Crypto Academy / S5W2 - Homework Summary [Advanced Level] - Trading Crypto with Aroon Indicator

Introduction

It's my pleasure again to put down a piece in our dear Academy. The Steemit Crypto Academy season 5 is underway and the second week of the new season has ended. Last week, I delivered a lecture on Trading Crypto with Aroon Indicator and we received quite several great articles by unique authors in the Academy. This piece of article would be used to give a summary of how things went in the just concluded week. Let's get into it.

Designed in Canva

Overview of Aroon Indicator

Aroon Indicator is one of the technical indicators used most often by trend traders and it works in such a way that it identifies the existence of a trend (uptrend/downtrend), change in the existing trend, measures the strength, and as well serve the purpose of using its buy/sell signals that occur as a result of the crossing over that took place on its lines. We noted in the lecture that most version of the Aroon indicator comes with two lines while some are a single oscillating line.

The two lines of the Aroon indicator are Aroon-Up and Aroon-Down. The Aroon-Up indicates the movement of an asset in the upward direction (uptrend) and measures the strength of the uptrend, while Aroon-Down indicates the movement of an asset in the downward direction (downtrend) and measure the strength of the downtrend. The scale of both Aroon-Up and Aroon-Down is between 0-100 while we have the Aroon indicator with a single oscillating line to range between -100 -to +100. Let's take a look at some of the solutions to the task given.

Observations

I observed a few errors in the submission of some students and in this section, we would be looking at some of the solutions to the task especially for the ones that were not given in the lecture.

Aroon Oscillator

Aroon Oscillator is an indicator used by trend traders, in short, it's a trend-following indicator that measures the strength of the trend of an asset on the chart. As the name sounds, Aroon Oscillator, it has a single oscillating line that range between -100 and +100 to measure the strength of the trend, the + reading indicates the movement towards uptrend while - reading indicates the movement towards downtrend.

We have talked about how to calculate Aroon-Up and Aroon-Down, the Aroon oscillating line derives its value/movement from the difference between Aroon-Up and Aroon-Down to determine where the trend falls and the strength. In essence, the Aroon oscillator considers Aroon-Up minus Aroon-Down and the resulting difference is the Aroon Oscillator value which measures the strength of the current trend. In addition, 0 indication of Aroon oscillator means the mid-point where there exists a new trend underway. Let's see the Aroon Indicator on the chart below.

Aroon Indicator and Oscillator | Source- https://www.tradingview.com/chart/

In the chart above, I have separately installed Aroon Indicator and Aroon Oscillator on the chart, each at 25 periods. Looking closer at the chart, at a point where Aroon-Up is 0 and Aroon-Down is 32, at this same point, the value of the Aroon Oscillator is -32, this is not magic but simple mathematics. Remember, Aroon Oscillator = Aroon-Up - Aroon-Down, therefore, 0 - 32 equals -32. I hope you understand how the Aroon Oscillator works now.

What does the trend strength measurement at +50 and -50 Signify?

We would analyze this based on the Aroon Oscillator, remember, it has a single oscillating line which is the result of the difference between Aroon-Up and Aroon-Down, and the measurement of the trend is based on the output of the differences and on a scale of -100 - +100.

That said, let's take a look at some important readings of the oscillator and see what they signify.

- Mid-Point (0): The movement of Aroon Oscillator at 0 means existence of a new trend is underway.

- Cross over Zero: This is an indication that Aroon-Up is gaining more power over Aroon-Down and it signifies the beginning of an Uptrend.

- Cross below 0: This is an indication that Aroon-Down is gaining more strength over Aroon-Up and it indicates that a downtrend is on the way.

- +50 and -50: The +50 movement of the Aroon oscillator is an indication that the uptrend is winning and the trend is getting stronger while the -50 movement of the oscillator is an indication that the downtrend continues and it's getting stronger.

- +100 and -100: An indication of the Aroon oscillator at +100 (stays for some time) indicates a very strong uptrend experiencing higher highs, likewise, when the movement of the oscillator is around and stays at -100, it indicates that downtrend is winning and as such, lower lows would be seen.

From the analyses above, we have solved the problem in the task, that is, reading at +50 on the Aroon oscillator indicates that an uptrend is getting stronger and -50 indicates a stronger downtrend.

Originality

There are a few issues associated with some homework task entries as regards originality. When a task involves an equation or formula that is general, if you are unable to express the formula according to your knowledge, do well to quote such equations or formulas instead. Formulas of Aroon-Up and Aroon-Down written by some students clashed with others on the internet and that affected their marks as regards originality. Kindly take note.

Compliance with the Topic

It's important to comply with the topic and the homework task that is given, that would earn students full marks in that section. A few homework tasks received this week failed to comply with the task given. It will profit the students to read the questions properly before writing the solutions and even when they are done, students should go over again to check if he/she have satisfied the requirement of each question.

