large trades can cause slippage issues. In this case the actual execution price is worse than the expected.

- Scalpers rely on the fast execution of the trades. And if there is slippage then it reduces the profit from the trades.

Exchange Fees

- As in the scalping there are a lot of trades and for each trade the trader has to pay a fees to the exchange. These high trading fees can eat the profit of the trades.

- Some exchanges charge a percentage per trade. This can be costly for the scalpers who execute dozens of trades per session.

- So the scalpers should for those platforms which have low trading fees or fee discounts for the high frequency traders.

Risk of Price Manipulation

- If Steem/USDT has low liquidity then the large orders from the big traders such as whales can easily manipulate prices in the market.

- Scalpers could get caught in fake price movements and suffer losses.

Exchange Stability & Speed

- Scalping always requires instant execution of the orders.

- If an exchange has delays, downtime, or lag in the trading then it can lead to miss the opportunities. It can also cause bad executions.

Best Practices for Scalping Steem/USDT

Here are some best practices which can be used for the scalping:

- Choose the right exchange.

- Use technical indicators.

- Use limit orders instead of market orders.

- Manage your risk.

- Use trading bots for the automation.

Steem/USDT can be a good pair for scalping but the suitability depends on the conditions of the market. The scalpers should analyze the liquidity, volatility, and trading fees before starting the trades. Proper risk management and the use of the right tools is very important for the success in scalping.

2️⃣ Question 2: Best Indicators for Scalping Steem/USDT

Analyze technical indicators that are useful for scalping Steem/USDT. Provide examples of how RSI, MACD, Bollinger Bands, or Moving Averages can help traders make informed scalping decisions.

In scalping the traders needs precise and fast decision-making. The right technical indicators help the traders to identify the entry and exit points. They help them to measure the momentum of the market and mange the risk effectively. Here are some of the best indicators for scalping Steem/USDT with examples of their application:

1. Relative Strength Index (RSI)

This is a famous indicator and widely used in the technical analysis. The RSI indicator measures the speed and magnitude of the movements of the price. It indicates the overbought and oversold conditions in the market. When the value of RSI is above 70 then it is an overbought condition. When the value of RSI is less than 30 then it is the oversold condition. It helps the scalpers to spot the short-term reversals in the market.

How RSI Helps in Scalping Steem/USDT

RSI helps to identify the following opportunities in the market to execute the trade accordingly:

Overbought Conditions: If RSI is above or near 70 then it is overbought condition in the market. It is possible that Steem may be due for a short term pullback. At that point the scalper can sell the assets and book profit.

Oversold Conditions: If RSI is below or near 30 then it is oversold condition in the market. It is possible that Steem could bounce back from this point. This is a buy signal for the scalpers to take entry.

Divergence Signals: RSI helps the traders to identify the divergence signals to move correctly in the market.

Bullish Divergence: If the price is making lower lows in the chart but the RSI is making higher lows then it is the bullish divergence which suggests a buying opportunity. It helps to identify the next move before it happens.

Bearish Divergence: If the price is making higher highs in the chart but the RSI is making lower highs then it is the bearish divergence which suggests a selling opportunity. It helps to identify the next move before it happens.

Here in the chart I have highlighted the different conditions in the market on the basis of the RSI indicator. We can observe that when the RSI indicator reaches near or below 30 then it is an oversold condition and it gives a buying opportunity to the scalpers. The scalpers can take entry in the market from this point.

On the other hand when the RSI indicator reaches near or above 70 then it is an overbought condition. This gives opportunity to the scalpers to sell their assets to lock the profits. After this they can wait some moments to take another entry when the price touches the support or when there is an oversold condition.

In the chart we can see that each oversold is followed by a overbought means RSI indicator is good at the determination of the market movements. By following the oversold and overbought condition in the market with the help of the RSI indicator the scalpers can make profit in minutes.

While scalping the traders should use short period such as 7 or 9 instead of the default value which is 14 for the faster signals.

2. Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence is a technical indicator to analyse the trends of the price and the momentum of the market. It follows the trends and helps the traders to identify the entry and exit points. The MACD indicator consists of:

- MACD Line which is a 12-period EMA - 26-period EMA.

- Signal Line which is a 9-period EMA of MACD.

- Histogram is the difference between MACD Line and Signal Line.

It helps scalpers identify trends and momentum shifts in the market.

How MACD Helps in Scalping Steem/USDT

It provides different opportunities in the market with different signals and indications:

Bullish Signal: When the MACD line which is by default a blue line of the MACD indicator crosses above the signal line which is represented by the orange colour then it gives a bullish signal. It is the buying opportunity.

Bearish Signal: When the MACD line which is by default a blue line of the MACD indicator crosses below the signal line which is represented by the orange colour then it gives a bearish signal. It is the selling opportunity.

