Steemit Crypto Academy Season 4 Week 6 [Advanced Course] | Investment through Private and Public Sales

Introduction

It's my pleasure to welcome you all to yet another session of learning at the Academy. Season 4 of the Academy has been running swiftly and it has entered week 6. Let's take a ride together as we take a look at another course for the week.

Background to the Study

Last week, we talked about Crypto assets diversification which is one of the investment strategies employed in crypto trading to effectively manage one's portfolio and control the capital invested into each asset to be at the safe side of investment, and we discussed the tools/strategies involved to effectively practice CAD. Of course, Crypto assets diversification comes with its good side of which one of it is risk mitigation and the other side of it can be reduced return on investment.

We can see that the investment strategy earlier mentioned is carried out on different centralized exchanges of choice (Binance, Huobi Global, Poloniex, Kraken...) where the assets selected by individual students are being listed for trading. There is an opportunity for an investor to put his/her resources into some assets even before they are listed on exchanges of choice and that leads us to the discussion for the day Investment through Private and Public Sales.

Made in Canva

Overview of Crypto Investment

Many financial sectors have different products which investors put their resources into in the quest to make some profits maybe for short term/long term purposes, likewise, the Crypto ecosystem comes with different investment types and this all depend on the user preference as a trader can choose to invest in an asset to make a profit quickly (short term) or through holding (HODL) the assets for some time after they are satisfied with the performance of the asset in question.

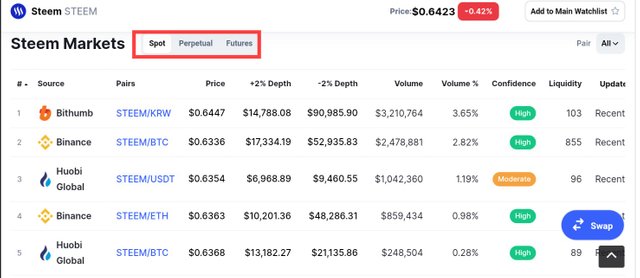

Mostly, the method of crypto investment (short term/Long term/Hodl) mentioned above depends on the user who has carried out his/her analysis on the assets. In addition, various tools could help a trader to track the information about any asset they are trying to invest into, notably, we have the CoinMarketCap which gives the user the needed information about the asset of choice. There are many other tools as well. Take, for instance, I am interested in investing in STEEM, I can easily check its information on CoinMarketCap and other tools.

STEEM Markets on CoinMarketCap

The image above shows the available steem markets, specifically, I have explored the spot market and one can look into other steem markets under perpetual and futures. From the above, the trader would be able to know where to find the asset of choice and easily invest in it but note that they are only available when the asset has been listed somewhere. Now even before listing takes place, you can still gain access to some new tokens and position yourself for making huge returns, and this can be achieved through participation in Private/Pre/Public Sales.

Private/Pre/Public Sales in Cryptocurrency

You must have heard about ICO (Initial Coin Offering)/ IEO (Initial Exchange Offering) but many don't know that sometimes a form of initial coin offering is being carried out in different phases and this is exactly what we will be looking at in this section.

Private Sale

Private sale can be considered as the first phase of an initial coin offering and in this case, a new token issuer invites suitable investors to participate in the token offering. These tokens ain't listed anywhere yet but they are new projects, investors are invited to buy a certain portion of the available supply for private sale and the funds generated in this are used by the token issuer to facilitate their project on the blockchain.

The fact about Private sales is that the token price as presented to the investors is very cheap and in this case, investors opened themselves to preserving value for their money and expectant of huge profits when the project finally comes live. Another thing to know here is that, sometimes, private sales also come in stages, for example, Private sale 1, Private sale 2, and so on.

Presale

This is the second phase of the initial coin offering which comes with more publicity, inviting more investors to participate. Presale is also a fundraising method employed by the token issuer, as such, tokens are sold at discounts and it results in a win-win when the project finally hit completion on the blockchain. Additionally, it allows investors to commit their assets in exchange for the new token and at a reduced price as compared to the price it would be sold when the token enters the public sale stage.