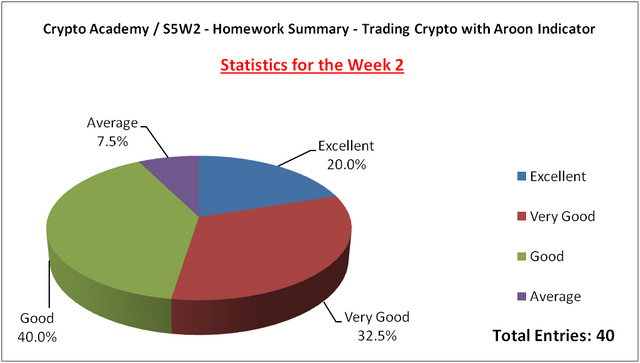

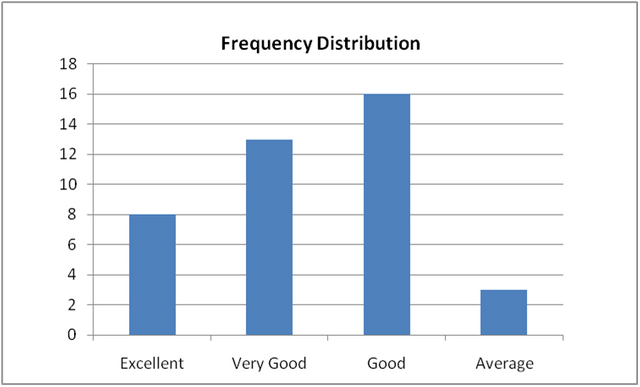

Statistics

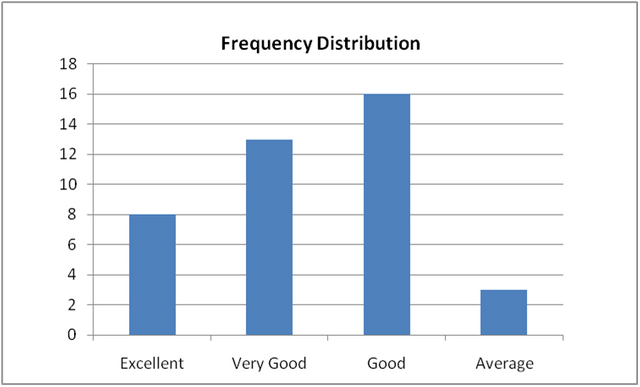

For the just concluded week, let's look at the statistics of participation in the lecture "Trading Crypto with Aroon Indicator", including the score distribution and performance of the total participants. A total number of 40 entries was received for the homework task, all the entries were reviewed timely. See the performance table below:

| Grade | Frequency |

|---|---|

| Excellent | 8 |

| Very Good | 13 |

| Good | 16 |

| Average | 3 |

| Below Average | 0 |

| Plagiarized Content | 0 |

| Invalid | 0 |

| Total | 40 |

Excellent represents grades within 9 - 10, Very Good for grades within 8 - 8.9, Good for grades within 6 - 7.9, Average for grades within 5 - 5.9, Below Average for grades below 5, Plagiarized are the contents that are found to have been copied from another source without proper reference and Invalid are incomplete articles/Users Powering down/Insufficient SP for the Advanced level. For this week, there are no records of below-average content, plagiarism, or invalid entries. Take a look at the charts below.

Top 3 Articles for the Week

| Rank | Author | Article's Link |

|---|---|---|

| 1 | @noshi | Link |

| 2 | @awesononso | Link |

| 3 | @drqamu | Link |

Conclusion

In conclusion, the percentage of excellent content received for the just concluded week is low as compared to the domination it used to enjoy. To make your homework task entry outstanding content and to even make it to the top, you must have tried something new, in short, creativity is highly needed. In addition, do not limit yourself to a few things we have discussed in the lecture, do more research, and present your entry with an overall clear structure. Also, take care of likely grammatical errors with Grammarly. I hope to see you coming back stronger in the coming weeks. Thank you.

Thank You Professor for selecting my post. It encourage and motivate me to create unique and creative content.

Congratulations!

Publishing content to a blog is perhaps the most established strategy for bringing in cash on the web. Individuals who love composing will quite often begin websites with a specialty center. For instance, a blog about lingering, vehicles, outsourcing, toys, and so forth, is regularly a limited sufficient concentration so you can fabricate a dependable after, yet large enough that you can cover a great deal of ground

My post is checked but didn't got the vote so i reposted it again kindly have a look.

https://steemit.com/hive-108451/@bassamjamal/repost-trading-crypto-with-aroon-indicator-crypto-academy-s5w2-homework-post-for-fredquantum