Steemit Crypto Academy Contest / S18W4 [SUMMARY]: Mastering Liquidity Levels in Trading

Hello steemians,

Welcome to the weekly edition of our competition, hosted by the Steemit Crypto Academy as part of the Steemit Engagement Challenge (SEC) Season 18. For this fourth week, from June 10 to 16, 2024, we explored an essential and intricate theme: Mastering Liquidity Levels in Trading.

This topic allowed us to delve into the importance of liquidity levels in trading, a crucial aspect for making informed trading decisions. Understanding liquidity levels helps traders identify potential entry and exit points, manage risks, and optimize their trading strategies in the volatile cryptocurrency market.

During this week, our participants showcased exceptional engagement and profound insights in their analyses and contributions. Through various articles, discussions, and case studies, they explored the concept of liquidity, how to identify key liquidity levels, and the impact of liquidity on market movements and trading strategies.

This report presents a synthesis of the best submissions, innovative ideas, and insightful analyses shared by our talented members. It also highlights the importance of understanding liquidity in navigating the complex and ever-changing cryptocurrency markets.

Join us as we look back on the fourth week of SEC Season 18, and learn how our community continues to grow and excel through enriching discussions and collaborative learning.

Participation statistics

During this week, we received a total of 12 entries. Despite a slight increase in the number of participants, we encountered some issues regarding rule compliance:

| Total number of entries | Invalid entry | Plagiarized content |

|---|---|---|

This result underscores the need for continuous vigilance to ensure the integrity of our competition. Nevertheless, we are particularly pleased with the quality of the valid contributions.

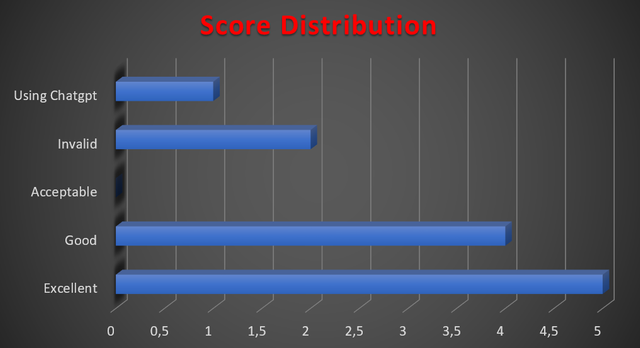

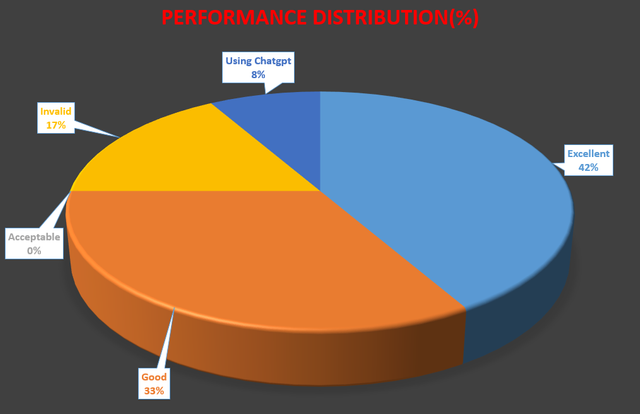

A significant portion of entries, 42%, was rated as excellent. This showcases the participants' deep understanding and analytical skills regarding the topic. A substantial number, 33%, were rated as good, indicating that many participants had a strong grasp of the subject matter.

However, 8% of the entries were identified as using ChatGPT-generated content, underscoring the importance of stricter originality checks. Additionally, 17% of the entries were invalid due to non-compliance or plagiarism, highlighting the need for participants to better adhere to the competition's rules. Notably, no entries fell into the acceptable category, which reflects the overall high quality of the submissions.

The score distribution and performance distribution graphs indicate a high level of engagement and quality among the participants. Despite a few invalid entries and one instance of ChatGPT-generated content, the majority of submissions were of good to excellent quality. This demonstrates the participants' strong understanding and analytical skills in mastering liquidity levels in trading. As we move forward, it will be important to continue encouraging original and well-thought-out contributions while ensuring adherence to competition rules to maintain this high standard.

Top 3 users this week

In our evaluation process, we first assessed the quality of the participants' performances, with a focus on their interactions with fellow contestants.

For choosing the top three participants, we considered their performance scores and how they engaged with others. Additionally, we made a special selection based on a standout article that provided exceptional content on the discussion topic. Here are the top three participants we have acknowledged this week.

| Ranking | Username | Article |

|---|---|---|

| 1 | @stream4u | Link |

| 2 | @mostofajaman | Link | 3 | @artist1111 | Link |

Conclusion

We are extremely pleased with the participation and quality of submissions this week. Despite the minor setbacks, the overall trend is positive, and we look forward to seeing even more participants join our future competitions.

These results highlight the importance of continuous encouragement for original and well-thought-out contributions while ensuring to avoid plagiarism and the misuse of AI-generated content. Together, we are building a stronger and more informed community, ready to tackle the challenges of the financial markets with insight and confidence.

We thank all participants for their outstanding contributions and look forward to future editions of our competitions, where we will continue to explore relevant and enriching themes.

congragulation @mostofajaman @stream4u

Congratulations for all the winners... @stream4u

@mostofajaman @artist1111 ...

💐💐💐🥳🥳🥳

Thank you so much dear @liasteem.

👍😊

Thank you Was waiting for your entry.

Hehe

Siip.... 👍

Thank you dear.

☺☺

Thank you so much for making me a winner @crypto-academy🙂

Thank you so much for selecting me a winner .

Glad to see in the list. Thank you for the honor.

Congratulations @mostofajaman and @artist1111.

Thank you so much 🤝

Thank you my friend.

Muchas felicitaciones a los ganadores @stream4u

@mostofajaman @artist1111 por sus merecidos lugares en el podio.

Saludos y éxitos para todos.

Thank you so much friend.

Thank you my friend.

Thank you.

The future of cryptocurrency https://cryptodaily.co.uk/2024/05/the-future-of-money-exploring-cryptocurrency is poised to be transformative, potentially reshaping the financial landscape. As blockchain technology continues to mature, cryptocurrencies could offer more efficient, transparent, and decentralized financial systems. Mainstream adoption may accelerate as regulatory frameworks become clearer, fostering trust and stability in the market. Innovations such as decentralized finance (DeFi) and smart contracts could revolutionize various sectors, enabling peer-to-peer transactions without intermediaries. Additionally, the integration of cryptocurrencies into traditional financial institutions and the development of central bank digital currencies (CBDCs) suggest a blended future where digital assets coexist with conventional money, driving further innovation and financial inclusion.