Histogram Strength: The rise in the shape of the histogram represents and confirms the string momentum of the trend and it supports the trading decisions.

In this chart we can see that whenever the MACD line is crossing above the signal line then the market is moving in the upward direction means when the MACD line crosses above the signal line then it is a buying opportunity for the traders.

Similarly when the MACD line crosses below the signal line then the market is moving in the downward direction. So when the MACD line crosses below the signal line then it is the selling opportunity for the traders. The trader can sell their assets and lock profits moreover the trader has the opportunity to take a short entry. In this way the traders can use the MACD indicator to determine the entry and exit points for the scalping.

When the market is moving in the either direction then depending upon the intensity of the movement of the price the magnitude of the histogram changes.

While scalping with the help of the MACD indicator use shorter MACD settings such as 6, 13,5 instead of the default 12,26,9 for the faster reaction and precision.

3. Bollinger Bands

Bollinger Band is also technical analysis indicator which uses the simple moving average and the standard deviations to asses the volatility of the market and to identify the trading opportunities.

Bollinger Bands consist of:

- Middle Band: 20-period Simple Moving Average (SMA).

- Upper Band: Middle Band + 2 Standard Deviations.

- Lower Band: Middle Band - 2 Standard Deviations.

These components of Bollinger Bands help the scalpers to identify volatility and price reversals in the market.

How Bollinger Bands Help in Scalping Steem/USDT

When the price touches the upper band then it represents overbought condition and the price reverses from this point. It is the sell opportunity for the scalpers and other traders.

When the price touches the lower band of the Bollinger Band then the price bounces back. It is the buying opportunity for the scalpers and they can take entry to make profit.

If the band of the Bollinger Bands contracts then the breakout in the market becomes imminent. The scalpers can prepare themselves for the rapid movement of the price and they can trade accordingly. The gap between the bands represents the volatility in the market.

Here we can see that whenever the price touches the lower band the price bounces back and rise in the upward direction. The scalper can take buy entry in the this situation when the price touches this lower band. The gap between the upper and lower band is the volatility of the market.

Similarly when the price touches the upper band it is reversing back. So it is a sell opportunity for the scalpers when the price touches the upper band. The SMA blue line can be used for the confirmation of the trend. When the price rise above or below the trend is confirmed.

For the short term scalping use Bollinger Bands (10, 2) instead of the default values (20, 2) for the quick signals and timely decisions.

4. Moving Averages (MA & EMA)

Moving Averages are the technical indicators which smooth out the action of the price and they help to identify the trends in the market. There are different types of moving averages:

Simple Moving Average (SMA): This indicator provides the avearge of the closing prices prices over a specific time period.

Exponential Moving Average (EMA): This moving average indicator focuses on the recent price changes and it is faster than SMA.

How Moving Averages Help in Scalping Steem/USDT

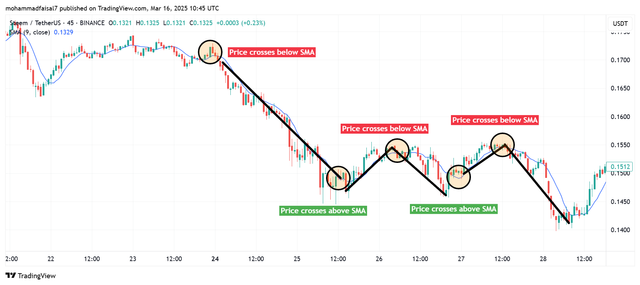

I will use SMA (Simple Moving Average) indicator to show how this can help in scalp trading.

Here the blue line is the simple moving average. Whenever the price crosses above this SMA line then the market price goes in the upward direction. This can be used as a buying opportunity for the scalpers. They can buy when the price crosses above the SMA line. This crossover is also known as bullish crossover.

Similarly the chart pattern shows that when the price crosses below the SMA line then the market price goes in the downward direction. This is the selling signal for the scalpers to lock their profits and to take a short entry. This crossover is also known as the bearish crossover.

The scalpers can also use more than one indicator at a time for the confirmation of the trends in the market. So in this way the scalpers can use technical indicators to make their scalp trading decisions.

3️⃣ Question 3: Developing a Scalping Strategy

Design a step-by-step scalping strategy for Steem/USDT, detailing entry and exit points, position sizing, and stop-loss placement. Illustrate how traders can efficiently execute multiple trades.

I will design the scalping trading strategy with the help of these indicators:

- RSI

- Bollinger Bands

But to use these indicators I will setup a scalp trading environment for the successful scalp trading:

- I will use 5 minutes timeframe for the chart.

- I will use RSI at 7 periods.

- I will use Bollinger Bands at the length of 10 with standard deviation 2.

The scalp trading environment is setup completely and now I will move on further to design the entry, exit, take profit and stop loss levels while taking into account position size.

In this chart with the 5 minutes timeframe I am using Bollinger Bands and RSI indicators. We can see that the RSI indicator is giving value below 30 which is the extreme oversold point. The oversold suggests a bounce back in the price and it is a potential buying buying signal. On the other hand if we see the Bollinger Bands we can confirm the entry point because the price is also touching the lower band. When the price touch the lower band and the RSI value is below 30 then as a scalper we can take a long entry. In the scalping the risk is higher so please use 1 - 2% of total capital. Here we can take entry at $0.1300.

If we want to take a short entry then we need to watch the RSI value above 70 and the price touching the upper band. Because these two things confirm the bearish trend in the market.

When the value of the RSI indicator rises from 50-60 and ultimately reaches 70 then this pushes the price towards the overbought condition. We should look the chart pattern carefully and if the price touches the upper band then we should exit the trade and we should book our profit from the trade. We can see that the price rose upto $0.1311 and it touch the upper band. It is the point where we need to exit the long trade to lock the profit and prepare ourselves for the next buy entry.

For the proper risk management it is important to set up a stop loss. We should set stop loss at the level of around 0.5 - 1%. If the price moves below the lower band of the Bollinger Band then it alarms a loss and risk. To avoid potential loss and risk of loosing all the assets we should set a stop loss level at 0.5% and 1%. In my strategy I will go to set a stop loss for the 50% assets at 0.5% and for the remaining 50% at 1% below the entry point. This strategy will help to accumulate a small shakeout in the market and while bouncing back it will give profit if all the stop loss points are not hit.

Keep in mind that we should always use credible exchanges for the fast execution of the trades with precision and without high slippage.

Then the trader should wait for the other entry point and then he can follow this process again and again to execute a number of multiple trades. As this trading is carried in low timeframe so it gives trading opportunities early and in a fast movement.

Use mix of the indicators for the confirmation of the trend. Use limit orders and avoid market orders. Do not be greedy and stick to 1% to 3% profit and revise your strategy. One more important thing to remember is to avoid revenge trading but use disciplined trading. Monitor the depth of the order book to avoid the liquidity issues. Scalping works greatly in the more volatile market.

4️⃣ Question 4: Risk Management in Scalping

Discuss the risks associated with scalping and explain how traders can mitigate losses, manage leverage, and avoid liquidation risks when scalping Steem/USDT.

Risk Management in Scalping Steem/USDT

In scalping the traders execute multiple trades with the small targets of profit. But scalping comes with the risks because of the fluctuations in the market. The market is always unpredictable but with careful risk management the traders can stand out in the market. There are also high transaction costs and the use of the leverage. So it is very important to manage the risk effectively for the long term success in scalping Steem/USDT.

Key Risks in Scalping Steem/USDT

There are a number of risks associated with the Steem/USDT. These risks are given below:

High Market Volatility

Market volatility is a key risk in trading. Steem/USDT can experience rapid swings. These rapid changes in the price make it difficult to execute the trades a desired prices.

The sharp price reversals can trigger the stop loss orders before the movement of the price in the desired direction.

To avoid this risk of volatility in the market we need to follow these steps:

- Trade only during the high liquidity sessions such as when the market of Steem/USDT is volatile.

- Do not do scalping during the news events such as those announcements which has high impact on the economy.

- Continuously monitor the order book and the volume because thin liquidity can lead to slippage.

Slippage and Execution Delays

Slippage is also a problem. It occurs when there is a difference between the expected and actual execution price. When the market is moving quickly then the market orders can result in a much worse entry and exit points.

Here are some steps to manage the risk occured by the slippage:

- Use limit orders instead of the market orders for the precise entries in the market.

- Use the exchange which has fast execution speed such as Binance.

- Try to trade those trading pairs which have tight bid-ask spreads to minimize the slippage.

Over-Leveraging and Liquidation Risk

The use of leverages impacts the gains and losses. If we use high leverage in scalping then we are at great risk. If a trader uses 10x leverage and the market moves by just 10% against the position then there will be a total loss.

The small movements of the price in the wrong direction can lead to margin calls or direct liquidation.

Here are some factors to mitigate the risk of high leverage:

- Use low leverage while scalping such as 2x to 5x instead of using high leverage such as 10x to 20x.

- Always set a stop loss such as 1% to 2% risk perctrade in scalping.

- Use healthy margin levels by ensuring extra funds in the account to avoid liquidation.

Trading Fatigue & Emotional Trading

Scalp trading requires constant attention and fast decision making. It involves emotional decisions like revenge trading after s loss. It can lead to impulsive trades.

Here are some important points which can help to manage the risk in scalping because of the emotional trading:

- Set a fixed number of trades per session like 5 trades per day.

- Take breaks after the consecutive losses to avoid the emotional decision making.

- Make a strict trading plan and always follow your plan and avoid chasing the trades.

High Transaction Costs

As scalping involves a number of frequent trades so it faces the problem of high trading fees. These high and repetitive trading fees can eat the profit. If the scalpers use market orders then they face higher transaction fees than the limit orders.

Here are some points which can help to manage the risk of high transaction fees:

- Use limit orders to reduce the fees of takers.

- Choose those exchanges which offer fee discounts for the high volume of trades and implement less fees than other exchanges.

- Use those exchanges for the trading which have low cost structures such as Binance.

Effective Risk Management Strategies for Scalping

Here are some effective risk management strategies:

- Do not take risk more than 1% to 2% out of your total capital per trade.

- Use stop loss and take profit levels. Here is an example:

| Trade Type | Entry | Stop-Loss (Risk) | Take-Profit (Reward) |

|---|---|---|---|

| Long (Buy) | $0.145 | $0.143 (1.3%) | $0.148 (2%) |

| Short (Sell) | $0.152 | $0.154 (1.3%) | $0.149 (2%) |

- Place stop loss on the key support or resistance levels.

- Maintain a risk to reward ratio of at least 1:1.5.

- Diversify your trading times and strategies. Trade when the blend of indicators confirm the breakout or reversal.

- Use correlated trading pairs such as Steem/USDT vs BTC/USDT.

- Take partial profits at key levels such as exit 50% at 1% gain and rest at 2% gain.

- Track all of your trades and compare your trading strategies with respect to profit and loss.

By following these risk management techniques scalping of Steem/USDT or any other pair can become profitable. These can help to reduce the risks.

5️⃣ Question 5: Real-World Scalping Case Study

Analyze a real or hypothetical scalping scenario involving Steem/USDT. What were the key takeaways? How did the trader adjust to market conditions to optimize performance?

I will analyze a hypothetical scenario for the scalping of Steem/USDT. Here is the overview of the hypothetical scenario:

A trader decides to scalp Steem/USDT on Binance exchange. He decides to use 5 minutes timeframe. He uses the combination of RSI, Bollinger Bands and Moving Averages for the identification of the different trends of the market.

His goal is to execute multiple trades in a session of 2 hours. He determines the risk reward ratio of 1:1.5 while keeping the risk perctrade trade at 1% of the total capital.

Trade Setup and Entry Strategy

Here is the trade setup and the strategy for taking entry:

Current price of Steem/USDT is $0.145 and the market sentiment is bullish with strong momentum. The Bollinger Bands indicator shows the price bounces from the lower band. RSI is also showing an oversold condition as it is below 30. The price is crossing above the EMA-20 and it confirms the bullish momentum of the price.

He executes the trade while entry at $0.145 and sets stop loss at $0.143 which is -1.3% below the recent support level. He set the take profit target at $0.148 which becomes 2%. Price is rebounding from the support with the confirmation of RSI and EMA. It suggests a short term bullish movement.

Suddenly the price spikes after 10 minutes to $0.1475 very close to the target level. Instead of waiting for the full tak e profit level the trader exits 50% of the position and locks profits. He secures the remaining 50% position by using trailing stops at $0.146 to ensure no loss.

Then the price retraces to $0.146 after hitting $0.248 but it does not break below EMA-20. RSI remains above 50 which confirms the continuous bullish momentum. So the trader takes a re-entry at $0.146 with a stop loss at $0.1445 and take profit at $0.149.

Here is the summary of the results of the trades:

| Trade # | Entry Price | Exit Price | Profit/Loss (%) | Notes |

|---|---|---|---|---|

| 1st Trade (50%) | $0.145 | $0.1475 | +1.72% | Partial TP |

| 1st Trade (50%) | $0.145 | $0.146 (trailing SL) | +0.69% | Secured profits |

| 2nd Trade | $0.146 | $0.149 | +2.05% | Re-entry |

The trader got a 1.5% portfolio growth in just 2 hours. The trader adjusted the trades according to the conditions of the market and achieved a good growth in the portfolio in just 2 hours.

Here are the key takeaways of this hypothetical scenario:

- Quick adjustments such as partial profit taking and trailing stops help to secure the gains.

- The use of the multiple indicators such as RSI, Bollinger Bands and EMA improves the accuracy of the trade.

- Re-entry in the market after the confirmation of the trend allows for the additional profits.

- Risk management strategy such as 1% per trade ensures the preservation of the capital.

This scalping strategy successfully adapted to the different conditions of the market while allowing the trade to lock early profits, re-entering on confirmation and managing the risk effectively. A well planned approach minizes the losses while maximizing the number of winning trades.

https://x.com/stylishtiger3/status/1901281589621113158