Crypto Academy Week 14 | Homework Post for [@stream4u]...Technical: Reverse Strategy | Crypto Prices & Market Source: Review Of COINGECKO

INTRODUCTION

Hello friends,

I'm glad to me among the participants of this week Cryptoacademy lessons, and I'm very much greatful to professor @stream4u , for his wonderful lesson on the topic : Technical: Reverse Strategy | Crypto Prices & Market Source: Review Of COINGECKO. In this topic I have learned very well in the aspect of CoinGecko which is the main reason I'm here to discussed about my homework task.

Technical Details On Reverse Strategy

Reserve Strategy is one of the strategy that is employed as a technical analysis of crypto to findout if price will retraces to previous resistance turned support, to become a bearish or bullish. With the help of technical details we can easily enter into trade. What this means is that Whenever a trader is to enter a trade very early, the trader might likely enter at the worst stage, when the trend become retraces in the market. At this point I can say that Reserve Strategy is the strategy that let traders to know when to be in control/charge of their trading performance.

How does Reverse Strategy works?

Reverse Strategy usually works when an investor has notices that a cryptocurrency is trying to become bullish or bearish, in such a way that it will keep traders waiting before it get to the stage of reversal before they can trade. It does work when each time the market is bearish for a buy order to be open before trader start buying. Normally investors can delay they trade if they notice that the price of assets about to get a point of bearish.

The Reverse Strategy work as a strategy that inform trader and allow them to be in charge of their buying of asset. In a reserve strategy when the market move to bullish or bearish it's advisable for the trader to paused for 24 hours and watch out to see how the price will become,high by +20% or -20%.

Displaying Reverse Strategy on BTC/USD Pair

For the purpose of this homework post I have make use of Coinmarketcap to BTC/USD pair to findout the reversal of bullish and bearish reversals with the help of the screenshot below.

About CoinGecko

We are going to know about CoinGecko features and also how helpful CoinGecko is in this post.

What Is A COINGECKO?

CoinGecko which started operating in 2014, is known to be one of the top sites for cryptocurrencies rice listing, where people traders get information regarding the performance of cryptocurrencies price, trading volume, the flow of price through the used of real time data starting from 1 hr to 1 w. CoinGecko was founded by TM Lee and Bobby Ong in Singapore.

