Steemit Crypto Academy Contest / S22W6 [SUMMARY] : Volatility Trading

Introduction

Dear Steemians,

Welcome to the sixth week of Season 22 of the Steemit Learning Challenge, focusing on the intriguing competition “Volatility Trading.” From January 20 to January 26, 2025, participants explored the dynamic and fast-paced world of trading market volatility, where sharp price swings present both challenges and opportunities.

Volatility trading is an advanced strategy that requires deep understanding, discipline, and careful planning. This week’s competition challenged participants to analyze volatility indicators, propose trading strategies, and reflect on the psychological impacts of trading in volatile markets, specifically in the context of Steem/USDT.

In this report, we summarize participation statistics, recognize outstanding contributors, and provide insights from the submissions received during this week.

Participation Statistics

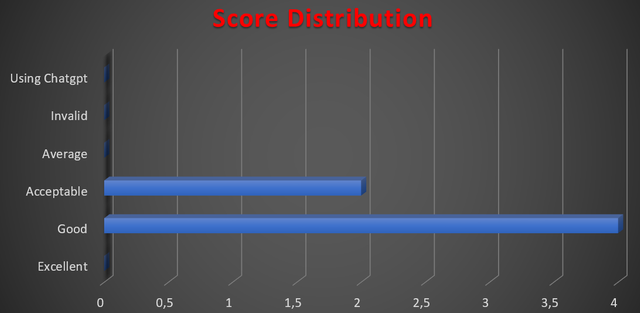

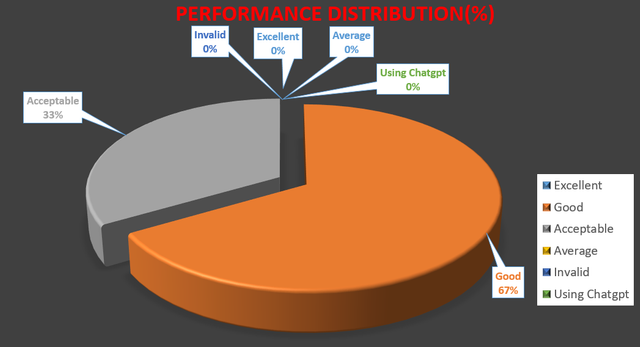

We are pleased to announce that 6 valid entries were submitted for this competition, showcasing participants’ strategic depth and creative thinking. Below is the breakdown of this week’s entries:

| Total Entries | Valid | Excellent | Good | Acceptable | Low Content | AI-Generated | Invalid | Plagiarized |

|---|---|---|---|---|---|---|---|---|

| 6 | 6 | 4 | 0 | 2 | 0 | 0 | 0 | 0 |

- 4 entries were rated Excellent, delivering insightful, well-researched, and actionable content.

- 2 entries were rated Acceptable, meeting minimum requirements but leaving room for improvement.

Performance Evaluation

Participants demonstrated a strong grasp of volatility trading concepts and provided actionable insights. The key themes explored in the entries include:

Understanding Volatility Metrics

- Participants explained the significance of Bollinger Bands, ATR, and historical volatility in analyzing price movements, using examples from the Steem/USDT pair to demonstrate practical applications.

Range-Bound and Breakout Strategies

- Submissions proposed innovative strategies for profiting from market swings, with detailed explanations of entry/exit points, support and resistance levels, and risk management practices.

Adapting to Volatility Spikes

- Authors discussed strategies to handle extreme market conditions, such as adjusting stop-loss orders and position sizing, while maintaining emotional discipline.

Psychological Resilience

- Insights on managing emotions like fear and overconfidence during volatile periods were a key focus, with practical tips for maintaining composure under pressure.

Top 4 Winners

The following participants stood out with exceptional submissions that combined theoretical knowledge with practical strategies:

| Ranking | Username | Article | Score |

|---|---|---|---|

| 1 | @ashkhan | Link | 8.8/10 |

| 2 | @artist1111 | Link | 8.6/10 |

| 3 | @shabbir86 | Link | 8.2/10 |

| 4 | @mostofajaman | Link | 8.0/10 |

@ashkhan secured the top position with a comprehensive exploration of volatility trading strategies for Steem/USDT. @artist1111 and @shabbir86 followed closely with well-structured and insightful submissions. @mostofajaman also delivered a strong performance, showcasing a practical approach to volatility trading.

Conclusion

The sixth week of Season 22 highlighted the complexity and opportunities within volatility trading. Participants showcased their ability to navigate market swings with strategic approaches, contributing valuable insights to the Steemit Crypto Academy.

Congratulations to all winners and participants for their dedication and creativity. Your contributions enrich our community and inspire further exploration of advanced trading strategies.

Stay tuned for the upcoming challenges, where we will continue to explore new dimensions of cryptocurrency trading and blockchain technology!

@tipu curate

Upvoted 👌 (Mana: 6/8) Get profit votes with @tipU :)

Congratulations all winners @ashkhan @artist1111 @mostofajaman🎉🎉🎉

thank you so much my dear friend and congratulation all winners.