Public Sale

Public sale is the last phase of initial coin offering where public call on investors to participate in the fundraising is made bigger as compared to the Presale phase. Generally, in this phase, investors get less discount on the price of the token as compared to the first two phases and it's typically the end of the fundraising as the token would be closer to listing on an exchange where it would be available for trading.

There are risks involved in participating in this kind of investment, yet, the public sale which is the last phase is less risky as compared to the risk of the investors that participated in the first two phases. We would talk about the risks involved in participating in Private/Pre/Public Sales later in this content.

Mediums used for Private/Pre/Public Sales

Issuer's website

Most of the token issuers utilize a designated website for the process of fundraising. In this case, investors exchange their crypto assets (Bitcoin, BNB, ETH...) to purchase a certain quantity of the new token at a rate depending on the phase of the initial coin offering. The quantity of the new tokens to be credited to the investor's account solely depend on the price of the token's sale phase and the amount of the assets committed to the fundraising .

For instance, if I entered the presale when the token is being issued at 0.05 USD, and I am purchasing the token with 0.005 BTC (~ 272 USD), then I will be getting 5,440 of the token.

Crypto Launchpad

Basically, crypto launchpad refers to the platform which is used for fundraising for a new project. This medium is usually used by crypto exchanges to carry out IEO (Initial Exchange Offering)/IDO (Initial DEX Offering), for public sale of a new token in the quest to raise funds for the project and as well enable investors to buy a place for themselves before the token is available for public trading.

A popular example of crypto launchpad is the Binance Launchpad, this is a platform on the Binance exchange for public sale of tokens whereby investors get a share in the public sale based on their commitment in the subscription, you will understand better what it means to commit ones asset on launchpad as we progress in this section. The newest project on the Binance Launchpad is the Beta Finance (BETA) where users are required to commit a certain amount of their BNB in subscription for the token sale. Let's take a look at how the Binance Launchpad works.

On a new project on the Binance Launchpad, assuming I am subscribing to the public sale with 5 BNB and other users participating committed 200 BNB with the total supply of 20,000, 000 of token A available in the public sale. Let's see the calculation below.

The expected token A to be received by me after the subscription period = (My Commitment / Total Commitment) * Total supply available in the public sale,

Therefore, (5/205) * 20,000,000 = 487,804

From the above, after the subscription period, I will be getting 487,804 of token A from the public sale and that's approximate, 2.44% of the supply.

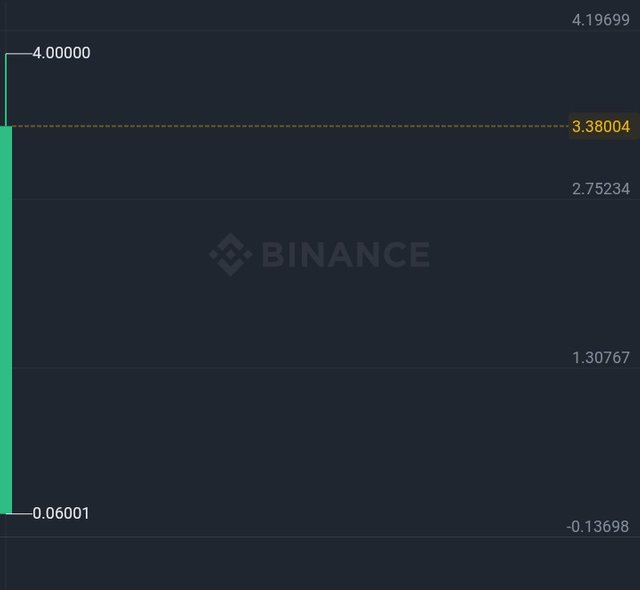

Earlier in this section, I mentioned the BETA token sale on the Binance launchpad, the token was offered at the rate of 0.06 USD for the participants in the sale. Let's take a look at the chart below.

Extract from Binance

Shortly after listing, the token's price moved up to as high as $4. You can see how profitable it is for the investors that participated. Imagine if I have acquired 50 BETA during the token sale based on my commitment and it's been offered at 0.06 USD, an equivalent value of 50 X 0.06 USD in BNB would be deducted from my committed BNB which is around 3 USD. When the price moved up, then I will be having 50 X 4 USD which is 200 USD, and that's 197 USD profit. That's how investors position themselves for taking profit from such token sales, although, there is Hard Cap per User which keeps users within a limit as specified in the contract and getting an attractive allocation solely depends on the weight of your commitment, take note of that.