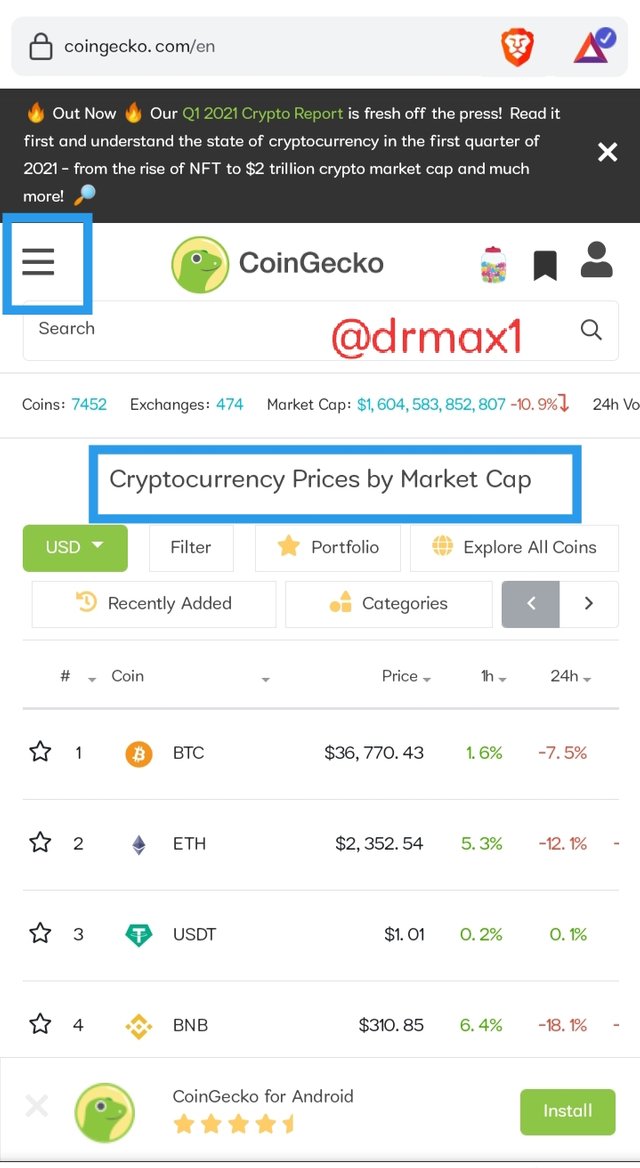

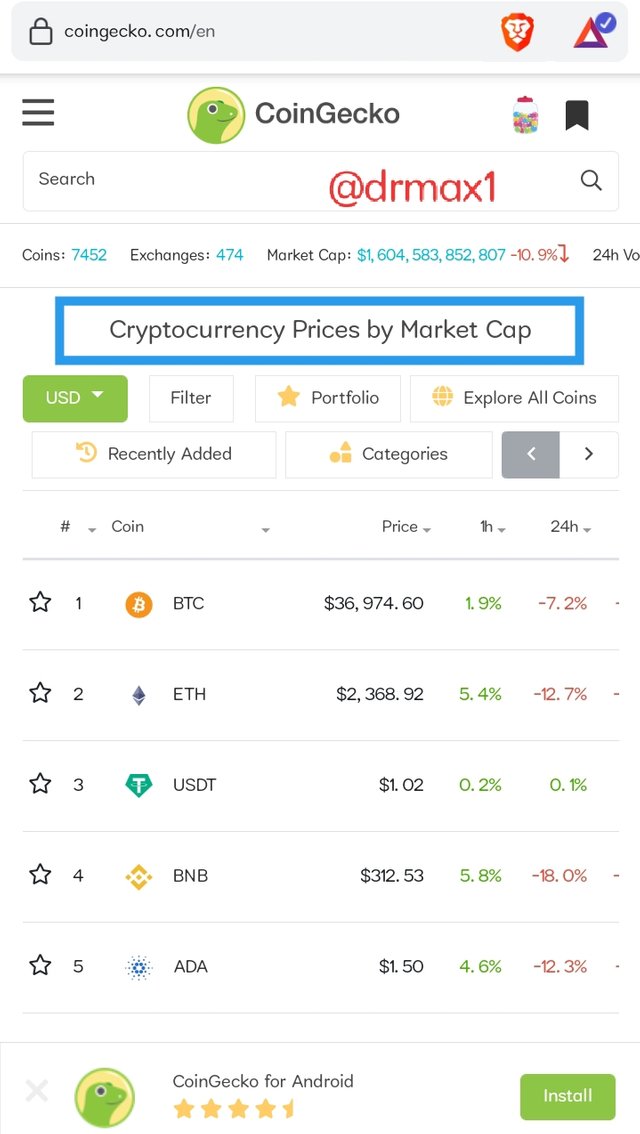

CoinGecko Landing Page

At the CoinGecko landing page, you will see the list of the top 100 performing cryptos. By default, coins are displayed under the Market vie, according to the order of market capitalization. At the top of the page, the number of different coins and it available exchange together with the crypto market capitalization can be view. You can also view crypto prices according to market domination in the "All Time High" or a range of GitHub statistics that is under the "Developer" view. At the time of writing this the CoinGecko market cap is $1,604,583,852,807 with a 24hour volume

How COINGECKO Can Be Helpful for you in a Crypto Market?

CoinGecko is very helpful to me in the crypto Market in the following underlying ways:

CoinGecko provide me with information around cryptocurrency prices, latest updates and also crypto related materials.

CoinGecko make things easy for me in the crypto industry to keep organized and keep track of portfolio with use of it tools.

CoinGecko is also helpful to me because it allows me to see live cryptocurrency prices that is organized and categorized in a way that is preferable to me.

CoinGecko help me to know market Capitalization and the volume of cryptocurrency.

