"Bitcoin's 2025 Outlook: From Fed to Fear"

This analysis delves into how so many factors, including regulations, market sentiment and technical indicators, are shaping Bitcoin's price trajectory in early 2025.

Market Regulations

Unlike Ethereum, which thrives on blockchain ecosystem innovations, Bitcoin's price dynamics are heavily influenced by regulatory changes. Because institutions, banks, and governments are among its largest holders and investors.

Bitcoin price has seen a significant drop, following the Fed's rate cut and inflation outlook for 2025. The release of the U.S. Consumer Price Index (CPI) data always significantly impacts market sentiment. The CPI data, revealing a lower-than-expected (2.8%), could signal a bullish turn for cryptocurrencies, and lower interest rates. Conversely, high inflation could lead to increased market volatility.

Federal Reserve Chair Jerome Powell's recent testimony before Congress on February 11 and 12 highlighted a strong economy with inflation nearing but still above the 2% target. Subsequently, his cautious stance on rate cuts has led to a bearish market sentiment, compounded by broader economic factors like tariffs and shifts towards safer or different investments options.

Under Donald Trump's administration, there's a pro-crypto policy lean, which might either stabilize or boost the market. However, the immediate impact of these policies remains uncertain. A strategic Bitcoin reserve and backing for stablecoins could legitimize cryptocurrencies further, potentially benefiting the sector long-term.

Global conflicts or shifts in diplomatic relations, especially involving major economies like the U.S. or China, could sway markets. Despite the bearish start of 2025 due to tariffs, If trade wars escalate, cryptocurrencies might be viewed as hedges against economic instability, similar to gold, driving interest in decentralized finance (DeFi).

This could drive innovation and investment into blockchain projects with real-world applications. The year 2024 saw massive inflows into Bitcoin and Ethereum ETFs, suggesting that institutional interest hasn't waned entirely but is perhaps recalibrating due to short-term shocks.

Altcoin

On the altcoin front, there's a noticeable trend of declining interest in lesser-known tokens as Bitcoin dominance grows, suggesting investors are favoring established cryptocurrencies like Bitcoin (BTC) and Solana (SOL).

Stablecoin

While much attention is on Bitcoin and major altcoins, the stablecoin market, particularly the dominance and stability of USDT and USDC, is less highlighted. This aspect is crucial as stablecoins underpin much of the trading volume and DeFi operations. Stablecoins become the backbone for trading pairs on exchanges, and are crucial for liquidity in crypto markets, especially during volatile times.

Ongoing regulatory could impact overall market sentiment and operations. The landscape is evolving with regulations like the EU's Markets in Crypto-Assets (MiCA) regulation set to be fully implemented in 2025. This could encourage more localized and regulated stablecoins, potentially diversifying the market beyond USD-centric options. Also, there's a growing interest in stablecoin yield generation, with platforms like Aave and Morpho offering double-digit yields for lending stablecoins. This could challenge traditional finance by offering competitive risk-free rates, potentially pulling more capital into the crypto space.

The stablecoin market has shown significant growth, with its market cap hitting $200 billion in 2024, and projections suggest it could double to $400 billion by the end of 2025. this significant increase in stablecoin supply, indicating increased liquidity that could drive higher crypto purchases.

Price Action

Bitcoin has found support between $92,000 to $94,000, suggesting resilience against bearish pressures. However, repeated tests of this support could weaken it over time.

Volume

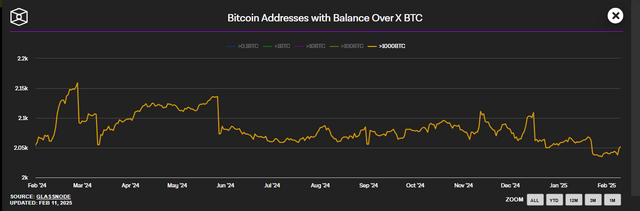

On February 11, on-chain data indicates smart money is accumulating during dips.

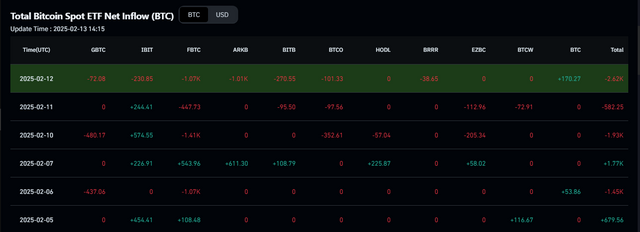

However, major ETF players have slowed their buying, showing distribution activities.

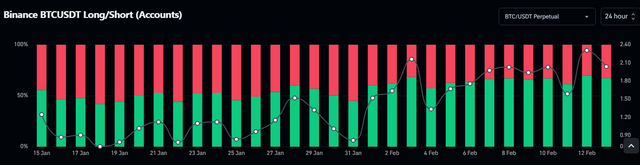

Smaller accounts on Binance have been buying from the start of February, hinting at a possible distribution and bear market scenario in near future.

