Steemit Crypto Academy Contest / S21W3 [SUMMARY] : Mastering the Bull Run with Trailing Stop Techniques and Multi-Timeframe Analysis

Introduction

Dear Steemians,

Welcome to the third week of Season 21 of the Steemit Crypto Academy's "Mastering the Bull Run with Trailing Stop Techniques and Multi-Timeframe Analysis" competition. From November 11 to November 17, 2024, we embarked on an advanced challenge designed to help traders maximize gains while securing their positions during a bull run. This week, we explored the sophisticated strategies of trailing stop techniques and multi-timeframe analysis to navigate the complexities of a bullish market. These methods offer a dynamic approach to managing positions, following trends, and adapting to fluctuations across different timeframes.

Participants were tasked with adjusting trailing stops and utilizing multiple timeframes to refine their trading decisions on the STEEM/USDT pair. Whether experienced traders or those seeking to enhance their skills, participants had the opportunity to develop a sophisticated risk management approach in a bull run context.

Our community rose to the challenge, showcasing impressive analytical skills and a deep understanding of advanced trading strategies. Their contributions reflect the core values of the Steemit Crypto Academy: continuous learning, strategic thinking, and a commitment to excellence.

In this report, we will highlight key aspects of this week's competition, present the most innovative ideas shared by participants, and reflect on the overall quality of the submissions.

Participation Statistics

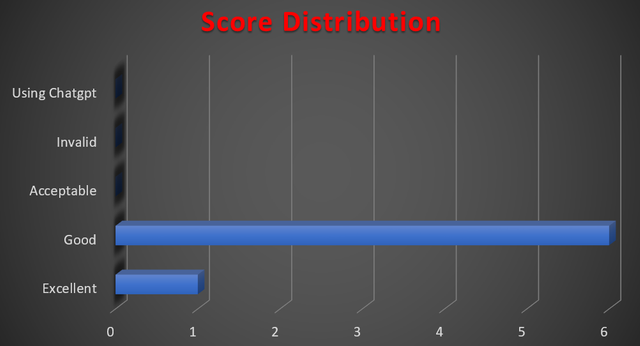

This week, we are pleased to report a robust level of engagement, with a total of 7 valid entries submitted. The sustained interest and enthusiasm within our crypto trading community are evident, and we are delighted to see such active participation.

Here is the detailed breakdown:

| Total Number of Entries | Valid Entries | Invalid Entries | Plagiarized Content |

|---|---|---|---|

| 7 | 7 | 0 | 0 |

Out of the 7 entries:

- 1 entry was rated Excellent, demonstrating outstanding understanding and application of the competition's concepts.

- 6 entries were rated Good, showcasing solid knowledge and practical application, with room for further enhancement.

- 0 entries were rated Acceptable.

- 0 entries were invalid or off-topic.

- 0 entries contained plagiarized content.

We are particularly pleased with the absence of invalid or plagiarized submissions, as it reflects the participants' dedication to producing original, high-quality content. The consistent participation indicates a growing interest in advanced trading techniques within our community.

Performance Evaluation

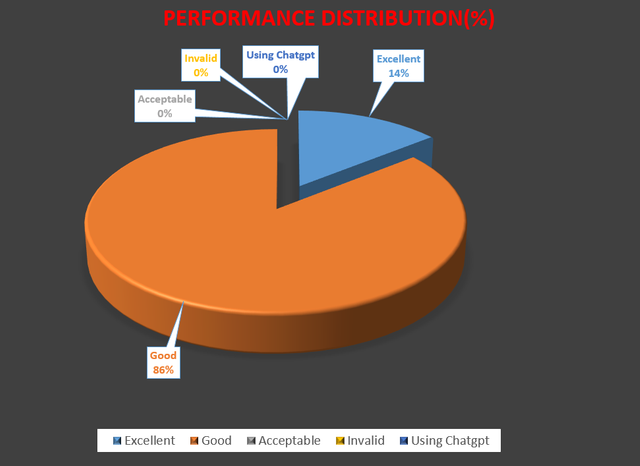

The overall quality of the submissions this week was impressive. Participants displayed a strong grasp of trailing stop techniques and multi-timeframe analysis, effectively applying these strategies to the STEEM market. Here's the distribution of performance evaluations:

- Excellent (14.29%): 1 post delivered exceptional content, showcasing both theoretical understanding and practical application of the concepts.

- Good (85.71%): 6 posts exhibited solid understanding and practical application, with thoughtful analyses and reflections.

- Acceptable (0%): No posts fell into this category.

- Invalid (0%): No entries were invalid or off-topic.

The entry rated Excellent stood out for its depth of analysis, clarity of explanation, and effective application of advanced trading strategies. The majority of participants fell into the Good category, indicating a strong overall performance and a solid understanding of the subject matter.

The performance distribution suggests that while participants are producing strong and well-structured submissions, there is potential for further enhancement. Encouraging participants to delve deeper into the nuances of trailing stop techniques and multi-timeframe analysis, explore advanced strategies, and provide more detailed analyses will help elevate their work to the 'Excellent' level in future contests.

Top 5 Contributors

We are pleased to recognize the participants who delivered outstanding submissions this week. These users demonstrated technical proficiency, creativity, and insightful analysis in their work. Here are the top performers:

| Ranking | Username | Article | Score |

|---|---|---|---|

| 1 | @mohammadfaisal | Link | 9.2/10 |

| 2 | @sahmie | Link | 8.8/10 |

| 3 | @artist1111 | Link | 8.6/10 |

| 4 | @luxalok | Link | 8.6/10 |

@mohammadfaisal achieved the highest score this week with 9.2/10, standing out for his detailed analysis and effective application of trailing stop techniques and multi-timeframe analysis in the STEEM market. His submission demonstrated a high level of understanding and practical insight, serving as an excellent example for others.

@sahmie, @artist1111, and @luxalok also delivered high-quality work, showcasing their ability to interpret market trends, adjust trailing stops effectively, and utilize multi-timeframe analysis to optimize their trading strategies.

We encourage all participants to review these top submissions to gain insights into how to enhance their analyses and presentations in future contests.

Conclusion

The third week of Season 21 has been both challenging and rewarding. Participants embraced the complexity of mastering the bull run with trailing stop techniques and multi-timeframe analysis, demonstrating their dedication to advancing their trading skills.

The strong performance across the board reflects a deepening understanding of advanced trading strategies within our community. As participants continue to refine their skills, we anticipate even more exceptional work in the coming weeks.

We are particularly pleased with the collaborative spirit and mutual support demonstrated within the community. By sharing insights and constructive feedback, participants are not only enhancing their own expertise but are also fostering a culture of continuous learning and improvement.

Moving forward, we encourage participants to:

- Delve Deeper: Explore the intricacies of trailing stop techniques and multi-timeframe analysis, seeking to understand both the theoretical foundations and practical applications.

- Enhance Analytical Rigor: Provide detailed analyses, supported by empirical data and real-world examples, to strengthen the credibility and impact of your submissions.

- Embrace Creativity: Innovate and think outside the box, developing unique strategies and perspectives that contribute to the advancement of trading knowledge.

We extend our heartfelt thanks to all participants for their dedication and hard work this week. Your contributions enrich the Steemit Crypto Academy and inspire others to pursue excellence.

☀️ ☀️

Дякую