Explore COINGECKO features with information

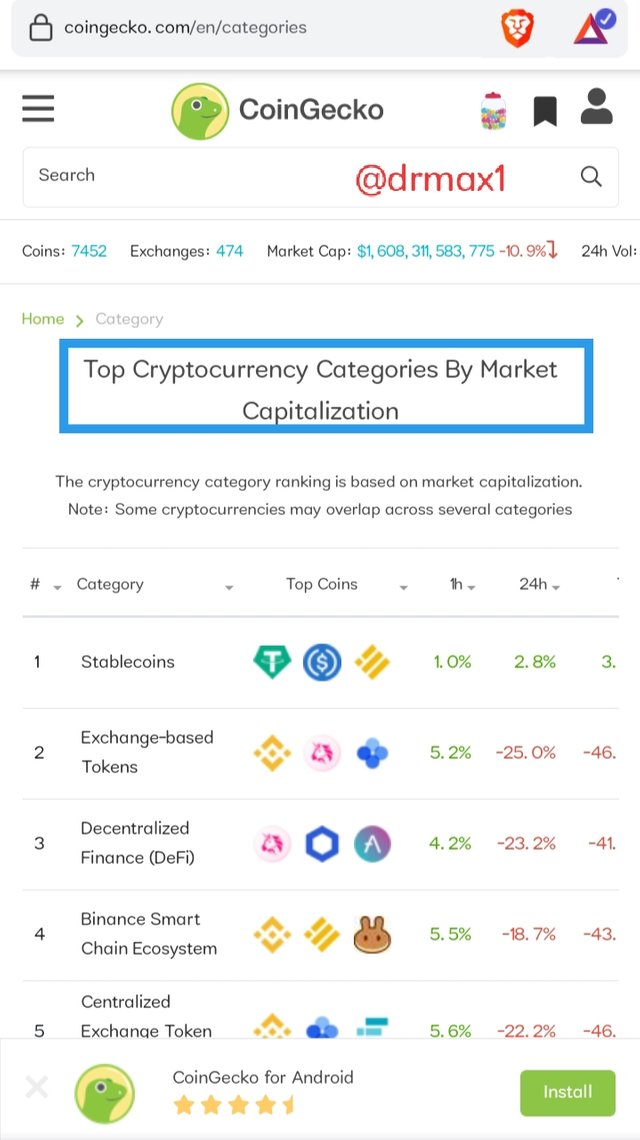

Categories

The categories features help you to get the details of cryptocurrencies according to their ranking. In the categories you will see Decentralized Finance, Centralized Exchange Tokens Binance Smart Chain Ecosystem, Automated Market Maker, Stablecoins etc that are listed on the categories. All the tokens have market capitalization information together with chart performance.