Benefits of Private/Pre/Public Sales in Cryptocurrency

Risks of Private/Pre/Public Sales in Cryptocurrency

Crypto Listing after Public Sale

After a successful Private/Pre/Public sales, then, the token can look forward to listing on an exchange (CEX/DEX). Listing of crypto assets is not just done anyhow, the asset in question must have met the requirements for listing on the exchange. If the targeted exchange is pleased with the claims of the issuer then the token may be considered for listing and it would be available for trading in the crypto ecosystem. For IEO, tokens are listed on the exchange that host the event immediately after the subscription period.

Likewise, projects consider listing on crypto tools (having thousands of assets listed for investors' ease of tracking) such as CoinMarketCap, CoinGecko and so on. The project might have applied for listing before and this earns it untracked listing, as active trading on an exchange is one of the criteria required to be fulfilled for tracked listing. After a successful listing on the tools, the token details becomes discoverable by the public as this platforms provide all the needed information to track crypto assets listed on them and this enable users to make decisions as regards investment in any crypto asset.

Conclusion

In conclusion, Private/Pre/Public sales are very beneficial to both the issuer and investors as it helps the project to raise the funds needed to complete the project on the blockchain and allow investors to position themselves for a huge return on their investment.

The process is often tagged with general terms like ICO (Initial Coin Offering or IEO (Initial Exchange Offering)...). As much as it sounds profitable to investors, they should be aware of the risks involved in this type of investment and proper research is required to be carried out before investing. You shouldn't bother too much about IEO as the exchange has examined the project before taking it to the launchpad, you only need a trusted exchange to engage with.

I am glad to have you again for this week and I hope you have learned something today. Have a fruitful week ahead. Thank you.

Homework Task

i. Private Sale in Cryptocurrency.

ii. Presale in Cryptocurrency.

iii. Public Sale in Cryptocurrency.

Hello Prof. In the 1st question either we have to analyse the fundamentals and technicals of any coin to demonstrate an investment opportunity or something else?

Hello @chetanpadliya. The question is about giving an overview of what investment is like, in the crypto ecosystem and how the available tools would help one to make good decisions. You don't really need to pick any asset for in-depth analysis. Thank you.

Okay, thank you!

Interesting lecture professor.

Under the heading of crypto listing after public sale you have written public twice by mistake.

Oh, thanks for the correction.

👍👍👍

[WhereIn Android] (http://www.wherein.io)

Interesting topic. But your question 5, I don't know how helpful for us students to do, it's confusing. Are we to create a project?

Kindly explain please

It's an imaginary project which is expected of the students to create (your knowledge about crypto whitepaper would help here, don't bother about calculations and other technical parts of the whitepaper), give adequate information about the imaginary token and state its use case. And utilize your knowledge about ICO to organize an imaginary pre-sale, your research in question 4 would help.

Hmm. These questions are really going to birth ideas this week. It sure will be an interesting read. Another classic from you prof @fredquantum.

Sure, it will birth ideas and that would be proof of quality research, lol. Thank you.

Un tema muy interesante para esta semana profesor y del que podemos sacar mucho provecho.

Gracias por está interesante conferencia, Saludos

Thank you.

hello professor. In question 5 where we have to create an imaginary token, can we also talk about the imaginary blockchain on which this token operates?

Yes, you can.

Yes I did. Waiting in anticipation for your review

Thank you

Hi professor here is my entry link https://steemit.com/hive-108451/@mccoy02/investment-through-private-and-public-sales-crypto-academy-season-4-week-6-homework-post-for-fredquantum

Hi Professor @fredquantum this is my homework:

https://steemit.com/hive-108451/@oppongk/steemit-crypto-academy-season-4-s4w6-homework-post-for-professor-fredquantum-investment-through-private-and-public-sales

Saludos profesor, @fredquantum, aquí le dejo mi tarea para que me la evalúe, gracias.

https://steemit.com/hive-108451/@elio9604802/inversion-a-traves-de-ventas-publicas-y-privadas-crypto-academy-s4w6-publicacion-de-tareas-para-fredquantum