Steemit Crypto Academy Contest / S22W2 [SUMMARY] : AI and Machine Learning in Cryptocurrency Trading

Introduction

Dear Steemians,

Welcome to the second week of Season 22 of the Steemit Learning Challenge: "AI and Machine Learning in Cryptocurrency Trading: A Steem/USDT Perspective." From December 23 to December 29, 2024, participants were invited to explore how emerging technologies—particularly Artificial Intelligence (AI) and Machine Learning (ML)—are revolutionizing cryptocurrency trading. These tools offer traders sophisticated methods for analyzing vast datasets, identifying market trends, and even automating entire trading strategies.

This week’s competition called for in-depth discussions on AI-driven techniques such as predictive analytics, sentiment analysis, and automated trading systems, all of which hold the potential to enhance precision, reduce human error, and optimize decision-making. By showcasing AI and ML applications in the STEEM/USDT market, participants highlighted the synergy between cutting-edge technology and the dynamic world of cryptocurrency.

In this report, we will review the most notable insights shared by participants, recognize outstanding contributions, and reflect on the general quality of submissions for the week.

Participation Statistics

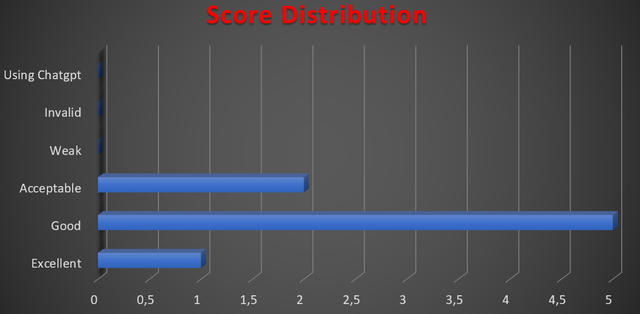

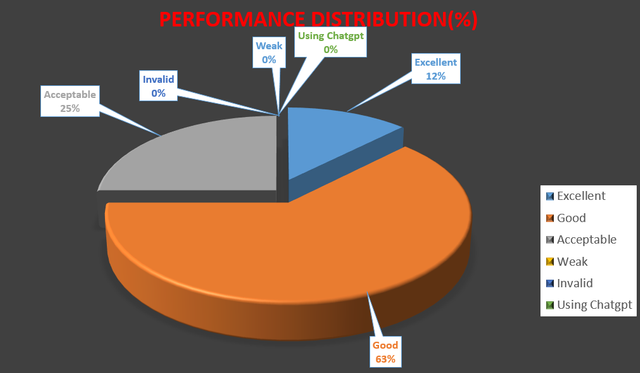

We are pleased to report that the second week of Season 22 attracted a commendable level of engagement, with a total of 8 valid entries submitted. Here is the overall breakdown:

| Total Entries | Valid Entries | Excellent Quality | Good Quality | Acceptable Quality | Invalid | Plagiarized |

|---|---|---|---|---|---|---|

| 8 | 8 | 1 | 5 | 2 | 0 | 0 |

- 1 entry received an Excellent rating, demonstrating exceptional depth of analysis and practical recommendations on leveraging AI and ML in the STEEM/USDT market.

- 5 entries were classified as Good, reflecting a strong understanding of the technology with well-organized articles.

- 2 entries were classified as Acceptable, meeting the basic criteria but with room for further elaboration and refinement.

- 0 invalid or plagiarized entries, underscoring the community’s dedication to authenticity and original content.

Performance Evaluation

Overall, the quality of submissions indicates growing interest and competence in applying AI and ML to cryptocurrency trading. Key themes included:

Predictive Analytics

- Several participants demonstrated how historical price data and technical indicators could train predictive models (e.g., using Python’s Scikit-learn or TensorFlow) to forecast STEEM/USDT price movements.

Sentiment Analysis

- By classifying social media or Steemit posts as positive, neutral, or negative, authors showcased how sentiment data could inform trading decisions, improve timing, and reduce exposure to unexpected volatility.

Automated Trading Systems

- Some articles discussed the logic behind automated bots that leverage AI-generated signals to execute trades, manage stop-losses, and secure profits—illustrating the potential for reduced emotional bias and improved execution speed.

Challenges and Reliability

- Participants also highlighted potential pitfalls, such as overfitting or data quality issues, proposing solutions to enhance model reliability and performance.

Top 4 Contributors

The following participants stood out for their high-quality work, offering insightful strategies and coherent analyses of AI/ML-driven trading:

| Ranking | Username | Article | Score |

|---|---|---|---|

| 1 | @luxalok | Link | 8.7/10 |

| 2 | @mohammadfaisal | Link | 8.4/10 |

| 3 | @rafk | Link | 8.2/10 |

| 4 | @kinkyamiee | Link | 8/10 |

@luxalok claimed the top spot with 8.7/10, standing out for a well-structured article that showcased the integration of Python-based model outputs and thorough reasoning on AI’s role in STEEM/USDT trading. @mohammadfaisal, @rafk, and @kinkyamiee also delivered excellent work, elaborating on practical use cases, potential pitfalls, and solutions to maximize AI-driven strategies.

We encourage all participants to review these top submissions for inspiration and a deeper understanding of how AI and ML can be effectively applied in crypto trading.

Conclusion

The second week of Season 22 underscored the transformative potential of AI and Machine Learning in the realm of cryptocurrency trading. Participants demonstrated how combining these advanced tools with established analysis methods can lead to more informed decisions, streamlined execution, and robust risk management.

Moving forward, we encourage all traders to:

- Deepen Their AI/ML Expertise: Continue exploring coding frameworks, data preprocessing techniques, and best practices for building reliable models.

- Combine Multiple Approaches: Integrate AI-driven analyses with sentiment metrics, fundamental research, and technical indicators for a holistic view of the market.

- Stay Vigilant Against Pitfalls: Remain aware of potential data quality issues, overfitting, and other challenges to ensure the consistency and reliability of AI-driven predictions.

Congratulations to our top contributors and thank you to everyone who participated! Your insights have enriched the community’s collective knowledge and inspired further innovation in crypto trading.

Stay tuned for more competitions and keep honing your analytical and technical skills!

"Fantastic overview of the second week of Season 22! The emphasis on AI and Machine Learning as transformative tools for cryptocurrency trading is not only timely but also critical as the industry continues to evolve. I particularly appreciate how the report highlighted specific AI techniques—predictive analytics, sentiment analysis, and automated trading systems—and their practical applications in the STEEM/USDT market.

It’s also inspiring to see the focus on challenges such as overfitting and data quality issues, as these are often overlooked in discussions about AI in trading. Addressing these head-on shows a maturity in understanding and approach.

Congratulations to @luxalok, @mohammadfaisal, @rafk, and @kinkyamiee for their outstanding contributions! Their work sets a benchmark for quality and innovation in this space.

Looking forward to more competitions and deeper dives into these technologies. This initiative is undoubtedly fostering a smarter and more informed trading community!"