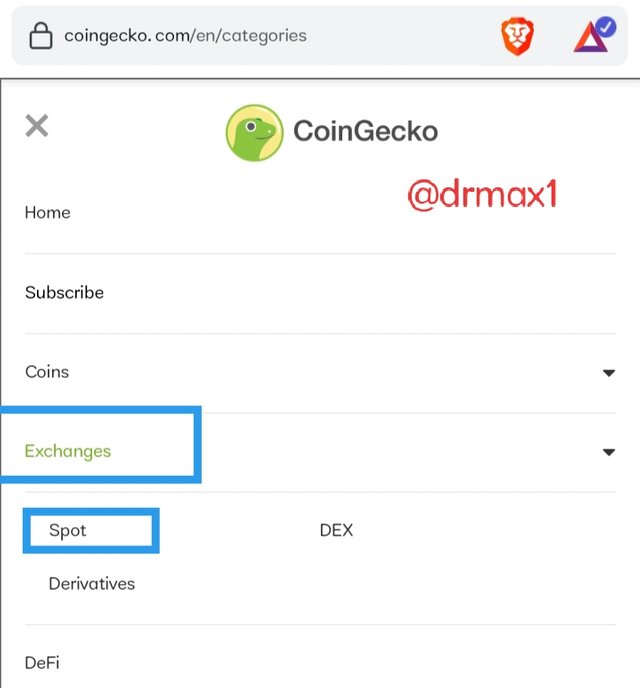

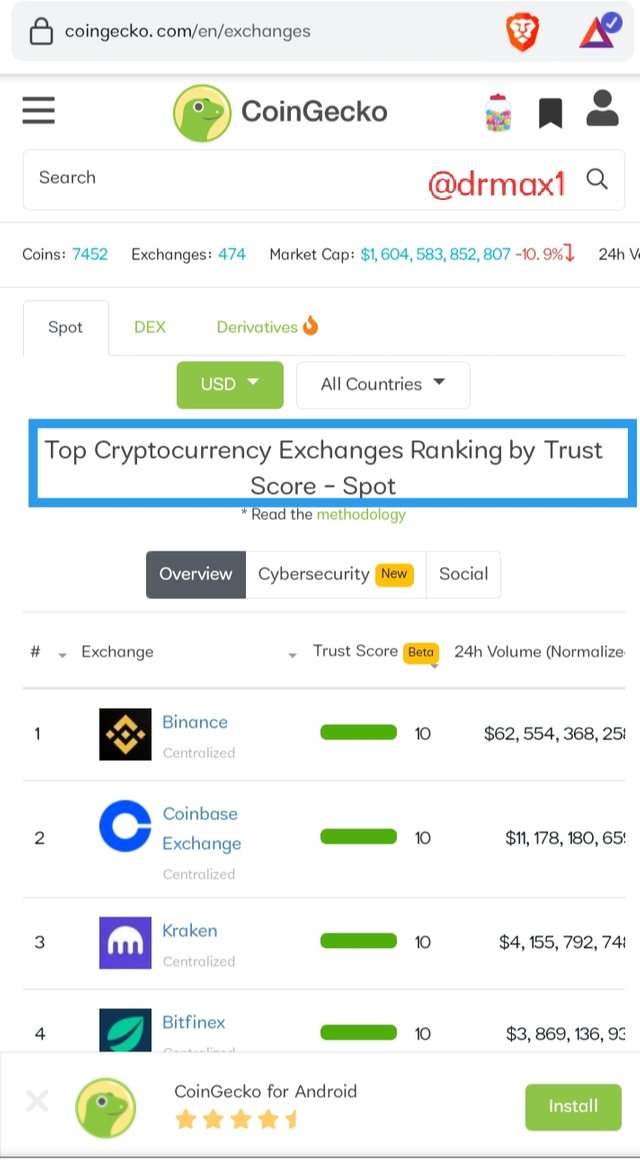

Exchanges

The exchange features displayed a list of different cryptocurrencies exchange that is on the Trust Score. At the exchange you will see Binance toping the list which is shown from the screenshot above.

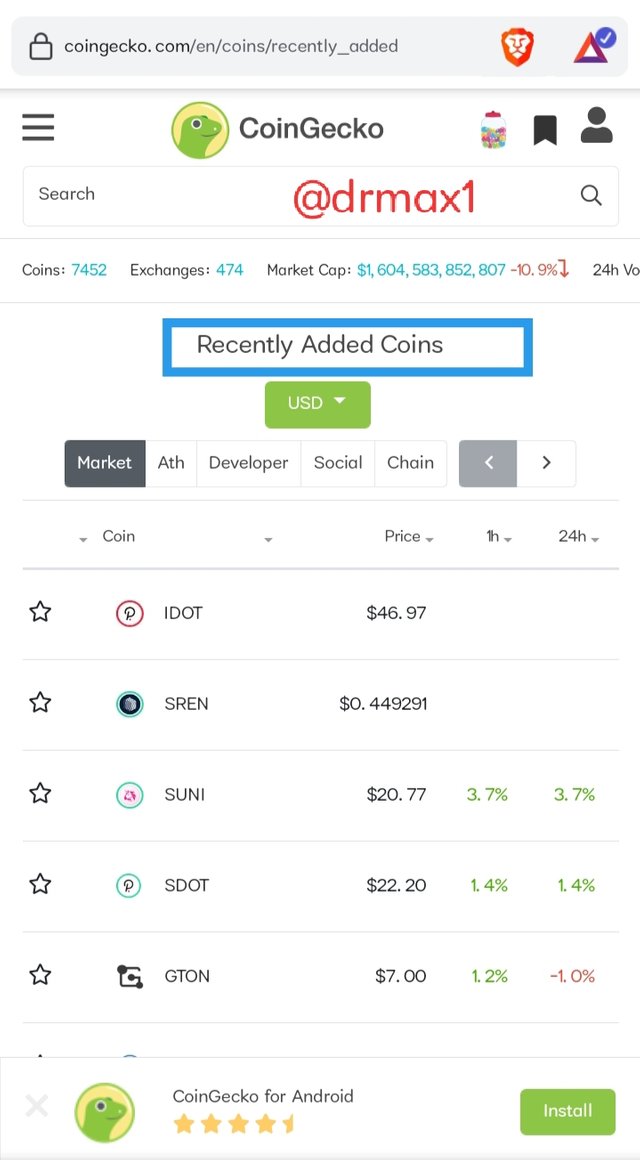

Recently Added Coins

This features displayed the coins that is just added new together with they information.