Transactions

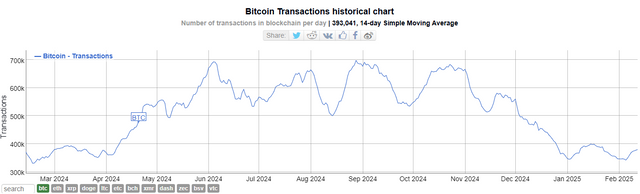

Also, Bitcoin Transactions historical chart, stopped at the lowest point, and gets ready to increase for coming campaign.

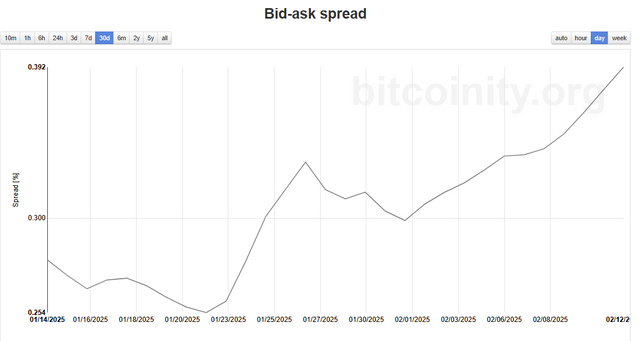

Bid-Ask spread

The increasing bid-ask spread suggests we're in a volatile campaign phase.

Liquidation

The Bitcoin Liquidation Heatmap indicates that downward pressure from liquidations might be subsiding, potentially allowing for new price movements or liquidation zone.

-2025-02-13_14_21_28.png)

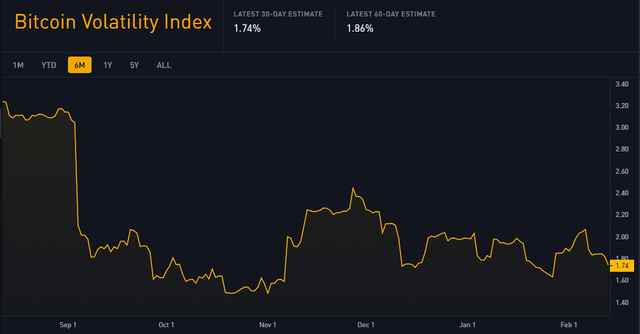

Volatility

The volatility index remains steady, indicating an efficient market handling of current conditions.

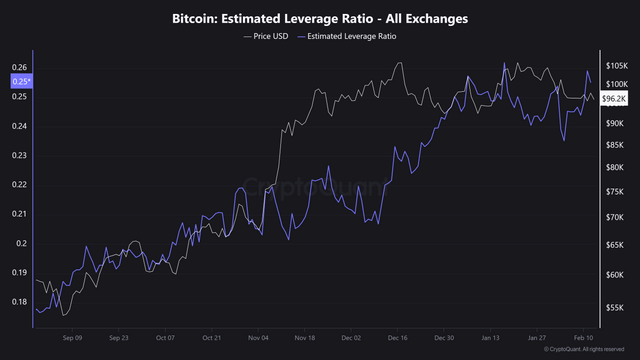

Bitcoin's leverage ratio shows no signs of overheating, suggesting potential for further price growth.

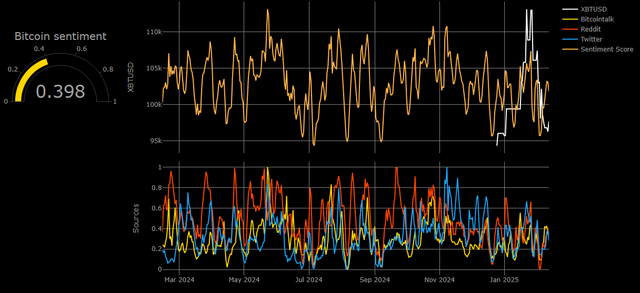

Sentiment

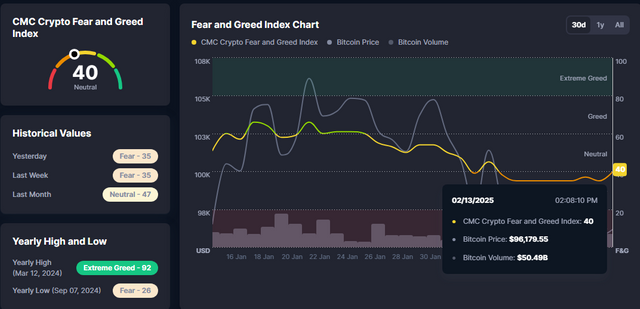

After ten days of fear, the Crypto Fear and Greed Index has moved to neutral, which means may the duration of panic selling ended, and market trying to find its confidence.

The sentiment in social networks too, backed from lower points, and proves the possible changing of character. Although, there is still bearish sentiment among some traders, due to the lack of aggressive reversal after last week's liquidation, and broader economic concerns.

Conclusion

Our analysis suggests the potential for a Bitcoin rebound remains, but the price must decisively break through the $98,500 resistance, potentially targeting $100,000 to signal an end to the current downtrend. Patience is key, and market reactions around the $92,000-$94,000 support will be crucial to watch.

Feel free to leave your thoughts, questions, or comments below! Your insights are invaluable, and I'm eager to hear what you think about Bitcoin's current landscape or any other points you'd like to discuss. Let's keep the conversation going!