Volatility Trading: Strategies for the Dynamic Steem/USDT Market

In the financial market particularly in cryptocurrency trading, which is known to experience sharp movements in price often, Volatility plays a very important role in this scenario, and understanding the volatility metrics and leveraging them can assist traders in capturing opportunities, managing risks, and making informed decisions. In this post, I will explore some of these effective strategies for trading Steem focusing more on volatility indicators, range-bound, and breakout strategies, and managing trading psychology in high-volatility scenarios.

Understanding Volatility Metrics

The volatility metrics are metrics that measure the degree to which the price movements vary over a specific period, this provides a good insight of the market dynamic for traders. There are some commonly used metrics, which include Bollinger Bands, Average True Range (ATR), and historical volatility.

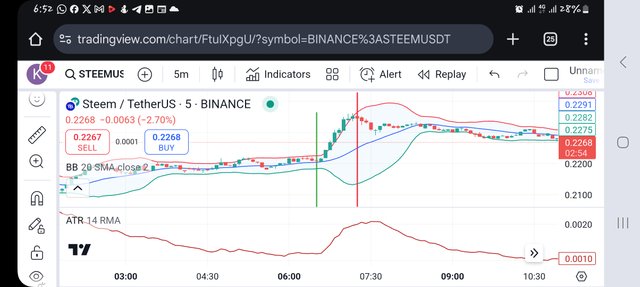

1. Bollinger Bands: this consists of two standard deviation bands and a moving average, it helps a trader identify the oversold and overbought conditions. A simple example of the Bollinger Bands indicator is, if the Steem/USDT trades at $0.20 making the indicator narrow, this shows that the volatility is reduced but If a breakout occurs beyond these bands that were narrowed, it indicates a price surge or drop which creates an actionable opportunity for the trader.

2. ATR: this indicator offers insight into the market volatility by reflecting the average price range of crypto over a given period of time. In recent days, the Steem/USDT's ATR has increased from $0.02 to $0.05 and this suggests a heightened in price swings, letting the trader know that they can adjust their stop-loss placements.

3. Historical Volatility: this is simple, it measures the past price volatility. Let's take for instance last month, the historical volatility of Steem/USDT rose to 70%, what does this tell us, this just highlighted the potential for a large price movement that will attract short-term traders to the market.

So from the chart above, you can see that the Bollinger Bands were narrowed at the arrow point indicating that the volatility is reduced at that period but as you can see ahead the Bollinger Bands were widened indicating that there was a surge, that is, the price movement rose. Also when you look at the ATR, it shows the average price range which increased, letting the trader know that they can adjust their stop-loss placement.

Designing a Range-Bound Strategy

This strategy allows traders to trade within clear and defined support and resistance levels, it helps traders take advantage of predictable prices that oscillate during periods of low volatility. A support level represents the downside of price where demands are strengthened while resistance levels act as the upside where the selling pressure is intensified. This enables the trader to enter a long position near the support level and a short position near the resistance level. This strategy can be applied to the Steem/USDT price market. Let's take a look at a few weeks back, the Steem/USDT price oscillated between $0.20 to $0.24. so a trader that bought at $0.20 and sold near $0.24 was able to leverage on defining his range. However, using RSI to confirm the over-sold conditions at the support level ensures that there is precision in his entries.

Risk Management: Understanding the principles of risk management helps a trader mitigate the risk of unexpected breakouts. If the trader is able to place a Stop-loss order below a support level of $0.16 or above a resistance level of $0.27, he is limiting the possibilities of attracting unexpected breakouts, and also the position sizes will help manage the losses when the market is in the Volatility period.

Capturing Breakouts with Volatility

Volatility is usually triggered by Breakouts and this occurs when there is a significant price movement established beyond support and resistance levels. To predict a potential breakout, the Bollinger Bands widens or the ATR spikes signal heightens. Let's take for instance, earlier this month when the Steem/USDT surge occurred, where the price increased from $0.20 to $0.27 after breaking resistance at $0.23, traders were able to use the breakout strategies to get more profit by entering positions immediately they confirmed and were also able to set their targets based on ATR. However, there can still be risks to this, and managing it is also very important, this can be done by trailing the Stop-loss orders which can help during volatile movements. Also, the traders have to be sure of the confirmation candles to avoid placing an entry when there is a false breakout.

In the chart above, from the Bollinger Bands indicator, you can see the point where the breakout was about to begin. The green line indicates the entry point, and the red line shows the exit point, which means the breakout isn’t going to be profitable to the trader anymore.

Adapting to Volatility Spikes

Volatility spike is usually triggered by news events or macroeconomic shifts and this tends to occur when there is extreme market movement. Traders are expected to adopt this strategy for them to be able to manage heightened risks. A few weeks back, the regulatory announcement made on the Steem/USDT's price caused a spike in market price which rose from $0.20 to $0.30 before it retraced. Traders that seized this opportunity by widening their stop-losses and reducing their position sizes mitigated their potential losses from abrupt reversals. There are few practical tips that traders can use when faced with a volatility spike, they are:

Firstly, Use the ATR indicator to help adjust the stop-loss level and accommodate larger price movements. Secondly, trade with smaller positions so as to limit any exposure. lastly, go for options that would reduce potential losses during periods that are unpredictable.

Evaluating Volatility’s Impact on Trading Psychology

The psychology of traders can be influenced by the volatility of the market and this amplifies the emotions of traders making them show some responses. these responses are:

- Fear: this shows when there is a sharp price drop in the market, this can make the trader exit prematurely making him incur some losses.

- Overconfidence: this comes in when the trader feels that the success he gets during a volatile period is as a result of excessive risk-taking, this can destroy a long-term profitability.

- Greed: this response comes in when a trader chases profits during a rally making him over-leverage and increasing risk.

However, there are some practices that can help the trader maintain the psychological impact of the market volatility.

- Making sure that they set clear profit and loss targets so as to avoid impulsive decision-making.

- Leveraging mindful techniques that can help manage stress.

- Lastly, reduce risk by following a predefined strategy during periods of high volatility.

Traders who adhere to their plans and stop-loss levels will definitely escape panic-selling when there is a dip, help protect their capital, and coordinate their emotions too.

In conclusion, volatility in the cryptocurrency world is like a double-edged sword, It is very important that traders master volatility tools like Bollinger Bands and ATR and by doing this, they are able to develop effective range-bound and breakout strategies while trading. However, Maintaining emotional discipline when there is a volatility spike will surely help traders achieve long-term success.

All Images were taken by me