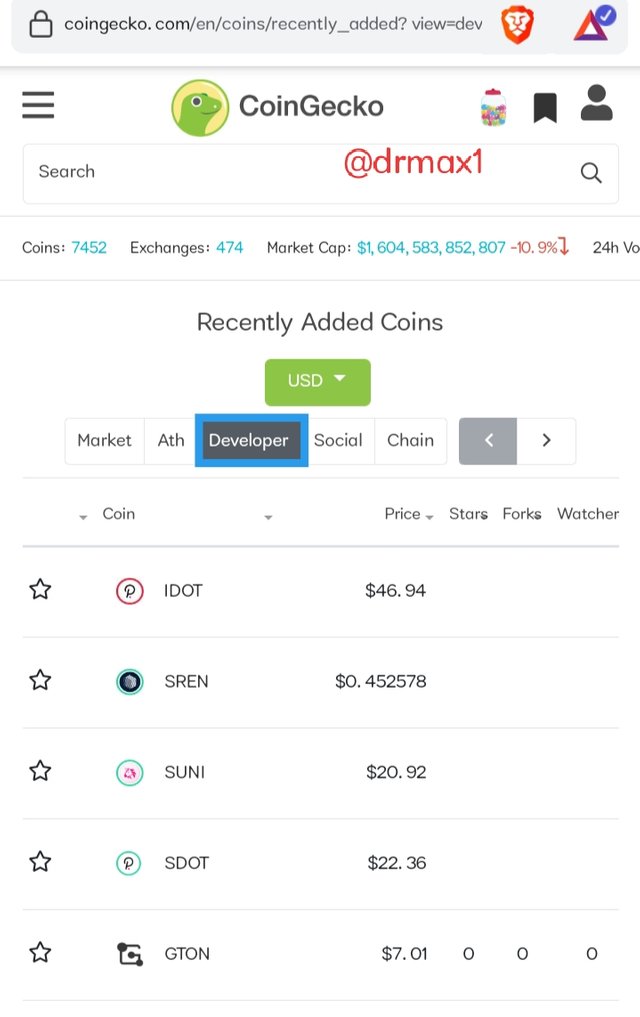

Developer

Developer features where social and Alex data are updated. Traders can easily find crypto through the activities that was recently performed. The details of the Developer is at the top with their Development activity.

Cryptocurrency price by Market Cap

This is the features that is used to measure the relative size of cryptocurrency. At the market cap you will see the trading volume and price of the cryptocurrency displayed.

Weekly Price Forcast For Crypto BTC/USD Pair

For the purpose of this homework, I make used of BTC/USD.

About Bitcoin

Bitcoin is the first digital assets that was invented in 2008 by Satoshi Nakamoto. The currency was started being use in 2009 when it's was fully released as an open source. We all know that Bitcoin is the first decentralized digital currency that was released.

Why I Have Chosen Bitcoin?

The reasons I have chosen Bitcoin is that of all the cryptocurrencies, Bitcoin is the number that anyone should think of. Bitcoin is the first cryptocurrency that is trending more than any other cryptocurrencies so I feel that me using it for this study will get my reads to know what am discussing about.Also in the cryptocurrency industry Bitcoin gains scale and capture about 20% of the global currency which make it the world most recognized crypto.

Technical Analysis - BTC/USD Pair

Today being Saturday, May 22 I have look into the technical analysis of BTC/USD pair of which I am going to give a details on the both coins prediction what it will look like in the next 1 week. As at today, May 22 : Bitcoin price is $36925.45 against the USD $411.92. tomorrow being 23rd, may, minimum price $33657.42, maximum $3446 at the end of the day price will fall to $336482 dollars a coin. Monday, may, 24: minimum price $31856, maximum $35668 and at the end of the day price $32748 dollars a coin. BTC to USD price predictions on Tuesday, may 25: the minimum price of Bitcoin will be $35237, whereas maximum $39063 and at the end of the day price $38653 dollars a coin.

Prediction on Wednesday, May, 26: minimum price $30363, maximum $35747 at the end of the day price $33647 dollars a coin. BTC to USD prediction May, 27: minimum price $29464, maximum $35748 the end of the day price $31947 dollars a coin. Friday May, 28: prediction minimum price $29747, maximum $31848 at the end of the day price $32744 dollars a coin.On Saturday being May, 29 which will become 1 week from now the BTC to USD predictions will be minimum price $29647, maximum price $30626, end of the day price $31546 dollars a coin.

Hi @drmax1

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable